The case for multi asset investment

... We believe that actively managed strategies can add real value over time for investors, but true ‘investment skill’ is scarce and requires dedicated resources to seek it out. As shown in Chart 4, the difference this ability can make is significant, with skilled managers able to consistently outperfo ...

... We believe that actively managed strategies can add real value over time for investors, but true ‘investment skill’ is scarce and requires dedicated resources to seek it out. As shown in Chart 4, the difference this ability can make is significant, with skilled managers able to consistently outperfo ...

This press release and any information contained herein shall not

... This announcement is for informational purposes only and is not an offer to sell, or the solicitation of an offer to buy, any securities. The offer and sale of the securities referred to in this announcement has not been, nor will it be, registered under the United States Securities Act of 1933 and ...

... This announcement is for informational purposes only and is not an offer to sell, or the solicitation of an offer to buy, any securities. The offer and sale of the securities referred to in this announcement has not been, nor will it be, registered under the United States Securities Act of 1933 and ...

A Single Protocol for Clearing and Settlement?

... “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” ...

... “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” ...

A Single Protocol for Clearing and Settlement?

... “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” ...

... “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” ...

ร่าง

... to hedging overall investment risks of the securities company or [ii] the performance of remaining obligation; (2) close out its derivatives positions unless: (a) entering into such derivatives contract for the purpose of hedging investment risks or obligation of the securities company; (b) such der ...

... to hedging overall investment risks of the securities company or [ii] the performance of remaining obligation; (2) close out its derivatives positions unless: (a) entering into such derivatives contract for the purpose of hedging investment risks or obligation of the securities company; (b) such der ...

The Alternatives to Registration Chart has been created to fit on

... initiates the “print” command, the printer properties dialogue box appears on the user’s PC. The user may select/change various properties, including paper size (11x17 inches), page orientation (landscape), duplex printing (or print on both sides) and “duplex opening” to the left (or flip on short s ...

... initiates the “print” command, the printer properties dialogue box appears on the user’s PC. The user may select/change various properties, including paper size (11x17 inches), page orientation (landscape), duplex printing (or print on both sides) and “duplex opening” to the left (or flip on short s ...

Document

... The securities industry and capital markets, just like other economic sectors have their specialists; firms and individuals that specialize in organizing and implementing primary market issuances and facilitate the secondary market trade of securities. Some of the key specialists operating on capita ...

... The securities industry and capital markets, just like other economic sectors have their specialists; firms and individuals that specialize in organizing and implementing primary market issuances and facilitate the secondary market trade of securities. Some of the key specialists operating on capita ...

Financial Statement Analysis and Security Valuation

... FASB Statement No. 115 requires the following disclosures each period: The aggregate market value, gross unrealized holding gains, gross unrealized holding losses, and amortized cost for debt securities held to maturity and debt and equity securities available for sale The proceeds from sales of sec ...

... FASB Statement No. 115 requires the following disclosures each period: The aggregate market value, gross unrealized holding gains, gross unrealized holding losses, and amortized cost for debt securities held to maturity and debt and equity securities available for sale The proceeds from sales of sec ...

Risk Sharing between Banks and Markets

... tial effects of asymmetric information. For that purpose the bank usually takes a first-loss position in the default risks of the underlying loan portfolio. This raises the question about the effective extent of the risk transfer in a CLO-transaction. The first purpose of this paper is to look into th ...

... tial effects of asymmetric information. For that purpose the bank usually takes a first-loss position in the default risks of the underlying loan portfolio. This raises the question about the effective extent of the risk transfer in a CLO-transaction. The first purpose of this paper is to look into th ...

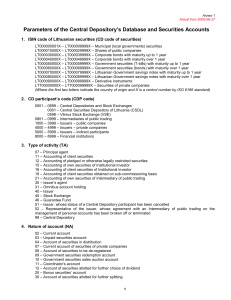

1. ISIN code of Lithuanian securities (CD code of securities)

... 10 – Government securities sales auction account 11 – Coordinator’s account 12 – Account of securities allotted for further choice of dividend 20 – Bonus securities’ account 30 – Account of securities allotted for further splitting ...

... 10 – Government securities sales auction account 11 – Coordinator’s account 12 – Account of securities allotted for further choice of dividend 20 – Bonus securities’ account 30 – Account of securities allotted for further splitting ...

Investors Guide To CMOs

... when rates fall, prices of outstanding CMOs generally rise, creating the opportunity for capital appreciation if the CMO is sold prior to the time when the principal is fully repaid. Movements in market interest rates have a greater effect on CMOs than on other fixed-interest obligations because rat ...

... when rates fall, prices of outstanding CMOs generally rise, creating the opportunity for capital appreciation if the CMO is sold prior to the time when the principal is fully repaid. Movements in market interest rates have a greater effect on CMOs than on other fixed-interest obligations because rat ...

Presentation title here in Arial 32pt

... is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Schroders has expressed its own views and opinions in this document and these may change. Information herein is believed to be reliable but Schroder Investment Management Ltd (SIM) does not warrant its ...

... is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Schroders has expressed its own views and opinions in this document and these may change. Information herein is believed to be reliable but Schroder Investment Management Ltd (SIM) does not warrant its ...

securitonomics ii/ cheat sheet on asset and mortgage backed lending

... loans or securities are not interested in generating more loans or acquiring more securities, causing a loss of liquidity. Other factors that influence markets but as to which ratings do not offer insights are (i) the amount and timing of amortization and the possibility of prepayment or delay, (ii ...

