CREDITO FONDIARIO, A LEADER IN THE ITALIAN CREDIT

... part of the Intesa Sanpaolo Group, on the acquisition pro soluto of two nonperforming leasing portfolios, comprising credit exposures and underlying assets (mostly instrumental goods and vehicles), with a gross book value of approx. 280 million Euro and over 8,000 positions. These investments are pa ...

... part of the Intesa Sanpaolo Group, on the acquisition pro soluto of two nonperforming leasing portfolios, comprising credit exposures and underlying assets (mostly instrumental goods and vehicles), with a gross book value of approx. 280 million Euro and over 8,000 positions. These investments are pa ...

PRESS RELEASE 11 July 2017 TIM PHILLIPS JOINS

... underwrite a broad spectrum of credit and political risks, and report to Bernie de Haldevang, who heads the Credit & Political Risk team in addition to his role as Global Head of Specialty. ...

... underwrite a broad spectrum of credit and political risks, and report to Bernie de Haldevang, who heads the Credit & Political Risk team in addition to his role as Global Head of Specialty. ...

You and Your Credit

... Why you should care… • Good credit scores allow you to receive loans more easily and at better rates • Poor credit scores can make it difficult to receive a loan, find a place to live, and even get a job • By law you are entitled to one free credit score report each year to check its ...

... Why you should care… • Good credit scores allow you to receive loans more easily and at better rates • Poor credit scores can make it difficult to receive a loan, find a place to live, and even get a job • By law you are entitled to one free credit score report each year to check its ...

Report to the insert Leader, Deputy Leader or Cabinet

... Short term ratings were specifically created by the agencies for money market investors placing deposits for up to one year as they reflect specifically the liquidity positions of the institutions concerned. The ratings of P1, A1 and F1 are considered to be strong investment grade with a extremely h ...

... Short term ratings were specifically created by the agencies for money market investors placing deposits for up to one year as they reflect specifically the liquidity positions of the institutions concerned. The ratings of P1, A1 and F1 are considered to be strong investment grade with a extremely h ...

View case study - Euler Hermes UK

... and far between: “At any one time up to 90% of our turnover can be covered, so if a limit is refused, there is a good reason for it.” Rotork has been credit insured for over twenty-five years, and Chris does not hold with those who refuse to work with their insurer in sharing information: “It is jus ...

... and far between: “At any one time up to 90% of our turnover can be covered, so if a limit is refused, there is a good reason for it.” Rotork has been credit insured for over twenty-five years, and Chris does not hold with those who refuse to work with their insurer in sharing information: “It is jus ...

Partial Credit Guarantees Discussions

... banks than the private market? Moral hazard – Insurance tradeoff is now moved to the contract between private banks and the government agency ...

... banks than the private market? Moral hazard – Insurance tradeoff is now moved to the contract between private banks and the government agency ...

US ORSA Requirements

... “NAIC also expanded its Capital Markets Bureau activities during the crisis to help analyze information on the insurance industry’s investments, such as exposure to potential market volatility, said NAIC officials. For example, one state said that the report on the effects of the European debt crisi ...

... “NAIC also expanded its Capital Markets Bureau activities during the crisis to help analyze information on the insurance industry’s investments, such as exposure to potential market volatility, said NAIC officials. For example, one state said that the report on the effects of the European debt crisi ...

Chapter 17 Instructor`s Manual

... Solution: Most have lines of credit at commercial banks, and larger finance companies issue commercial paper to obtain short-term funding. They also issue long-term debt. Captive finance companies can borrow (obtain “transfer credit”) from their corporate parents. 3. Why are good credit ratings impo ...

... Solution: Most have lines of credit at commercial banks, and larger finance companies issue commercial paper to obtain short-term funding. They also issue long-term debt. Captive finance companies can borrow (obtain “transfer credit”) from their corporate parents. 3. Why are good credit ratings impo ...

