Mark scheme - Unit F582 - The national and international

... If consumer confidence is low, people may decide to increase their savings. A high rate of interest will discourage borrowing/encourage saving. Inflation will reduce purchasing power if prices are rising by more than wages/inflation may cause spending to be cut to maintain the real value of savings/ ...

... If consumer confidence is low, people may decide to increase their savings. A high rate of interest will discourage borrowing/encourage saving. Inflation will reduce purchasing power if prices are rising by more than wages/inflation may cause spending to be cut to maintain the real value of savings/ ...

Mortgage-Related Securities

... qualified loans together and convert these packages into securities known as mortgage-backed securities, which they then guarantee. As the borrowers whose loans are in the pool make their loan payments, the money is distributed on a pro rata basis to the holders of the securities (the investors). Th ...

... qualified loans together and convert these packages into securities known as mortgage-backed securities, which they then guarantee. As the borrowers whose loans are in the pool make their loan payments, the money is distributed on a pro rata basis to the holders of the securities (the investors). Th ...

Bank of England Inflation Report May 2013

... The fan chart depicts the probability of various outcomes for GDP growth. It has been conditioned on the assumption that the stock of purchased assets financed by the issuance of central bank reserves remains at £375 billion throughout the forecast period. To the left of the first vertical dashed li ...

... The fan chart depicts the probability of various outcomes for GDP growth. It has been conditioned on the assumption that the stock of purchased assets financed by the issuance of central bank reserves remains at £375 billion throughout the forecast period. To the left of the first vertical dashed li ...

Optimal Monetary Policy in a Two Country Model with Firm

... terms of trade and reducing the monetary distortion which depends on the size of the monopoly distortion. The terms of trade channel just described generates one conflict of interest between the two countries. However, this conflict is not the only basis for policy competition because monetary policy ...

... terms of trade and reducing the monetary distortion which depends on the size of the monopoly distortion. The terms of trade channel just described generates one conflict of interest between the two countries. However, this conflict is not the only basis for policy competition because monetary policy ...

Market for Loanable Funds

... deficit reduces the supply of loanable funds available to finance investment by households and firms. • This fall in investment is referred to as crowding out. • The deficit borrowing crowds out private borrowers who are trying to finance investments. ...

... deficit reduces the supply of loanable funds available to finance investment by households and firms. • This fall in investment is referred to as crowding out. • The deficit borrowing crowds out private borrowers who are trying to finance investments. ...

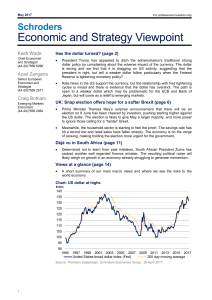

Economic and Strategy Viewpoint

... Theresa May has complained that “other parties and members of the House of Lords have sought to frustrate the process”. However, while there has been some protest over May’s relatively “hard” Brexit plans, the House of Commons voted to back the triggering of Article 50, and the House of Lords did li ...

... Theresa May has complained that “other parties and members of the House of Lords have sought to frustrate the process”. However, while there has been some protest over May’s relatively “hard” Brexit plans, the House of Commons voted to back the triggering of Article 50, and the House of Lords did li ...

A “HOW-TO” GUIDE: UNDERSTANDING AND MEASURING

... weighting placed on the prices of expensive restaurants, fine wine, or international luxury travel – but a CPI for very high-income consumers will include those factors. Some more specialized adjusted CPI indices are also reported in many countries. For example, central bankers are often interested ...

... weighting placed on the prices of expensive restaurants, fine wine, or international luxury travel – but a CPI for very high-income consumers will include those factors. Some more specialized adjusted CPI indices are also reported in many countries. For example, central bankers are often interested ...

Unemployed

... • Criticisms of how who is counted as unemployed – Part-time employment; those working part-time but also those who wanted to work full time but could find a job and had to settle for part time • By counting these workers, the unemployment rate is understated – Workers who become discouraged and giv ...

... • Criticisms of how who is counted as unemployed – Part-time employment; those working part-time but also those who wanted to work full time but could find a job and had to settle for part time • By counting these workers, the unemployment rate is understated – Workers who become discouraged and giv ...

HMT1355 - Sukuk Banking Sevices notice

... The first phase concerns the preparatory work required to structure the Sukuk and develop it such that it is ready to bring to market. This work will include, but is not necessarily limited to, identifying an asset, structuring, documentation, gaining Sharia’a approval, addressing legislative issues ...

... The first phase concerns the preparatory work required to structure the Sukuk and develop it such that it is ready to bring to market. This work will include, but is not necessarily limited to, identifying an asset, structuring, documentation, gaining Sharia’a approval, addressing legislative issues ...

Capital Budgeting - University of North Florida

... All expenses are paid in the same period as incurred Annual operating cash flows occur at the end of the year Conservatism ...

... All expenses are paid in the same period as incurred Annual operating cash flows occur at the end of the year Conservatism ...

The monetary theory of unemployment and inflation or why there

... impossibility of a reserve of value motive. Assuming that firms recoup more money than they have to pay back does not imply any demand for money function. These monetary profits are to be recycled in the next production process, which endows them again with real value4. In any case, firms’ access to ...

... impossibility of a reserve of value motive. Assuming that firms recoup more money than they have to pay back does not imply any demand for money function. These monetary profits are to be recycled in the next production process, which endows them again with real value4. In any case, firms’ access to ...

The Asset Market, Money, and Prices

... • The asset market is the entire set of markets in which people buy and sell real and financial assets, for example, gold, houses, stocks and bonds. • Money is an asset widely used and accepted as payment. • Money has long been believed to have special significance. • The market for money is importa ...

