Practice Problems Ch. 10 Loanable Funds Mkt

... 14. If consumers decide to be more frugal and save more out of their income, then this will cause A) a shift in the supply curve for loanable funds to the right. B) a shift in the supply curve for loanable funds to the left. C) a movement to the right along the supply curve for loanable funds. D) a ...

... 14. If consumers decide to be more frugal and save more out of their income, then this will cause A) a shift in the supply curve for loanable funds to the right. B) a shift in the supply curve for loanable funds to the left. C) a movement to the right along the supply curve for loanable funds. D) a ...

Broker-dealer Companies Indicators

... 15. Trading in securities where the owners give authorisation to third parties to manage their shareowner’s and money accounts where there are ‘connected’ money transactions in trading securities between owners and authorised persons. 16. Trading in securities for the benefit of offshore legal entit ...

... 15. Trading in securities where the owners give authorisation to third parties to manage their shareowner’s and money accounts where there are ‘connected’ money transactions in trading securities between owners and authorised persons. 16. Trading in securities for the benefit of offshore legal entit ...

St Andrew`s Retirement Plan

... (Australia) Ltd was making changes to the UBS Property Securities Fund. The changes being made include change of benchmark and investment strategy. To advise members that the responsible entity changed to Equity Trustees replacing Ventura Investment Management Ltd. ...

... (Australia) Ltd was making changes to the UBS Property Securities Fund. The changes being made include change of benchmark and investment strategy. To advise members that the responsible entity changed to Equity Trustees replacing Ventura Investment Management Ltd. ...

ReAssure guide to unit linked funds

... such a fund allows for a much larger range of investments than could normally be achieved by one individual. The total value of these assets is split up into units of equal price. This ‘unit price’ determines how many units you receive when you invest your money in the fund and how much money you wi ...

... such a fund allows for a much larger range of investments than could normally be achieved by one individual. The total value of these assets is split up into units of equal price. This ‘unit price’ determines how many units you receive when you invest your money in the fund and how much money you wi ...

The International Diversification Fallacy of Exchange

... country funds in providing global risk diversification for U.S. investors. Barry, Peavy, and Rodriguez (1997) take a comprehensive look at emerging stock markets and country funds. They find that the country funds listed on the U.S. exchanges are more highly correlated with the S&P 500 than the retu ...

... country funds in providing global risk diversification for U.S. investors. Barry, Peavy, and Rodriguez (1997) take a comprehensive look at emerging stock markets and country funds. They find that the country funds listed on the U.S. exchanges are more highly correlated with the S&P 500 than the retu ...

TCW High Dividend Equities Fund Summary Prospectus

... compare with a broad measure of market performance. This information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year. The bar chart shows performance of the Fund’s Class I shares. Class N performance may be lower than Clas ...

... compare with a broad measure of market performance. This information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year. The bar chart shows performance of the Fund’s Class I shares. Class N performance may be lower than Clas ...

AMENDMENT NO. 1 DATED JULY 21, 2016 TO

... built shareholder value over time. A common characteristic of these companies is their ability to generate free cash flow, which supports growth and profitability, allows management to make strategic acquisitions, buy back stock and pay generous and growing dividends. Through investments in North Am ...

... built shareholder value over time. A common characteristic of these companies is their ability to generate free cash flow, which supports growth and profitability, allows management to make strategic acquisitions, buy back stock and pay generous and growing dividends. Through investments in North Am ...

a guide to mutual fund investing

... distribution they receive, even if the fund declines in value after the shares are purchased. » Knowledge of Portfolio Holdings – By relying on the fund managers to manage the fund’s holdings, the individual investor usually has little knowledge of the exact make-up of a fund’s portfolio. Additiona ...

... distribution they receive, even if the fund declines in value after the shares are purchased. » Knowledge of Portfolio Holdings – By relying on the fund managers to manage the fund’s holdings, the individual investor usually has little knowledge of the exact make-up of a fund’s portfolio. Additiona ...

