DECEMBER 2016 ECONOMICS FOR BUSINESS Instructions to

... Discuss the economic effects of a fall in the general level of interest rates. ...

... Discuss the economic effects of a fall in the general level of interest rates. ...

Economics, by R. Glenn Hubbard and Anthony Patrick O`Brien

... Price Level Effect: P =>QDM at each i (DM ) People care about purchasing power of money, real money balances = X = M/P ...

... Price Level Effect: P =>QDM at each i (DM ) People care about purchasing power of money, real money balances = X = M/P ...

Foreign Exchange Rate Forecasting

... *Uncovered interest arbitrage caused by exceptionally low borrowing interest rates in Japan coupled with high real interest rates in the United States was a problem for much of the 1990s. *Borrowing yen to invest in safe U.S. government ...

... *Uncovered interest arbitrage caused by exceptionally low borrowing interest rates in Japan coupled with high real interest rates in the United States was a problem for much of the 1990s. *Borrowing yen to invest in safe U.S. government ...

Economics 203/Quiz 5

... 11. To find a recession equal to the most recent one in length and intensity, you would need to go back to a. 1929-33 b. 1969-70 c. 1980-82 d. 1990-91 12. In order for monetary stimulus or and fiscal stimulus to work, a. individuals must be willing to live with higher than normal interest rates b. ...

... 11. To find a recession equal to the most recent one in length and intensity, you would need to go back to a. 1929-33 b. 1969-70 c. 1980-82 d. 1990-91 12. In order for monetary stimulus or and fiscal stimulus to work, a. individuals must be willing to live with higher than normal interest rates b. ...

Jamaica_en.pdf

... among Jamaica’s trading partners, especially the United States, weak domestic demand, and uncertainty among the private sector in terms of areas of investment. In addition, employment fell in some sectors. Within the goods sector, agriculture, forestry and fishing was the only sector that experience ...

... among Jamaica’s trading partners, especially the United States, weak domestic demand, and uncertainty among the private sector in terms of areas of investment. In addition, employment fell in some sectors. Within the goods sector, agriculture, forestry and fishing was the only sector that experience ...

Suriname_en.pdf

... At the end of 2011 the fiscal deficit is estimated to be approximately 2.2% of GDP. The gap between revenues and expenditures narrowed owing to restrained public sector spending combined with strong revenues dominated by transfers from the mineral sector, especially oil and gold receipts. The high p ...

... At the end of 2011 the fiscal deficit is estimated to be approximately 2.2% of GDP. The gap between revenues and expenditures narrowed owing to restrained public sector spending combined with strong revenues dominated by transfers from the mineral sector, especially oil and gold receipts. The high p ...

UK Monetary Policy

... • It could be that spending cuts and tax increases perpetuate weakness in aggregate demand, leading to capacity being scrapped and increased unemployment and skill loss. • Keynesians believe that weak aggregate demand can be boosted by government fiscal injection. • This could lead to higher employm ...

... • It could be that spending cuts and tax increases perpetuate weakness in aggregate demand, leading to capacity being scrapped and increased unemployment and skill loss. • Keynesians believe that weak aggregate demand can be boosted by government fiscal injection. • This could lead to higher employm ...

Monetary Policy

... – Demand-pull inflation? – Wage inflation? – Fears that there is too much velocity to the ...

... – Demand-pull inflation? – Wage inflation? – Fears that there is too much velocity to the ...

question 1 - Institute of Bankers in Malawi

... Say the economy starts at point U with expected inflation at 0%, and the government decide that they want to lower the level of unemployment because it is too high. They therefore decide to boost demand by 5%. The attempt to reduce unemployment would primarily be through boosting aggregate demand ( ...

... Say the economy starts at point U with expected inflation at 0%, and the government decide that they want to lower the level of unemployment because it is too high. They therefore decide to boost demand by 5%. The attempt to reduce unemployment would primarily be through boosting aggregate demand ( ...

Heading for the exit: Is this the end of cheap...

... • The deployment of unconventional monetary policy instruments since 2009 has disproportionately benefited emerging markets. This was because yields on traditionally safe assets like government bonds in advanced economies were pushed to record lows, forcing investors to look elsewhere for return. As ...

... • The deployment of unconventional monetary policy instruments since 2009 has disproportionately benefited emerging markets. This was because yields on traditionally safe assets like government bonds in advanced economies were pushed to record lows, forcing investors to look elsewhere for return. As ...

