Principles Of Macro Economics

... (C) As a result of technological change (D) When an individual retires 52. The natural rate of unemployment equals the sum of those who are: (A) Frictionally and structurally unemployed (B) Frictionally and cyclically unemployed (C) Structurally and cyclically unemployed (D) Frictionally structurall ...

... (C) As a result of technological change (D) When an individual retires 52. The natural rate of unemployment equals the sum of those who are: (A) Frictionally and structurally unemployed (B) Frictionally and cyclically unemployed (C) Structurally and cyclically unemployed (D) Frictionally structurall ...

Bank of England Inflation Report February 2013

... corresponding cross-sections of the November 2012 Inflation Report fan chart, which was conditioned on the same assumption about the stock of purchased assets financed by the issuance of central bank reserves. (b) Average probability within each band; the figures on the y-axis indicate the probabili ...

... corresponding cross-sections of the November 2012 Inflation Report fan chart, which was conditioned on the same assumption about the stock of purchased assets financed by the issuance of central bank reserves. (b) Average probability within each band; the figures on the y-axis indicate the probabili ...

Monetary policy rules in economies with traded and non

... Firms face perfectly competitive factor markets for hiring capital and the labor. Thus, each …rm chooses Ki;t (f ) and Li;t (f), taking as given both the aggregate wage index Wt and the rental price of capital in its sector RKi;t . While …rms in each sector are assumed to face a common wage rate, th ...

... Firms face perfectly competitive factor markets for hiring capital and the labor. Thus, each …rm chooses Ki;t (f ) and Li;t (f), taking as given both the aggregate wage index Wt and the rental price of capital in its sector RKi;t . While …rms in each sector are assumed to face a common wage rate, th ...

PDF Download

... growing incentive to convert dollars into other currencies. In Japan the built up of foreign-currency denominated assets was mainly driven by private capital outflows, with foreign reserve accumulation substituting private foreign assets only discretionally. 7 With short-term and long-term interest ...

... growing incentive to convert dollars into other currencies. In Japan the built up of foreign-currency denominated assets was mainly driven by private capital outflows, with foreign reserve accumulation substituting private foreign assets only discretionally. 7 With short-term and long-term interest ...

macronotes - Houston H. Stokes Page

... Goal of the Notes: Allow the student to have an outline of the key ideas and solutions to the problems. Since the notes are distributed in WORD® 97 format, students can edit the notes. I. Fundamentals of Macroeconomics: Chapter 1 The Macroeconomy: Growth and Fluctuations Macroeconomics studies the a ...

... Goal of the Notes: Allow the student to have an outline of the key ideas and solutions to the problems. Since the notes are distributed in WORD® 97 format, students can edit the notes. I. Fundamentals of Macroeconomics: Chapter 1 The Macroeconomy: Growth and Fluctuations Macroeconomics studies the a ...

Zimbabwe - COMESA Monetary Institute (CMI)

... Because the underlying macroeconomic fundamentals had not been corrected, and that monetary injections into the economy continued unabated, the positive impact of currency rebasing did not last for long. The three zeros knocked out of the currency were soon to return – with a vengeance (Kramarenko, ...

... Because the underlying macroeconomic fundamentals had not been corrected, and that monetary injections into the economy continued unabated, the positive impact of currency rebasing did not last for long. The three zeros knocked out of the currency were soon to return – with a vengeance (Kramarenko, ...

chapter overview

... Bulletin, will have a table giving the amount of this debt currently held by the Fed. In other words, the Fed has significant power to affect the money supply by buying or selling these securities. Also remind students that the Fed deals only in federal government bonds, not corporate stock or bonds ...

... Bulletin, will have a table giving the amount of this debt currently held by the Fed. In other words, the Fed has significant power to affect the money supply by buying or selling these securities. Also remind students that the Fed deals only in federal government bonds, not corporate stock or bonds ...

2. Keynes and the failure of self-correction

... Money shares with bonds the property that it is a nominal asset, but it differs from bonds in two aspects: it is more liquid (it provides liquidity services) and pays no return. Hence, when the interest rate on bonds increases, people will reduce the fraction of wealth they hold in the form of money ...

... Money shares with bonds the property that it is a nominal asset, but it differs from bonds in two aspects: it is more liquid (it provides liquidity services) and pays no return. Hence, when the interest rate on bonds increases, people will reduce the fraction of wealth they hold in the form of money ...

FRBSF L CONOMIC

... inflation in the medium term? And what is the appropriate response of Federal Reserve monetary policy? Regarding the first question, we’ve seen a very substantial pickup in prices for many energy, food, and industrial commodities. For example, in the past year copper prices have risen 26%, Brent cru ...

... inflation in the medium term? And what is the appropriate response of Federal Reserve monetary policy? Regarding the first question, we’ve seen a very substantial pickup in prices for many energy, food, and industrial commodities. For example, in the past year copper prices have risen 26%, Brent cru ...

Investment Strategy Quarterly

... There is no assurance the trends mentioned will continue or that the forecasts discussed will be realized. Investing involves risks, including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and ...

... There is no assurance the trends mentioned will continue or that the forecasts discussed will be realized. Investing involves risks, including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and ...

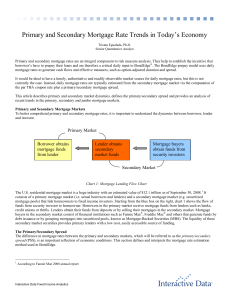

Primary and Secondary Mortgage Rate Trends in Today`s Economy

... form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between Interactive Data Fixed Income Analytics and/or affiliates and theirs clients relating to any of the products or services described he ...