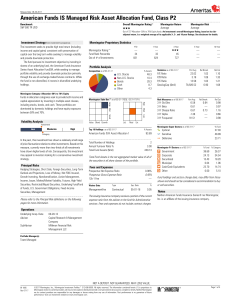

American Funds IS Managed Risk Asset Allocation Fund

... variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar R ...

... variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar R ...

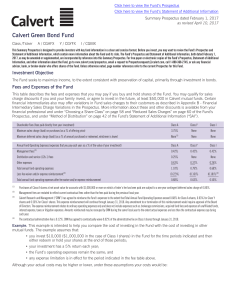

Calvert Green Bond Fund

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

Portfolio1 - people.bath.ac.uk

... • Other issue: fund managers are careerist. When the payoffperformance relationship is convex, there are incentives to take high risks. This might hurts investors’ return. • It has been found that net flows into funds are highly sensitive to performance. This can generate incentive to be excessivel ...

... • Other issue: fund managers are careerist. When the payoffperformance relationship is convex, there are incentives to take high risks. This might hurts investors’ return. • It has been found that net flows into funds are highly sensitive to performance. This can generate incentive to be excessivel ...

Investment policy statement - Giving to CU

... investment strategy. The Investment Policy Committee also believes that while certain potentially high-return asset classes may pose substantial individual risk, they still may be prudently held because of their ability to enhance returns while maintaining or reducing overall portfolio risk. In addi ...

... investment strategy. The Investment Policy Committee also believes that while certain potentially high-return asset classes may pose substantial individual risk, they still may be prudently held because of their ability to enhance returns while maintaining or reducing overall portfolio risk. In addi ...

2017-01-0130-SBIMF_Blue Chip Leaflet Dec A5

... long-term investing goals. SBI Blue Chip Fund invests predominantly in such blue chip companies and hence, is a must-have scheme for every portfolio. The focus of the fund is on generating optimal risk-adjusted returns by better stock selection and taking opportunistic allocation to mid-caps when re ...

... long-term investing goals. SBI Blue Chip Fund invests predominantly in such blue chip companies and hence, is a must-have scheme for every portfolio. The focus of the fund is on generating optimal risk-adjusted returns by better stock selection and taking opportunistic allocation to mid-caps when re ...

Average Credit Quality in Bond Portfolios

... funds with average maturities of less than three years. 5 Alternative measures of the length of a bond The “term” of a bond – how far distant in the future investors in bonds or bond portfolios receive cash flows - matters because the market value of a bond, other things equal, is lower and more sen ...

... funds with average maturities of less than three years. 5 Alternative measures of the length of a bond The “term” of a bond – how far distant in the future investors in bonds or bond portfolios receive cash flows - matters because the market value of a bond, other things equal, is lower and more sen ...

Personal Finance Literacy

... stocks from many different companies that are purchased and managed together cash and coins the way money moves from hand to hand the money an individual makes or earns ...

... stocks from many different companies that are purchased and managed together cash and coins the way money moves from hand to hand the money an individual makes or earns ...

A legitimate question is raised in several fora– why an

... schemes if such transaction is done directly by the investor. AMCs are also required to inform the unitholders any change in the load structure accordingly as per the provisions under clause 3(d) of standard observations. Removal of initial issue expenses. SEBI has vide its circular number SEBI/IMD/ ...

... schemes if such transaction is done directly by the investor. AMCs are also required to inform the unitholders any change in the load structure accordingly as per the provisions under clause 3(d) of standard observations. Removal of initial issue expenses. SEBI has vide its circular number SEBI/IMD/ ...

Mutual Fund Assets and Flows in 1999

... Net flow to retail money funds was $82 billion, second only to the record $131 billion in 1998. Inflows slowed from their 1998 pace during the first half of 1999 as yields on retail money funds fell relative to rates on bank and thrift deposits. The slowdown may also have reflected a decline in hous ...

... Net flow to retail money funds was $82 billion, second only to the record $131 billion in 1998. Inflows slowed from their 1998 pace during the first half of 1999 as yields on retail money funds fell relative to rates on bank and thrift deposits. The slowdown may also have reflected a decline in hous ...

Secondary Market Regulations of Government Bonds

... Trading per se is neutral to total returns, and never pays for trading costs without additional risk taking. Even a capital gain brings you nothing. Trading always eats up some yield. Nonetheless, people trade for: ...