Macroeconomic Theory Solutions to Problem Set 1

... aborts the multiplier process. Y and T both increase by one unit, so disposable income, and hence consumption, do not change. Ch. 3 #6 [8] a. Tax rate is less than one. b. Y=c0+c1YD+I+G implies Y=[1/(1-c1+c1t1)]*[c0-c1t0+I+G]. c. The multiplier is [1/(1-c1+c1t1)], which is less than 1/(1-c1), so the ...

... aborts the multiplier process. Y and T both increase by one unit, so disposable income, and hence consumption, do not change. Ch. 3 #6 [8] a. Tax rate is less than one. b. Y=c0+c1YD+I+G implies Y=[1/(1-c1+c1t1)]*[c0-c1t0+I+G]. c. The multiplier is [1/(1-c1+c1t1)], which is less than 1/(1-c1), so the ...

Economics 104B, Section 41 Instructor: Tara Sinclair

... GDP rises by $8,000 because the garage is a final good. b. Smith purchases $2,000 worth of materials and builds a garage herself, which adds $8,000 to the value of her house. GDP rises by only $2,000, the value of the goods bought in the market. The value of the labor does not count towards GDP beca ...

... GDP rises by $8,000 because the garage is a final good. b. Smith purchases $2,000 worth of materials and builds a garage herself, which adds $8,000 to the value of her house. GDP rises by only $2,000, the value of the goods bought in the market. The value of the labor does not count towards GDP beca ...

Brazil_en.pdf

... including prospects for future production of new oil fields (pre-salt layer) and expectations of increased commodities exports. An additional factor was expectations with respect to financial variables, such as short-term transactions generated by domestic and international interest rate arbitrage. ...

... including prospects for future production of new oil fields (pre-salt layer) and expectations of increased commodities exports. An additional factor was expectations with respect to financial variables, such as short-term transactions generated by domestic and international interest rate arbitrage. ...

Sterling – US Dollar - Smart Currency Exchange

... US – Shadow on the horizon It’s been a positive quarter on the whole for the US economy, thanks to encouraging employment and job openings data. Events elsewhere in the world – most notably in Greece – drove up demand for the relative safe-haven US dollar. The International Monetary Fund (IMF) has c ...

... US – Shadow on the horizon It’s been a positive quarter on the whole for the US economy, thanks to encouraging employment and job openings data. Events elsewhere in the world – most notably in Greece – drove up demand for the relative safe-haven US dollar. The International Monetary Fund (IMF) has c ...

PDF Download

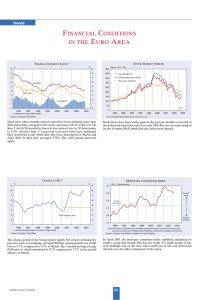

... 2002 and in May averaged 2.41% in the eurozone (2.64 % in EU-15). On June 5, the ECB decided to lower its key interest rate by 50 basis points to 2.0%, effective June 9. Long-term (ten-year) bond rates continued their downward trend which had only been interrupted in March and April 2003. In May the ...

... 2002 and in May averaged 2.41% in the eurozone (2.64 % in EU-15). On June 5, the ECB decided to lower its key interest rate by 50 basis points to 2.0%, effective June 9. Long-term (ten-year) bond rates continued their downward trend which had only been interrupted in March and April 2003. In May the ...

FedViews

... A wide range of other labor market indicators—including initial claims for unemployment insurance, surveys of household perceptions of job availability, and temporary help employment—are improving. These indicators tend to lead job growth and unemployment declines, so we expect that the labor market ...

... A wide range of other labor market indicators—including initial claims for unemployment insurance, surveys of household perceptions of job availability, and temporary help employment—are improving. These indicators tend to lead job growth and unemployment declines, so we expect that the labor market ...

Introduction to Macroeconomics · Final exam · 22 June 2015 1

... value of the unemployment rate but it is to represent the effect of open market operations. (d) Taylor’s rule is an equation stating how a central bank would set the interest rate. 7. An aggregate demand function can be assumed downward sloping because, if the inflation rate rises, then (a) the purc ...

... value of the unemployment rate but it is to represent the effect of open market operations. (d) Taylor’s rule is an equation stating how a central bank would set the interest rate. 7. An aggregate demand function can be assumed downward sloping because, if the inflation rate rises, then (a) the purc ...

... around 6.6% in 2015, compared with 7.3% in 2014. That growth is driven by the continued expansion of domestic demand and favourable external conditions, including falling oil prices and the buoyancy of the United States economy. The upswing in the United States economy is impacting exports (chiefly ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.