Fund Categories and Basis of Accounting

... It is used to account for the general operations of government and for any activity not accounted for in another fund. Assets in general funds include cash, investment, receivable (unpaid property tax), and receivable from other funds. (Due from other funds). If receivable are not currently due, the ...

... It is used to account for the general operations of government and for any activity not accounted for in another fund. Assets in general funds include cash, investment, receivable (unpaid property tax), and receivable from other funds. (Due from other funds). If receivable are not currently due, the ...

TD Emerging Markets Low Volatility Fund

... believed to be reliable. Where such statements are based in whole or in part on information provided by third parties, they are not guaranteed to be accurate or complete. The Product Overview document does not provide individual financial, legal, tax or investment advice and is for information purpo ...

... believed to be reliable. Where such statements are based in whole or in part on information provided by third parties, they are not guaranteed to be accurate or complete. The Product Overview document does not provide individual financial, legal, tax or investment advice and is for information purpo ...

6020 - Mansfield School District

... The General Fund (GF) is financed primarily from local taxes, state support funds, federal grants, and local receipts. These revenues are used specifically for financing the ordinary and legally authorized operations of the district for all grades. The GF includes moneys which has been segregated fo ...

... The General Fund (GF) is financed primarily from local taxes, state support funds, federal grants, and local receipts. These revenues are used specifically for financing the ordinary and legally authorized operations of the district for all grades. The GF includes moneys which has been segregated fo ...

(acc) USD - Fund Fact Sheet - Franklin Templeton Investments

... 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The value of investments and the income from them can ...

... 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The value of investments and the income from them can ...

What does teR mean and What is it foR?

... Investors have a good understanding as to the cost structure of their investments. TER specifically discloses performance fees. Investors are able to compare differently structured investment solutions, e.g. costs related to investing in funds of funds versus investing in single or multi-manag ...

... Investors have a good understanding as to the cost structure of their investments. TER specifically discloses performance fees. Investors are able to compare differently structured investment solutions, e.g. costs related to investing in funds of funds versus investing in single or multi-manag ...

Key Investor Information AMP Capital Global Listed Infrastructure

... from the Fund Prospectus and latest annual and halfyear reports. These documents are available free of charge in English, and can be found along with other information such as share prices on the AMP Capital website at www.ampcapital.com by selecting your country. Alternatively these can be obtained ...

... from the Fund Prospectus and latest annual and halfyear reports. These documents are available free of charge in English, and can be found along with other information such as share prices on the AMP Capital website at www.ampcapital.com by selecting your country. Alternatively these can be obtained ...

Mutual Funds Sharekhan`s Top Equity Fund Picks

... With a long history of more than 11years, the MF scheme has been an outperformer compared to both, the benchmark Nifty 50 index and the Large Cap category average. Despite the volatility and uncertainties in the market, the MF scheme has performed better than its peers, giving a return of 20% over t ...

... With a long history of more than 11years, the MF scheme has been an outperformer compared to both, the benchmark Nifty 50 index and the Large Cap category average. Despite the volatility and uncertainties in the market, the MF scheme has performed better than its peers, giving a return of 20% over t ...

TIPS ETF Driven Higher By Inflation Worries

... The Federal Reserve is pumping more money into the financial system with rate cuts and by taking agencybacked securities. As long as the system is in gridlock, TIPS will likely stay high. "The Fed has to do a lot of easing to catch up to the market, and these products are going to benefit," Spa ...

... The Federal Reserve is pumping more money into the financial system with rate cuts and by taking agencybacked securities. As long as the system is in gridlock, TIPS will likely stay high. "The Fed has to do a lot of easing to catch up to the market, and these products are going to benefit," Spa ...

Busting the myth that value has underperformed since the financial

... environment. This benchmark is a broad-based index which is used for comparative/illustrative purposes only and has been selected as it is well known and easily recognizable by investors. Please refer to http://www.ftse.com/products/indices/uk for further information on this index. Comparisons to be ...

... environment. This benchmark is a broad-based index which is used for comparative/illustrative purposes only and has been selected as it is well known and easily recognizable by investors. Please refer to http://www.ftse.com/products/indices/uk for further information on this index. Comparisons to be ...

