CHAPTER 12

... 51% of the voting shares, and therefore can’t control the investee, but can exercise “significant influence” over the operating and financial policies of an investee. It should be presumed, in the absence of evidence to the contrary, that the investor exercises significant influence over the investe ...

... 51% of the voting shares, and therefore can’t control the investee, but can exercise “significant influence” over the operating and financial policies of an investee. It should be presumed, in the absence of evidence to the contrary, that the investor exercises significant influence over the investe ...

Portfolio Management: Course Introduction

... Portfolio Construction within the larger context of asset allocation • Optimization, in general, is constructing the best portfolio for the client based on the client characteristics and CMEs. • When all the steps are performed with careful analysis, the process may be called integrated asset alloc ...

... Portfolio Construction within the larger context of asset allocation • Optimization, in general, is constructing the best portfolio for the client based on the client characteristics and CMEs. • When all the steps are performed with careful analysis, the process may be called integrated asset alloc ...

Urgent Notice for non-EU issuers of Securities

... need a home Member State with which to file annual information under Article 10 of the Directive. If the issuer neither lists nor offers to the public any further securities, how does it choose its home Member State for this purpose? Although Article 30.1 of the Directive appears to intend to create ...

... need a home Member State with which to file annual information under Article 10 of the Directive. If the issuer neither lists nor offers to the public any further securities, how does it choose its home Member State for this purpose? Although Article 30.1 of the Directive appears to intend to create ...

Soobschenie_viplata_kupon_09.12.10_EN

... 2.1. Type, category (form), series and other details of the securities: series 02 certificated interest-bearing inconvertible bearer bonds with obligatory centralized custody (hereinafter “the Bonds”). 2.2. State registration number of issue/additional issue of securities, date of the state registra ...

... 2.1. Type, category (form), series and other details of the securities: series 02 certificated interest-bearing inconvertible bearer bonds with obligatory centralized custody (hereinafter “the Bonds”). 2.2. State registration number of issue/additional issue of securities, date of the state registra ...

this instrument and any securities issuable pursuant hereto have not

... (b) The execution, delivery and performance by the Company of this instrument is within the power of the Company and, other than with respect to the actions to be taken when equity is to be issued to the Investor, has been duly authorized by all necessary actions on the part of the Company. This ins ...

... (b) The execution, delivery and performance by the Company of this instrument is within the power of the Company and, other than with respect to the actions to be taken when equity is to be issued to the Investor, has been duly authorized by all necessary actions on the part of the Company. This ins ...

The Asset-Backed Securities Markets, the Crisis

... more generally. It started with a decrease in house price appreciation and an increase in subprime-mortgages defaults. As more uncertainty about the housing market developed, residential investment started declining and residential borrowing and lending dropped. In July 2007, ABS issues backed by re ...

... more generally. It started with a decrease in house price appreciation and an increase in subprime-mortgages defaults. As more uncertainty about the housing market developed, residential investment started declining and residential borrowing and lending dropped. In July 2007, ABS issues backed by re ...

UDR, Inc. - Barchart.com

... properties from Home Properties generally on the terms that we have disclosed and other risk factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time, including the Company's Annual Report on Form 10-K and the Company's Quarterly Reports on Fo ...

... properties from Home Properties generally on the terms that we have disclosed and other risk factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time, including the Company's Annual Report on Form 10-K and the Company's Quarterly Reports on Fo ...

The Handbook of Mortgage-Backed Securities, 7th Edition

... purchased from originators by an arranger who bundles the underlying loans together into a pool. The arranger could be the Government National Mortgage Association (Ginnie Mae, a federal agency) or one of the government-sponsored enterprises (GSEs)—Freddie Mac and Fannie Mae—but could also be a priv ...

... purchased from originators by an arranger who bundles the underlying loans together into a pool. The arranger could be the Government National Mortgage Association (Ginnie Mae, a federal agency) or one of the government-sponsored enterprises (GSEs)—Freddie Mac and Fannie Mae—but could also be a priv ...

The Securities Market in Vietnam

... The conditions for listing on the stock exchange (of which there are currently none in Vietnam) are different from the conditions to list on a securities trading centre. However, in anticipation of the HCMCSTC converting to a stock exchange, new registrations for listing on the HCMCSTC must satisfy ...

