Comparative Analysis of Blue Chip Fund

... 12, Shivam Nagar 1st, Jagatpura, Jaipur – 302017. Rajasthan. e-mail: [email protected] ...

... 12, Shivam Nagar 1st, Jagatpura, Jaipur – 302017. Rajasthan. e-mail: [email protected] ...

2015 December Distribution

... The following Funds declare dividends from net investment income and distribute these dividends quarterly: ...

... The following Funds declare dividends from net investment income and distribute these dividends quarterly: ...

Important information regarding changes to the

... program depending on a variety of factors, including account type and asset level. Money market mutual funds and bank deposit programs have different types of protection/insurance coverage. Funds invested in money market mutual funds through Merrill Lynch are protected by the Securities Investor Pro ...

... program depending on a variety of factors, including account type and asset level. Money market mutual funds and bank deposit programs have different types of protection/insurance coverage. Funds invested in money market mutual funds through Merrill Lynch are protected by the Securities Investor Pro ...

Mutual funds

... • ready to buy and sell shares at a price based on net asset value (NAV) • NAV per share equals the market value of the portfolio minus the liabilities of the mutual fund divided by the number of shares owned by the mutual fund investors. ...

... • ready to buy and sell shares at a price based on net asset value (NAV) • NAV per share equals the market value of the portfolio minus the liabilities of the mutual fund divided by the number of shares owned by the mutual fund investors. ...

Chapter 6

... Hong Kong Dollar Bond Market • Hong Kong Dollar Linked to US dollar. • Supposing the representative Hong Kong Dollar bond was about as risky as the representative US dollar bond, the interest rate should be the same. • If there are any differentials, the supply curve for HK loanable funds (the dema ...

... Hong Kong Dollar Bond Market • Hong Kong Dollar Linked to US dollar. • Supposing the representative Hong Kong Dollar bond was about as risky as the representative US dollar bond, the interest rate should be the same. • If there are any differentials, the supply curve for HK loanable funds (the dema ...

LU0028118809

... recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustr ...

... recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustr ...

Asset Enhancement CPF INVESTMENT GUIDELINES (CPFIG

... For a FMC that intends to offer an authorised Fund that is wholly managed in Singapore, the FMC and its related group of companies must manage at least S$500million of discretionary funds in Singapore. 2 For a FMC that intends to offer an authorised Fund that is sub-managed or feeds into another CIS ...

... For a FMC that intends to offer an authorised Fund that is wholly managed in Singapore, the FMC and its related group of companies must manage at least S$500million of discretionary funds in Singapore. 2 For a FMC that intends to offer an authorised Fund that is sub-managed or feeds into another CIS ...

Key Investor Information db x-trackers Equity Value Factor UCITS ETF

... The Index is calculated and published by Solactive AG. Solactive AG does not offer any explicit or tacit guarantee or assurance to the results of use of the Index or value of the Index. There is no obligation of Solactive AG to advise of any errors in the Index. The Index is rules based and is not c ...

... The Index is calculated and published by Solactive AG. Solactive AG does not offer any explicit or tacit guarantee or assurance to the results of use of the Index or value of the Index. There is no obligation of Solactive AG to advise of any errors in the Index. The Index is rules based and is not c ...

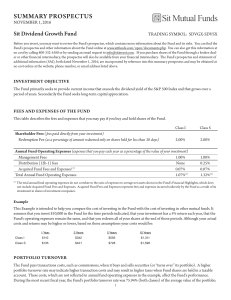

summary prospectus

... ›› strong prospects for growing dividend payments indicated in part by growing earnings and cash flow, ›› unique product or service, ›› growing product demand, ›› dominant and growing market share, ›› management experience and capabilities, and ›› strong financial condition. Since stocks that pay di ...

... ›› strong prospects for growing dividend payments indicated in part by growing earnings and cash flow, ›› unique product or service, ›› growing product demand, ›› dominant and growing market share, ›› management experience and capabilities, and ›› strong financial condition. Since stocks that pay di ...

