Credit Derivatives, Leverage, and Financial

... bank regulators, and monetary policy generally. See, e.g., Heidi Mandanis Schooner, The Role of Central Banks in Bank Supervision in the United States and the United Kingdom, 28 BROOKLYN J. INT'L L. 411 (2003) (analyzing compatibility of monetary policy and prudential supervision roles of central ba ...

... bank regulators, and monetary policy generally. See, e.g., Heidi Mandanis Schooner, The Role of Central Banks in Bank Supervision in the United States and the United Kingdom, 28 BROOKLYN J. INT'L L. 411 (2003) (analyzing compatibility of monetary policy and prudential supervision roles of central ba ...

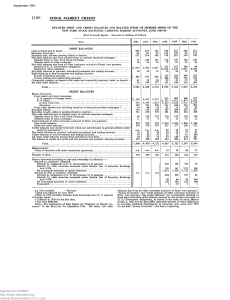

Detailed Debit and Credit Balances and Related Items of Member

... "money borrowed," and "credit balances of other customers exclusive of firms' own partners—free credit balances" are conceptually identical to these items (including debit balances secured by and money borrowed on U. S. Government obligations), as shown in the table on Stock Market Credit, p. 1069, ...

... "money borrowed," and "credit balances of other customers exclusive of firms' own partners—free credit balances" are conceptually identical to these items (including debit balances secured by and money borrowed on U. S. Government obligations), as shown in the table on Stock Market Credit, p. 1069, ...

Information on risk, own funds and capital requirements

... in force previously). The document takes a 3-year perspective and is reviewed and updated annually. It is approved by the Bank’s Management Board and Supervisory Board. The risk strategy is inextricably linked to other strategic documents, such as: Budget, Liquidity Plan, Capital Plan. The Risk Stra ...

... in force previously). The document takes a 3-year perspective and is reviewed and updated annually. It is approved by the Bank’s Management Board and Supervisory Board. The risk strategy is inextricably linked to other strategic documents, such as: Budget, Liquidity Plan, Capital Plan. The Risk Stra ...

AMP Capital Derivatives Risk Statement

... portfolio risk management, currency hedging may be used by AMP Capital. Currency profiles are established to ensure there is a clear understanding of the objectives, authorities and controls on such activity. It is acknowledged that hedging activity will primarily be by way of forward contracts, but ...

... portfolio risk management, currency hedging may be used by AMP Capital. Currency profiles are established to ensure there is a clear understanding of the objectives, authorities and controls on such activity. It is acknowledged that hedging activity will primarily be by way of forward contracts, but ...

R CAPITAL SOLUTIONS LTD DISCLOSURE AND MARKET

... Furthermore, the risk capacity/tolerance is the maximum amount of risk which the Company is technically able to assume before breaching one or more of its capital base, liquidity, borrowing capacity, reputational and regulatory constraints. The risk capacity represents the upper limit beyond which ...

... Furthermore, the risk capacity/tolerance is the maximum amount of risk which the Company is technically able to assume before breaching one or more of its capital base, liquidity, borrowing capacity, reputational and regulatory constraints. The risk capacity represents the upper limit beyond which ...

Credit Risk Transfer

... While credit risk sharing is not new at Fannie Mae, it has evolved dramatically since the financial crisis. Fannie Mae has traditionally utilized upfront forms of credit protection, such as primary mortgage insurance, as a normal course of business, and also used mortgage insurance pool policies as ...

... While credit risk sharing is not new at Fannie Mae, it has evolved dramatically since the financial crisis. Fannie Mae has traditionally utilized upfront forms of credit protection, such as primary mortgage insurance, as a normal course of business, and also used mortgage insurance pool policies as ...

Wolfsberg Statement - Guidance on a Risk Based Approach for

... Increased levels of ongoing controls and reviews of relationships. ...

... Increased levels of ongoing controls and reviews of relationships. ...

A Framework to Monitor Systemic Risk Sep. 27-28, 2012

... • Motivated by research on amplification mechanisms o Bernanke and Gertler (1989), Kyotaki and Moore (1997), (Geanakoplos (2003), Allen and Gale (2000), Adrian and Shin (2010), Brunnermeier and Pedersen (2009), He and Krishnamurthy (2012), Adrian and Boyarchenko (2012) ...

