Chapter 6

... What is the role of securitization in practice? Securitization has been a prominent feature of U.S. financial markets for decades, and has gradually displaced banks as the ultimate source of funds lent to households. An early example was so-called mortgage passthroughs, in which investors purchased ...

... What is the role of securitization in practice? Securitization has been a prominent feature of U.S. financial markets for decades, and has gradually displaced banks as the ultimate source of funds lent to households. An early example was so-called mortgage passthroughs, in which investors purchased ...

Collateralized Mortgage Obligations (CMOs)

... 1970 Ginnie Mae issued the first bonds backed by pools of mortgages to free up funds for more home loans 1977 The first private mortgage backed securities are sold 1983 Freddie Mac issues the first collateralized mortgage obligation, which allows investors to pick their level of risk ...

... 1970 Ginnie Mae issued the first bonds backed by pools of mortgages to free up funds for more home loans 1977 The first private mortgage backed securities are sold 1983 Freddie Mac issues the first collateralized mortgage obligation, which allows investors to pick their level of risk ...

ESTR.ASpA successfully places EUR 100 million senior notes BNP

... On 13 July 2015, E.s.tr.a. S.p.A. successfully finalised the issuance of €100 million senior unsecured and non-convertible notes; the notes are guaranteed by Centria S.r.l., a 100% owned subsidiary of Estra, and have been entirely subscribed for by institutional investors outside the United States o ...

... On 13 July 2015, E.s.tr.a. S.p.A. successfully finalised the issuance of €100 million senior unsecured and non-convertible notes; the notes are guaranteed by Centria S.r.l., a 100% owned subsidiary of Estra, and have been entirely subscribed for by institutional investors outside the United States o ...

Asset Backed Securities offer investors protection against a

... by the European Central Bank (ECB), while inflation and interest rates are expected to rise in the US and in Europe over the longer term. However, Asset Backed Securities (ABS), which are bonds backed by collateral such as residential mortgage loans, consumer loans, loans to small- and medium-sized ...

... by the European Central Bank (ECB), while inflation and interest rates are expected to rise in the US and in Europe over the longer term. However, Asset Backed Securities (ABS), which are bonds backed by collateral such as residential mortgage loans, consumer loans, loans to small- and medium-sized ...

Lessons from the Financial Crisis

... Also argue that “did everything they could” with Lehman, but could not legally save it because it might have been insolvent But if the problem is liquidity, it can be solved for free by guaranteeing liabilities, as with money market funds, etc. The crisis came from insolvency of financial institutio ...

... Also argue that “did everything they could” with Lehman, but could not legally save it because it might have been insolvent But if the problem is liquidity, it can be solved for free by guaranteeing liabilities, as with money market funds, etc. The crisis came from insolvency of financial institutio ...

Mortgage crisis in the US, economic slowdown in Europe

... unexpected. Investment and industrial output are weaker (due to cyclical factors). The European economic cycle, ...

... unexpected. Investment and industrial output are weaker (due to cyclical factors). The European economic cycle, ...

Global Securities Finance Fixed Income Repo

... • Full service financing – ING offers financing for a broad range of fixed income securities ...

... • Full service financing – ING offers financing for a broad range of fixed income securities ...

Interest Rate Parity

... securities market and for matters connected therewith or incidental thereto. To protects the Rights and interests of investors, particularly individual investors. To prevents trading malpractices and aims at achieving a balance between self-regulation by securities industry and its statutory reg ...

... securities market and for matters connected therewith or incidental thereto. To protects the Rights and interests of investors, particularly individual investors. To prevents trading malpractices and aims at achieving a balance between self-regulation by securities industry and its statutory reg ...

CHP 1

... Financial Intermediaries: Institutions that “connect” borrowers and lenders by accepting funds from lenders and loaning funds to borrowers. ...

... Financial Intermediaries: Institutions that “connect” borrowers and lenders by accepting funds from lenders and loaning funds to borrowers. ...

Document

... value of a tranche can either be quoted in terms of credit spread or in term of the correlation figure corresponding to such spread. This concept is known as implied correlation. Notice that the Gaussian copula plays the same role as the Black and Scholes formula in option prices. Since equity tranc ...

... value of a tranche can either be quoted in terms of credit spread or in term of the correlation figure corresponding to such spread. This concept is known as implied correlation. Notice that the Gaussian copula plays the same role as the Black and Scholes formula in option prices. Since equity tranc ...

The Global Risk of Subprime

... Is the Risk Only About Subprime? • No. The “subprime crisis” is less about the credit quality of the mortgage loans behind a given bond issue and more about how banks package loans and other assets using complex derivative structures, ratings from Moody’s and S&P, and private mortgage insurance. • ...

... Is the Risk Only About Subprime? • No. The “subprime crisis” is less about the credit quality of the mortgage loans behind a given bond issue and more about how banks package loans and other assets using complex derivative structures, ratings from Moody’s and S&P, and private mortgage insurance. • ...

