US subprime credit crisis and its implications from a corporate

... Bank loans and financing from the international markets has became more expensive The following financing characteristics could help lessen the effects: available shelf facilities in sufficient amount loan portfolio with longer maturity/maturities spread over time only a part of the debt needs to be ...

... Bank loans and financing from the international markets has became more expensive The following financing characteristics could help lessen the effects: available shelf facilities in sufficient amount loan portfolio with longer maturity/maturities spread over time only a part of the debt needs to be ...

In Practice The negative impact of complex corporate structures in

... creditors may be depressed by these added working capital demands. Insolvency practitioners should also see a benefit in more open disclosure, if it exposes problems at an earlier stage and allows them to deliver more positive outcomes, saving more businesses and jobs. If nothing else it would make ...

... creditors may be depressed by these added working capital demands. Insolvency practitioners should also see a benefit in more open disclosure, if it exposes problems at an earlier stage and allows them to deliver more positive outcomes, saving more businesses and jobs. If nothing else it would make ...

Building better credit unions (summary)

... credit union can be transformed through refurbishing existing or acquiring new premises. Rather, there appears to be an appropriate point in a credit union’s growth cycle when such activities will give a further pronounced impetus to membership and asset growth. ...

... credit union can be transformed through refurbishing existing or acquiring new premises. Rather, there appears to be an appropriate point in a credit union’s growth cycle when such activities will give a further pronounced impetus to membership and asset growth. ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... banks into the banking industry. As a result of alternative interest rate on deposits and loans, credits were given out indiscriminately without proper credit appraisal (Philip, 1994). The resultant effects were that many of these loans turn out to be bad. It is therefore not surprising to find bank ...

... banks into the banking industry. As a result of alternative interest rate on deposits and loans, credits were given out indiscriminately without proper credit appraisal (Philip, 1994). The resultant effects were that many of these loans turn out to be bad. It is therefore not surprising to find bank ...

Chapter 13

... Liquidity is an entity’s ability to make payments as they come due. Lenders and creditors want to assess the liquidity of an entity to ensure that it will be able to pay amounts owed. If there is concern that the entity will not be able to meet its obligations, lenders and creditors may not want to ...

... Liquidity is an entity’s ability to make payments as they come due. Lenders and creditors want to assess the liquidity of an entity to ensure that it will be able to pay amounts owed. If there is concern that the entity will not be able to meet its obligations, lenders and creditors may not want to ...

view - Pacra.com

... exorbitant expense ratio (123%). This translates into underwriting loss increasing to PKR 35mln (9M13: PKR 17mln). The investment income contributed PKR 14mln to absorb the loss; mainly through sale of investment property (PKR 10mln). The investment income stream needs to be strengthened on sustaina ...

... exorbitant expense ratio (123%). This translates into underwriting loss increasing to PKR 35mln (9M13: PKR 17mln). The investment income contributed PKR 14mln to absorb the loss; mainly through sale of investment property (PKR 10mln). The investment income stream needs to be strengthened on sustaina ...

AfDB perspective ppt

... • The Bank is present with a representative office in most of its countries of operation which allows for close monitoring ...

... • The Bank is present with a representative office in most of its countries of operation which allows for close monitoring ...

Jean-Pierre Landau: Procyclicality

... valuation gain or loss should instantly be recognized as a profit (or loss) and financially treated as such. There is a possibility to delink valuation from income / profit recognition. Some disconnection between the valuation process – which should remain anchored on market prices – and income and ...

... valuation gain or loss should instantly be recognized as a profit (or loss) and financially treated as such. There is a possibility to delink valuation from income / profit recognition. Some disconnection between the valuation process – which should remain anchored on market prices – and income and ...

The „out-of-sample“ method

... (GDP per capita; households consumption; inflation etc.), using data for developed countries • applying the estimated elasticities „out of sample“, i.e. on CEE countries to calculate „equilibrium credit“ • in contrast to HP filter, the out-of-sample method takes into account the economic fundamental ...