... form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between Interactive Data Fixed Income Analytics and/or affiliates and theirs clients relating to any of the products or services described he ...

Interactive Tool

... time of goods and services purchased by households. The CPI is based on prices of food, clothing, shelter, and fuels, transportation, fares, charges for doctors' and dentists' services, drugs, and other goods and services that people buy for day-to-day living. “Prices are collected in 87 urban areas ...

... time of goods and services purchased by households. The CPI is based on prices of food, clothing, shelter, and fuels, transportation, fares, charges for doctors' and dentists' services, drugs, and other goods and services that people buy for day-to-day living. “Prices are collected in 87 urban areas ...

How high is the natural rate of unemployment in Hong Kong? (A

... unemployment. A system of simultaneous equations is developed to explain aggregate wage and price setting behavior, whilst also taking into account the supply side factors as well as the structural aspects in Hong Kong’s labour market. The use of simultaneous equation system has the merit that the n ...

... unemployment. A system of simultaneous equations is developed to explain aggregate wage and price setting behavior, whilst also taking into account the supply side factors as well as the structural aspects in Hong Kong’s labour market. The use of simultaneous equation system has the merit that the n ...

2 0 0 0 E D I T I O N O F F I C I A L S T U D Y G U I D E

... 1. An economy that is fully employing all its productive resources but allocating less to investment than to consumption will be at which of the following positions on the production possibilities curve shown above? (A) (B) (C) (D) (E) ...

... 1. An economy that is fully employing all its productive resources but allocating less to investment than to consumption will be at which of the following positions on the production possibilities curve shown above? (A) (B) (C) (D) (E) ...

Investment Quarterly

... imbalances were the root cause of the sell-offs, as most EM current accounts gradually fell into deficit over the past few years, increasingly financed by short term, volatile foreign capital. The sell-offs can be seen as a reassessment of risks after a period of relative complacency, a negative sid ...

... imbalances were the root cause of the sell-offs, as most EM current accounts gradually fell into deficit over the past few years, increasingly financed by short term, volatile foreign capital. The sell-offs can be seen as a reassessment of risks after a period of relative complacency, a negative sid ...

SOLUTIONS TO MACRO END-OF-CHAPTER

... v) Potential Rate of Growth (PGR) = Labour force growth + productivity growth = 1.44 % + 0.80 % = 2.24 % in 2006 vi) The target for growth in the economy is 3.0%. In 2006 the economy’s capacity to produce grew by only 2.24%, which is substantially below the target. If this rate does not rebound, the ...

... v) Potential Rate of Growth (PGR) = Labour force growth + productivity growth = 1.44 % + 0.80 % = 2.24 % in 2006 vi) The target for growth in the economy is 3.0%. In 2006 the economy’s capacity to produce grew by only 2.24%, which is substantially below the target. If this rate does not rebound, the ...

Risks of a deflation in the EMU. Why is this time so deceitful?

... „creative destruction‟ and the related processes of „merger and acquisitions”) that increases the market power of the surviving firms. Hence, economic crises would have to lead either to a reduction of the positive variations or to negative changes in the average production costs (first of all, unit ...

... „creative destruction‟ and the related processes of „merger and acquisitions”) that increases the market power of the surviving firms. Hence, economic crises would have to lead either to a reduction of the positive variations or to negative changes in the average production costs (first of all, unit ...

Chapter 16 - UCSB Economics

... 1) Do what the Fed did: Accommodate the demand for money by increasing Ms to make AA curve go back to where started. Back to normal. This is perhaps its most widely praised monetary policy action. 2) Could have increased government expenditure. But why do this? It takes longer, and improves Y throug ...

... 1) Do what the Fed did: Accommodate the demand for money by increasing Ms to make AA curve go back to where started. Back to normal. This is perhaps its most widely praised monetary policy action. 2) Could have increased government expenditure. But why do this? It takes longer, and improves Y throug ...

Chronic Deflation in Japan - Faculty of Business and Economics

... once the central bank faced the zero floor, it was no longer able to lower the policy rate in tandem with the decline in the natural interest rate. This may have produced the negative output gap, since the policy rate was too restrictive compared to the natural rate. Couching his argument in the Fis ...

... once the central bank faced the zero floor, it was no longer able to lower the policy rate in tandem with the decline in the natural interest rate. This may have produced the negative output gap, since the policy rate was too restrictive compared to the natural rate. Couching his argument in the Fis ...

What does it mean? Common terms for home ownership factsheet

... and quality of buildings. They are designed to ensure public safety, health and minimum acceptable standards of construction. Building society - Institutions operating in a similar fashion to banks. That is, they take deposits and provide loans. Customers are ‘members’. Capital gain - The financial ...

... and quality of buildings. They are designed to ensure public safety, health and minimum acceptable standards of construction. Building society - Institutions operating in a similar fashion to banks. That is, they take deposits and provide loans. Customers are ‘members’. Capital gain - The financial ...

The Economics of Small Open Economies

... issues about four units of debt and pays an interest rate of 3 percent. To be precise, Figure 1 is a snapshot of the country’s debt market. That the demand line is flat at 3 percent does not necessarily mean that it will be at that level next month. In fact, demand will most likely change over time. ...

... issues about four units of debt and pays an interest rate of 3 percent. To be precise, Figure 1 is a snapshot of the country’s debt market. That the demand line is flat at 3 percent does not necessarily mean that it will be at that level next month. In fact, demand will most likely change over time. ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.