Mishkin`s Chapter 9 PPT

... The Money Markets Defined: Why Do We Need Money Markets? In theory, the banking industry should handle the needs for short-term loans and accept short-term deposits. Banks also have an information advantage on the credit-worthiness of participants. Banks do mediate between savers and borrowers; how ...

... The Money Markets Defined: Why Do We Need Money Markets? In theory, the banking industry should handle the needs for short-term loans and accept short-term deposits. Banks also have an information advantage on the credit-worthiness of participants. Banks do mediate between savers and borrowers; how ...

Target Outcome Funds

... targeting a specific risk/reward trade‐off achieved through a combination of fixed income securities and options contracts. Each Target Outcome Fund seeks to deliver a return corresponding to a market index or reference asset within specific risk constraints or accompanied by certain return enhancem ...

... targeting a specific risk/reward trade‐off achieved through a combination of fixed income securities and options contracts. Each Target Outcome Fund seeks to deliver a return corresponding to a market index or reference asset within specific risk constraints or accompanied by certain return enhancem ...

Poplar Forest Cornerstone Fund Summary Prospectus

... Equity securities in which the Fund may invest include, but are not limited to, common stocks, foreign equity securities, convertible securities, and options on stocks, warrants, rights, and/or other investment companies, including mutual funds and exchange-traded funds (“ETFs”). Equity securities w ...

... Equity securities in which the Fund may invest include, but are not limited to, common stocks, foreign equity securities, convertible securities, and options on stocks, warrants, rights, and/or other investment companies, including mutual funds and exchange-traded funds (“ETFs”). Equity securities w ...

Sample Investment Policy 2

... monitoring the investment management of the various fund assets on behalf of “Organization Name”. As such, the Finance Committee is authorized to delegate certain responsibilities to professional experts in various fields. These include, but are not limited to Investment Management Consultant, Inves ...

... monitoring the investment management of the various fund assets on behalf of “Organization Name”. As such, the Finance Committee is authorized to delegate certain responsibilities to professional experts in various fields. These include, but are not limited to Investment Management Consultant, Inves ...

FCA Consultation CP16/30: Transaction cost disclosure in

... being traded are often small and so are met out of funds’ cash-flows (investor inflows and outflows as well as rental income) rather than buying or selling assets. As a result, while transaction costs in equity and bond funds can be linked to specific sales and purchases of portfolio holdings, there ...

... being traded are often small and so are met out of funds’ cash-flows (investor inflows and outflows as well as rental income) rather than buying or selling assets. As a result, while transaction costs in equity and bond funds can be linked to specific sales and purchases of portfolio holdings, there ...

proposed post card text - University of North Carolina

... the ORP, you can look forward to a new, simplified selection of ORP investment funds from which to choose. They will continue to be offered by the four current ORP carriers, AIG VALIC, Fidelity Investments, Lincoln Financial Group and TIAA-CREF. This new selection of funds provides a broad array of ...

... the ORP, you can look forward to a new, simplified selection of ORP investment funds from which to choose. They will continue to be offered by the four current ORP carriers, AIG VALIC, Fidelity Investments, Lincoln Financial Group and TIAA-CREF. This new selection of funds provides a broad array of ...

Mutual Funds Investment

... Investment in order to lower the risk of investing. As the mutual funds allocate their funds into stocks of different companies and in different bonds, the risk is diversified. If at a time, market price of some particular stocks fall, the loss of the mutual fund may be offset by the rise in price o ...

... Investment in order to lower the risk of investing. As the mutual funds allocate their funds into stocks of different companies and in different bonds, the risk is diversified. If at a time, market price of some particular stocks fall, the loss of the mutual fund may be offset by the rise in price o ...

China opens up the securities investment fund

... Including (1) the Seventh China-U.S. Strategic and Economic Dialogue (2015.6.23) whereby the Chinese government committed to increase participation of foreign financial services firms and investors in the PRC capital markets through several detailed policies, (2) the Seventh China-UK Economic and Fi ...

