brazilian credit cooperatives and financial banks: a - FEA

... economic performance in the last years and how each type of institution behaved in economic growth scenarios. Initially, it is necessary to verify whether those institutions are comparable, given they have different operations, services and objectives. Furthermore, must be analyzed the influence of ...

... economic performance in the last years and how each type of institution behaved in economic growth scenarios. Initially, it is necessary to verify whether those institutions are comparable, given they have different operations, services and objectives. Furthermore, must be analyzed the influence of ...

Risk Management and Asset and Liability Management in Banks

... products and their uses and formulated recommendations about their proper management. Importantly, it dispelled many concerns about the products and placed the emphasis on identification, management, control and monitoring of the risks as a mandatory starting point in the provision of these valuable ...

... products and their uses and formulated recommendations about their proper management. Importantly, it dispelled many concerns about the products and placed the emphasis on identification, management, control and monitoring of the risks as a mandatory starting point in the provision of these valuable ...

Download Full Article

... 2007 with negative impact on financial industry markets around the world. It causes loss of many financial institutions, including banks. In countries where the market-based capital markets dominate economic activity, many banks face a deterioration of profitability, capital and liquidity status bec ...

... 2007 with negative impact on financial industry markets around the world. It causes loss of many financial institutions, including banks. In countries where the market-based capital markets dominate economic activity, many banks face a deterioration of profitability, capital and liquidity status bec ...

Pillar 3 - Dimensional Fund Advisors

... ultimately the risk of redemptions from funds managed by the Firm. Based on the current level of assets under management, DFAL could withstand a sizeable decrease and still be able to meet all costs. Given the scale of the decrease that would be required in order to threaten DFAL’s ability to meet ...

... ultimately the risk of redemptions from funds managed by the Firm. Based on the current level of assets under management, DFAL could withstand a sizeable decrease and still be able to meet all costs. Given the scale of the decrease that would be required in order to threaten DFAL’s ability to meet ...

annual report - Anfaal Capital

... On behalf of the Board of Directors, I hereby share with you the Annual Report and Audited Financial Statement of Anfaal Capital (“Anfaal” or “the Company”) for the year ended 31 December 2015. The year 2015 witnessed the fall of the crude oil price from around 100 USD/bbl in 2014 to as low as 30 US ...

... On behalf of the Board of Directors, I hereby share with you the Annual Report and Audited Financial Statement of Anfaal Capital (“Anfaal” or “the Company”) for the year ended 31 December 2015. The year 2015 witnessed the fall of the crude oil price from around 100 USD/bbl in 2014 to as low as 30 US ...

Introduction to Financial Management

... • = Diversifiable risk • Risk factors that affect a limited number of assets • Risk that can be eliminated by combining assets into portfolios • “Unique risk” • “Asset-specific risk” • Examples: labor strikes, part shortages, etc. Return to Quick Quiz ...

... • = Diversifiable risk • Risk factors that affect a limited number of assets • Risk that can be eliminated by combining assets into portfolios • “Unique risk” • “Asset-specific risk” • Examples: labor strikes, part shortages, etc. Return to Quick Quiz ...

IFRS 9 Financial Instruments

... In 2013 EFRAG and the National Standard Setters (ANC, ASCG, FRC and the OIC) carried out a field-test on the proposed classification and measurement requirements for financial assets contained within IFRS 9 Financial Instruments, as amended by the Exposure Draft Classification and Measurement (Limit ...

... In 2013 EFRAG and the National Standard Setters (ANC, ASCG, FRC and the OIC) carried out a field-test on the proposed classification and measurement requirements for financial assets contained within IFRS 9 Financial Instruments, as amended by the Exposure Draft Classification and Measurement (Limit ...

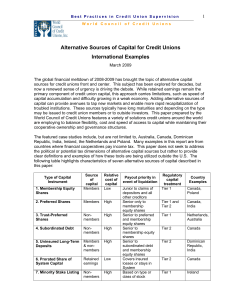

Alternative Sources of Capital for Credit Unions

... Although U.S. credit unions have separate statutory capital requirements per the Federal Credit Union Act, U.S. banks and credit unions in many countries are influenced by the Basel Accord on Capital Adequacy. Therefore, as a starting point we define what is meant by the terms Tier 1 and Tier 2 capi ...