Structured Products to Gain Interest in Korea

... products such as synthetic collateralized debt obligations in Korea, an international financial service company said Tuesday. During the Korea Finance and Capital Markets Conference organized by Euro Events and sponsored by The Korea Times, Sam Pang, vice president at Fortis Bank, said that there wi ...

... products such as synthetic collateralized debt obligations in Korea, an international financial service company said Tuesday. During the Korea Finance and Capital Markets Conference organized by Euro Events and sponsored by The Korea Times, Sam Pang, vice president at Fortis Bank, said that there wi ...

Real vs Financial Assets

... Derivative securities – The payoffs of derivative securities is determined by the prices of other assets such as bonds or stock prices. In other words, derivative securities derive their prices from the prices of other assets. Portfolio – An investor’s portfolio is simply their collection of financi ...

... Derivative securities – The payoffs of derivative securities is determined by the prices of other assets such as bonds or stock prices. In other words, derivative securities derive their prices from the prices of other assets. Portfolio – An investor’s portfolio is simply their collection of financi ...

CLOs, CDOs and the Search for High Yield

... Whilst considerable care has been taken to ensure the information contained within is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of t ...

... Whilst considerable care has been taken to ensure the information contained within is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of t ...

The Financial Crisis

... firms reliant upon CP market Unsecured notes, 1 day to 9 month maturity Backbone of money market Sold at discount and usually backed by ...

... firms reliant upon CP market Unsecured notes, 1 day to 9 month maturity Backbone of money market Sold at discount and usually backed by ...

Risk and risk management of Collateralized Debt Obligations

... first rating model, the binomial expansion technique (BET) developed by Moody's, was widely used to rate CDO portfolios, including those associated with sub-prime mortgages. This model produces the sum of defaulted loans in a portfolio with the rate of recurrence if loans of the security portfolio a ...

... first rating model, the binomial expansion technique (BET) developed by Moody's, was widely used to rate CDO portfolios, including those associated with sub-prime mortgages. This model produces the sum of defaulted loans in a portfolio with the rate of recurrence if loans of the security portfolio a ...

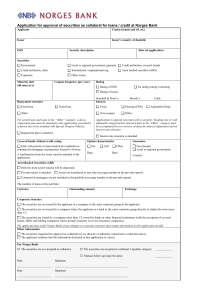

Søknadsskjema for godkjenning av obligasjoner og

... The securities are not issued by a company where the applicant or a bank in the same corporate group directly or indirectly owns more than 1/3. The securities are issued by a company more than 1/3 owned by banks or other financial institutions (with the exception of covered bonds, ABSs and holding c ...

... The securities are not issued by a company where the applicant or a bank in the same corporate group directly or indirectly owns more than 1/3. The securities are issued by a company more than 1/3 owned by banks or other financial institutions (with the exception of covered bonds, ABSs and holding c ...

The Risk and Term Structure of Interest Rates

... in house prices, the subprime lending soon expanded its credit to borrowers with heterogeneous characteristics (high loan-to-value ratios or zerodownpayment, unwilling to disclose financial status, high loan-to-income ratio): the subprime lending no longer focused on only poor credit borrowers, but ...

... in house prices, the subprime lending soon expanded its credit to borrowers with heterogeneous characteristics (high loan-to-value ratios or zerodownpayment, unwilling to disclose financial status, high loan-to-income ratio): the subprime lending no longer focused on only poor credit borrowers, but ...

GSE Credit Risk Transfer Securitizations (CRTs)

... • CRT deals primarily come in 2 series: Structured Agency Credit Risk (STACRs) for Freddie Mac, and Connecticut Avenue Securities (CAS) for Fannie Mae • 23 CRT deals with combined security balances of $12B have been issued since July 2013 • These represent exposure to ~$750B of residential single-fa ...

... • CRT deals primarily come in 2 series: Structured Agency Credit Risk (STACRs) for Freddie Mac, and Connecticut Avenue Securities (CAS) for Fannie Mae • 23 CRT deals with combined security balances of $12B have been issued since July 2013 • These represent exposure to ~$750B of residential single-fa ...

The Traditional Securitization Process Bank

... equity funds, venture funds through equity investing and/or lending. • Unregulated activities conducted off the bank’s balance sheet. ...

... equity funds, venture funds through equity investing and/or lending. • Unregulated activities conducted off the bank’s balance sheet. ...

Economics 434 Financial Markets - SHANTI Pages

... – Pretty often (slightly more than 1/5 of the time) – Get a C rating for the second tranche (Security 2) ...

... – Pretty often (slightly more than 1/5 of the time) – Get a C rating for the second tranche (Security 2) ...

AFR Statement on SEC Final Rules Concerning Asset

... Today, the Securities and Exchange Commission finalized two rules intended to address abuses in the securities markets that helped to trigger the 2008 financial crisis. One rule sets out new controls designed to improve business practices at major credit rating firms such as Moody’s and Standard and ...

... Today, the Securities and Exchange Commission finalized two rules intended to address abuses in the securities markets that helped to trigger the 2008 financial crisis. One rule sets out new controls designed to improve business practices at major credit rating firms such as Moody’s and Standard and ...