Nationwide® Investor Destinations Conservative Fund

... investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. It rolls up into other Barclays flagship indices, such as the multi-currency Global Aggreg ...

... investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. It rolls up into other Barclays flagship indices, such as the multi-currency Global Aggreg ...

Privatization: Pros and Cons

... • What do we do when the stock market drops or goes through a long-term decline? • In four 20 year periods in the past century, inflation adjusted returns were close to zero. • These years were 1901-1921, 1929-1949, ...

... • What do we do when the stock market drops or goes through a long-term decline? • In four 20 year periods in the past century, inflation adjusted returns were close to zero. • These years were 1901-1921, 1929-1949, ...

Important information on Fidelity Advisor Stable Value Portfolio

... Exp Ratio (Gross): Expense ratio is a measure of what it costs to operate an investment, expressed as a percentage of its assets, as a dollar amount, or in basis points. These are costs the investor pays through a reduction in the investment's rate of return. For a mutual fund, the gross expense rat ...

... Exp Ratio (Gross): Expense ratio is a measure of what it costs to operate an investment, expressed as a percentage of its assets, as a dollar amount, or in basis points. These are costs the investor pays through a reduction in the investment's rate of return. For a mutual fund, the gross expense rat ...

Chapter 11 PPT - McGraw Hill Higher Education

... short-term borrowers and provides savers who hold temporary cash surpluses with an interestbearing outlet for their funds. In this chapter, we focus on securities dealers and banks, and explore in detail four popular money market instruments – Treasury bills, repurchase agreements, Federal funds, ...

... short-term borrowers and provides savers who hold temporary cash surpluses with an interestbearing outlet for their funds. In this chapter, we focus on securities dealers and banks, and explore in detail four popular money market instruments – Treasury bills, repurchase agreements, Federal funds, ...

understanding monetary policy series no 27 the nigerian money

... buying and selling of securities with original maturities of one year or less. The money market evolved out of the need to match economic agents with surplus funds, with those in need of funds. Consequently, the money market acts as a medium to channel short term funds from agents with excess to tho ...

... buying and selling of securities with original maturities of one year or less. The money market evolved out of the need to match economic agents with surplus funds, with those in need of funds. Consequently, the money market acts as a medium to channel short term funds from agents with excess to tho ...

Meet Dave - Allegis Financial Partners

... All investments involve risks, including possible loss of principal. The fund’s share price and yield will be affected by interest rate movements. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in the fund adjust to a rise in interest rates, the ...

... All investments involve risks, including possible loss of principal. The fund’s share price and yield will be affected by interest rate movements. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in the fund adjust to a rise in interest rates, the ...

Evidence from Real Estate Private Equity

... is locked into the fund for several years and is only freed upon its liquidation. Because of this long-term commitment, careful selection of funds and fund managers may be of even greater importance for REPE than for investments offering a quick exit option. Our study sets out to investigate whether ...

... is locked into the fund for several years and is only freed upon its liquidation. Because of this long-term commitment, careful selection of funds and fund managers may be of even greater importance for REPE than for investments offering a quick exit option. Our study sets out to investigate whether ...

mutual fund strategy

... Money market funds invest in money market instruments, which are fixed income securities with a very short time to maturity and high credit quality. Investors often use money market funds as a substitute for bank savings accounts, though money market funds are not insured by the government, unlike b ...

... Money market funds invest in money market instruments, which are fixed income securities with a very short time to maturity and high credit quality. Investors often use money market funds as a substitute for bank savings accounts, though money market funds are not insured by the government, unlike b ...

Word format - Parliament of Australia

... impose significantly increased costs across the system due to the surge in transactions that could be expected to occur. This would, in particular, impact on all members of those funds that do not impose an Exit Fee because the costs would be spread across all members. Alternatively such funds would ...

... impose significantly increased costs across the system due to the surge in transactions that could be expected to occur. This would, in particular, impact on all members of those funds that do not impose an Exit Fee because the costs would be spread across all members. Alternatively such funds would ...