... The conditions for listing on the stock exchange (of which there are currently none in Vietnam) are different from the conditions to list on a securities trading centre. However, in anticipation of the HCMCSTC converting to a stock exchange, new registrations for listing on the HCMCSTC must satisfy ...

PRESS RELEASE UniCredit Board approves rights issue terms and

... shares to the existing shareholders (the “Offering”) based on the resolution of the extraordinary shareholders’ meeting dated January 12, 2017. The Offering and its terms and conditions are subject to regulatory approvals as required by applicable laws. Subject to obtaining regulatory approvals, the ...

... shares to the existing shareholders (the “Offering”) based on the resolution of the extraordinary shareholders’ meeting dated January 12, 2017. The Offering and its terms and conditions are subject to regulatory approvals as required by applicable laws. Subject to obtaining regulatory approvals, the ...

Available-for-Sale Securities

... from changes in their market prices. Trading securities are often held by banks, mutual funds, insurance companies, and other financial institutions. Because trading securities are held as a short-term investment, they are reported as a current asset on the balance sheet. ...

... from changes in their market prices. Trading securities are often held by banks, mutual funds, insurance companies, and other financial institutions. Because trading securities are held as a short-term investment, they are reported as a current asset on the balance sheet. ...

ANIXTER INTERNATIONAL INC

... tendered and accepted outstanding Liquid Yield Option™ Notes due 2033 of the Company (the “Old Securities”) upon the terms and subject to the conditions contained in the prospectus (as may be amended and supplemented from time to time, the “Prospectus”) which is part of Amendment No. 1 to the Regist ...

... tendered and accepted outstanding Liquid Yield Option™ Notes due 2033 of the Company (the “Old Securities”) upon the terms and subject to the conditions contained in the prospectus (as may be amended and supplemented from time to time, the “Prospectus”) which is part of Amendment No. 1 to the Regist ...

Non-Bank Finance Companies Criteria

... expense from total net operating revenue. As with other metrics, Ind-Ra emphasizes stability and predictability of earnings over a period rather than a position at a particular point in time. Ind-Ra also looks at operating expenses relative to loans or leases, including the mix of variable and fixed ...

... expense from total net operating revenue. As with other metrics, Ind-Ra emphasizes stability and predictability of earnings over a period rather than a position at a particular point in time. Ind-Ra also looks at operating expenses relative to loans or leases, including the mix of variable and fixed ...

New York REIT, Inc. (Form: DFAN14A, Received: 10

... NEW YORK, NY, October 4, 2016, — (PR Newswire) - Michael L. Ashner, Steven Witkoff, and WW Investors LLC (“WW Investors”), a jointly owned entity of Michael L. Ashner and Steven Witkoff, announced today that they, on behalf of their affiliate, Winthrop Realty Partners, L.P. (“Winthrop”), have delive ...

... NEW YORK, NY, October 4, 2016, — (PR Newswire) - Michael L. Ashner, Steven Witkoff, and WW Investors LLC (“WW Investors”), a jointly owned entity of Michael L. Ashner and Steven Witkoff, announced today that they, on behalf of their affiliate, Winthrop Realty Partners, L.P. (“Winthrop”), have delive ...

FORM 4

... and each of them individually, his true and lawful attorney-in-fact to: (1) execute for and on behalf of the undersigned, in the undersigned's capacity as an officer, director and/or 10% or greater stockholder of REVA Medical, Inc. (the "Company"), any and all Form 3, 4 and 5 reports required to be ...

... and each of them individually, his true and lawful attorney-in-fact to: (1) execute for and on behalf of the undersigned, in the undersigned's capacity as an officer, director and/or 10% or greater stockholder of REVA Medical, Inc. (the "Company"), any and all Form 3, 4 and 5 reports required to be ...

Rating Funding Agreement-Backed Securities Programs

... could be disrupted, for example, when interest rates decline and the durations of certain assets shorten, which often occurs with collateralized mortgage obligations (CMOs). To compensate, an insurer may fund a floating-rate FA with fixed-rate assets and then “swap” the resulting fixed payments for ...

... could be disrupted, for example, when interest rates decline and the durations of certain assets shorten, which often occurs with collateralized mortgage obligations (CMOs). To compensate, an insurer may fund a floating-rate FA with fixed-rate assets and then “swap” the resulting fixed payments for ...

