notice of change to director`s interests

... Number of securities prior to change Date of change Number of securities acquired Number of securities disposed Value of consideration for acquisition or disposal Note: if the form of the consideration is non-cash, provide details of the form of the consideration and the method and estimate of valua ...

... Number of securities prior to change Date of change Number of securities acquired Number of securities disposed Value of consideration for acquisition or disposal Note: if the form of the consideration is non-cash, provide details of the form of the consideration and the method and estimate of valua ...

The Capital Stack - Lancaster Pollard

... addition to the mortgage, personal or corporate guarantees are usually a part of a senior secured loan. Should the operations of the company be insufficient to cover the debt service, the guarantors will need to support the cash needs. The loan documents and underwriting are typically standardized w ...

... addition to the mortgage, personal or corporate guarantees are usually a part of a senior secured loan. Should the operations of the company be insufficient to cover the debt service, the guarantors will need to support the cash needs. The loan documents and underwriting are typically standardized w ...

Investment Securities Internal Control Questionnaire

... 17. For international division investments, are entries for U.S. dollar carrying values of foreign currencydenominated securities rechecked at inception by a ...

... 17. For international division investments, are entries for U.S. dollar carrying values of foreign currencydenominated securities rechecked at inception by a ...

New Issue of Securities (Chapter 6 of Listing Requirements): Fund

... Receipt of confirmation from Bursa Depository that the additional new shares are ready for crediting into the respective account holders; and (iii) An announcement in accordance to paragraph 12.2 of Guidance Note 17 is submitted via Bursa Link before 3.00 p.m. on the market day prior to the listing ...

... Receipt of confirmation from Bursa Depository that the additional new shares are ready for crediting into the respective account holders; and (iii) An announcement in accordance to paragraph 12.2 of Guidance Note 17 is submitted via Bursa Link before 3.00 p.m. on the market day prior to the listing ...

Volta Finance Limited : Net Asset Value(s)

... Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order") or (iii) high net worth companies, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as "relevant persons") ...

... Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order") or (iii) high net worth companies, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as "relevant persons") ...

1. Application for quotation of added securities

... Details of whether the securities rank equally in all respects from the date of issue with an existing class of quoted securities. If the securities do not rank equally, details of: ...

... Details of whether the securities rank equally in all respects from the date of issue with an existing class of quoted securities. If the securities do not rank equally, details of: ...

treasury direction - Olympia Trust Company

... And we also certify that the said allotment and issuance hereunder constitutes the first transaction having an effect of creating ownership, control, or the right to receive such shares. Furthermore, we also certify that this Treasury Direction adheres to the requirements as set out in the Company’s ...

... And we also certify that the said allotment and issuance hereunder constitutes the first transaction having an effect of creating ownership, control, or the right to receive such shares. Furthermore, we also certify that this Treasury Direction adheres to the requirements as set out in the Company’s ...

Triple-A Failure

... The loans in Subprime XYZ were issued in early spring 2006 — what would turn out to be the peak of the boom. They were originated by a West Coast company that Moody’s identified as a “nonbank lender.” Traditionally, people have gotten their mortgages from banks, but in recent years, new types of le ...

... The loans in Subprime XYZ were issued in early spring 2006 — what would turn out to be the peak of the boom. They were originated by a West Coast company that Moody’s identified as a “nonbank lender.” Traditionally, people have gotten their mortgages from banks, but in recent years, new types of le ...

I. Debt around the world

... The increased security provided by an orderly legal system should also entail less variable enforcement risk, leading to smaller differences in the tranches of the same loan. ...

... The increased security provided by an orderly legal system should also entail less variable enforcement risk, leading to smaller differences in the tranches of the same loan. ...

2012 News - GoldQuest Corporation

... that number of non-transferable broker warrants (“Broker Warrants”) as is equal to 6.0% of the number of Offered Securities sold (inclusive of the Option). Each Broker Warrant will be exercisable into one Share of the Company, for a period of 24 months from the Closing Date at a price of $1.25 per S ...