The place for listing Alternative Investment Funds

... Most of the Luxembourg providers are able to perform high quality accounting of alternative funds with the specific aspects of consolidation and IFRS reporting. In addition, distribution aspects like shareholder monitoring (e.g. hot issues, capital calls and side pockets) and performance fee managem ...

... Most of the Luxembourg providers are able to perform high quality accounting of alternative funds with the specific aspects of consolidation and IFRS reporting. In addition, distribution aspects like shareholder monitoring (e.g. hot issues, capital calls and side pockets) and performance fee managem ...

Baird Core Intermediate Municipal Bond Fund Summary Prospectus

... Non-investment grade debt obligations (sometimes referred to as “high yield” or “junk” bonds) involve greater risk than investment-grade debt obligations, including the possibility of default or bankruptcy. They tend to be more sensitive to economic conditions than higher-rated debt obligations and, ...

... Non-investment grade debt obligations (sometimes referred to as “high yield” or “junk” bonds) involve greater risk than investment-grade debt obligations, including the possibility of default or bankruptcy. They tend to be more sensitive to economic conditions than higher-rated debt obligations and, ...

IBEW-NECA Stable Value Fund

... Returns on stable value would exceed intermediate and longer duration fixed income in this environment; stable value will also outpace money market Source for data: US Treasury, Invesco. Starting values as of 12/31/13 are used for the IBEW-NECA Stable Value Trust; however, these are not return pro ...

... Returns on stable value would exceed intermediate and longer duration fixed income in this environment; stable value will also outpace money market Source for data: US Treasury, Invesco. Starting values as of 12/31/13 are used for the IBEW-NECA Stable Value Trust; however, these are not return pro ...

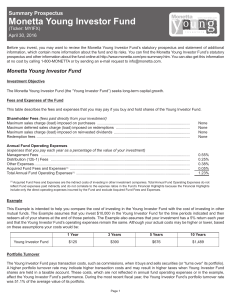

Monetta Young Investor Fund

... broad-based market indices that primarily include stocks of large capitalization U.S. companies. The balance of the Fund is directly invested in common stocks of companies of all market capitalization ranges and is diversified among industries and market sectors. However, the Adviser will primarily ...

... broad-based market indices that primarily include stocks of large capitalization U.S. companies. The balance of the Fund is directly invested in common stocks of companies of all market capitalization ranges and is diversified among industries and market sectors. However, the Adviser will primarily ...

There are may different kinds of assets in which financial wealth can

... for money curve “MD1” shifts upward to “Md2” and the equilibrium interest rate rises to ‘i2’. The reason for the increase in the interest rate is as follows: We start from an equilibrium position in the financial market as presented by point “a”. At this equilibrium position people are not only hold ...

... for money curve “MD1” shifts upward to “Md2” and the equilibrium interest rate rises to ‘i2’. The reason for the increase in the interest rate is as follows: We start from an equilibrium position in the financial market as presented by point “a”. At this equilibrium position people are not only hold ...

In the Matters of DELAWARE MANAGEMENT COMPANY, INC

... Management is the investment advisers to and principal underwriter for Delaware and Decatur, and its officers hold or help corresponding positions in those companies. Such officers were vested by the Funds with the executive and supervisory responsibility for conducting the affairs of the Funds, whi ...

... Management is the investment advisers to and principal underwriter for Delaware and Decatur, and its officers hold or help corresponding positions in those companies. Such officers were vested by the Funds with the executive and supervisory responsibility for conducting the affairs of the Funds, whi ...

Recuperation and repair

... circumstances. Commissions, management fees and expenses all may be associated with mutual fund investments. Important information about Scotiabank Mutual Funds and the Scotia DBG Caribbean Income Fund is contained in their respective Funds’ prospectus. Copies are available from your local Investmen ...

... circumstances. Commissions, management fees and expenses all may be associated with mutual fund investments. Important information about Scotiabank Mutual Funds and the Scotia DBG Caribbean Income Fund is contained in their respective Funds’ prospectus. Copies are available from your local Investmen ...