US Money Market Reform: The Scandi angle

... Secondly, especially for foreign banks including eurozone banks, we are now approaching a level where it may soon be cheaper to get funding through ECB utilising the USD swap lines that were established in the wake of the financial crisis. However, the use of these liquidity facilities are probably ...

... Secondly, especially for foreign banks including eurozone banks, we are now approaching a level where it may soon be cheaper to get funding through ECB utilising the USD swap lines that were established in the wake of the financial crisis. However, the use of these liquidity facilities are probably ...

EURO HIGH YIELD BOND FUND

... Fixed interest securities are the debts of governments and companies, generally in the form of bonds. These bonds are particularly affected by changes in interest rates, inflation and the decline in credit worthiness of the issuer, which may in turn affect the bonds value. The fund will be subject t ...

... Fixed interest securities are the debts of governments and companies, generally in the form of bonds. These bonds are particularly affected by changes in interest rates, inflation and the decline in credit worthiness of the issuer, which may in turn affect the bonds value. The fund will be subject t ...

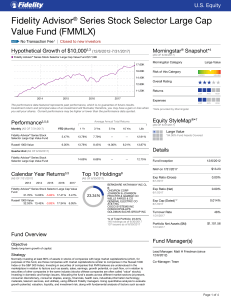

Fidelity Advisor® Series Stock Selector Large Cap Value Fund

... 6. Percent Rank in Category is the fund's total-return percentile rank relative to all funds that have the same Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always rec ...

... 6. Percent Rank in Category is the fund's total-return percentile rank relative to all funds that have the same Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always rec ...

Fidelity Convertible Securities Investment Trust

... Fidelity’s mutual funds are sold by registered Investment Professionals. Each Fund has a simplified prospectus, which contains important information on the Fund, including its investment objective, purchase options, and applicable charges. Please obtain a copy of the prospectus, read it carefully, a ...

... Fidelity’s mutual funds are sold by registered Investment Professionals. Each Fund has a simplified prospectus, which contains important information on the Fund, including its investment objective, purchase options, and applicable charges. Please obtain a copy of the prospectus, read it carefully, a ...

Presentation to the Andrew Brimmer Policy Forum IBEFA/ASSA Meeting San Francisco, CA

... time-honored function for central banks and is critical in mitigating systemic risk. But in doing so during the current crisis, the Fed has crossed traditional boundaries by extending the maturity of the loans, the range of acceptable collateral, and the range of eligible borrowing institutions. At ...

... time-honored function for central banks and is critical in mitigating systemic risk. But in doing so during the current crisis, the Fed has crossed traditional boundaries by extending the maturity of the loans, the range of acceptable collateral, and the range of eligible borrowing institutions. At ...

Investment Fund Sample Portfolios

... Morningstar, unless otherwise noted, does not adjust total returns for sales charges (such as front-end loads, deferred loads and redemption fees). Total returns are net of management, administrative, 12b-1 fees, and other costs deducted from funds assets. ...

... Morningstar, unless otherwise noted, does not adjust total returns for sales charges (such as front-end loads, deferred loads and redemption fees). Total returns are net of management, administrative, 12b-1 fees, and other costs deducted from funds assets. ...

newsletter - New York State Deferred Compensation Plan

... A transition account is required when an investment option being removed delivers securities rather than the cash amount of Plan assets invested in it. This process helps protect fund investors from incurring costs associated with large asset inflows and outflows while maintaining market exposure. W ...

... A transition account is required when an investment option being removed delivers securities rather than the cash amount of Plan assets invested in it. This process helps protect fund investors from incurring costs associated with large asset inflows and outflows while maintaining market exposure. W ...

Mutual Fund Performance and Manager Style. J.L. Davis, FAJ, Jan

... Selection Criteria for funds to be included in the data set: 1. If a fund’s stated objective was growth, growth and income, maximum capital gains, small-cap growth, or aggressive growth; 2. Objective not listed but policy statement indicated that they primarily invested in common stocks. ...