... that number of non-transferable broker warrants (“Broker Warrants”) as is equal to 6.0% of the number of Offered Securities sold (inclusive of the Option). Each Broker Warrant will be exercisable into one Share of the Company, for a period of 24 months from the Closing Date at a price of $1.25 per S ...

Syndicated Loans as Securities

... federal securities laws. However, there is useful judicial guidance on the subject. While the U.S. Supreme Court has not addressed this specific issue, lower courts have held that, absent unusual circumstances, loan participations and syndications are not securities. Summarized below are the leading ...

... federal securities laws. However, there is useful judicial guidance on the subject. While the U.S. Supreme Court has not addressed this specific issue, lower courts have held that, absent unusual circumstances, loan participations and syndications are not securities. Summarized below are the leading ...

Preferred Securities: A Tax-Advantaged Alternative to Muni Bonds

... after-tax yield of 3.9% for investors making less than $415K per year, conservatively assuming that half of the securities pay QDI-eligible distributions. This is more than municipal bonds at 3.0% or 10-year Treasuries at 1.4% after taxes. For those earning more than $415K, the yield advantage is al ...

... after-tax yield of 3.9% for investors making less than $415K per year, conservatively assuming that half of the securities pay QDI-eligible distributions. This is more than municipal bonds at 3.0% or 10-year Treasuries at 1.4% after taxes. For those earning more than $415K, the yield advantage is al ...

Claim for Securities

... Rule 503—Voidable Securities Transactions (a) Nothing in these Series 500 Rules shall be construed as limiting the rights of a trustee in a liquidation proceeding under the Act to avoid any securities transaction as fraudulent, preferential, or otherwise voidable under applicable law. (b) Nothing ...

... Rule 503—Voidable Securities Transactions (a) Nothing in these Series 500 Rules shall be construed as limiting the rights of a trustee in a liquidation proceeding under the Act to avoid any securities transaction as fraudulent, preferential, or otherwise voidable under applicable law. (b) Nothing ...

Securitisation-Markets

... Ginnie Maes are securities issued by private lenders mainly mortgage bankers, under the auspices of the Government National Mortgage Association, a US government corporation. The GNMA (hence the name Ginnie Mae) was split off from Fannie Mae in 1968, and is intended to promote home ownership among f ...

... Ginnie Maes are securities issued by private lenders mainly mortgage bankers, under the auspices of the Government National Mortgage Association, a US government corporation. The GNMA (hence the name Ginnie Mae) was split off from Fannie Mae in 1968, and is intended to promote home ownership among f ...

Chapter 15 PowerPoint Presentation

... On September 1, 2012, Music City paid $29,500 plus a $500 brokerage fee to buy Dell’s 7%, 2-year bonds payable with a $30,000 par value. The bonds pay interest semiannually on August 31st and February 28th. Music City plans to hold the bonds until they mature (HTM securities). ...

... On September 1, 2012, Music City paid $29,500 plus a $500 brokerage fee to buy Dell’s 7%, 2-year bonds payable with a $30,000 par value. The bonds pay interest semiannually on August 31st and February 28th. Music City plans to hold the bonds until they mature (HTM securities). ...

Momentum Securities solutions

... This publication is not intended to give legal, tax, accounting, exchange control or any other professional advice. No reader should act on the basis of any matter contained in this publication without considering and taking appropriate advice on their own particular circumstances. Past performance ...

... This publication is not intended to give legal, tax, accounting, exchange control or any other professional advice. No reader should act on the basis of any matter contained in this publication without considering and taking appropriate advice on their own particular circumstances. Past performance ...

Ananda Development: 2Q earnings to be weak with stronger presales

... options, futures or other derivatives related to such securities ("related investments"). Officers of Phatra Securities may have a financial interest in securities of the issuer(s) or in related investments. Phatra Securities or its affiliates may from time to time perform investment banking or othe ...

... options, futures or other derivatives related to such securities ("related investments"). Officers of Phatra Securities may have a financial interest in securities of the issuer(s) or in related investments. Phatra Securities or its affiliates may from time to time perform investment banking or othe ...

