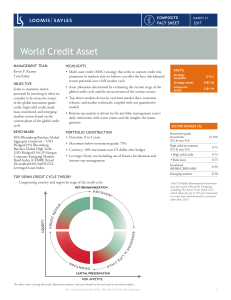

World Credit Asset

... Leverage Risk, Counterparty Risk, Prepayment Risk and Extension Risk. Investing involves risk including possible loss of principal. Due to rounding, Sector and Credit Quality distribution totals may not equal 100%. This portfolio is actively managed and characteristics are subject to change. Credit ...

... Leverage Risk, Counterparty Risk, Prepayment Risk and Extension Risk. Investing involves risk including possible loss of principal. Due to rounding, Sector and Credit Quality distribution totals may not equal 100%. This portfolio is actively managed and characteristics are subject to change. Credit ...

Rating Technology Choice and Loan Pricing

... banks to choose between two broad methodologies for calculating their capital requirements for credit risk, the {\em Standardized Approach} and the {\em Internal Ratings-Based Approach}, that are characterized by distinct levels of accuracies and capital requirements. This paper models the rating te ...

... banks to choose between two broad methodologies for calculating their capital requirements for credit risk, the {\em Standardized Approach} and the {\em Internal Ratings-Based Approach}, that are characterized by distinct levels of accuracies and capital requirements. This paper models the rating te ...

Interest Rate Risk

... a. Are the bank/financial institution with which UNDP banks financially sound? b. What is the deposit size of the bank/financial institution? c. How are the bank/financial institution ranked vs. its peers in the same country? d. What are the bank/financial institution’s credit rating? Foreign Curren ...

... a. Are the bank/financial institution with which UNDP banks financially sound? b. What is the deposit size of the bank/financial institution? c. How are the bank/financial institution ranked vs. its peers in the same country? d. What are the bank/financial institution’s credit rating? Foreign Curren ...

Minnesota 9-12 Personal Finance Standards

... Personal and financial goals can be achieved by applying economic concepts and principles to personal financial planning, budgeting, spending, saving, investing, borrowing and insuring decisions. 9.2.2.2.1 Establish financial goals; make a financial plan considering budgeting and asset building to m ...

... Personal and financial goals can be achieved by applying economic concepts and principles to personal financial planning, budgeting, spending, saving, investing, borrowing and insuring decisions. 9.2.2.2.1 Establish financial goals; make a financial plan considering budgeting and asset building to m ...

Lester Coyle - We look at where the bonds will be in a year

... might be 5% or 6%. But because of rolldown, the first year real yield could be 8% or 9%. In European CMBS we are buying paper with a two-year average life that has as much as 10% yield. Why does roll-down provide such a big pick-up? Many double Bs should get upgraded as the senior notes pay down, an ...

... might be 5% or 6%. But because of rolldown, the first year real yield could be 8% or 9%. In European CMBS we are buying paper with a two-year average life that has as much as 10% yield. Why does roll-down provide such a big pick-up? Many double Bs should get upgraded as the senior notes pay down, an ...

credit evaluation from the corporate practitioners

... area of Credit Management. While the theoretical aspects of each topic would be addressed, the seminar would pay particular attention to the practical aspects of Credit Management. Who Should Attend This seminar is designed for all levels of credit staff as well as corporate CFOs who are interested ...

... area of Credit Management. While the theoretical aspects of each topic would be addressed, the seminar would pay particular attention to the practical aspects of Credit Management. Who Should Attend This seminar is designed for all levels of credit staff as well as corporate CFOs who are interested ...

The following is a sample One-Pager to be used in legislative

... The following is a sample One-Pager to be used in legislative meetings. This document is intended to be left with the elected official or their staffer, and function as a “resume” for your credit union. It should be printed on credit union stationary and customized for the products and services offe ...

... The following is a sample One-Pager to be used in legislative meetings. This document is intended to be left with the elected official or their staffer, and function as a “resume” for your credit union. It should be printed on credit union stationary and customized for the products and services offe ...

