Course FM Manual by Dr. Krzysztof Ostaszewski, FSA, CERA, FSAS

... • Implied repo rate: This concept is now deleted from the syllabus. It is still discussed in the manual, to provide background information. • Synthetic forward: This concept is now deleted from the syllabus. • Paylater Strategy: This concept is now deleted from the syllabus. • Option Spread: This co ...

... • Implied repo rate: This concept is now deleted from the syllabus. It is still discussed in the manual, to provide background information. • Synthetic forward: This concept is now deleted from the syllabus. • Paylater Strategy: This concept is now deleted from the syllabus. • Option Spread: This co ...

C01_Reilly1ce

... Pure Rate of Interest – Exchange rate between future consumption (future dollars) and present consumption (current dollars) • Market forces determine rate • Example: – If you can exchange $100 today for $104 next year, this rate is ...

... Pure Rate of Interest – Exchange rate between future consumption (future dollars) and present consumption (current dollars) • Market forces determine rate • Example: – If you can exchange $100 today for $104 next year, this rate is ...

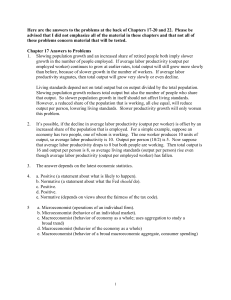

Chapter Problems Frank and Bernanke Chapters 17

... 2.3% per year over the 27-year period from 1973 to 2000, in 2000 it would have equaled x*(1.023)27, or 1.848*x. We’d like to compare that with actual U.S. productivity in 2000. To determine actual U.S. labor productivity using only the information in Table 20.3, recall first that productivity grew b ...

... 2.3% per year over the 27-year period from 1973 to 2000, in 2000 it would have equaled x*(1.023)27, or 1.848*x. We’d like to compare that with actual U.S. productivity in 2000. To determine actual U.S. labor productivity using only the information in Table 20.3, recall first that productivity grew b ...

The Goods Market and the IS Curve

... The Goods Market and the IS Curve Deriving the IS Curve: • If investment falls, the planned expenditure line must shift downward because at any level of income, expenditure is now lower than it was before – this is represented by a shift downward of the planned expenditure line E (Planned Expenditu ...

... The Goods Market and the IS Curve Deriving the IS Curve: • If investment falls, the planned expenditure line must shift downward because at any level of income, expenditure is now lower than it was before – this is represented by a shift downward of the planned expenditure line E (Planned Expenditu ...

Chapter 3

... The additional return that investors expect to earn to compensate them for a security’s risk. When a cash flow is risky, to compute its present value we must discount the cash flow we expect on average at a rate that equals the risk-free interest rate plus an appropriate risk premium. ...

... The additional return that investors expect to earn to compensate them for a security’s risk. When a cash flow is risky, to compute its present value we must discount the cash flow we expect on average at a rate that equals the risk-free interest rate plus an appropriate risk premium. ...

L3_20110311

... • Taxes on interest income substantially reduce the future payoff from current saving and, as a result, reduce the incentive to save. • A tax decrease increases the incentive for households to save at any given interest rate. • The supply of loanable funds curve shifts to the right. • The equilibriu ...

... • Taxes on interest income substantially reduce the future payoff from current saving and, as a result, reduce the incentive to save. • A tax decrease increases the incentive for households to save at any given interest rate. • The supply of loanable funds curve shifts to the right. • The equilibriu ...

Mankiw 5e Chapter 7

... If two economies are identical except for their rates of population growth, then if both economies are in steady state, the economy with the higher rate of population growth will have a A. lower rate of growth of total output. B. higher rate of growth of total output. C. lower rate of growth of outp ...

... If two economies are identical except for their rates of population growth, then if both economies are in steady state, the economy with the higher rate of population growth will have a A. lower rate of growth of total output. B. higher rate of growth of total output. C. lower rate of growth of outp ...

CHAPTER OVERVIEW

... 1. As tax rates increase from zero, tax revenues increase from zero to some maximum level (m) and then decline. 2. Tax rates above or below this maximum rate will cause a decrease in tax revenue. 3. Laffer argued that tax rates were above the optimal level and by lowering tax rates government could ...

... 1. As tax rates increase from zero, tax revenues increase from zero to some maximum level (m) and then decline. 2. Tax rates above or below this maximum rate will cause a decrease in tax revenue. 3. Laffer argued that tax rates were above the optimal level and by lowering tax rates government could ...

Lecture Outline

... show graphically. Begin with money supply, money demand, and an equilibrium interest rate. Show how both an increase and a decrease in the money supply affect interest rates. ...

... show graphically. Begin with money supply, money demand, and an equilibrium interest rate. Show how both an increase and a decrease in the money supply affect interest rates. ...

the wizard of bubbleland

... lendable funds must equal the supply for lendable funds and this is only possible if the rate of interest is appropriately defined. If the interest rate were such that the demand for lendable funds was not equal to the supply of it, then we would also not have investment equal to savings. Thus the F ...

... lendable funds must equal the supply for lendable funds and this is only possible if the rate of interest is appropriately defined. If the interest rate were such that the demand for lendable funds was not equal to the supply of it, then we would also not have investment equal to savings. Thus the F ...

Part I Overview and Poverty Impact of Main Macroeconomic Policies

... of this volume, successful countries are those that have effectively exploited this ‘policy space’ for growth and poverty alleviation purposes. A first group of positive experiences in this camp refers to several cases of successful unorthodox stabilization programmes. Two famous cases in the 1980s ...

