Regulation of Alternative Investments

... To deal with the abuses perceived to have triggered the stock market crash of 1929, the US Congress enacted four major pieces of legislation that continue to serve as the foundation of US securities law: The Securities Act of 1933, The Securities Act of 1934, The Investment Advisers Act of 1940, and ...

... To deal with the abuses perceived to have triggered the stock market crash of 1929, the US Congress enacted four major pieces of legislation that continue to serve as the foundation of US securities law: The Securities Act of 1933, The Securities Act of 1934, The Investment Advisers Act of 1940, and ...

Collateral-Motivated Financial Innovation

... and Pulvoni (2011), Garleanu and Pedersen (2011)). More recently, Fleckenstein, Longstaff, and Lustig (2010) find that the prices of Treasury Inflation-Protected Securities (TIPS) are lower than that of their replicating portfolios that consist of inflation swaps and nominal Treasury bonds. These pheno ...

... and Pulvoni (2011), Garleanu and Pedersen (2011)). More recently, Fleckenstein, Longstaff, and Lustig (2010) find that the prices of Treasury Inflation-Protected Securities (TIPS) are lower than that of their replicating portfolios that consist of inflation swaps and nominal Treasury bonds. These pheno ...

550.448 Financial Engineering and Structured Products

... shortened. This is caused by higher-than-expected prepayments: This benefits the holder of a discount MBS (i.e., the holder bought the MBS for less than face principal value - below par), as principal purchased below par is returned early at par. This harms the holder of a premium MBS (i.e., the ...

... shortened. This is caused by higher-than-expected prepayments: This benefits the holder of a discount MBS (i.e., the holder bought the MBS for less than face principal value - below par), as principal purchased below par is returned early at par. This harms the holder of a premium MBS (i.e., the ...

The Securities Claim Exemption in Bankruptcy

... At least one commentator claimed that Congress did not intend to include such claims within the scope of the securities claim exemption.5 He argued that, in general, only debts stemming from culpable conduct could be nondischargeable.6 At least one court has made a note of this argument.7 But, the c ...

... At least one commentator claimed that Congress did not intend to include such claims within the scope of the securities claim exemption.5 He argued that, in general, only debts stemming from culpable conduct could be nondischargeable.6 At least one court has made a note of this argument.7 But, the c ...

Balanced Income Portfolio Interim Management Report of Fund

... At least annually, the IRC reviews the Related Party Transactions for which they have issued standing instructions. The IRC is required to advise the Canadian securities regulatory authorities, after a matter has been referred or reported to the IRC by the Manager, if it determines that an investmen ...

... At least annually, the IRC reviews the Related Party Transactions for which they have issued standing instructions. The IRC is required to advise the Canadian securities regulatory authorities, after a matter has been referred or reported to the IRC by the Manager, if it determines that an investmen ...

Federal Reserve Rule Regarding Capital

... Because of the “netting” of goodwill and the inclusion of additional restricted core capital elements subject to the limit, the proposed “25% limit” in practice reduces the amount of trust preferred securities that may be included in Tier 1 capital for any bank holding company with goodwill and Clas ...

... Because of the “netting” of goodwill and the inclusion of additional restricted core capital elements subject to the limit, the proposed “25% limit” in practice reduces the amount of trust preferred securities that may be included in Tier 1 capital for any bank holding company with goodwill and Clas ...

Dominated assets, the expected utility maxim, and mean

... The investor’s portfolio decision will be considered under mean-variance portfolio selection (MV) compared with portfolio selection using the expected utility of terminal wealth maximization maxim (EU). It is well known that MV is a special case of EU if security returns are assumed to be normally d ...

... The investor’s portfolio decision will be considered under mean-variance portfolio selection (MV) compared with portfolio selection using the expected utility of terminal wealth maximization maxim (EU). It is well known that MV is a special case of EU if security returns are assumed to be normally d ...

chapter 8

... This is where there is a personal offer of securities and where none of the offers results in a breach of the 20investors ceiling and none of the offers results in a breach of the $2-million ceiling: s 708(1). An offer by a person to issue securities results in a breach of the 20-investors ceiling i ...

... This is where there is a personal offer of securities and where none of the offers results in a breach of the 20investors ceiling and none of the offers results in a breach of the $2-million ceiling: s 708(1). An offer by a person to issue securities results in a breach of the 20-investors ceiling i ...