... loans or securities are not interested in generating more loans or acquiring more securities, causing a loss of liquidity. Other factors that influence markets but as to which ratings do not offer insights are (i) the amount and timing of amortization and the possibility of prepayment or delay, (ii ...

Lexis Securities Mosaic: SEC Forms Guide

... The registration of securities offered by a company to its employees as part of a This is the most frequently filed benefit plan or performance incentive plan. As such, it is almost always an equity registration statement. ...

... The registration of securities offered by a company to its employees as part of a This is the most frequently filed benefit plan or performance incentive plan. As such, it is almost always an equity registration statement. ...

NHA Mortgage-Backed Securities

... residents, as well as the process for doing so. As a result, some of the securities discussed in this report may not be available to every interested investor. Accordingly, this report is provided for informational purposes only, and does not constitute an offer or solicitation to buy or sell any se ...

... residents, as well as the process for doing so. As a result, some of the securities discussed in this report may not be available to every interested investor. Accordingly, this report is provided for informational purposes only, and does not constitute an offer or solicitation to buy or sell any se ...

Investment policy statement - Giving to CU

... inflation, there could be a loss of real purchasing power with the holding of cash assets. Except in unusual circumstances, the Fund shall strive to be fully invested at all times with cash equivalent holdings being kept to a minimum level to support necessary spending/disbursement levels. 2. Hedge ...

... inflation, there could be a loss of real purchasing power with the holding of cash assets. Except in unusual circumstances, the Fund shall strive to be fully invested at all times with cash equivalent holdings being kept to a minimum level to support necessary spending/disbursement levels. 2. Hedge ...

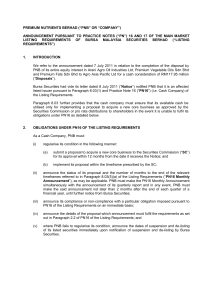

PREMIUM NUTRIENTS BERHAD (“PNB” OR “COMPANY

... Announcement”), as may be applicable. PNB must make the PN16 Monthly Announcement simultaneously with the announcement of its quarterly report and in any event, PNB must make the said announcement not later than 2 months after the end of each quarter of a financial year, until further notice from Bu ...

... Announcement”), as may be applicable. PNB must make the PN16 Monthly Announcement simultaneously with the announcement of its quarterly report and in any event, PNB must make the said announcement not later than 2 months after the end of each quarter of a financial year, until further notice from Bu ...

Key Issues for Reporters

... proactively communicate with FRB to explain reasoning behind zero market value securities; a large number of securities with zero price or market value may require revisions • Fair market values should exclude accrued interest on securities ...

... proactively communicate with FRB to explain reasoning behind zero market value securities; a large number of securities with zero price or market value may require revisions • Fair market values should exclude accrued interest on securities ...

Why should a company use a broker

... Prior to 1985, many attorneys correctly advised that the “sale of a business” doctrine provided that if a business was sold, that the federal securities laws may not apply, even if the transaction vehicle was the sale of stock. However, the Supreme Court rejected the “sale of a business” doctrine in ...

... Prior to 1985, many attorneys correctly advised that the “sale of a business” doctrine provided that if a business was sold, that the federal securities laws may not apply, even if the transaction vehicle was the sale of stock. However, the Supreme Court rejected the “sale of a business” doctrine in ...

commercial / multifamily mortgage debt outstanding | q1 2016

... Total commercial/multifamily debt outstanding rose to $2.86 trillion at the end of the first quarter. Multifamily mortgage debt outstanding rose to $1.07 trillion, an increase of $18.2 billion, or 1.7 percent, from the fourth quarter of 2015. “The amount of commercial and multifamily mortgage debt o ...

... Total commercial/multifamily debt outstanding rose to $2.86 trillion at the end of the first quarter. Multifamily mortgage debt outstanding rose to $1.07 trillion, an increase of $18.2 billion, or 1.7 percent, from the fourth quarter of 2015. “The amount of commercial and multifamily mortgage debt o ...

Canadian Investment Grade Corporate Fixed Income Strategy

... **Benchmark based on FTSE TMX Canada Universe Bond Index prior to July 2015, and FTSE TMX Canada Corporate Bond Index thereafter. The FTSE TMX Canada Corporate Bond index is comprised primarily of semi-annual pay fixed rate corporate bonds issued domestically in Canada and denominated in Canadian do ...

... **Benchmark based on FTSE TMX Canada Universe Bond Index prior to July 2015, and FTSE TMX Canada Corporate Bond Index thereafter. The FTSE TMX Canada Corporate Bond index is comprised primarily of semi-annual pay fixed rate corporate bonds issued domestically in Canada and denominated in Canadian do ...

Understanding the global financial crisis

... and re-securitization. In particular, the practice of securitization was one important source of the decline of underwriting standards during the recent past. Financial institutions were able to make quick profits from changes in investor sentiment. Money market funds demand for AAA-rated bonds for ...

... and re-securitization. In particular, the practice of securitization was one important source of the decline of underwriting standards during the recent past. Financial institutions were able to make quick profits from changes in investor sentiment. Money market funds demand for AAA-rated bonds for ...

Slide 1

... Intuitive result : at the limit, if the investors are “random”, almost no impact but if the investors are “shared” the risk is huge ...

... Intuitive result : at the limit, if the investors are “random”, almost no impact but if the investors are “shared” the risk is huge ...