... Although U.S. credit unions have separate statutory capital requirements per the Federal Credit Union Act, U.S. banks and credit unions in many countries are influenced by the Basel Accord on Capital Adequacy. Therefore, as a starting point we define what is meant by the terms Tier 1 and Tier 2 capi ...

Basel III Pillar 3 Regulatory Capital Disclosure Report 12.31.15

... raise supervisory concerns. It is the policy of the Federal Reserve Board that a savings and loan holding company like Synchrony should generally pay dividends on common stock only out of earnings, and only if prospective earnings retention is consistent with the company’s capital needs and overall ...

... raise supervisory concerns. It is the policy of the Federal Reserve Board that a savings and loan holding company like Synchrony should generally pay dividends on common stock only out of earnings, and only if prospective earnings retention is consistent with the company’s capital needs and overall ...

Active Portfolio Management and Performance Measure

... • “Set it and forget it” • Change allocations in 1 or 2 according to perceptions of risk to keep current with portfolio goals. • Active management – Forecasting future rates of return on either/both asset classes and individual securities ...

... • “Set it and forget it” • Change allocations in 1 or 2 according to perceptions of risk to keep current with portfolio goals. • Active management – Forecasting future rates of return on either/both asset classes and individual securities ...

Comments on “Risk Allocation, Debt Fueled Expansion and Financial Crisis,” Beaudry

... hold-to-maturity price. The adverse selection problem then aggregates from individual securities to financial services institutions. Because of losses on their real estate investments, these firms are undercapitalized. Investors fear that any firm that would like to issue new equity or debt is curre ...

... hold-to-maturity price. The adverse selection problem then aggregates from individual securities to financial services institutions. Because of losses on their real estate investments, these firms are undercapitalized. Investors fear that any firm that would like to issue new equity or debt is curre ...

Rating Action: Moody`s affirms HMN Naturgas I/S Aaa debt rating

... reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient ...

... reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient ...

Privacy Policy - Georgia Power Valdosta FCU

... services, the credit union obtains nonpublic personal information, either directly from the member or from outside sources. This nonpublic personal information is used to comply with federal and state laws and regulations, to provide effective member service and to inform members of products and ser ...

... services, the credit union obtains nonpublic personal information, either directly from the member or from outside sources. This nonpublic personal information is used to comply with federal and state laws and regulations, to provide effective member service and to inform members of products and ser ...

Click here to add a title

... • Conversely, the shares of upper sizes are boosted. • In particular, effect more significant among larger firms. • This may mean that credit allows firms to expand into higher size segments but we can’t test that with this dataset with no information on gross flows. ...

... • Conversely, the shares of upper sizes are boosted. • In particular, effect more significant among larger firms. • This may mean that credit allows firms to expand into higher size segments but we can’t test that with this dataset with no information on gross flows. ...

here. - DePaul University

... Firms that use bank credit are larger, less profitable, less liquid and more opaque as measured by firm age, i.e., younger. Among firms that use bank credit, the amount used as a percentage of assets is positively related to firm liquidity and to firm opacity as measured by firm age. Again, these re ...

... Firms that use bank credit are larger, less profitable, less liquid and more opaque as measured by firm age, i.e., younger. Among firms that use bank credit, the amount used as a percentage of assets is positively related to firm liquidity and to firm opacity as measured by firm age. Again, these re ...

Chapter 14: Management of Inventory and Liquidity

... • Establishment of a credit policy: – Is the company prepared to offer credit? – Assuming credit is to be offered, what standards will be applied in the decision to grant credit to a customer? – How much credit should a customer be granted? – What credit terms will be offered? Copyright 2009 McGra ...