... (GDP per capita; households consumption; inflation etc.), using data for developed countries • applying the estimated elasticities „out of sample“, i.e. on CEE countries to calculate „equilibrium credit“ • in contrast to HP filter, the out-of-sample method takes into account the economic fundamental ...

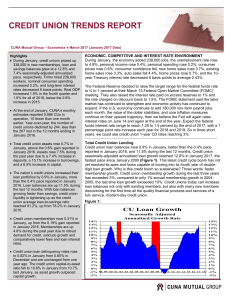

credit union trends report

... home sales rose 3.3%, auto sales fell 4.4%, home prices rose 0.7%, and the 10year Treasury interest rate decreased 6 basis points to average 2.43%. The Federal Reserve decided to raise the target range for the federal funds rate to ¾ to 1 percent at their March 15 Federal Open Market Committee (FOMC ...

... home sales rose 3.3%, auto sales fell 4.4%, home prices rose 0.7%, and the 10year Treasury interest rate decreased 6 basis points to average 2.43%. The Federal Reserve decided to raise the target range for the federal funds rate to ¾ to 1 percent at their March 15 Federal Open Market Committee (FOMC ...

Introduction to Hansa Investment Funds What is risk?

... • Since we cannot be aware of exposure NOR all of the affecting factors, the risk cannot be generally defined • One can define and measure only the certain perceived component of the risk – be it credit quality, volatility, etc • Therefore, it is worthless to ask wheither any risk metric measures th ...

... • Since we cannot be aware of exposure NOR all of the affecting factors, the risk cannot be generally defined • One can define and measure only the certain perceived component of the risk – be it credit quality, volatility, etc • Therefore, it is worthless to ask wheither any risk metric measures th ...

Prioritizing Opportunities to Reduce Foodborne Illness: Constructing

... – Measuring costs of regulation is more difficult for foodborne risks because of mix of incentives – Flexible regulatory approaches that allow choice are likely to be more cost effective – Redistribution rather than level of costs is likely to be most prominent effect of regulations ...

... – Measuring costs of regulation is more difficult for foodborne risks because of mix of incentives – Flexible regulatory approaches that allow choice are likely to be more cost effective – Redistribution rather than level of costs is likely to be most prominent effect of regulations ...

IDENTIFYING & MANAGING SYSTEMIC RISK

... should be traded on exchanges or electronic trading platforms and cleared through Central ...

... should be traded on exchanges or electronic trading platforms and cleared through Central ...

Dynamic analysis of bankruptcy and economic waves

... Operating enterprise must be solvable. According to accounting principles it signifies that it can serve and refund all its debt’s becoming due. Insolvency is the situation when the enterprise’s debt is greater than its asset value including: stocks, accorded credits, real estates, machines and othe ...

... Operating enterprise must be solvable. According to accounting principles it signifies that it can serve and refund all its debt’s becoming due. Insolvency is the situation when the enterprise’s debt is greater than its asset value including: stocks, accorded credits, real estates, machines and othe ...

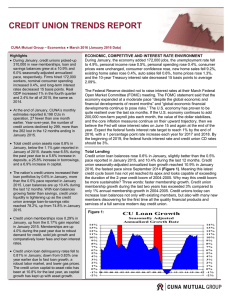

March

... boom at credit unions in the first quarter, which is keeping the record origination volume set in 2015 continuing into 2016. Expect mortgage interest rates to remain below 4% through the first half of the year as the Federal Reserve waits until summer to resume their rate normalization policy. Home ...

... boom at credit unions in the first quarter, which is keeping the record origination volume set in 2015 continuing into 2016. Expect mortgage interest rates to remain below 4% through the first half of the year as the Federal Reserve waits until summer to resume their rate normalization policy. Home ...

ConsumerMan Video for LifeSmarts 3: YOUR CREDIT REPORT

... Credit is so much more than a little piece of plastic. Good credit lets you buy things on time at a lower Page | 1 interest rate. If your credit is bad, you could be denied a credit card or forced to make a big deposit when you sign up for cable TV. This lesson explores the basic facts about credit ...

... Credit is so much more than a little piece of plastic. Good credit lets you buy things on time at a lower Page | 1 interest rate. If your credit is bad, you could be denied a credit card or forced to make a big deposit when you sign up for cable TV. This lesson explores the basic facts about credit ...