Following the press release issued on 23 February 2017, UniCredit

... Neither this document nor any part of it nor the fact of its distribution may form the basis of, or be relied on in connection with, any contract or investment decision in relation thereto. The securities referred to herein have not been registered and will not be registered in the United States und ...

... Neither this document nor any part of it nor the fact of its distribution may form the basis of, or be relied on in connection with, any contract or investment decision in relation thereto. The securities referred to herein have not been registered and will not be registered in the United States und ...

DOC - Europa EU

... Integrated European financial markets will mean that consumers will be better able to purchase financial services and securities from the best European suppliers of investments, insurance and pension funds, with costs falling and net yields increasing as investment choice widens. ...

... Integrated European financial markets will mean that consumers will be better able to purchase financial services and securities from the best European suppliers of investments, insurance and pension funds, with costs falling and net yields increasing as investment choice widens. ...

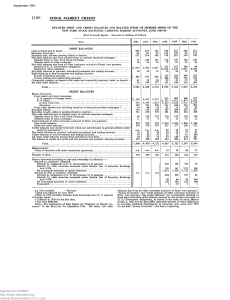

Detailed Debit and Credit Balances and Related Items of Member

... Entirely by obligations of U. S. Government or its agencies Entirely by other securities exempted under Section 3 (a) of Securities Exchange Act—1934 By nonexempt securities or mixed collateral Secured by firm or partners' collateral: Entirely by obligations of U S. Government or its agencies Entire ...

... Entirely by obligations of U. S. Government or its agencies Entirely by other securities exempted under Section 3 (a) of Securities Exchange Act—1934 By nonexempt securities or mixed collateral Secured by firm or partners' collateral: Entirely by obligations of U S. Government or its agencies Entire ...

Hindalco EGM Notice - 2015

... investors, foreign portfolio investors, qualified foreign investors, Indian and/or multilateral financial institutions, mutual funds, insurance companies, non-resident Indians, stabilizing agents, pension funds and/or any other categories of investors, whether they be holders of equity shares of the ...

... investors, foreign portfolio investors, qualified foreign investors, Indian and/or multilateral financial institutions, mutual funds, insurance companies, non-resident Indians, stabilizing agents, pension funds and/or any other categories of investors, whether they be holders of equity shares of the ...

Aluvion Professional Corporation - Notice This sample Term Sheet

... purposes only and does not constitute advertising, a solicitation, or legal advice. Neither the transmission of this sample Term Sheet nor the transmission of any information contained in this website is intended to create, and receipt hereof or thereof does not constitute formation of, a lawyer-cli ...

... purposes only and does not constitute advertising, a solicitation, or legal advice. Neither the transmission of this sample Term Sheet nor the transmission of any information contained in this website is intended to create, and receipt hereof or thereof does not constitute formation of, a lawyer-cli ...

The Rise and Fall of Mortgage Securitization

... argue that since the riskiest mortgages attracted the highest yields when packaged into AAA rated securities that traders within firms had incentives to go after mortgages they knew were likely to default precisely because they could sell the bonds made from them for more money. One prominent and il ...

... argue that since the riskiest mortgages attracted the highest yields when packaged into AAA rated securities that traders within firms had incentives to go after mortgages they knew were likely to default precisely because they could sell the bonds made from them for more money. One prominent and il ...

Collective action and securities law in the UK

... Institutional investors have long used litigation, strategically and selectively, to recover losses and maintain market discipline. Institutional investors have played a central and active role in both the RBS and Tesco actions. One important feature of this has been the formation of small and cohes ...

... Institutional investors have long used litigation, strategically and selectively, to recover losses and maintain market discipline. Institutional investors have played a central and active role in both the RBS and Tesco actions. One important feature of this has been the formation of small and cohes ...

NPL Panel presentation - Kamen

... NPL Policy developments in CEE: SLOVENIA: A policy strategy paper for Slovenia containing a section on “Solving the non-performing loan problem” ROMANIA: a series of proactive steps and recommendations established by the National Bank of Romania aimed at supporting the sustainable resolution of ...

... NPL Policy developments in CEE: SLOVENIA: A policy strategy paper for Slovenia containing a section on “Solving the non-performing loan problem” ROMANIA: a series of proactive steps and recommendations established by the National Bank of Romania aimed at supporting the sustainable resolution of ...