Payoff complementarities and financial fragility Evidence from

... reported to the National Association of Securities Dealers (NASD) by 6:00 pm. In many cases, however, the trades made by mutual funds in response to redemptions happen only after the day of the redemptions and thus their costs are not reflected in the NAV of that day. This happens for two reasons. Fi ...

... reported to the National Association of Securities Dealers (NASD) by 6:00 pm. In many cases, however, the trades made by mutual funds in response to redemptions happen only after the day of the redemptions and thus their costs are not reflected in the NAV of that day. This happens for two reasons. Fi ...

Sprott Bridging Income Fund LP Overview

... Sprott Asset Management LP is the investment manager to the Sprott Funds (collectively, the “Funds”). The Sprott Bridging Income Fund LP (the “Fund”) is offered on a private placement basis pursuant to an offering memorandum and is only available to investors who meet certain eligibility or minimum ...

... Sprott Asset Management LP is the investment manager to the Sprott Funds (collectively, the “Funds”). The Sprott Bridging Income Fund LP (the “Fund”) is offered on a private placement basis pursuant to an offering memorandum and is only available to investors who meet certain eligibility or minimum ...

Setting up a Sovereign Wealth Fund: Some Policy and

... Investment Portfolio.7 Assets in the Backing Portfolio are invested in highly liquid and shortterm U.S. dollar-denominated fixed income securities. While assets in the Investment Portfolio are invested in a more dynamic way, including investment in equities. Typically, however, the limited tolerance ...

... Investment Portfolio.7 Assets in the Backing Portfolio are invested in highly liquid and shortterm U.S. dollar-denominated fixed income securities. While assets in the Investment Portfolio are invested in a more dynamic way, including investment in equities. Typically, however, the limited tolerance ...

Costs of Eliminating Discretionary Broker Voting on Uncontested

... to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for example, have a duty of care requirement to monitor corporate actions and vote client proxies in many instances. Fiduciaries to private pension plans—typically plan sponsors—are subject ...

... to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for example, have a duty of care requirement to monitor corporate actions and vote client proxies in many instances. Fiduciaries to private pension plans—typically plan sponsors—are subject ...

Nov 2012 Visitors Program_v3

... Tips for stock report by Warren Buffet: "I never buy anything unless I can fill out on a piece of paper my reasons. I may be wrong, but I would know the answer to that. “I’m paying $32 billion today for the Coca Cola Company because...” ...

... Tips for stock report by Warren Buffet: "I never buy anything unless I can fill out on a piece of paper my reasons. I may be wrong, but I would know the answer to that. “I’m paying $32 billion today for the Coca Cola Company because...” ...

The Asset Allocation Debate: Provocative Questions

... of Chicago CRSP Survivor Bias-Free US Mutual Fund Database. The data include monthly net returns, annual allocations to asset classes, and fund characteristics such as expense ratios and turnover rates. Multiple share classes of the same fund were aggregated by market cap, weighting returns and expe ...

... of Chicago CRSP Survivor Bias-Free US Mutual Fund Database. The data include monthly net returns, annual allocations to asset classes, and fund characteristics such as expense ratios and turnover rates. Multiple share classes of the same fund were aggregated by market cap, weighting returns and expe ...

How to Invest in the U.S. Overall Market?

... $17 trillion at year- end 2013 is managed by U.S. investment companies. Most of these investments are in mutual funds, which are responsible for almost 90 percent of the assets, and therefore playing a significant role in the total U.S. fund industry. Moreover, the ICI fact book (2014) pointed out t ...

... $17 trillion at year- end 2013 is managed by U.S. investment companies. Most of these investments are in mutual funds, which are responsible for almost 90 percent of the assets, and therefore playing a significant role in the total U.S. fund industry. Moreover, the ICI fact book (2014) pointed out t ...

4212201 WFA Hedge Fund Guide

... Risks of investing in hedge funds and funds of hedge funds Following are some of the most significant risks associated with investing in hedge funds and funds of hedge funds. The list is not exhaustive. Particular hedge funds may involve other risks that will be disclosed in the official offering do ...

... Risks of investing in hedge funds and funds of hedge funds Following are some of the most significant risks associated with investing in hedge funds and funds of hedge funds. The list is not exhaustive. Particular hedge funds may involve other risks that will be disclosed in the official offering do ...

Money Market Funds - Fort Pitt Capital Group

... your actual costs may be higher or lower, based on these assumptions your costs would be: Class A 1 year ...