... of this volume, successful countries are those that have effectively exploited this ‘policy space’ for growth and poverty alleviation purposes. A first group of positive experiences in this camp refers to several cases of successful unorthodox stabilization programmes. Two famous cases in the 1980s ...

Chapter 7

... unemployment rate that is estimated to prevail in the long-run macroeconomic equilibrium Should not reflect cyclical unemployment When seasonally adjusted, the natural rate should include only frictional and structural ...

... unemployment rate that is estimated to prevail in the long-run macroeconomic equilibrium Should not reflect cyclical unemployment When seasonally adjusted, the natural rate should include only frictional and structural ...

NBER WORKING PAPER SERIES INTERNATIONAL LENDING AND BORROWING IN A STOCHASTIC SEQUENCE EQUILIBRIUM

... deterministic case. Lucas (1982, part 2) studies a two—country Arrow— Debreu equilibrium model which features Markovian fluctuations in the national outputs of imperfectly substitutable goods. Although his primary concern is with asset pricing in the open economy, the strong implication of the risk ...

... deterministic case. Lucas (1982, part 2) studies a two—country Arrow— Debreu equilibrium model which features Markovian fluctuations in the national outputs of imperfectly substitutable goods. Although his primary concern is with asset pricing in the open economy, the strong implication of the risk ...

... sibility for them should be attributed to the Bank of Canada or the National Bureau of Economic Research. In preparing this paper, we have had invaluable research collaboration and assistance from Ardo Hansson, Michael Margolick, Tim Padmore, and Reg Plummer. In building the MACE model described in ...

The Myth of Expansionary Fiscal Austerity

... consistent with standard Keynesian analysis. In the short run, fiscal adjustment is contractionary, with cuts in spending being more contractionary than increases in taxes. This is consistent with both the theoretical view that spending will more directly impact the economy than taxes and also a lar ...

... consistent with standard Keynesian analysis. In the short run, fiscal adjustment is contractionary, with cuts in spending being more contractionary than increases in taxes. This is consistent with both the theoretical view that spending will more directly impact the economy than taxes and also a lar ...

Second Midterm and Answers

... 14. Suppose there is an increase in the government budget deficit in a country with a closed economy. Holding everything else constant, this will a.) increase the equilibrium level of the interest rate and the level of investment in this country; and, in the next time period output in this economy w ...

... 14. Suppose there is an increase in the government budget deficit in a country with a closed economy. Holding everything else constant, this will a.) increase the equilibrium level of the interest rate and the level of investment in this country; and, in the next time period output in this economy w ...

Document

... households to work or save depends largely on which of the following? a. What philosophies are taught in school b. The nature of the people in a particular geographic area c. The government’s tax policy and the economic outlook d. The availability of government subsides ANSWER: c 24. An unstable eco ...

... households to work or save depends largely on which of the following? a. What philosophies are taught in school b. The nature of the people in a particular geographic area c. The government’s tax policy and the economic outlook d. The availability of government subsides ANSWER: c 24. An unstable eco ...

FINAL EXAM—REVIEW SHEET (This sheet, while not all inclusive

... Know the general characteristics/features of bonds. Understand the basic concept of valuation. Be able to compute the value and the yield to maturity of a bond. Understand what the yield to maturity (YTM) of a bond represents. Understand the relationship between YTM and the coupon rate and t ...

... Know the general characteristics/features of bonds. Understand the basic concept of valuation. Be able to compute the value and the yield to maturity of a bond. Understand what the yield to maturity (YTM) of a bond represents. Understand the relationship between YTM and the coupon rate and t ...

A DSGE Model for an Emerging Open Economy Oil

... place in not just emerging economies but also in some developed economies post the financial crisis of 2008/09. Formalising such interventions as an additional monetary policy instrument in macroeconomic models should further epitomize the actions of central banks when faced with the two-pronged eff ...

... place in not just emerging economies but also in some developed economies post the financial crisis of 2008/09. Formalising such interventions as an additional monetary policy instrument in macroeconomic models should further epitomize the actions of central banks when faced with the two-pronged eff ...

KW2_Ch08_FINAL

... 7. The natural rate of unemployment changes over time. 8. Policy makers worry about inflation as well as unemployment. 9. Inflation does not, as many assume, make everyone poorer by raising the level of prices. That's because wages and incomes are adjusted to take into account a rising price level, ...

... 7. The natural rate of unemployment changes over time. 8. Policy makers worry about inflation as well as unemployment. 9. Inflation does not, as many assume, make everyone poorer by raising the level of prices. That's because wages and incomes are adjusted to take into account a rising price level, ...

Document

... reflect the stronger momentum into the year. While political uncertainty remains elevated ahead of crucial elections in France, Germany and potentially Italy, both fiscal policy and monetary policy are expansionary and the recovery in global trade growth supports exports and investment. We anticipat ...

... reflect the stronger momentum into the year. While political uncertainty remains elevated ahead of crucial elections in France, Germany and potentially Italy, both fiscal policy and monetary policy are expansionary and the recovery in global trade growth supports exports and investment. We anticipat ...

Fiscal Policy and the Recession: The Case of Greece

... applicable to all euro area economies, irrespective of the country’s rising indebtedness and elevated inflation. For example, as demonstrated in Figure 3, interest rates on Greek and German public debt securities differed only marginally from Greece’s entry to the euro zone in 2002 up until the end o ...

... applicable to all euro area economies, irrespective of the country’s rising indebtedness and elevated inflation. For example, as demonstrated in Figure 3, interest rates on Greek and German public debt securities differed only marginally from Greece’s entry to the euro zone in 2002 up until the end o ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.