A TOUGH PUMP TO PRIME Peter A. Schulkin

... deposits. Large denomination ($100,000 or more) time deposits also have zero reserve requirements but are not included in M2. Since there are no reserve requirements on ZRRDs, the Fed cannot influence their magnitude directly by increasing or decreasing reserves. The amount of ZRRDs outstanding and ...

... deposits. Large denomination ($100,000 or more) time deposits also have zero reserve requirements but are not included in M2. Since there are no reserve requirements on ZRRDs, the Fed cannot influence their magnitude directly by increasing or decreasing reserves. The amount of ZRRDs outstanding and ...

MS Word - Securities Commission Malaysia

... proposed fund, (if any) such as closed-ended in nature, limited life of fund, special fees / charges structure etc. ...

... proposed fund, (if any) such as closed-ended in nature, limited life of fund, special fees / charges structure etc. ...

Can mutual funds successfully adopt factor investing strategies?

... adopted in the investment management industry if the empirical evidence on which this knowledge is inconclusive. Our findings provide a case to justify spending on research and development in the investment management industry. Our results also indicate that the excess returns earned by funds that h ...

... adopted in the investment management industry if the empirical evidence on which this knowledge is inconclusive. Our findings provide a case to justify spending on research and development in the investment management industry. Our results also indicate that the excess returns earned by funds that h ...

Commingled funds

... 2. Creative accounting: from the same 1999 paper: “The bizarre case of industrial giant Tyco is one of the most curious in recent years. Again, a merger appears to be at the centre of this controversy. The acquisitions of U.S. Surgical and AMP Inc. were questioned for their value, with certain indiv ...

... 2. Creative accounting: from the same 1999 paper: “The bizarre case of industrial giant Tyco is one of the most curious in recent years. Again, a merger appears to be at the centre of this controversy. The acquisitions of U.S. Surgical and AMP Inc. were questioned for their value, with certain indiv ...

East Carolina University Basic Spending Guidelines by

... example of an exception would include allowances for food costs for seminars or workshops associated with the objectives of the award. Contracts and grants may also be subject to Cost Accounting Standards (CAS) or other requirements set forth in OMB Circulars or other federal regulations or specific ...

... example of an exception would include allowances for food costs for seminars or workshops associated with the objectives of the award. Contracts and grants may also be subject to Cost Accounting Standards (CAS) or other requirements set forth in OMB Circulars or other federal regulations or specific ...

1 Quarterly Statistical Release March 2010, N° 40 This release and

... Net Assets by Investment Type Total net assets of UCITS increased by 2.8 percent in the fourth quarter to reach EUR 5,299 billion at end of 2009. Equity funds experienced the strongest asset increase (EUR 98 billion or 7 percent). Balanced and bond funds also saw their assets increase by 4 percent a ...

... Net Assets by Investment Type Total net assets of UCITS increased by 2.8 percent in the fourth quarter to reach EUR 5,299 billion at end of 2009. Equity funds experienced the strongest asset increase (EUR 98 billion or 7 percent). Balanced and bond funds also saw their assets increase by 4 percent a ...

Oaktree High Yield Bond Fund

... the Adviser (commonly referred to as “junk bonds” or “high yield bonds”). Split rated securities will be considered to have the lower credit rating. For purposes of the Fund’s 80% policy, “bonds” may include, but are not limited to, fixed and floating rate corporate bonds, debentures and notes, bank ...

... the Adviser (commonly referred to as “junk bonds” or “high yield bonds”). Split rated securities will be considered to have the lower credit rating. For purposes of the Fund’s 80% policy, “bonds” may include, but are not limited to, fixed and floating rate corporate bonds, debentures and notes, bank ...

Chapter 9

... The Money Markets Defined: Why Do We Need Money Markets? In theory, the banking industry should handle the needs for short-term loans and accept short-term deposits. Banks also have an information advantage on the credit-worthiness of participants. Banks do mediate between savers and borrowers; how ...

... The Money Markets Defined: Why Do We Need Money Markets? In theory, the banking industry should handle the needs for short-term loans and accept short-term deposits. Banks also have an information advantage on the credit-worthiness of participants. Banks do mediate between savers and borrowers; how ...