Chile_en.pdf

... Fiscal policy was directed towards achieving a structural balance. However, in 2009, owing to the countercyclical measures instituted, together with reduced tax revenues in the wake of the economic slowdown and falling copper prices, government spending increased considerably, as did the effective d ...

... Fiscal policy was directed towards achieving a structural balance. However, in 2009, owing to the countercyclical measures instituted, together with reduced tax revenues in the wake of the economic slowdown and falling copper prices, government spending increased considerably, as did the effective d ...

Economic Framework Powerpoint

... • The opportunity cost is the sacrifice of the item you must do without when you have to make a choice between two items you want to produce or purchase. ...

... • The opportunity cost is the sacrifice of the item you must do without when you have to make a choice between two items you want to produce or purchase. ...

CHAPTER 2 FINANCIAL PLANNING PROBLEMS

... 1. Jenny Franklin estimates that as a result of completing her Masters degree she will earn $6,000 a year more for the next 40 years. a. What would be the total amount of these additional earnings? b. What would be the future value of these additional earnings based on an annual interest rate of 6 p ...

... 1. Jenny Franklin estimates that as a result of completing her Masters degree she will earn $6,000 a year more for the next 40 years. a. What would be the total amount of these additional earnings? b. What would be the future value of these additional earnings based on an annual interest rate of 6 p ...

past and present international monetary

... *prices could fall in Malaysia relative to Indonesia *the ringgit could fall in value relative to the rupiah (thereby changing relative prices) If resources are immobile, then flexible exchange rates help to adjust relative prices when the monetary authorities try to limit price changes ...

... *prices could fall in Malaysia relative to Indonesia *the ringgit could fall in value relative to the rupiah (thereby changing relative prices) If resources are immobile, then flexible exchange rates help to adjust relative prices when the monetary authorities try to limit price changes ...

Abstract

... also refers to how the central bank uses interest rates and the money supply to guide economic growth by controlling inflation and stabilizing currency. Like any other central bank, Bangladesh Bank is performing the role to formulate monetary policy in Bangladesh. The control of money supply is an i ...

... also refers to how the central bank uses interest rates and the money supply to guide economic growth by controlling inflation and stabilizing currency. Like any other central bank, Bangladesh Bank is performing the role to formulate monetary policy in Bangladesh. The control of money supply is an i ...

In Class Worksheet 7

... 1. Suppose you want to setup a college fund for your 2 year old son. How much would you need to put into a bank account now so that your son will have $20,000 for college when he turns 18? Assume an interest rate of 4.89% compounded continuously. ...

... 1. Suppose you want to setup a college fund for your 2 year old son. How much would you need to put into a bank account now so that your son will have $20,000 for college when he turns 18? Assume an interest rate of 4.89% compounded continuously. ...

Rate influences ppt

... Influences on Rates Factors that influence all rates as well as account for differences in rates – Inflation – Market forces on supply and demand for loans (price of borrowing-lending) Income growth & expectations (consumption; business investment decisions) Risk Time ...

... Influences on Rates Factors that influence all rates as well as account for differences in rates – Inflation – Market forces on supply and demand for loans (price of borrowing-lending) Income growth & expectations (consumption; business investment decisions) Risk Time ...

presentation file

... Contribution from credit card asset-backed somewhat larger than that from home mortgages sold. ...

... Contribution from credit card asset-backed somewhat larger than that from home mortgages sold. ...

An updated post-Keynesian alternative to the New consensus on

... • Assume that the economy starts off from point A, shown in all quadrants of the Figure. In a ‘Minsky moment’, the risk spread τ rises considerably. As there is a rush towards liquidity and riskless assets, the prices of risky assets fall, and hence the interest rates on these assets rise. This is r ...

... • Assume that the economy starts off from point A, shown in all quadrants of the Figure. In a ‘Minsky moment’, the risk spread τ rises considerably. As there is a rush towards liquidity and riskless assets, the prices of risky assets fall, and hence the interest rates on these assets rise. This is r ...