Broker-dealer Companies Indicators

... 6. The client has bad reputation, he is known for having been involved in illicit activities or his past cannot be verified. 7. The client frequently changes broker-dealer companies trying to conceal its activities in the capital market and its financial situation or it has multiple accounts with di ...

... 6. The client has bad reputation, he is known for having been involved in illicit activities or his past cannot be verified. 7. The client frequently changes broker-dealer companies trying to conceal its activities in the capital market and its financial situation or it has multiple accounts with di ...

The Law of Ukraine On Securities and Stock Market of 23.02.2006

... exchanges may be simple bill of exchange or transfer note and exist exclusively in a documentary form. Peculiarities of issue and turnover of bill of exchanges, fulfillment of operations with bills of exchange, payment of bill liabilities and collecting payments on bill of exchanges is defined by th ...

... exchanges may be simple bill of exchange or transfer note and exist exclusively in a documentary form. Peculiarities of issue and turnover of bill of exchanges, fulfillment of operations with bills of exchange, payment of bill liabilities and collecting payments on bill of exchanges is defined by th ...

Filing of Preliminary Prospectus for Initial Public

... permits; labour disputes; the Company may not receive the necessary regulatory approvals for its products or the listing with the CSE or approvals with respect to the prospectus; the increase in cost estimates and the potential for unexpected costs and expenses; general economic and market condition ...

... permits; labour disputes; the Company may not receive the necessary regulatory approvals for its products or the listing with the CSE or approvals with respect to the prospectus; the increase in cost estimates and the potential for unexpected costs and expenses; general economic and market condition ...

Title in Arial bold Subhead in Arial

... – SF arranges security on a portfolio basis on behalf of all eligible companies – all eligible companies (based on minimum credit rating) must participate ...

... – SF arranges security on a portfolio basis on behalf of all eligible companies – all eligible companies (based on minimum credit rating) must participate ...

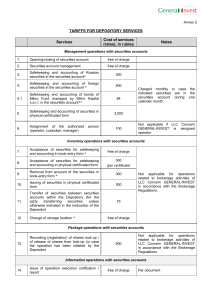

Tariffs depository

... 1. Settlement period shall be a calendar month; the calculation is carried out for each securities account of the Depositor. 2. All rates do not include any overhead costs and services of third parties (parent depositories, registrars). 3. Payment for Depository services shall be made by the Deposit ...

... 1. Settlement period shall be a calendar month; the calculation is carried out for each securities account of the Depositor. 2. All rates do not include any overhead costs and services of third parties (parent depositories, registrars). 3. Payment for Depository services shall be made by the Deposit ...

Corporate Securities Law Prospectus Exemption

... associates. This broadens the pool of potential capital available to issuers and allows ordinary retail investors who, for all practical intents and purposes, were limited to participating in the secondary market access to ...

... associates. This broadens the pool of potential capital available to issuers and allows ordinary retail investors who, for all practical intents and purposes, were limited to participating in the secondary market access to ...

for Financing by Seconds of Radio–TV Advertisements

... 4- If the seconds of advertisement are considered as Manfa’ah and transferred to investors in form of Manfa’ah transaction or Manfa’ah reconciliation6, the ownership of the benefits of which are completely transferred to investors and there would be no need to sign a new contract with originator (IR ...

... 4- If the seconds of advertisement are considered as Manfa’ah and transferred to investors in form of Manfa’ah transaction or Manfa’ah reconciliation6, the ownership of the benefits of which are completely transferred to investors and there would be no need to sign a new contract with originator (IR ...

A1.2 - DFSA

... Factors that impact repayment of principal or return on capital (i) description of any insurance policies; (ii) overview of parties to arrangement; (iii) material relationship between Issuer, guarantor and obligor; (iv) principal lending criteria for loan and credit; (v) significant representations ...

... Factors that impact repayment of principal or return on capital (i) description of any insurance policies; (ii) overview of parties to arrangement; (iii) material relationship between Issuer, guarantor and obligor; (iv) principal lending criteria for loan and credit; (v) significant representations ...