The Fallacy behind Investor versus Fund Returns

... application of an inadequately-analyzed, poorly-understood mathematical measure. As I will explain, there is no way to determine if investors underperform the mutual funds they own, either because of bad timing or for any other reason. Why is it a desirable result for investment professionals? A com ...

... application of an inadequately-analyzed, poorly-understood mathematical measure. As I will explain, there is no way to determine if investors underperform the mutual funds they own, either because of bad timing or for any other reason. Why is it a desirable result for investment professionals? A com ...

Trustee Corporations Association of Australia

... community’s very low tolerance for institutional failure has been revealed”.1 As evidenced by the HIH episode, this “expectation gap” results in pressure on the Government to use taxpayer funds to provide compensation for losses suffered by investors in regulated institutions. This highlights the im ...

... community’s very low tolerance for institutional failure has been revealed”.1 As evidenced by the HIH episode, this “expectation gap” results in pressure on the Government to use taxpayer funds to provide compensation for losses suffered by investors in regulated institutions. This highlights the im ...

University of Louisville Endowment Fund Statement of Investment

... Bonds, debentures, notes and other evidences of indebtedness issued by United States domestic corporations. Other dollar denominated securities (e.g. Yankees and Eurodollars) Preferred stocks. Convertible bonds (when considered a debt issue). Mortgage and other asset-backed securities. Tax-exempt bo ...

... Bonds, debentures, notes and other evidences of indebtedness issued by United States domestic corporations. Other dollar denominated securities (e.g. Yankees and Eurodollars) Preferred stocks. Convertible bonds (when considered a debt issue). Mortgage and other asset-backed securities. Tax-exempt bo ...

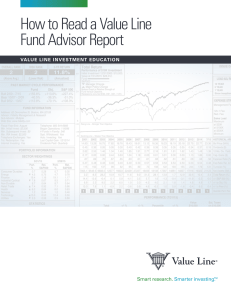

How to Read a Value Line Fund Advisor Report

... fixed-income, or municipal bond funds. Funds are rewarded only for the consistency with which they outperform, not for the magnitude of the outperformance. The three-year risk-adjusted performance is calculated by dividing a fund’s three-year total return by its standard deviation. These three measu ...

... fixed-income, or municipal bond funds. Funds are rewarded only for the consistency with which they outperform, not for the magnitude of the outperformance. The three-year risk-adjusted performance is calculated by dividing a fund’s three-year total return by its standard deviation. These three measu ...

Superannuation funds and alternative asset investment

... alternative investment markets. There is some concern that the supply of high-quality alternative assets is limited, both domestically and internationally, and that there is a limited number of fund managers with the expertise and resources to manage this asset class successfully. This can result in ...

... alternative investment markets. There is some concern that the supply of high-quality alternative assets is limited, both domestically and internationally, and that there is a limited number of fund managers with the expertise and resources to manage this asset class successfully. This can result in ...

Establishing China`s Green Financial System Detailed

... unlikely for two or more wastewater plants to exist in the same region given their natural monopoly. In this situation, environmental infrastructure projects like wastewater treatment would req ...

... unlikely for two or more wastewater plants to exist in the same region given their natural monopoly. In this situation, environmental infrastructure projects like wastewater treatment would req ...

Wisconsin`s Uniform Prudent Management of Institutional Act

... asset must be made not in isolation but rather in the context of the institutional fund’s portfolio of investments as a whole and as a part of an overall investment strategy having risk and return objectives reasonably suited to the fund and to the institution. No per se permitted or prohibited inve ...

... asset must be made not in isolation but rather in the context of the institutional fund’s portfolio of investments as a whole and as a part of an overall investment strategy having risk and return objectives reasonably suited to the fund and to the institution. No per se permitted or prohibited inve ...

Co-Investment Funds - IP Conference

... focus, sectors, investment sizes, followon and reserve policy, holding periods, role in financing rounds Fund size: justification for size through bottom-up analysis, min / target / max size, modification to strategy according to size scenarios Target profiles: criteria for investment targets (compa ...

... focus, sectors, investment sizes, followon and reserve policy, holding periods, role in financing rounds Fund size: justification for size through bottom-up analysis, min / target / max size, modification to strategy according to size scenarios Target profiles: criteria for investment targets (compa ...