Chapter One * Introduction - Mutual Fund Directors Forum

... market events of 2008 and 2009 where credit and liquidity challenges affected most cash collateral pools. Additionally, the default of Lehman Brothers tested the unwinding procedures of the lending and collateralization processes at agent and principal lenders alike. Short sale bans and negative pre ...

... market events of 2008 and 2009 where credit and liquidity challenges affected most cash collateral pools. Additionally, the default of Lehman Brothers tested the unwinding procedures of the lending and collateralization processes at agent and principal lenders alike. Short sale bans and negative pre ...

Repurchase agreements and the law

... amendment to the bankruptcy code to exempt repo collateral from automatic stay. The chief argument for an exemption for repo collateral, as well as collateral used in derivatives transactions, was that a ...

... amendment to the bankruptcy code to exempt repo collateral from automatic stay. The chief argument for an exemption for repo collateral, as well as collateral used in derivatives transactions, was that a ...

Collective Investment Schemes Control Act: Determination on

... "systemic risk" refers to systemic risk as defined in the Financial Markets Act; "total expense ratio" means a measure of a portfolio's assets that have been expended as payment for services rendered in the management of the portfolio or fund, expressed as a percentage of the average daily value of ...

... "systemic risk" refers to systemic risk as defined in the Financial Markets Act; "total expense ratio" means a measure of a portfolio's assets that have been expended as payment for services rendered in the management of the portfolio or fund, expressed as a percentage of the average daily value of ...

Managing a Matching Adjustment Portfolio

... undertaken, the insurer can take shorter-dated credit exposures, with fewer maturity constraints, while still maintaining a matched position. The PRA have explicitly considered such strategies, including their consistency with the buy and maintain requirements. In particular, the PRA have highlighte ...

... undertaken, the insurer can take shorter-dated credit exposures, with fewer maturity constraints, while still maintaining a matched position. The PRA have explicitly considered such strategies, including their consistency with the buy and maintain requirements. In particular, the PRA have highlighte ...

Portfolio rebalancing is the process of bringing the different asset

... Portfolios are adjusted if and when a particular asset class deviates from its target allocation by more than a certain amount—say plus or minus five percentage points. So if, for example, the target for large-cap stocks was 60%, but a market rise caused that share to climb above 65%, stocks would ...

... Portfolios are adjusted if and when a particular asset class deviates from its target allocation by more than a certain amount—say plus or minus five percentage points. So if, for example, the target for large-cap stocks was 60%, but a market rise caused that share to climb above 65%, stocks would ...

Disclosure of Interest/ Changes in Interest of Substantial

... medium such as an e-mail attachment. The Listed Issuer will attach both forms to the prescribed SGXNet announcement template for dissemination as required under section 137G(1), 137R(1) or 137ZC(1) of the SFA, as the case may be. While Form C will be attached to the announcement template, it will no ...

... medium such as an e-mail attachment. The Listed Issuer will attach both forms to the prescribed SGXNet announcement template for dissemination as required under section 137G(1), 137R(1) or 137ZC(1) of the SFA, as the case may be. While Form C will be attached to the announcement template, it will no ...

How and Why Credit Rating Agencies are not Like Other Gatekeepers

... Yet the agencies were not regulated, in part because regulators perceived that they did not play a prominent role in the financial system. During the early 1970s, the SEC decided that instead of regulating the credit rating industry, it would begin relying on the ratings of a handful of major credit ...

... Yet the agencies were not regulated, in part because regulators perceived that they did not play a prominent role in the financial system. During the early 1970s, the SEC decided that instead of regulating the credit rating industry, it would begin relying on the ratings of a handful of major credit ...

real estate players must understand that the introduction of

... a cautionary tale of the heightened risks associated with mezzanine lending. Octaviar, formerly known as MFS Limited, was a Queensland based property finance group. As a specialist mezzanine lender, Octaviar raised funds from retail investors, promising high yields of up to 8% per annum. The impact ...

... a cautionary tale of the heightened risks associated with mezzanine lending. Octaviar, formerly known as MFS Limited, was a Queensland based property finance group. As a specialist mezzanine lender, Octaviar raised funds from retail investors, promising high yields of up to 8% per annum. The impact ...

preferred securities - Janney Montgomery Scott LLC

... Preferred Securities J a n n e y C o r p o r at e C r e d i t ...

... Preferred Securities J a n n e y C o r p o r at e C r e d i t ...