... • The asset market is the entire set of markets in which people buy and sell real and financial assets, for example, gold, houses, stocks and bonds. • Money is an asset widely used and accepted as payment. • Money has long been believed to have special significance. • The market for money is importa ...

Document

... seek full employment, stable prices, and satisfactory external balances in the short run. How are the goals of full employment and stable prices related to the long -run goal of economic growth? How can policymakers affect long-run growth? The goals of full employment and stable prices are related t ...

... seek full employment, stable prices, and satisfactory external balances in the short run. How are the goals of full employment and stable prices related to the long -run goal of economic growth? How can policymakers affect long-run growth? The goals of full employment and stable prices are related t ...

M o n e t a r y ... Contents 1 March 2001

... At this stage, we do not know how severe the international slowdown may be, or how long it might last. Most international commentators, even the relatively pessimistic ones, expect the United States economy to recover fairly quickly from the current slowdown. Moreover, there are some special factors ...

... At this stage, we do not know how severe the international slowdown may be, or how long it might last. Most international commentators, even the relatively pessimistic ones, expect the United States economy to recover fairly quickly from the current slowdown. Moreover, there are some special factors ...

THE IMPACT OF FISCAL POLICY ON GROSS DOMESTIC PRODUCT IN

... Due to the financial and economic crisis that started in 2007, and covered most of the EU member states, fiscal and monetary authorities have tried to counter the effects of the crisis by various measures, but all concluded in the rising of public debt and government deficit. Our researched focused ...

... Due to the financial and economic crisis that started in 2007, and covered most of the EU member states, fiscal and monetary authorities have tried to counter the effects of the crisis by various measures, but all concluded in the rising of public debt and government deficit. Our researched focused ...

2) The misery index in 1980 exceeded 25.

... 1. Locate this change in conditions as point B on the production function you drew in part 1b above. 2. (10 points for correct and completely labeled diagram with points A, B, C, and D) Now construct a supply curve as we did in lecture with point A representing the original price – output combinati ...

... 1. Locate this change in conditions as point B on the production function you drew in part 1b above. 2. (10 points for correct and completely labeled diagram with points A, B, C, and D) Now construct a supply curve as we did in lecture with point A representing the original price – output combinati ...

Paper - Caribbean Centre for Money and Finance

... and capital inflows. Moreover, the long-term gap determines the trend path of output growth. In this paper we would focus only on the short-term or stabilization problem, of which compensation is at its core. When the central bank buys foreign exchange it injects excess reserves into the banking sys ...

... and capital inflows. Moreover, the long-term gap determines the trend path of output growth. In this paper we would focus only on the short-term or stabilization problem, of which compensation is at its core. When the central bank buys foreign exchange it injects excess reserves into the banking sys ...

Lesson 7

... but after 1918 it was attempted again. The U.S. reinstated the gold standard from 1919 to 1933 at $20.67 per ounce and from 1934 to 1944 at $35.00 per ounce (a devaluation of the dollar). The U.K. reinstated the gold standard from 1925 to 1931. ...

... but after 1918 it was attempted again. The U.S. reinstated the gold standard from 1919 to 1933 at $20.67 per ounce and from 1934 to 1944 at $35.00 per ounce (a devaluation of the dollar). The U.K. reinstated the gold standard from 1925 to 1931. ...

A New Strategy for Social Security Investment in Latin America

... reduces the amount of income and payroll taxes that the government collects. As all of this makes clear, the difference between a pay as you go system and an investment based system is greater when the growth rates of wage incomes are lower. If the combined rise of the labor force and of wages per w ...

... reduces the amount of income and payroll taxes that the government collects. As all of this makes clear, the difference between a pay as you go system and an investment based system is greater when the growth rates of wage incomes are lower. If the combined rise of the labor force and of wages per w ...

IOSR Journal Of Humanities And Social Science (IOSR-JHSS)

... the degree of the pass-through. The importance of the bank credit in monetary policy transmission mechanism has also been stressed and it is presented below: The Credit Channel of Monetary Policy Transmission Mechanism The credit channel relates to bank lending and the bank balance- sheet transmissi ...

... the degree of the pass-through. The importance of the bank credit in monetary policy transmission mechanism has also been stressed and it is presented below: The Credit Channel of Monetary Policy Transmission Mechanism The credit channel relates to bank lending and the bank balance- sheet transmissi ...

Investment Implications of an “Activist” Federal Reserve

... the economy via increased reserves in the banking system (i.e., deposits of commercial banks at the central bank). This gives depository institutions the ability to make new loans. Currently, there is not strong demand for loans in the economy. If loan demand were to pick up, and if the banks lent t ...

... the economy via increased reserves in the banking system (i.e., deposits of commercial banks at the central bank). This gives depository institutions the ability to make new loans. Currently, there is not strong demand for loans in the economy. If loan demand were to pick up, and if the banks lent t ...

MONETARY POLICY IN THE US BEFORE AND AFTER THE CRISIS

... Open Market Desk was unable to offset completely the increase in deposits of depository institutions because it lacked a sufficient volume of unencumbered Treasury securities. Subsequently, however, the FOMC adopted a near-zero target range for the federal funds rate, and so a very large volume of r ...

... Open Market Desk was unable to offset completely the increase in deposits of depository institutions because it lacked a sufficient volume of unencumbered Treasury securities. Subsequently, however, the FOMC adopted a near-zero target range for the federal funds rate, and so a very large volume of r ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.