... Including (1) the Seventh China-U.S. Strategic and Economic Dialogue (2015.6.23) whereby the Chinese government committed to increase participation of foreign financial services firms and investors in the PRC capital markets through several detailed policies, (2) the Seventh China-UK Economic and Fi ...

Mutual Funds

... Fee Structure of Investment Funds (2 of 2) • Other fees charges by mutual funds include: ─ contingent deferred sales charge: a back end fee that may disappear altogether after a specific period. ─ redemption fee: another name for a back end load ─ exchange fee: a fee (usually low) for transferring ...

... Fee Structure of Investment Funds (2 of 2) • Other fees charges by mutual funds include: ─ contingent deferred sales charge: a back end fee that may disappear altogether after a specific period. ─ redemption fee: another name for a back end load ─ exchange fee: a fee (usually low) for transferring ...

Wilson Kattelus

... Managing Investment Trust Funds and Pension Funds (Cont’d) A sound investment policy allows managers of the fund to maximize total return consistent with the defined level of risk tolerance. Types of risk to consider: ...

... Managing Investment Trust Funds and Pension Funds (Cont’d) A sound investment policy allows managers of the fund to maximize total return consistent with the defined level of risk tolerance. Types of risk to consider: ...

QUALIFIED PLAN STATEMENT OF INVESTMENT DIRECTION FOR DOLLAR COST AVERAGING Account Number: _________________________

... and amounts indicated by parenthesis $ (0.00) and buy the funds and amounts indicated without parenthesis $ 0.00. These monthly investments shall: (Choose one) Continue for the next _________ months at which time this direction will expire. Continue until another Investment Direction For Dollar Cost ...

... and amounts indicated by parenthesis $ (0.00) and buy the funds and amounts indicated without parenthesis $ 0.00. These monthly investments shall: (Choose one) Continue for the next _________ months at which time this direction will expire. Continue until another Investment Direction For Dollar Cost ...

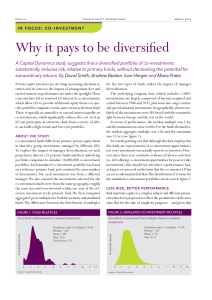

Why it pays to be diversified

... of portfolios returning less than the invested amount: 14.9% for the primary funds, and 11.3% for the simulated co-investment funds. In other words, the simulated co-investment funds exhibit less risk of not returning the full invested amount. Furthermore, the difference would be wider if fees were ...

... of portfolios returning less than the invested amount: 14.9% for the primary funds, and 11.3% for the simulated co-investment funds. In other words, the simulated co-investment funds exhibit less risk of not returning the full invested amount. Furthermore, the difference would be wider if fees were ...

understanding mutual fund pricing and marketing

... record keeping and related services to those funds. These fees may also be referred to as shareholder accounting fees, administrative services fees, sub-transfer agent fees or networking fees. The sub-transfer agent or networking fees are negotiated and payments are made based upon the number or agg ...

... record keeping and related services to those funds. These fees may also be referred to as shareholder accounting fees, administrative services fees, sub-transfer agent fees or networking fees. The sub-transfer agent or networking fees are negotiated and payments are made based upon the number or agg ...

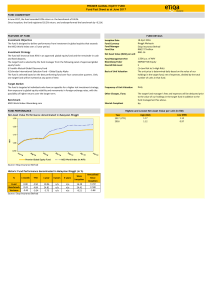

Etiqa Insurance Berhad Overall Risk Level Basis of Unit Valuation

... • At any time, we reserve the right to close any fund, or to transfer the investments to a new fund, subject to prior approval by the regulator. In such an event, we will provide 90 days prior written notification. RISK DISCLOSURE The policyholders should consider the following potential risks when ...

... • At any time, we reserve the right to close any fund, or to transfer the investments to a new fund, subject to prior approval by the regulator. In such an event, we will provide 90 days prior written notification. RISK DISCLOSURE The policyholders should consider the following potential risks when ...