... your actual costs may be higher or lower, based on these assumptions your costs would be: Class A 1 year ...

Standard Deviation as a Measure of Risk for a Mutual Fund

... mutual fund? How would you apply it? We suggest that a person start by comparing similar funds. If two funds have a similar history of returns, then the one with the smaller standard deviation gives the same return with less risk. Fund B: Value at Risk (VaR) “is an estimate of the maximum loss that ...

... mutual fund? How would you apply it? We suggest that a person start by comparing similar funds. If two funds have a similar history of returns, then the one with the smaller standard deviation gives the same return with less risk. Fund B: Value at Risk (VaR) “is an estimate of the maximum loss that ...

Barings Developed and Emerging Markets High Yield Bond

... For Income Unit Classes (Inc), dividend, if declared, will be paid. For Accumulation Unit Classes (Acc), no dividend will be paid. * The Fund normally pays dividends out of surplus net income. However, the Managers may also distribute such part of any capital gains less realised and unrealised capit ...

... For Income Unit Classes (Inc), dividend, if declared, will be paid. For Accumulation Unit Classes (Acc), no dividend will be paid. * The Fund normally pays dividends out of surplus net income. However, the Managers may also distribute such part of any capital gains less realised and unrealised capit ...

“ЗАТВЕРДЖЕНО”

... - Expenses for servicing the Fund's participants. 6.7. Expenses specified in this item may not exceed 5 (five) percent of annual average Fund's net asset value during the fiscal year. 6.8. The Company at its own account pays for other expenses and expenses exceeding the amount specified by legislati ...

... - Expenses for servicing the Fund's participants. 6.7. Expenses specified in this item may not exceed 5 (five) percent of annual average Fund's net asset value during the fiscal year. 6.8. The Company at its own account pays for other expenses and expenses exceeding the amount specified by legislati ...

A Clearer View of Your Path to Retirement

... from a target date portfolio is not guaranteed at any time, including on or after the target date. An investment in a target date portfolio does not eliminate the need for investors to decide—before investing and periodically thereafter—whether the portfolio fits their financial situation. For more ...

... from a target date portfolio is not guaranteed at any time, including on or after the target date. An investment in a target date portfolio does not eliminate the need for investors to decide—before investing and periodically thereafter—whether the portfolio fits their financial situation. For more ...

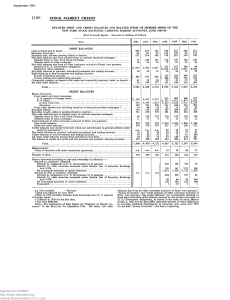

Detailed Debit and Credit Balances and Related Items of Member

... Net debit balances in partners' individual investment and trading accounts Debit balances in firm investment and trading accounts: In firm investment accounts In firm trading and underwriting accounts Commodity margins on deposit with banks and commodity guaranty funds on deposit.. All other debit b ...

... Net debit balances in partners' individual investment and trading accounts Debit balances in firm investment and trading accounts: In firm investment accounts In firm trading and underwriting accounts Commodity margins on deposit with banks and commodity guaranty funds on deposit.. All other debit b ...

Are Funds of Funds Simply Multi-Strategy

... to invest (strategy allocation) and choosing managers within these strategies (manager selection). Before comparing multi-strategy funds to funds of funds in these two areas, it is worthwhile to understand the potential impact each can have on performance. A number of studies have shown that for tra ...

... to invest (strategy allocation) and choosing managers within these strategies (manager selection). Before comparing multi-strategy funds to funds of funds in these two areas, it is worthwhile to understand the potential impact each can have on performance. A number of studies have shown that for tra ...

Self Regulation - Superfinanciera

... selection of its directors and administration of its affairs Must have rules designed to prevent fraud and promote “just and equitable principles of trade” Must have fair procedure for bringing disciplinary actions against its members and associated persons Rules must not impose unnecessary burden o ...

... selection of its directors and administration of its affairs Must have rules designed to prevent fraud and promote “just and equitable principles of trade” Must have fair procedure for bringing disciplinary actions against its members and associated persons Rules must not impose unnecessary burden o ...

XPP-PDF Support Utility

... Designation of Liquidity Program Administrator. The Liquidity Rule requires a fund’s board to approve the designation of the fund’s investment adviser, officer, or officers (which may not be solely portfolio managers of the fund) responsible for administering the fund’s Liquidity Program (the Progra ...