The Case for Funds of Hedge Funds

... Having explored the issues around the build or buy decision investors should also consider taking advantage of strategy-specific managers. Geographically, the case for funds of funds is both appealing and strong, where a detailed understanding of local markets is crucial to extracting better returns ...

... Having explored the issues around the build or buy decision investors should also consider taking advantage of strategy-specific managers. Geographically, the case for funds of funds is both appealing and strong, where a detailed understanding of local markets is crucial to extracting better returns ...

Franklin High Yield Tax-Free Income Fund Fact Sheet

... Information is historical and may not reflect current or future portfolio characteristics. All portfolio holdings are subject to change. Dividends are general subject to state and local taxes, if any. For investors subject to the alternative minimum tax, a small portion of fund dividends may be taxa ...

... Information is historical and may not reflect current or future portfolio characteristics. All portfolio holdings are subject to change. Dividends are general subject to state and local taxes, if any. For investors subject to the alternative minimum tax, a small portion of fund dividends may be taxa ...

CF Canlife Portfolio Funds

... CF Canlife Portfolio VII Fund invests predominantly in equities (85%), with a substantial proportion of this invested overseas (50%). The remainder is allocated to UK corporate bonds, global high yield bonds and UK commercial property. This is primarily achieved through investment in funds managed b ...

... CF Canlife Portfolio VII Fund invests predominantly in equities (85%), with a substantial proportion of this invested overseas (50%). The remainder is allocated to UK corporate bonds, global high yield bonds and UK commercial property. This is primarily achieved through investment in funds managed b ...

- CAIA Association

... an incompetent manager). Further, you have every reason to believe that the asset will continue to lose money going forward. You wonder how good it would be if you could short this mutual fund. You could not only make some money but also help bring some discipline to the market, removing incompetent ...

... an incompetent manager). Further, you have every reason to believe that the asset will continue to lose money going forward. You wonder how good it would be if you could short this mutual fund. You could not only make some money but also help bring some discipline to the market, removing incompetent ...

May 2016 Factsheet Monthly

... Equity risk: Equity prices fluctuate daily, based on many factors including general, economic, industry or company news. High yield bond risk: High yield bonds (normally lower rated or unrated) generally carry greater market, credit and liquidity risk. Interest rate risk: A rise in interest rates ge ...

... Equity risk: Equity prices fluctuate daily, based on many factors including general, economic, industry or company news. High yield bond risk: High yield bonds (normally lower rated or unrated) generally carry greater market, credit and liquidity risk. Interest rate risk: A rise in interest rates ge ...

Gravitational waves

... could reach USD2.2tn in the next five years. This is one way that technology is being used to adapt to the changing investment habits of investors. If one assumes that technology giants such as Google and Apple have long been at the vanguard of interacting with end users, should they eventually move ...

... could reach USD2.2tn in the next five years. This is one way that technology is being used to adapt to the changing investment habits of investors. If one assumes that technology giants such as Google and Apple have long been at the vanguard of interacting with end users, should they eventually move ...

Pioneer Funds – US Dollar Short-Term I USD

... The Sub-Fund may not be registered for sale with the relevant authorities in your jurisdiction. Where unregistered, the Sub-Fund may not be sold or offered except in the circumstances permitted by law. The Fund may not be regulated or supervised by any governmental or similar authority in your juris ...

... The Sub-Fund may not be registered for sale with the relevant authorities in your jurisdiction. Where unregistered, the Sub-Fund may not be sold or offered except in the circumstances permitted by law. The Fund may not be regulated or supervised by any governmental or similar authority in your juris ...

Emerging Markets Fund

... used (ie Global Industry Classification Standard or Industry Classification Benchmark) varies by fund. Top Positions: those companies in which the largest percentages of the fund’s total net assets are effectively invested. Positions in other funds - including ETFs (Exchange Traded Funds) - can appe ...

... used (ie Global Industry Classification Standard or Industry Classification Benchmark) varies by fund. Top Positions: those companies in which the largest percentages of the fund’s total net assets are effectively invested. Positions in other funds - including ETFs (Exchange Traded Funds) - can appe ...