... • Motivated by research on amplification mechanisms o Bernanke and Gertler (1989), Kyotaki and Moore (1997), (Geanakoplos (2003), Allen and Gale (2000), Adrian and Shin (2010), Brunnermeier and Pedersen (2009), He and Krishnamurthy (2012), Adrian and Boyarchenko (2012) ...

D -F M : R

... an article on the history of money (1936), Douglas highlights how the relation between money creation and wealth creation has become divorced over time. in its very early stages money was originally created by the producers of wealth, i.e. the owners of livestock. the creation of money then passed o ...

... an article on the history of money (1936), Douglas highlights how the relation between money creation and wealth creation has become divorced over time. in its very early stages money was originally created by the producers of wealth, i.e. the owners of livestock. the creation of money then passed o ...

2016 DFAST Mid-Cycle Stress Test Disclosure

... – Citi identified events which would have a significant impact to its risk profile, with input from business and control function leaders. – Citi used these events with historical data and observed relationships between variables to create a global macroeconomic forecast which was then applied to ea ...

... – Citi identified events which would have a significant impact to its risk profile, with input from business and control function leaders. – Citi used these events with historical data and observed relationships between variables to create a global macroeconomic forecast which was then applied to ea ...

Basel Committee guidance on accounting for IFRS 9 expected credit

... Banks will need to consider what their peers are doing to help achieve consistency of implementation of the new ECL requirements. For example, are banks with access to the same information about future events, consistently considering that information in respect of portfolios with similar credit ris ...

... Banks will need to consider what their peers are doing to help achieve consistency of implementation of the new ECL requirements. For example, are banks with access to the same information about future events, consistently considering that information in respect of portfolios with similar credit ris ...

Probability and Impact Rating System

... process are to: • determine APRA’s assessment of the Probability that a regulated entity will fail; and • measure the impact of the potential consequences of that failure. As noted above, the primary responsibility for financial soundness of entities regulated by APRA lies with the board of directo ...

... process are to: • determine APRA’s assessment of the Probability that a regulated entity will fail; and • measure the impact of the potential consequences of that failure. As noted above, the primary responsibility for financial soundness of entities regulated by APRA lies with the board of directo ...

Basel III Pillar 3 Regulatory Capital Disclosures

... banks are Wells Fargo Bank, National Association (Wells Fargo Bank, N.A.), Wells Fargo Bank South Central, National Association (Wells Fargo Bank South Central, N.A.), Wells Fargo Bank Northwest, National Association (Wells Fargo Bank Northwest, N.A.), Wells Fargo Financial National Bank, Wells Farg ...

... banks are Wells Fargo Bank, National Association (Wells Fargo Bank, N.A.), Wells Fargo Bank South Central, National Association (Wells Fargo Bank South Central, N.A.), Wells Fargo Bank Northwest, National Association (Wells Fargo Bank Northwest, N.A.), Wells Fargo Financial National Bank, Wells Farg ...

Supporting Credit Union Success

... Credit unions face pressure from a steady long-term decline in financial margin, an increasing regulatory burden, rapid technology change, and socio-demographic trends. Membership growth is flat, as chartered banks are becoming better at competing with the credit union value proposition. Although cr ...

... Credit unions face pressure from a steady long-term decline in financial margin, an increasing regulatory burden, rapid technology change, and socio-demographic trends. Membership growth is flat, as chartered banks are becoming better at competing with the credit union value proposition. Although cr ...

Program_of_MAF_2016

... Empirical Bayes smoothing splines correlated noise to study mortality rates ...

... Empirical Bayes smoothing splines correlated noise to study mortality rates ...

Good Practices on Reducing Reliance on CRAs in Asset

... Credit rating agencies (CRAs) play a prominent role in the global financial markets. CRAs provide external credit ratings of individual financial instruments and issuers that express a view on the instrument or entity’s overall creditworthiness (hereafter “credit ratings”) 1. The role of CRAs has co ...

... Credit rating agencies (CRAs) play a prominent role in the global financial markets. CRAs provide external credit ratings of individual financial instruments and issuers that express a view on the instrument or entity’s overall creditworthiness (hereafter “credit ratings”) 1. The role of CRAs has co ...