The Endowment Fund of the YMCA of Greater Vancouver 2015

... the YMCA of Greater Vancouver enabled our Y to impact over 115,000 people in 2015. We are proud to say that the Endowment Funds have been well stewarded in 2015, with a return on market investments of 11.5%, and with steady growth in our real estate investments. These returns, combined with the incr ...

... the YMCA of Greater Vancouver enabled our Y to impact over 115,000 people in 2015. We are proud to say that the Endowment Funds have been well stewarded in 2015, with a return on market investments of 11.5%, and with steady growth in our real estate investments. These returns, combined with the incr ...

Immigrant Investor Programme - Guidelines for Funds

... to investors. While the Immigrant Investor Programme does not attach any conditions to return on investment, the Evaluation Committee will require details of the target return on investment in order to satisfy themselves that the fund and the investment strategy is at least based on viable and reali ...

... to investors. While the Immigrant Investor Programme does not attach any conditions to return on investment, the Evaluation Committee will require details of the target return on investment in order to satisfy themselves that the fund and the investment strategy is at least based on viable and reali ...

Introduction - Furman University

... of underlying assets, where the classes differ only by fee structure, e.g. one class will have a front-end load while another class uses a contingent deferred sales charge. Operationally, there is no difference between classes. The attraction to sponsors is that different fee structures can be used ...

... of underlying assets, where the classes differ only by fee structure, e.g. one class will have a front-end load while another class uses a contingent deferred sales charge. Operationally, there is no difference between classes. The attraction to sponsors is that different fee structures can be used ...

report to the board of governors subject endowment funds

... Decisions, financial and otherwise, with respect to any fellowship award arising from the Gift, including the continuing eligibility of a person to hold an award or to obtain a renewal thereof, as well as any matters relating to the investment, management, use or administration of the Fund will be m ...

... Decisions, financial and otherwise, with respect to any fellowship award arising from the Gift, including the continuing eligibility of a person to hold an award or to obtain a renewal thereof, as well as any matters relating to the investment, management, use or administration of the Fund will be m ...

Chap4

... • Although the original intent of Rule 12b-1 was to promote a fund’s asset base and give existing fund shareholders access to lower expenses due to economies of scale, fund companies themselves do not tend to spend distribution fee revenue on advertising. The ICI (2005) surveyed its members in 2004 ...

... • Although the original intent of Rule 12b-1 was to promote a fund’s asset base and give existing fund shareholders access to lower expenses due to economies of scale, fund companies themselves do not tend to spend distribution fee revenue on advertising. The ICI (2005) surveyed its members in 2004 ...

Investment Policy Statement

... While the investment parameters for all of the Investment Portfolios offered in the Program are approved by the Board, Account Owners (or participants) bear the risk of investment results derived from the selected Investment Portfolio specifically and the Program generally. The appropriate Investmen ...

... While the investment parameters for all of the Investment Portfolios offered in the Program are approved by the Board, Account Owners (or participants) bear the risk of investment results derived from the selected Investment Portfolio specifically and the Program generally. The appropriate Investmen ...

10.xxx Endowment Funds - UNT Health Science Center

... It is the specific and strong preference of the Board of Regents that all endowment gifts be eligible for commingling for investment purposes with other endowment funds. This commingling permits enhancement of long-term investment programs, affords appropriate risk control through diversification, a ...

... It is the specific and strong preference of the Board of Regents that all endowment gifts be eligible for commingling for investment purposes with other endowment funds. This commingling permits enhancement of long-term investment programs, affords appropriate risk control through diversification, a ...

Glossary of Mutual Fund and Other Related Financial Terms

... common asset classes are equities (e.g., stocks), fixed income (e.g., bonds), and cash equivalents (e.g., money market funds). assets. The securities, cash, and receivables owned by a fund. Examples of this are stocks, bonds, and other investments. auditor. An auditor certifies a fund’s financial st ...

... common asset classes are equities (e.g., stocks), fixed income (e.g., bonds), and cash equivalents (e.g., money market funds). assets. The securities, cash, and receivables owned by a fund. Examples of this are stocks, bonds, and other investments. auditor. An auditor certifies a fund’s financial st ...

Why expenses matter - Charles Schwab Investment Management

... Shares and 0.08% for Institutional Shares for so long as the investment adviser serves as the adviser to the fund. This agreement may only be amended or terminated with the approval of the fund’s Board of Trustees. ...