The IS–LM model

... • Positive effect of Y on M d : A greater GDP means greater production of goods and services, more sales and more spending. The idea is that if people and firms are going to spend more, then other things equal they will wish to have more money on hand. • Negative effect of r on M d : Here we’re look ...

... • Positive effect of Y on M d : A greater GDP means greater production of goods and services, more sales and more spending. The idea is that if people and firms are going to spend more, then other things equal they will wish to have more money on hand. • Negative effect of r on M d : Here we’re look ...

solution

... 10. An inflow attack is different from capital flight, but many parallels exist. In an “outflow” attack, speculators sell the home currency and drain the central bank of its foreign assets. The central bank could always defend if it so chooses (they can raise interest rates to improbably high levels ...

... 10. An inflow attack is different from capital flight, but many parallels exist. In an “outflow” attack, speculators sell the home currency and drain the central bank of its foreign assets. The central bank could always defend if it so chooses (they can raise interest rates to improbably high levels ...

OUTLOOK - Front Barnett Associates LLC

... Early last year, you will recall, we pointed to consumer debt burdens, excessive inventories, and vulnerable exports as reasons for expecting the then buoyant economy to cool. The first two factors will continue to keep a lid on growth in 1996, as well. Exports, on the other hand, may turn out to be ...

... Early last year, you will recall, we pointed to consumer debt burdens, excessive inventories, and vulnerable exports as reasons for expecting the then buoyant economy to cool. The first two factors will continue to keep a lid on growth in 1996, as well. Exports, on the other hand, may turn out to be ...

Presentation to Lambda Alpha International and Arizona Bankers Association Phoenix, Arizona

... “quantitative easing” or “QE” by people outside the Fed. Inside the Fed, it’s less elegantly referred to as LSAPs. That stands for large-scale asset purchases. This program was part of our response to the financial crisis and slow recovery. During the worst days of the recession, the economy was st ...

... “quantitative easing” or “QE” by people outside the Fed. Inside the Fed, it’s less elegantly referred to as LSAPs. That stands for large-scale asset purchases. This program was part of our response to the financial crisis and slow recovery. During the worst days of the recession, the economy was st ...

Introduction

... • Short-run wage stickiness causes the aggregate price level to adjust less completely to changes in aggregate demand than it would otherwise. • This has an important consequence for the response of the exchange rate to policy actions that affect aggregate demand. • Exchange Rate Overshooting is a s ...

... • Short-run wage stickiness causes the aggregate price level to adjust less completely to changes in aggregate demand than it would otherwise. • This has an important consequence for the response of the exchange rate to policy actions that affect aggregate demand. • Exchange Rate Overshooting is a s ...

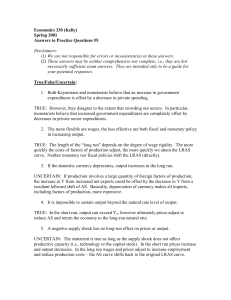

Economics 330 (Kelly)

... 7. Changes in the money supply cause changes in output. UNCERTAIN: First, this depends on your view of money demand. Generally, though, changes in money supply do affect Y. However, the direction of causation in practice is not at all obvious. One can justify that output growth leads money supply gr ...

... 7. Changes in the money supply cause changes in output. UNCERTAIN: First, this depends on your view of money demand. Generally, though, changes in money supply do affect Y. However, the direction of causation in practice is not at all obvious. One can justify that output growth leads money supply gr ...

AP Macro Review

... Fiscal vs. Monetary policy Contractionary Fiscal • Implemented by govt. • Increase taxes • Decrease govt. purchases • Decreases budget deficit • Decreases D for loanable funds • Decreases interest rate • $ depreciates ...

... Fiscal vs. Monetary policy Contractionary Fiscal • Implemented by govt. • Increase taxes • Decrease govt. purchases • Decreases budget deficit • Decreases D for loanable funds • Decreases interest rate • $ depreciates ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.