... Selection Criteria for funds to be included in the data set: 1. If a fund’s stated objective was growth, growth and income, maximum capital gains, small-cap growth, or aggressive growth; 2. Objective not listed but policy statement indicated that they primarily invested in common stocks. ...

fund accounting training

... Since endowment principals are generally kept in perpetuity, cash gifts are generally invested in long‐term instruments. When non‐cash instruments such as stocks or bonds are donated to establish an endowment, the asset is valued at market value as of the gift date. Income earned on endowments i ...

... Since endowment principals are generally kept in perpetuity, cash gifts are generally invested in long‐term instruments. When non‐cash instruments such as stocks or bonds are donated to establish an endowment, the asset is valued at market value as of the gift date. Income earned on endowments i ...

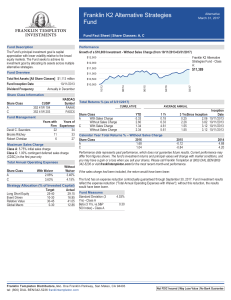

Franklin K2 Alternative Strategies Fund Fact Sheet

... The Fund may shift allocations among strategies at any time. Further, K2 may determine in its sole discretion to not allocate to one or more of the strategies and/or to add new strategies. Accordingly the above target allocations are presented for illustrative purposes only, and should not be viewed ...

... The Fund may shift allocations among strategies at any time. Further, K2 may determine in its sole discretion to not allocate to one or more of the strategies and/or to add new strategies. Accordingly the above target allocations are presented for illustrative purposes only, and should not be viewed ...

Chapter 18 Practice Problems 1. Suppose the demand for reserves

... It would become more difficult for the central bank to determine the supply of reserves required to achieve the target federal funds rate. The rate would become more volatile and monetary policy will become less effective. ...

... It would become more difficult for the central bank to determine the supply of reserves required to achieve the target federal funds rate. The rate would become more volatile and monetary policy will become less effective. ...

2050 Retirement Strategy Fund

... The Retirement Strategy Funds’ underlying investments include international companies, which involve such risks as currency fluctuations, economic instability and political developments. The portfolios also invest some of their assets in small and midsize companies. Such investments increase the ris ...

... The Retirement Strategy Funds’ underlying investments include international companies, which involve such risks as currency fluctuations, economic instability and political developments. The portfolios also invest some of their assets in small and midsize companies. Such investments increase the ris ...

Scottish Equitable JPMorgan Mansart Risk Profile 10 Fund

... It will do so by tracking the performance of developed market and emerging market equities, UK fixed interest and cash markets, balancing the allocation between these markets to manage volatility. The fund uses derivatives to gain exposure to the returns of the specified equity and UK fixed interest ...

... It will do so by tracking the performance of developed market and emerging market equities, UK fixed interest and cash markets, balancing the allocation between these markets to manage volatility. The fund uses derivatives to gain exposure to the returns of the specified equity and UK fixed interest ...

THEME: THE CHANGING ECONOMIC LANDSCAPE WITHIN EAC

... Kuwait gained independence from the United Kingdom. According to many estimates, Kuwait's fund is now worth approximately US$600 billion. Other early registered SWFs is the Revenue Equalization Reserve Fund of Kiribati. Created in 1956, when the British administration of the Gilbert Islands in Micro ...

... Kuwait gained independence from the United Kingdom. According to many estimates, Kuwait's fund is now worth approximately US$600 billion. Other early registered SWFs is the Revenue Equalization Reserve Fund of Kiribati. Created in 1956, when the British administration of the Gilbert Islands in Micro ...

FL BlackRock Long Term (Aquila C) IE/XE

... G - Derivatives: Where a fund uses derivatives for investment purposes, there may be an increase in the risk and volatility of the fund. Some derivative investments also expose investors to counterparty or default risk where another party is unable to meets its obligations and pay what is due, which ...

... G - Derivatives: Where a fund uses derivatives for investment purposes, there may be an increase in the risk and volatility of the fund. Some derivative investments also expose investors to counterparty or default risk where another party is unable to meets its obligations and pay what is due, which ...