Read full ASX announcement – pdf

... be quoted under section 1019B of the Corporations Act at the time that we request that the +securities be quoted. We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or expense arising from or connected with any breach of the warranties in this agreement. We ...

... be quoted under section 1019B of the Corporations Act at the time that we request that the +securities be quoted. We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or expense arising from or connected with any breach of the warranties in this agreement. We ...

WHAT YOU NEED TO KNOW ABOUT THE EU

... UCITS management company respectively, rather than the relevant fund itself (in comparison to EMIR, where the obligation is commonly assumed to remain on the fund)3. Secondly, NFCs that are defined as “medium sized undertakings” under the Directive on Financial Statements (2013/34/EU, Article (3) ...

... UCITS management company respectively, rather than the relevant fund itself (in comparison to EMIR, where the obligation is commonly assumed to remain on the fund)3. Secondly, NFCs that are defined as “medium sized undertakings” under the Directive on Financial Statements (2013/34/EU, Article (3) ...

INVESTMENT POLICY STATEMENT APPROVED JANUARY 30

... “Baa" or better by Moody’s or “BBB” or better by Standard & Poor’s; b. Maintain a Beta less than 1.2X the blended benchmark index; c. Invest no more than 25% of the portfolio in any one economic sector; d. Assure that no position of any one issuer shall exceed 5% of the manager’s total portfolio as ...

... “Baa" or better by Moody’s or “BBB” or better by Standard & Poor’s; b. Maintain a Beta less than 1.2X the blended benchmark index; c. Invest no more than 25% of the portfolio in any one economic sector; d. Assure that no position of any one issuer shall exceed 5% of the manager’s total portfolio as ...

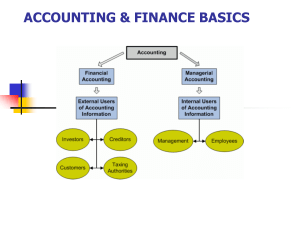

WIS ACCOUNTING BASICS

... With respect to Events No. 1 and 2, it is clear that only the balance sheet and statement of cash flows are affected. There is no effect on the income statement. Furthermore, you can see that Event No. 1 increases assets and equity and that the cash inflow is defined as a financing activity. Event N ...

... With respect to Events No. 1 and 2, it is clear that only the balance sheet and statement of cash flows are affected. There is no effect on the income statement. Furthermore, you can see that Event No. 1 increases assets and equity and that the cash inflow is defined as a financing activity. Event N ...

Refunding Bonds Terminology

... redemption provision, which allows the issuer to prepay the bonds by redeeming them on or after a predetermined date and at a pre-determined price (e.g. at par or 101% of par). It is the issuer’s ability to prepay bonds prior to maturity that creates the opportunity to refund bonds in order to reali ...

... redemption provision, which allows the issuer to prepay the bonds by redeeming them on or after a predetermined date and at a pre-determined price (e.g. at par or 101% of par). It is the issuer’s ability to prepay bonds prior to maturity that creates the opportunity to refund bonds in order to reali ...

Government National Mortgage Association

... prospectus supplement for the initial Distribution Date, but will adjust as described herein. The HECM MBS Rate is generally equal to the weighted average of the interest rates on the underlying Participations (each, the “Participation Interest Rate”). With respect to each Participation, the Partici ...

... prospectus supplement for the initial Distribution Date, but will adjust as described herein. The HECM MBS Rate is generally equal to the weighted average of the interest rates on the underlying Participations (each, the “Participation Interest Rate”). With respect to each Participation, the Partici ...

bondch11s

... One of the most innovative developments occurring in the security markets over the last two decades has been the securitization of assets. Securitization refers to a process in which the assets of a corporation or financial institution are pooled into a package of securities backed by the assets. Th ...

... One of the most innovative developments occurring in the security markets over the last two decades has been the securitization of assets. Securitization refers to a process in which the assets of a corporation or financial institution are pooled into a package of securities backed by the assets. Th ...

initial public offer of securities

... clawback feature in the case of issues which involve both placement and public subscription tranches) are to be divided equally into pools: pool A and pool B. The securities in pool A should be allocated on an equitable basis to applicants who have applied for securities in the value of HK$5 million ...

... clawback feature in the case of issues which involve both placement and public subscription tranches) are to be divided equally into pools: pool A and pool B. The securities in pool A should be allocated on an equitable basis to applicants who have applied for securities in the value of HK$5 million ...