3.56 MB - Financial System Inquiry

... The mFunds platform provides investors with the ability to apply for and redeem units in managed funds through their stockbroker or adviser through electronic means without the need for paper based applications. Trades are effected through the ASX settlement system and in accordance with the ASX’s o ...

... The mFunds platform provides investors with the ability to apply for and redeem units in managed funds through their stockbroker or adviser through electronic means without the need for paper based applications. Trades are effected through the ASX settlement system and in accordance with the ASX’s o ...

PDF article file - Krungsri Asset Management

... making returns to be close to S&P 500 and Nikkei Index. No less than 90 per cent of these funds are hedged against foreign exchange risks (FX risks). KSAM believes that both US and Japanese markets contain upside at approximately 9%. Investors are advised to watch a right timing to invest for higher ...

... making returns to be close to S&P 500 and Nikkei Index. No less than 90 per cent of these funds are hedged against foreign exchange risks (FX risks). KSAM believes that both US and Japanese markets contain upside at approximately 9%. Investors are advised to watch a right timing to invest for higher ...

Заголовок слайда отсутствует

... In main all issuers looking for big institutional investors like banks and pension funds Two main reasons: 1) issue bonds to sell it pension funds 2) to have tax privilege of profit for buy and sell securities ...

... In main all issuers looking for big institutional investors like banks and pension funds Two main reasons: 1) issue bonds to sell it pension funds 2) to have tax privilege of profit for buy and sell securities ...

Comments on : “The Greek Pension System

... sponsors to be as competitive or low-cost as possible May protect beneficiaries against insolvency of operators and investment risks; ensures diversification Reduces need for an insurance fund Protects governments from need to bail out individuals from imprudent investments in DC products Compliance ...

... sponsors to be as competitive or low-cost as possible May protect beneficiaries against insolvency of operators and investment risks; ensures diversification Reduces need for an insurance fund Protects governments from need to bail out individuals from imprudent investments in DC products Compliance ...

1 - The North West Fund

... It is anticipated that between 50-100 investments are likely to be made over the next 12 month period, however this figure is for information only and the NWBF cannot guarantee this or any business. It should be noted that the Framework is being available for the fund managers to use, it is not mand ...

... It is anticipated that between 50-100 investments are likely to be made over the next 12 month period, however this figure is for information only and the NWBF cannot guarantee this or any business. It should be noted that the Framework is being available for the fund managers to use, it is not mand ...

Goldman Sachs India Equity Portfolio

... Source: Morningstar ©2017 Morningstar, Inc. All Rights Reserved. (2) The ongoing charges figure is based on expenses during the previous year. See details in the Key Investor Information Document. (3) Fund returns are shown net of applicable ongoing fees within the portfolio, with dividends re-inve ...

... Source: Morningstar ©2017 Morningstar, Inc. All Rights Reserved. (2) The ongoing charges figure is based on expenses during the previous year. See details in the Key Investor Information Document. (3) Fund returns are shown net of applicable ongoing fees within the portfolio, with dividends re-inve ...

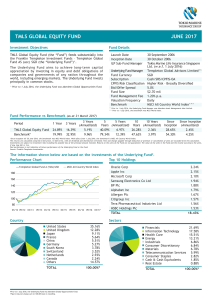

tmls global equity fund june 2017

... Past performance is not indicative of future performance. Investments are subject to investment risks including the possible loss of the principal amount invested. Returns on the units of the Fund are not guaranteed. The value of the units in the Fund and the income accruing to the units, if any, ma ...

... Past performance is not indicative of future performance. Investments are subject to investment risks including the possible loss of the principal amount invested. Returns on the units of the Fund are not guaranteed. The value of the units in the Fund and the income accruing to the units, if any, ma ...

title - ARK Financial Services

... The academic world has provided investors with a road map to a prudent investment strategy based on passive investing. Building a globally diversified portfolio of passive asset class funds is most likely to allow all levels of investors to achieve their financial goals with the least amount of risk ...