... Designation of Liquidity Program Administrator. The Liquidity Rule requires a fund’s board to approve the designation of the fund’s investment adviser, officer, or officers (which may not be solely portfolio managers of the fund) responsible for administering the fund’s Liquidity Program (the Progra ...

Challenges arising from alternative investment management

... investment strategies. While these strategies are flexible, and many different combinations exist, we can basically identify four major investment styles, of which there are numerous variations. – Long/short strategies involve taking simultaneously short and long positions in different securities, s ...

... investment strategies. While these strategies are flexible, and many different combinations exist, we can basically identify four major investment styles, of which there are numerous variations. – Long/short strategies involve taking simultaneously short and long positions in different securities, s ...

LF and FEM

... together to determine equilibrium, and then the effects of shifts in demand and supply are analyzed. • The two markets are linked together and r, NCO, EP/P*, and NX are jointly determined. • Different policies and situations are then analyzed and their affect on r, NCO, EP/P*, and NX identified. ...

... together to determine equilibrium, and then the effects of shifts in demand and supply are analyzed. • The two markets are linked together and r, NCO, EP/P*, and NX are jointly determined. • Different policies and situations are then analyzed and their affect on r, NCO, EP/P*, and NX identified. ...

Sovereign Wealth Funds in the Pacific Island Countries

... funds’ potential impact on international financial markets, from a domestic policymaker’s viewpoint, a more fundamental question is whether SWFs can be a useful instrument to achieve domestic policy goals. While there is no universally agreed-upon definition of SWFs and their objectives, in general ...

... funds’ potential impact on international financial markets, from a domestic policymaker’s viewpoint, a more fundamental question is whether SWFs can be a useful instrument to achieve domestic policy goals. While there is no universally agreed-upon definition of SWFs and their objectives, in general ...

1 - Sidley Austin LLP

... The SEC’s increased concern regarding liquidity risk is due in part to the growth of assets held by funds that are pursuing strategies that are focused on less liquid asset classes, such as certain fixed income or alternative investment strategies. 6 An open-end fund that holds significant amounts o ...

... The SEC’s increased concern regarding liquidity risk is due in part to the growth of assets held by funds that are pursuing strategies that are focused on less liquid asset classes, such as certain fixed income or alternative investment strategies. 6 An open-end fund that holds significant amounts o ...

Technical note - Federal Reserve Bank of New York

... Technical Note Concerning the Methodology for Calculating the Effective Federal Funds Rate July 8, 2015 The effective federal funds rate (EFFR) is currently calculated as a volume-weighted mean using data collected from major federal funds brokers. In February 2015, the Federal Reserve Bank of New Y ...

... Technical Note Concerning the Methodology for Calculating the Effective Federal Funds Rate July 8, 2015 The effective federal funds rate (EFFR) is currently calculated as a volume-weighted mean using data collected from major federal funds brokers. In February 2015, the Federal Reserve Bank of New Y ...

MFSA Guidance Note for Shariah Compliant Funds

... The Manager of the fund shall appoint a Shariah Advisory Board composed of at least two internationally recognised Islamic Shariah Scholars to ensure that the fund meets Shariah compliance standards in the management of its assets. Members of the Shariah Advisory Board are to be independent from the ...

... The Manager of the fund shall appoint a Shariah Advisory Board composed of at least two internationally recognised Islamic Shariah Scholars to ensure that the fund meets Shariah compliance standards in the management of its assets. Members of the Shariah Advisory Board are to be independent from the ...

stock comparison - MBA Projects

... specified securities. They make both bid and offer at the same time. A market maker has to abide by bye-laws, rules regulations of the concerned stock exchange. He is exempt from the margin requirements. As per the listing requirements, a company where the paid-up capital is Rs. 3 crore but not more ...

... specified securities. They make both bid and offer at the same time. A market maker has to abide by bye-laws, rules regulations of the concerned stock exchange. He is exempt from the margin requirements. As per the listing requirements, a company where the paid-up capital is Rs. 3 crore but not more ...

Amendment No 3 dated August 10, 2016 to the Simplified Prospectus

... securities in the other series of the fund because they are hedged against such risk. However, the currency hedging strategy may not provide a perfect hedge of the foreign currency exposure of H and FH Series securities. During periods of high market tension or volatility, the fund may not be able t ...

... securities in the other series of the fund because they are hedged against such risk. However, the currency hedging strategy may not provide a perfect hedge of the foreign currency exposure of H and FH Series securities. During periods of high market tension or volatility, the fund may not be able t ...