... Trading per se is neutral to total returns, and never pays for trading costs without additional risk taking. Even a capital gain brings you nothing. Trading always eats up some yield. Nonetheless, people trade for: ...

BMO US Dollar Money Market Fund (the “Fund”)

... MANAGEMENT DISCUSSION OF FUND PERFORMANCE Investment Objective and Strategies The Fund’s objective is to provide a high level of U.S. dollar interest income and liquidity, while preserving the value of your investment, by investing primarily in a variety of U.S. government and corporate money market ...

... MANAGEMENT DISCUSSION OF FUND PERFORMANCE Investment Objective and Strategies The Fund’s objective is to provide a high level of U.S. dollar interest income and liquidity, while preserving the value of your investment, by investing primarily in a variety of U.S. government and corporate money market ...

Investment Companies Entities Expert Panel

... experience serving investment management, capital markets and other financial services companies. As a member of the Firm's National Office Accounting Service Group, Chris is involved in technical consultations, thought leadership and proposed technical matters, especially those impacting the asset ...

... experience serving investment management, capital markets and other financial services companies. As a member of the Firm's National Office Accounting Service Group, Chris is involved in technical consultations, thought leadership and proposed technical matters, especially those impacting the asset ...

IFSL Brunsdon Investment Funds brochure

... The IFSL BRUNSDON CAUTIOUS GROWTH FUND The Cautious mandate is looking to target a LIBOR + 2.5% return per annum on a rolling three year time horizon, while looking to achieve a positive return on any 12 month basis by seeking to find the optimum balance between risk and return using traditional ass ...

... The IFSL BRUNSDON CAUTIOUS GROWTH FUND The Cautious mandate is looking to target a LIBOR + 2.5% return per annum on a rolling three year time horizon, while looking to achieve a positive return on any 12 month basis by seeking to find the optimum balance between risk and return using traditional ass ...

First Trust Large Cap Core AlphaDEX® Fund

... fund are listed for trading as of the time that the fund’s NAV is calculated. Returns are average annualized total returns, except those for periods of less than one year, which are cumulative. The fund’s performance reflects fee waivers and expense reimbursements, absent which performance would have ...

... fund are listed for trading as of the time that the fund’s NAV is calculated. Returns are average annualized total returns, except those for periods of less than one year, which are cumulative. The fund’s performance reflects fee waivers and expense reimbursements, absent which performance would have ...

key investor information

... The lowest category does not mean ‘risk free’. The Fund does not offer any capital guarantee or assurance that the investor will receive a fixed amount when redeeming. Further risks that may have a significant effect on the net asset value of the Fund include: Liquidity risk is the risk tha ...

... The lowest category does not mean ‘risk free’. The Fund does not offer any capital guarantee or assurance that the investor will receive a fixed amount when redeeming. Further risks that may have a significant effect on the net asset value of the Fund include: Liquidity risk is the risk tha ...

the mystery of the money supply definition

... initiated sweep programs to lower statutory reserve requirements on demand deposits. In a sweep program, banks “sweep” funds from demand deposits into money market deposit accounts (MMDA), personal savings deposits under the Federal Reserve’s Regulation D, that have a zero statutory reserve requirem ...

... initiated sweep programs to lower statutory reserve requirements on demand deposits. In a sweep program, banks “sweep” funds from demand deposits into money market deposit accounts (MMDA), personal savings deposits under the Federal Reserve’s Regulation D, that have a zero statutory reserve requirem ...

Investment Policy - Hindu Temple Society of Augusta

... The Investment Records should be maintained for the life and should be handed over to the successors, as appropriate. The above policy has been reviewed and approved by Hindu Temple Society of Augusta Board of Trustees on December 31, 2003. Signed by Chairman, Board of Trustees………………………………………… ...

... The Investment Records should be maintained for the life and should be handed over to the successors, as appropriate. The above policy has been reviewed and approved by Hindu Temple Society of Augusta Board of Trustees on December 31, 2003. Signed by Chairman, Board of Trustees………………………………………… ...