Word Wall Words

... credit-The supplying of money, goods, or services at present in exchange for the promise of future payment. creditor- The business or organization that extends the credit. finance charge- The total cost of using credit, including interest and any fees. credit score- A numerical rating, based on cred ...

... credit-The supplying of money, goods, or services at present in exchange for the promise of future payment. creditor- The business or organization that extends the credit. finance charge- The total cost of using credit, including interest and any fees. credit score- A numerical rating, based on cred ...

The characteristics of the capital market

... Main weaknesses in the capital market during the crisis and its implications for the financial system Before the crisis • Underpricing • Structural problems following the reforms During the crisis • Steep decline in nonbank credit • Lack of infrastructures for debt arrangements • Loss of confidence ...

... Main weaknesses in the capital market during the crisis and its implications for the financial system Before the crisis • Underpricing • Structural problems following the reforms During the crisis • Steep decline in nonbank credit • Lack of infrastructures for debt arrangements • Loss of confidence ...

Member Service Representative ProMedica Federal Credit Union

... MSR Position Summary: The primary functions of an MSR are to process member deposits, withdraws, loan and credit card payments, issue cashier’s checks, money orders, and cash advances. MSR’s must balance each day’s transactions and verify cash and check totals. MSR’s also assist members with questio ...

... MSR Position Summary: The primary functions of an MSR are to process member deposits, withdraws, loan and credit card payments, issue cashier’s checks, money orders, and cash advances. MSR’s must balance each day’s transactions and verify cash and check totals. MSR’s also assist members with questio ...

A1 Advanced products for managing the bank`s balance sheet

... Exercise: structuring a credit linked note. ...

... Exercise: structuring a credit linked note. ...

resolution - World Council of Credit Unions

... communities in which they have served since they were founded more than 150 years ago; and WHEREAS, credit unions have championed the idea that people from all walks of life should have access to affordable financial services offered by credit unions; and WHEREAS, credit unions empower people to imp ...

... communities in which they have served since they were founded more than 150 years ago; and WHEREAS, credit unions have championed the idea that people from all walks of life should have access to affordable financial services offered by credit unions; and WHEREAS, credit unions empower people to imp ...

back to the future? basel iii and basel ii

... Basel II • Hailed as evolution compared to B I • More precise treatment of credit risks • Market-friendly: based on markets’ best practices in risk measurement (inducement instead of compulsion; working through private financial practices) • Role for market discipline ...

... Basel II • Hailed as evolution compared to B I • More precise treatment of credit risks • Market-friendly: based on markets’ best practices in risk measurement (inducement instead of compulsion; working through private financial practices) • Role for market discipline ...

At US Bank, we`re passionate about helping customers and the

... new ones. Provides specialized support in credit structuring since much of the financing extended will be tax-exempt in nature. Responsibilities include: - Underwriting nonprofit sector credit exposure - Managing assigned credit portfolio - Monitoring credit risk within that portfolio, to include • ...

... new ones. Provides specialized support in credit structuring since much of the financing extended will be tax-exempt in nature. Responsibilities include: - Underwriting nonprofit sector credit exposure - Managing assigned credit portfolio - Monitoring credit risk within that portfolio, to include • ...

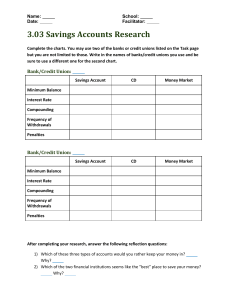

3.03 Savings Account Research

... Complete the charts. You may use two of the banks or credit unions listed on the Task page but you are not limited to those. Write in the names of banks/credit unions you use and be sure to use a different one for the second chart. ...

... Complete the charts. You may use two of the banks or credit unions listed on the Task page but you are not limited to those. Write in the names of banks/credit unions you use and be sure to use a different one for the second chart. ...