1 The primary investment objective of Fund B is to maximize the

... Entities with the objective of maximizing the present value of distributions to the Segregated Securities from Collateral Securities. The Collateral Manager has been contractually charged with the responsibility to develop and implement a prudent "work out" or liquidation strategy consistent with th ...

... Entities with the objective of maximizing the present value of distributions to the Segregated Securities from Collateral Securities. The Collateral Manager has been contractually charged with the responsibility to develop and implement a prudent "work out" or liquidation strategy consistent with th ...

Statement of Investment Objectives, Policies and Guidelines For The

... the principal to protect against unforeseen expenses. The benefit needs to accrue for the long term and keep up with inflation. Thus, the growth of principal must be measured relative to the Consumer Price Index (CPI). The Reserve Fund’s total real return over a five year period should equal or exce ...

... the principal to protect against unforeseen expenses. The benefit needs to accrue for the long term and keep up with inflation. Thus, the growth of principal must be measured relative to the Consumer Price Index (CPI). The Reserve Fund’s total real return over a five year period should equal or exce ...

Mutual Fund

... capital for the beneficiary. The objective of the scheme is to generate regular returns and/or capital appreciation / accretion with the aim of giving lump sum capital growth at the end of the chosen target period or otherwise to the Beneficiary. Principal Global Opportunities Fund It is an open-end ...

... capital for the beneficiary. The objective of the scheme is to generate regular returns and/or capital appreciation / accretion with the aim of giving lump sum capital growth at the end of the chosen target period or otherwise to the Beneficiary. Principal Global Opportunities Fund It is an open-end ...

Collector Car Funds: Is this the Next Market Development?

... The IGA Automotive Fund will be a long-term investment, and investors will be unable to sell or encash their investment until the fund has sold its cars, and has “cashed out.” For this reason alone, this fund is for very wealthy individuals and institutions who would not go hungry if (in the worst c ...

... The IGA Automotive Fund will be a long-term investment, and investors will be unable to sell or encash their investment until the fund has sold its cars, and has “cashed out.” For this reason alone, this fund is for very wealthy individuals and institutions who would not go hungry if (in the worst c ...

Word document - Benefits and Pensions Monitor

... activity, the potential universe of companies worthy of investment remains largely untapped. There are more than 100,000 private companies in the United States versus only roughly 10,000 to 12,000 public companies and the universe of attractive private equity targets expands even further when genera ...

... activity, the potential universe of companies worthy of investment remains largely untapped. There are more than 100,000 private companies in the United States versus only roughly 10,000 to 12,000 public companies and the universe of attractive private equity targets expands even further when genera ...

22 July 2016 Dear Sir/Madam Change in management fee

... assess the viability of the Fund. The review identified that the Fund can no longer be managed in a cost efficient manner due to very low assets under management and changing investor appetites. The flow of assets under management has been out of the strategy for an extended period of time and has f ...

... assess the viability of the Fund. The review identified that the Fund can no longer be managed in a cost efficient manner due to very low assets under management and changing investor appetites. The flow of assets under management has been out of the strategy for an extended period of time and has f ...

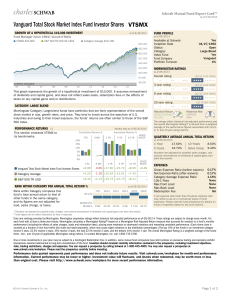

Vanguard Total Stock Market Index Fund Investor Shares

... International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Government bond fund shares are not guaranteed. Their price and investment return will fluctuate with market conditions and interest rates. Investment income f ...

... International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc. Government bond fund shares are not guaranteed. Their price and investment return will fluctuate with market conditions and interest rates. Investment income f ...

Lawrence G. McDonald

... There is a study by the Financial Stability Oversight Council, due within 6 months of enactment that will make recommendations for implementing enhanced safety and soundness, as well as how to minimize risky activity. ...

... There is a study by the Financial Stability Oversight Council, due within 6 months of enactment that will make recommendations for implementing enhanced safety and soundness, as well as how to minimize risky activity. ...