Syllabus - KEI Abroad

... The primary objective of this course is to introduce the student to the fundamental principles of finance so as to provide a sound foundation for further studies in the area of finance. In addition the course provides the non-finance student with a basic understanding of the fundamentals of finance ...

... The primary objective of this course is to introduce the student to the fundamental principles of finance so as to provide a sound foundation for further studies in the area of finance. In addition the course provides the non-finance student with a basic understanding of the fundamentals of finance ...

presents at the Humboldt Distinguished Lecture Series in Applied Mathematics

... May 19th; 16:oo 17:oo and 17:30 18:3o; Erwin Schrödinger Zentrum; Room 0.307 May 20th; 16:oo 17:oo and 17:30 18:3o; Erwin Schrödinger Zentrum; Room 0.307 These lectures will cover problems of mathematical modeling that arise from efforts to enhance the stability of the financial system. The ...

... May 19th; 16:oo 17:oo and 17:30 18:3o; Erwin Schrödinger Zentrum; Room 0.307 May 20th; 16:oo 17:oo and 17:30 18:3o; Erwin Schrödinger Zentrum; Room 0.307 These lectures will cover problems of mathematical modeling that arise from efforts to enhance the stability of the financial system. The ...

Paul Glasserman

... May 19th; 16:oo 17:oo and 17:30 18:3o; Erwin Schrödinger Zentrum; Room 0.307 May 20th; 16:oo 17:oo and 17:30 18:3o; Erwin Schrödinger Zentrum; Room 0.307 These lectures will cover problems of mathematical modeling that arise from efforts to enhance the stability of the financial system. The ...

... May 19th; 16:oo 17:oo and 17:30 18:3o; Erwin Schrödinger Zentrum; Room 0.307 May 20th; 16:oo 17:oo and 17:30 18:3o; Erwin Schrödinger Zentrum; Room 0.307 These lectures will cover problems of mathematical modeling that arise from efforts to enhance the stability of the financial system. The ...

op-ed

... The problem is that Wall Street and regulators relied on complex mathematical models that told financial institutions how much risk they were taking at any given time. Since the 1990s, risk management on Wall Street has been dominated by a model called "value at risk" (VaR). VaR attributes risk fact ...

... The problem is that Wall Street and regulators relied on complex mathematical models that told financial institutions how much risk they were taking at any given time. Since the 1990s, risk management on Wall Street has been dominated by a model called "value at risk" (VaR). VaR attributes risk fact ...

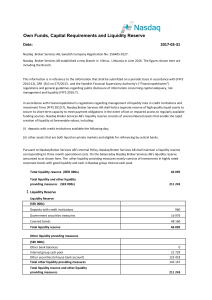

Own Funds, Capital Requirements and Liquidity Reserve

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

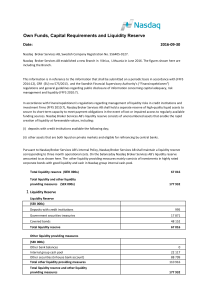

Own Funds, Capital Requirements and Liquidity Reserve

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

2009 Pillar 3 - Sucden Financial

... Systems Steering Committee, Strategy Group and Back Office Managers meetings). All committees meet at least monthly. Management Information. Directors receive extensive management information including monthly management accounts packs, daily credit, market and liquidity risk and error reports. Peop ...

... Systems Steering Committee, Strategy Group and Back Office Managers meetings). All committees meet at least monthly. Management Information. Directors receive extensive management information including monthly management accounts packs, daily credit, market and liquidity risk and error reports. Peop ...

Market Risk Management guideline for Co

... Banks Act No 40 of 2007 (“Act”) and the Exemption Notice No 404 and comes into effect 1 April, 2014. ...

... Banks Act No 40 of 2007 (“Act”) and the Exemption Notice No 404 and comes into effect 1 April, 2014. ...

IMT

... Banks are required to arrive at their capital requirements for loan/facility exposures to various entities using stipulated risk weights • These risk weights are linked to the credit ratings of ...