Presentation_Fahim

... Role of Credit Rating Agencies in the new Voluntary Pension System – Rating and investment performance measurement ...

... Role of Credit Rating Agencies in the new Voluntary Pension System – Rating and investment performance measurement ...

UCI Group Strategy A. Profumo, CEO of

... BIS II is a great opportunity for UCI: achieving a full compliance will represent the fulfilment of the ongoing development process aimed at further improving our Risk Management tools; this will result in: An effective control of the whole Group real risk profile (integrated control of all the ca ...

... BIS II is a great opportunity for UCI: achieving a full compliance will represent the fulfilment of the ongoing development process aimed at further improving our Risk Management tools; this will result in: An effective control of the whole Group real risk profile (integrated control of all the ca ...

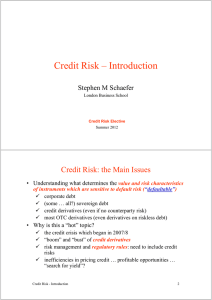

Credit Risk – Introduction

... 2. A bankruptcy filing or legal receivership by the debt issuer or obligor that will likely cause a miss or delay in future contractually-obligated debt service payments; 3. A distressed exchange whereby 1) an obligor offers creditors a new or restructured debt, or a new package of securities, cash ...

... 2. A bankruptcy filing or legal receivership by the debt issuer or obligor that will likely cause a miss or delay in future contractually-obligated debt service payments; 3. A distressed exchange whereby 1) an obligor offers creditors a new or restructured debt, or a new package of securities, cash ...

Alerta HARBOR: A Pesar de Reducción Crediticia por Fitch Ratings

... likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation. Obligations rated 'BB', 'B', 'CCC', 'CC', and 'C' are regarded as having significant speculative characteristics. 'BB' indicates the least degree of speculation and 'C' the highest. While such ob ...

... likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation. Obligations rated 'BB', 'B', 'CCC', 'CC', and 'C' are regarded as having significant speculative characteristics. 'BB' indicates the least degree of speculation and 'C' the highest. While such ob ...

Aucun titre de diapositive

... • Bank money management specialists will be at a disadvantage compared with non bank fund managers due to the operational risk capital they will now have to maintain • If a bank can structure a loan to reduce LGD by half, the capital requirement falls by half. Banks may respond by giving more emphas ...

... • Bank money management specialists will be at a disadvantage compared with non bank fund managers due to the operational risk capital they will now have to maintain • If a bank can structure a loan to reduce LGD by half, the capital requirement falls by half. Banks may respond by giving more emphas ...

Download Syllabus

... derivative market over the past 25 years (notional principal of over $648 trillion as end of 2011) has made this an increasingly important form of credit risk. In contrast to the credit risk of a loan portfolio, counterparty credit risk is characterized by uncertain future exposures, offsetting expo ...

... derivative market over the past 25 years (notional principal of over $648 trillion as end of 2011) has made this an increasingly important form of credit risk. In contrast to the credit risk of a loan portfolio, counterparty credit risk is characterized by uncertain future exposures, offsetting expo ...

Banking and FIs 10

... and systems or from external events” Regulators and banks are working towards a consistent and standardised way of measuring and holding capital against this risk Causes of operational risk include internal and external fraud, employment practices and work safety, illegal business practices (eg ...

... and systems or from external events” Regulators and banks are working towards a consistent and standardised way of measuring and holding capital against this risk Causes of operational risk include internal and external fraud, employment practices and work safety, illegal business practices (eg ...

Business Profile

... sheet strength, operating performance and business profile Where there is risk, there is uncertainty and where there is uncertainty there is exposure to volatility It’s not risk avoidance, it’s risk management Fundamental objective of a sound risk management is to manage organizations exposure ...

... sheet strength, operating performance and business profile Where there is risk, there is uncertainty and where there is uncertainty there is exposure to volatility It’s not risk avoidance, it’s risk management Fundamental objective of a sound risk management is to manage organizations exposure ...