SERIES

... In late 1979, Turkeystood in the throes of a foreign exchange crisis. with widespread shortages, negative growth, and inflation into triple digits. A decade later, Turkey has a comfortable balance-of-payments situation, and sits atop considerable foreign exchange reserves. The economy has achieved a ...

... In late 1979, Turkeystood in the throes of a foreign exchange crisis. with widespread shortages, negative growth, and inflation into triple digits. A decade later, Turkey has a comfortable balance-of-payments situation, and sits atop considerable foreign exchange reserves. The economy has achieved a ...

EC827_B1 - Michigan State University

... IS Curve: Those values of real output and real interest rates that are consistent with commodity market equilibrium; i.e agents are just willing to purchase the total amount of output that is being currently produced ...

... IS Curve: Those values of real output and real interest rates that are consistent with commodity market equilibrium; i.e agents are just willing to purchase the total amount of output that is being currently produced ...

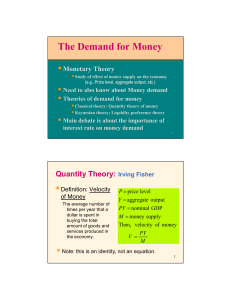

The Demand for Money - Spears School of Business

... ⇒ Neutrality of money (money cannot affect output) Interest rate has no role in money demand ...

... ⇒ Neutrality of money (money cannot affect output) Interest rate has no role in money demand ...

The Federal Reserve and Its Power

... • Changes in the Discount rate will affect the money supply only if banks are willing to respond. • Because the Fed scrutinizes borrowing at the discount window, banks may be reluctant to overuse this privilege. • Borrowing under the discount window is short-term and it is difficult to gauge the imp ...

... • Changes in the Discount rate will affect the money supply only if banks are willing to respond. • Because the Fed scrutinizes borrowing at the discount window, banks may be reluctant to overuse this privilege. • Borrowing under the discount window is short-term and it is difficult to gauge the imp ...

Practice Test 2 - Dasha Safonova

... A. smaller than M1. B. equal to M1, but only when all three functions of money apply. C. larger than M1. D. equal to M1, given full employment. 25. An asset category that caries the highest interest rate is A. savings deposits. B. checkable deposit accounts. C. loans. D. cash in the bank vault. 26. ...

... A. smaller than M1. B. equal to M1, but only when all three functions of money apply. C. larger than M1. D. equal to M1, given full employment. 25. An asset category that caries the highest interest rate is A. savings deposits. B. checkable deposit accounts. C. loans. D. cash in the bank vault. 26. ...

PDF

... Spain, as in eighteenth century France; as with wampum in Colonial America, greenbacks during the American Civil War, and monetized government bonds in the United States today. Deflation is associated with a shrinking supply of money, as we saw after the American Civil War and during the Great Depre ...

... Spain, as in eighteenth century France; as with wampum in Colonial America, greenbacks during the American Civil War, and monetized government bonds in the United States today. Deflation is associated with a shrinking supply of money, as we saw after the American Civil War and during the Great Depre ...

The Rand Crises of 1998 and 2001

... crises episodes, in 1998 and in 2001, and finds that, while both were characterized by intensive pressure on the rand, the policy response, and subsequent macroeconomic performance, were very different. Between end-April and end-August in 1998, the rand depreciated by 28 percent in nominal terms aga ...

... crises episodes, in 1998 and in 2001, and finds that, while both were characterized by intensive pressure on the rand, the policy response, and subsequent macroeconomic performance, were very different. Between end-April and end-August in 1998, the rand depreciated by 28 percent in nominal terms aga ...

policy platform - Research Center SAFE

... that is, in much of Europe. Just as importantly, it also led to broad acceptance, in Europe and elsewhere, of the notion that operational independence is a crucial precondition for good monetary policy. The movement towards the establishment of the euro area also led to a growing realisation that so ...

... that is, in much of Europe. Just as importantly, it also led to broad acceptance, in Europe and elsewhere, of the notion that operational independence is a crucial precondition for good monetary policy. The movement towards the establishment of the euro area also led to a growing realisation that so ...

Examiners` commentaries 2016 - University of London International

... are intended to test your knowledge of important concepts and understanding of key analytical points. A brief answer is expected, and candidates need to be selective in order to focus their answers on the most important points, since, for some of these questions, a very long answer could be given. S ...

... are intended to test your knowledge of important concepts and understanding of key analytical points. A brief answer is expected, and candidates need to be selective in order to focus their answers on the most important points, since, for some of these questions, a very long answer could be given. S ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... 10 trillion each year as lending margin (row A, defined as interest and dividends earned minus interest paid). Revenue from such sources as bond and currency dealing and service charges were about JPY 3 trillion (row B). This includes all other revenue except capital gains realized on stocks and rea ...