Fidelity Value (FDVLX)

... changed during this time. It is likely the risk has been reduced due to a slight reallocation of holdings within the fund such as an increase in energy and a decrease in financials. This fund, like all others, is subject to a number of expenses. First, an expense ratio of 0.32% is required. This is ...

... changed during this time. It is likely the risk has been reduced due to a slight reallocation of holdings within the fund such as an increase in energy and a decrease in financials. This fund, like all others, is subject to a number of expenses. First, an expense ratio of 0.32% is required. This is ...

5 key facts to consider- Ideall Absolute Return Strategies Fund (7652)

... Most conventional investment funds only reward investors when markets go up. Absolute return funds seek to deliver positive absolute returns over the medium to long term whether markets are rising or falling. ...

... Most conventional investment funds only reward investors when markets go up. Absolute return funds seek to deliver positive absolute returns over the medium to long term whether markets are rising or falling. ...

Download attachment

... these questions raise issues, the successful addressing of which determine a fund manager's ability to penetrate the Islamic investment market. When fund sponsors are considering the creation and distribution of an Islamic fund, the first decision is whether to out-source the management of the portf ...

... these questions raise issues, the successful addressing of which determine a fund manager's ability to penetrate the Islamic investment market. When fund sponsors are considering the creation and distribution of an Islamic fund, the first decision is whether to out-source the management of the portf ...

semester v cm05bba05 – investment management

... d. None of the above 76. …………….. is an organized market for trading securities a. Stock exchange b. Primary market c. New issue market d. None of the above 77. Carry over the transactions /settlement of share purchase to the next day is called ………………. a. Badla b. Call c. Spot delivery d. Hand delive ...

... d. None of the above 76. …………….. is an organized market for trading securities a. Stock exchange b. Primary market c. New issue market d. None of the above 77. Carry over the transactions /settlement of share purchase to the next day is called ………………. a. Badla b. Call c. Spot delivery d. Hand delive ...

Is it Overreaction? The Long-Horizon Performance of Value and

... Focus on NASDAQ stocks above the 80th P/S percentile ...

... Focus on NASDAQ stocks above the 80th P/S percentile ...

Office of Government Ethics Guidance on Hedge Fund and Other

... interest in the fund in order to comply with the disclosure requirements. To receive a certification without divestiture, the filer must demonstrate to OGE that the information is inaccessible. OGE guidance states that typically “the filer will submit a letter to OGE from a representative of the poo ...

... interest in the fund in order to comply with the disclosure requirements. To receive a certification without divestiture, the filer must demonstrate to OGE that the information is inaccessible. OGE guidance states that typically “the filer will submit a letter to OGE from a representative of the poo ...

Taiwan 2015 - 2016.docx

... Due to the widened movement of the market and banks’ refusals to large deposits, large capital inflow from Institutional Investors into domestic money market funds gained a total of NTD198 billion in assets during this period. ...

... Due to the widened movement of the market and banks’ refusals to large deposits, large capital inflow from Institutional Investors into domestic money market funds gained a total of NTD198 billion in assets during this period. ...

BEPS Action 6 – Discussion Draft on non-CIV examples

... return as the regional investment platform for PAF through the acquisition of a diversified portfolio of private market investments located in countries in a regional grouping which includes States C and R. PAF and RCo are managed by a regulated Fund Manager located in State R. PAF is marketed to in ...

... return as the regional investment platform for PAF through the acquisition of a diversified portfolio of private market investments located in countries in a regional grouping which includes States C and R. PAF and RCo are managed by a regulated Fund Manager located in State R. PAF is marketed to in ...

Detailed request to act, or continue to act, as manager of a regulated

... (c) Asset management/investment adviser agreement or other document under which asset management/investment advice is carried out (including schedule of fees); and (d) Any other material agreements IV Draft offering document and application form V A copy of any prospectus VI New fund – A marketing p ...

... (c) Asset management/investment adviser agreement or other document under which asset management/investment advice is carried out (including schedule of fees); and (d) Any other material agreements IV Draft offering document and application form V A copy of any prospectus VI New fund – A marketing p ...