... The academic world has provided investors with a road map to a prudent investment strategy based on passive investing. Building a globally diversified portfolio of passive asset class funds is most likely to allow all levels of investors to achieve their financial goals with the least amount of risk ...

US monetary policy normalisation tool box stocked

... This research has been prepared by Danske Bank Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any re ...

... This research has been prepared by Danske Bank Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any re ...

Market Turmoil and Destabilizing Speculation Supplementary Material

... evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short-term ‡uctuations. This suggests that the incentives to capture capital gains are greater if the fund’s ...

... evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short-term ‡uctuations. This suggests that the incentives to capture capital gains are greater if the fund’s ...

PDF - BAM Advisor Services

... The academic world has provided investors with a road map to a prudent investment strategy based on passive investing. Building a globally diversified portfolio of passive asset class funds is most likely to allow all levels of investors to achieve their financial goals with the least amount of risk ...

... The academic world has provided investors with a road map to a prudent investment strategy based on passive investing. Building a globally diversified portfolio of passive asset class funds is most likely to allow all levels of investors to achieve their financial goals with the least amount of risk ...

VIT Multi-Strategy Alternatives Portfolio

... Equity securities are more volatile than bonds and subject to greater risks. Bonds are subject to interest rate, price and credit risks. Prices tend to be inversely affected by changes in interest rates. Investors should also consider some of the potential risks of alternative investments: Alternati ...

... Equity securities are more volatile than bonds and subject to greater risks. Bonds are subject to interest rate, price and credit risks. Prices tend to be inversely affected by changes in interest rates. Investors should also consider some of the potential risks of alternative investments: Alternati ...

how hedge funds are structured

... Fee structures at hedge funds differ from other types of investment vehicles. Hedge funds typically charge investors a management fee, usually a percentage of the assets managed. Most hedge funds also charge a performance fee of anywhere between 10-20 percent of fund profits. Managers only collect t ...

... Fee structures at hedge funds differ from other types of investment vehicles. Hedge funds typically charge investors a management fee, usually a percentage of the assets managed. Most hedge funds also charge a performance fee of anywhere between 10-20 percent of fund profits. Managers only collect t ...

Repurchase Agreements – Benefits, Risks and Controls

... If a counterparty defaults, a loss may be realized on the sale of the underlying security to the extent that the proceeds from the sale and accrued interest of the security are less than the resale price, including interest, provided in the repurchase agreement. Moreover, should a counterparty decla ...

... If a counterparty defaults, a loss may be realized on the sale of the underlying security to the extent that the proceeds from the sale and accrued interest of the security are less than the resale price, including interest, provided in the repurchase agreement. Moreover, should a counterparty decla ...

ch.11

... the market value of a mutual fund share found by dividing the net value of the fund by the number of shares issued ...

... the market value of a mutual fund share found by dividing the net value of the fund by the number of shares issued ...

FRONT STREET TACTICAL BOND FUND Interim Management

... In December of 2015, the U.S. Federal Reserve raised interest rates 25 basis points, with an outlook of three to four more hikes in 2016. As the new year began, market sentiment deteriorated on concerns that China’s economy was slowing faster than anticipated, and amid rumours of large portfolio rea ...

... In December of 2015, the U.S. Federal Reserve raised interest rates 25 basis points, with an outlook of three to four more hikes in 2016. As the new year began, market sentiment deteriorated on concerns that China’s economy was slowing faster than anticipated, and amid rumours of large portfolio rea ...

Financial Report 2005

... Record breaking oil prices continued to drive the underlying economic fundamentals keeping markets buoyant. The Sultanate has announced that the official price for Omani Crude for March’05 was at US$ 47.5 per barrel the highest since the Sultanate started the production of crude. The first quarter o ...