... 10 trillion each year as lending margin (row A, defined as interest and dividends earned minus interest paid). Revenue from such sources as bond and currency dealing and service charges were about JPY 3 trillion (row B). This includes all other revenue except capital gains realized on stocks and rea ...

2. I E D

... the aim to bring inflation closer to the target range. Other emerging market central banks, particularly in Eastern Europe, continued to ease monetary policy in this period as inflation remained mostly below the target. The first quarter of 2014 was marked by policy rate hikes across countries such ...

... the aim to bring inflation closer to the target range. Other emerging market central banks, particularly in Eastern Europe, continued to ease monetary policy in this period as inflation remained mostly below the target. The first quarter of 2014 was marked by policy rate hikes across countries such ...

Lecture Notes: Econ 202 - Faculty Personal Homepage

... where 20% will be added to the required reserves and the remaining balance will be given as a loan . ...

... where 20% will be added to the required reserves and the remaining balance will be given as a loan . ...

36A. Key Problem - McGraw Hill Higher Education

... unemployed. The unemployment rate would also fall. 6. The potential GDP is $840. (Since there is 2% cyclical unemployment, using Okun's Law gives us 2% x 2.5 = 5% multiplied by $800 billion = a GDP gap of $40 billion. The actual GDP of $800 plus the GDP gap of $40 equals potential GDP of $840.) 7. I ...

... unemployed. The unemployment rate would also fall. 6. The potential GDP is $840. (Since there is 2% cyclical unemployment, using Okun's Law gives us 2% x 2.5 = 5% multiplied by $800 billion = a GDP gap of $40 billion. The actual GDP of $800 plus the GDP gap of $40 equals potential GDP of $840.) 7. I ...

Download paper (PDF)

... this noteworthy is not what is said—much of the economics profession had long come to this view2— but who was saying it. Indeed, it would have been truly striking if they had come to any other conclusion. The report should be read seriously by past and present policy-makers—including those in the US ...

... this noteworthy is not what is said—much of the economics profession had long come to this view2— but who was saying it. Indeed, it would have been truly striking if they had come to any other conclusion. The report should be read seriously by past and present policy-makers—including those in the US ...

Triangular Relation Foreign Direct Investments - Exchange Rate – Capital Market for the CEE Countries:

... As such, Czech reflects a quite positive impact during the whole period of analysis, meaning that under the influence of important foreign direct investments, the exchange rate tends to reflect an appreciation of the national currency; this effect can be remarked at the level of the other countries ...

... As such, Czech reflects a quite positive impact during the whole period of analysis, meaning that under the influence of important foreign direct investments, the exchange rate tends to reflect an appreciation of the national currency; this effect can be remarked at the level of the other countries ...

Risk Management and Financial Institutions

... showing the rate of interest at which a AA-rated company can borrow for 1, 2, 3 … years Alternative 2: Use swap rates so that the term structure represents future short term AA borrowing rates Alternative 2 is the usual approach. It creates the LIBOR/swap term structure of interest rates ...

... showing the rate of interest at which a AA-rated company can borrow for 1, 2, 3 … years Alternative 2: Use swap rates so that the term structure represents future short term AA borrowing rates Alternative 2 is the usual approach. It creates the LIBOR/swap term structure of interest rates ...

NBER WORKING PAPER SERIES THEORY AND HISTORY BEHIND

... the Regulation Q ceilings on the interest that could be paid on bank and savings and loan accounts were in place. ...

... the Regulation Q ceilings on the interest that could be paid on bank and savings and loan accounts were in place. ...

The Monetary-Fiscal Policy Mix

... George W. Bush defeated Clinton’s vice President Al Gore in a soundly contested election of 2000, and thus far, his policies could be characterized as fairly expansionary. The War on Terrorism that the US is waging against Osama bin Laden has brought forth increases in the need for military expendit ...

... George W. Bush defeated Clinton’s vice President Al Gore in a soundly contested election of 2000, and thus far, his policies could be characterized as fairly expansionary. The War on Terrorism that the US is waging against Osama bin Laden has brought forth increases in the need for military expendit ...

Chapter_16

... Assume that you have deposited $1,000 dollars in your checking account. The bank doesn’t keep all of your money, but rather lends out some of it to businesses and other people. The portion of your original $1,000 that the bank needs to keep on hand, or not loan out, is called the required reserve ra ...

... Assume that you have deposited $1,000 dollars in your checking account. The bank doesn’t keep all of your money, but rather lends out some of it to businesses and other people. The portion of your original $1,000 that the bank needs to keep on hand, or not loan out, is called the required reserve ra ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.