... • Establishment of a credit policy: – Is the company prepared to offer credit? – Assuming credit is to be offered, what standards will be applied in the decision to grant credit to a customer? – How much credit should a customer be granted? – What credit terms will be offered? Copyright 2009 McGra ...

ESTIMATINg pROBABILITY Of DEfAULT AND COMpARINg IT TO

... probability of default by a borrower in repaying its obligation in the normal course of the business. According to the Article 13 of the Regulation on the assessment of credit risk losses of banks and savings banks (hereinafter referred to as Regulation) Slovenian banks classify borrowers into five ...

... probability of default by a borrower in repaying its obligation in the normal course of the business. According to the Article 13 of the Regulation on the assessment of credit risk losses of banks and savings banks (hereinafter referred to as Regulation) Slovenian banks classify borrowers into five ...

Default risk and spread risk

... The correlation between default risks of different borrowers is generally low (that is, low joint default frequency), though it can be significant for related companies, and smaller companies within the same domestic industry sector. ...

... The correlation between default risks of different borrowers is generally low (that is, low joint default frequency), though it can be significant for related companies, and smaller companies within the same domestic industry sector. ...

Policy on MIS Board Approval of Credit Rating

... All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopt ...

... All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopt ...

Risks Underlying Islamic Modes of Financing

... • Renting an asset to the party who sold it, has been questioned by scholars. 3. Pricing of Sukuk • Muslim economists and Shariah scholars have not come up with an alternative to the interest rate as a readily available indicator of profitability. Hence the use of LIBOR/KIBOR as a benchmark has beco ...

... • Renting an asset to the party who sold it, has been questioned by scholars. 3. Pricing of Sukuk • Muslim economists and Shariah scholars have not come up with an alternative to the interest rate as a readily available indicator of profitability. Hence the use of LIBOR/KIBOR as a benchmark has beco ...

Before The - Maryland Public Service Commission

... segregation of responsibilities. Traders should not be given authority over funds flows or trade ...

... segregation of responsibilities. Traders should not be given authority over funds flows or trade ...

Credit Creation Social Optimality Southampton Uni

... In 2007 to 2008 the financial system of the developed world suffered a huge crisis. At the peak of the crisis, in October and November 2008, fears that it would produce a new Great Depression were common. By mid-2009 those fears appeared misplaced and regulators turned to focus attention on the refo ...

... In 2007 to 2008 the financial system of the developed world suffered a huge crisis. At the peak of the crisis, in October and November 2008, fears that it would produce a new Great Depression were common. By mid-2009 those fears appeared misplaced and regulators turned to focus attention on the refo ...

The relevance and the limits of the Arrow-Lind Theorem

... increase in demand for electricity in a specific isolated region, the value of the project is positive only if the regional economy will indeed be growing in the future. This also yields a large beta. The same argument applies for fast train lines. Arrow and Lind (1970) also justify the recommendati ...

... increase in demand for electricity in a specific isolated region, the value of the project is positive only if the regional economy will indeed be growing in the future. This also yields a large beta. The same argument applies for fast train lines. Arrow and Lind (1970) also justify the recommendati ...

Risk Management Lessons from the Credit Crisis

... Many financial institutions that experienced large losses over the past few months apparently employed sophisticated risk management systems. That losses occurred does not necessarily imply that there were failures in risk management, however. As Stulz (2008) put it, “A large loss is not evidence of ...

... Many financial institutions that experienced large losses over the past few months apparently employed sophisticated risk management systems. That losses occurred does not necessarily imply that there were failures in risk management, however. As Stulz (2008) put it, “A large loss is not evidence of ...

THE SEARCH FOR HIGHER RETURNS

... peer-beating returns usually comes as the result of taking measured risk in one of the three areas. Although more exotic strategies exist, cash managers tend not to use them as often given the safety, liquidity and yield objectives of cash investing. In presenting each of the three “pillars” of inve ...

... peer-beating returns usually comes as the result of taking measured risk in one of the three areas. Although more exotic strategies exist, cash managers tend not to use them as often given the safety, liquidity and yield objectives of cash investing. In presenting each of the three “pillars” of inve ...