... Record breaking oil prices continued to drive the underlying economic fundamentals keeping markets buoyant. The Sultanate has announced that the official price for Omani Crude for March’05 was at US$ 47.5 per barrel the highest since the Sultanate started the production of crude. The first quarter o ...

Global Unconstrained Bond a sub-fund of Schroder

... The fund will be invested in bonds and related instruments issued by governments, government agencies and companies worldwide in various currencies. The bonds may include asset-backed securities and mortgage-backed securities. ...

... The fund will be invested in bonds and related instruments issued by governments, government agencies and companies worldwide in various currencies. The bonds may include asset-backed securities and mortgage-backed securities. ...

11amoneyAPUnit4Macro

... STORE OF VALUE This is something people keep in order to maintain the value of their wealth. While it would usually be the same as medium of exchange, in inflationary times other media might be substituted, such as jewelry, land or collectable goods. In this sense, money is “set aside” for the futu ...

... STORE OF VALUE This is something people keep in order to maintain the value of their wealth. While it would usually be the same as medium of exchange, in inflationary times other media might be substituted, such as jewelry, land or collectable goods. In this sense, money is “set aside” for the futu ...

MANSFIELD TOWNSHIP BURLINGTON COUNTY RESOLUTION

... Affairs, which rules shall provide for disclosure and reporting requirements, and other provisions deemed necessary by the board to provide for the safety, liquidity and yield of the investments; ...

... Affairs, which rules shall provide for disclosure and reporting requirements, and other provisions deemed necessary by the board to provide for the safety, liquidity and yield of the investments; ...

Islamic Mutual Funds` Financial Performance and Investment Style

... – prevents a pure profit focus but might be good long term risk management – restricts market risk timing abilities, which, on average, do not generate value (e.g. Bollen & Busse, 2001) ...

... – prevents a pure profit focus but might be good long term risk management – restricts market risk timing abilities, which, on average, do not generate value (e.g. Bollen & Busse, 2001) ...

Market Penetration and Investment Pattern: A Study

... Firms engaged in production of goods and services are concerned about the strategic management of its marketing. For, they may be able to attract additional buyers and bigger market share. In this pursuit, they endeavor to look at the potential of their products in the existing and new markets. Thes ...

... Firms engaged in production of goods and services are concerned about the strategic management of its marketing. For, they may be able to attract additional buyers and bigger market share. In this pursuit, they endeavor to look at the potential of their products in the existing and new markets. Thes ...

The Global Financial Crisis

... corporations who control a pool of hot money worth over US$13 trillion. I call the managers of these banks, mutual funds, hedge funds, stock brokerages and insurance funds the money traders. Business Week describes how this new class of investment fund managers rules over international financial mar ...

... corporations who control a pool of hot money worth over US$13 trillion. I call the managers of these banks, mutual funds, hedge funds, stock brokerages and insurance funds the money traders. Business Week describes how this new class of investment fund managers rules over international financial mar ...

Diversification – Too Much of a Good Thing is a Bad Thing

... be invested in such a way that there is exposure to differing geographies, varying asset classes (stocks, bonds, cash, real estate), company size and company sector. Interestingly, there can actually be too much diversification. We have seen this in several portfolios recently received from new clie ...

... be invested in such a way that there is exposure to differing geographies, varying asset classes (stocks, bonds, cash, real estate), company size and company sector. Interestingly, there can actually be too much diversification. We have seen this in several portfolios recently received from new clie ...

Employing Finders and Solicitors

... effects securities transactions through U.S. jurisdictional means to register with the SEC as a brokerdealer, unless, in the case of an individual, such person is an associated person of a registered brokerdealer. In very limited circumstances, finders who are not registered broker-dealers may be us ...

... effects securities transactions through U.S. jurisdictional means to register with the SEC as a brokerdealer, unless, in the case of an individual, such person is an associated person of a registered brokerdealer. In very limited circumstances, finders who are not registered broker-dealers may be us ...