... Shares and 0.08% for Institutional Shares for so long as the investment adviser serves as the adviser to the fund. This agreement may only be amended or terminated with the approval of the fund’s Board of Trustees. ...

Calvert High Yield Bond Fund

... may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed-income mutual funds may be higher than normal, causing increased supply in the market due to selling activity. The secondary market for municipal obligations also tends to be less well ...

... may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed-income mutual funds may be higher than normal, causing increased supply in the market due to selling activity. The secondary market for municipal obligations also tends to be less well ...

Revenue Sharing Fund Families

... is higher for those services than the rate for networked accounts presents a conflict of interest for Morgan Stanley to recommend purchases of omnibustraded funds over networked funds. In addition, while all fund families are charged the same administrative service fee rates for either omnibus or ne ...

... is higher for those services than the rate for networked accounts presents a conflict of interest for Morgan Stanley to recommend purchases of omnibustraded funds over networked funds. In addition, while all fund families are charged the same administrative service fee rates for either omnibus or ne ...

The Roaring 20`s and Great Depression

... When a person buys stock, he/she is buying partial ____________ in a corporation. If the corporation prospers, the investor prospers makes___________ on the investment. If the corporation fails, the investor can ___________ his investment. (Money) Buying on Margin: ____________ money to invest money ...

... When a person buys stock, he/she is buying partial ____________ in a corporation. If the corporation prospers, the investor prospers makes___________ on the investment. If the corporation fails, the investor can ___________ his investment. (Money) Buying on Margin: ____________ money to invest money ...

Geometric Average Capitalization

... Japan, Australia/NZ, and Asia ex-Japan), the geometric average capitalization of the fund can be compared to the large-, mid-, and small-cap divisions of the Morningstar Style BoxTM. In these cases, the Style Box size score (raw y) is derived from the natural logarithm of the geometric average capit ...

... Japan, Australia/NZ, and Asia ex-Japan), the geometric average capitalization of the fund can be compared to the large-, mid-, and small-cap divisions of the Morningstar Style BoxTM. In these cases, the Style Box size score (raw y) is derived from the natural logarithm of the geometric average capit ...

Carnegie Fund V - C WorldWide Asset Management/US

... I acknowledge that the subscribed amount including all fees is payable, at the latest 3 Luxembourg bank business days after the Valuation Day on which the Net Asset Value is used to determine the Subscription Price. I the signatory and Investor, confirm that I have received and am fully acquainted w ...

... I acknowledge that the subscribed amount including all fees is payable, at the latest 3 Luxembourg bank business days after the Valuation Day on which the Net Asset Value is used to determine the Subscription Price. I the signatory and Investor, confirm that I have received and am fully acquainted w ...

A Guide to Irish Regulated Real Estate Funds

... flexibility in terms of investment and borrowing limits. However, a high minimum initial subscription requirement of Euro 250,000 per investor applies and investors must meet certain net worth tests. An individual investing into a QIF must have a minimum net worth of at least Euro 1.25 million (excl ...

... flexibility in terms of investment and borrowing limits. However, a high minimum initial subscription requirement of Euro 250,000 per investor applies and investors must meet certain net worth tests. An individual investing into a QIF must have a minimum net worth of at least Euro 1.25 million (excl ...

Automatic Account Rebalancing

... Some experts consider your asset allocation decision to be the most important investing decision you can make in your retirement planning. In fact, over time it has been shown to account for over 90%* of investment results. Carefully selecting your investment mix and sticking with a long-term plan h ...

... Some experts consider your asset allocation decision to be the most important investing decision you can make in your retirement planning. In fact, over time it has been shown to account for over 90%* of investment results. Carefully selecting your investment mix and sticking with a long-term plan h ...

REPORT TO SECURITYHOLDERS

... regulators for independent review committees of publicly offered investment funds. It considers conflicts of interest matters that Fiera refers to it for its recommendations, and where applicable, its approval. The IRC considers conflicts of interest matters referred to it and makes recommendations ...

... regulators for independent review committees of publicly offered investment funds. It considers conflicts of interest matters that Fiera refers to it for its recommendations, and where applicable, its approval. The IRC considers conflicts of interest matters referred to it and makes recommendations ...