... Banks are required to arrive at their capital requirements for loan/facility exposures to various entities using stipulated risk weights • These risk weights are linked to the credit ratings of ...

Repurchase Agreements (Repo) - International Islamic Financial

... cannot be derecognised from the books as the transferor retains substantially all the risks and rewards of ownership. • On-balance sheet: An accounting entry appears as secured loan and not as a “sell” transaction. Bonds given as collateral remain on the balance sheet; corresponding liability is rep ...

... cannot be derecognised from the books as the transferor retains substantially all the risks and rewards of ownership. • On-balance sheet: An accounting entry appears as secured loan and not as a “sell” transaction. Bonds given as collateral remain on the balance sheet; corresponding liability is rep ...

11:00 Issues in Depository Institutions and Hedging

... • Furthermore, the Reagan administration reduced thrift examination staffs as part of its budget-cutting initiatives, enabling thrifts to initiate and continue operations which would have been prevented by regulatory agencies. ...

... • Furthermore, the Reagan administration reduced thrift examination staffs as part of its budget-cutting initiatives, enabling thrifts to initiate and continue operations which would have been prevented by regulatory agencies. ...

this resource

... Given that concentration risk, by its nature, tends to relate to aggregation of risk, it is essential that appropriate oversight is exercised by the Board of Directors ultimately at a strategic level. If issues of concern are identified by the monitoring activity, an institution's management should ...

... Given that concentration risk, by its nature, tends to relate to aggregation of risk, it is essential that appropriate oversight is exercised by the Board of Directors ultimately at a strategic level. If issues of concern are identified by the monitoring activity, an institution's management should ...

NYU_class7

... – Supply and demand – The market’s view : “implied” future interest rate environment ...

... – Supply and demand – The market’s view : “implied” future interest rate environment ...

SMERA Press Release: 20 September, 2016 Jahir Impex (JI)

... Limited (D&B) and leading public and private sector banks in India. SMERA is registered with SEBI as a Credit Rating Agency and accredited by Reserve Bank of India. For more details, please visit www.smera.in. Disclaimer: A SMERA rating does not constitute an audit of the rated entity and should not ...

... Limited (D&B) and leading public and private sector banks in India. SMERA is registered with SEBI as a Credit Rating Agency and accredited by Reserve Bank of India. For more details, please visit www.smera.in. Disclaimer: A SMERA rating does not constitute an audit of the rated entity and should not ...

risk management

... both of the above are required Only 1 is required Only 2 is required both are insufficient ...

... both of the above are required Only 1 is required Only 2 is required both are insufficient ...

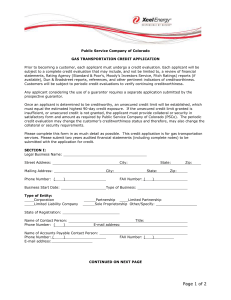

Contact - Xcel Energy - Web site maintenance

... Once an applicant is determined to be creditworthy, an unsecured credit limit will be established, which must equal the estimated highest 90-day credit exposure. If the unsecured credit limit granted is insufficient, or unsecured credit is not granted, the applicant must provide collateral or securi ...

... Once an applicant is determined to be creditworthy, an unsecured credit limit will be established, which must equal the estimated highest 90-day credit exposure. If the unsecured credit limit granted is insufficient, or unsecured credit is not granted, the applicant must provide collateral or securi ...

Use of Deposit Agents - CU-2016-01

... The term 'nominee', while used in securities regulation, has no formal meaning within the Financial Institutions Act (FIA). FICOM's intent in stating that "deposit agents cannot act as nominee" in Information Bulletin CU-2014-02 Use of Deposit Agents was to clarify that deposits cannot be held for a ...

... The term 'nominee', while used in securities regulation, has no formal meaning within the Financial Institutions Act (FIA). FICOM's intent in stating that "deposit agents cannot act as nominee" in Information Bulletin CU-2014-02 Use of Deposit Agents was to clarify that deposits cannot be held for a ...