Active ESG investing - BlueBay Asset Management

... Active management enables investors to explicitly, proactively and systematically take these into account. ...

... Active management enables investors to explicitly, proactively and systematically take these into account. ...

the probability of default under ifrs 9: multi

... losses should be discounted with the effective interest rate (or its approximation). When estimating expected credit losses, all relevant and supportable information about current, historical, but also future conditions that can be obtained without undue cost and effort should be taken into account. ...

... losses should be discounted with the effective interest rate (or its approximation). When estimating expected credit losses, all relevant and supportable information about current, historical, but also future conditions that can be obtained without undue cost and effort should be taken into account. ...

Presentation title here in Arial 32pt

... The forecasts stated in the presentation are the result of statistical modelling, based on a number of assumptions. Forecasts are subject to a high level of uncertainty regarding future economic, and market factors that may affect actual future performance. The forecasts are provided to you for info ...

... The forecasts stated in the presentation are the result of statistical modelling, based on a number of assumptions. Forecasts are subject to a high level of uncertainty regarding future economic, and market factors that may affect actual future performance. The forecasts are provided to you for info ...

1.1. Necessity of the research problem

... Technological and Commercial Joint Stock Bank (Techcombank) in particular. For this reason, credit risk management is a major task of Vietnam Technological and Commercial Joint Stock Bank (Techcombank). However, in addition to contributing greatly to commercial banks, credit is risky. Credit risks o ...

... Technological and Commercial Joint Stock Bank (Techcombank) in particular. For this reason, credit risk management is a major task of Vietnam Technological and Commercial Joint Stock Bank (Techcombank). However, in addition to contributing greatly to commercial banks, credit is risky. Credit risks o ...

Australia`s Authorised Depository Institutions The Capital–Assets Ratio

... • After insolvency and the liquidation of the remaining $92 in assets, depositors would get only 92/95 in the dollar (96.84%). Copyright 2007 McGraw-Hill Australia Pty Ltd PPTs t/a Financial Institutions Management 2e, by Lange, Saunders, Anderson, Thomson and Cornett Slides prepared by Maike Sund ...

... • After insolvency and the liquidation of the remaining $92 in assets, depositors would get only 92/95 in the dollar (96.84%). Copyright 2007 McGraw-Hill Australia Pty Ltd PPTs t/a Financial Institutions Management 2e, by Lange, Saunders, Anderson, Thomson and Cornett Slides prepared by Maike Sund ...

Risk Management - Governance

... Committee to invest per mandated requirements and pricing actuaries have to use models and assumptions agreed-upon based on the decision per Models and Assumptions Changes Committees. Proprietary ...

... Committee to invest per mandated requirements and pricing actuaries have to use models and assumptions agreed-upon based on the decision per Models and Assumptions Changes Committees. Proprietary ...

R Failures in Risk Management

... in economic life because people and firms make irrevocable investments in research and product development, plant and equipment, inventory, and human capital, without knowing whether the future cash flows from these investments will be sufficient to compensate both debt and equity holders. If such r ...

... in economic life because people and firms make irrevocable investments in research and product development, plant and equipment, inventory, and human capital, without knowing whether the future cash flows from these investments will be sufficient to compensate both debt and equity holders. If such r ...

Problems and Countermeasures in Constructing Credit Guarantee

... At present, China's credit guarantee system has been established, but the operating mechanism of risk diversification and transferring has not yet been fully established, which is an important reason constraining the development of China's security system. Therefore, we should set up risk diversifi ...

... At present, China's credit guarantee system has been established, but the operating mechanism of risk diversification and transferring has not yet been fully established, which is an important reason constraining the development of China's security system. Therefore, we should set up risk diversifi ...

1. Introduction to risk

... horizon. Generally, the time horizon chosen should not be shorter than the time frame over which risk-mitigating actions can be taken. It does not prescribe any one particular time horizon but suggests two possible time horizons that can provide management information relevant for credit risk manage ...

... horizon. Generally, the time horizon chosen should not be shorter than the time frame over which risk-mitigating actions can be taken. It does not prescribe any one particular time horizon but suggests two possible time horizons that can provide management information relevant for credit risk manage ...