Franklin U.S. Dollar Liquid Reserve Fund - A (acc) USD

... This document is intended to be of general interest only and does not constitute legal or tax advice nor is it an offer for shares or invitation to apply for shares of the Franklin Templeton Investment Funds SICAV (the Fund). Nothing in this document should be construed as investment advice. Given t ...

... This document is intended to be of general interest only and does not constitute legal or tax advice nor is it an offer for shares or invitation to apply for shares of the Franklin Templeton Investment Funds SICAV (the Fund). Nothing in this document should be construed as investment advice. Given t ...

MF score-card in Q2: HDFC, SBI Mutual see

... selection and a streak of aggression in investment strategy. Only five of the top 50 gainers among stocks figured in the portfolios of mutual funds. Funds from HDFC Mutual and SBI Mutual notched up yet another good quarter. The former has an impressive presence in the diversified funds space; the la ...

... selection and a streak of aggression in investment strategy. Only five of the top 50 gainers among stocks figured in the portfolios of mutual funds. Funds from HDFC Mutual and SBI Mutual notched up yet another good quarter. The former has an impressive presence in the diversified funds space; the la ...

pax small cap fund

... Small Cap Core Funds Average is a total return performance average of the mutual funds tracked by Lipper, Inc. that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a threeyear weighted basis) below Lipper’s USDE small-cap ceiling. Small ...

... Small Cap Core Funds Average is a total return performance average of the mutual funds tracked by Lipper, Inc. that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a threeyear weighted basis) below Lipper’s USDE small-cap ceiling. Small ...

The case for low-cost index-fund investing for Asian investors

... appealing to investors who may have tired of the vagaries of active approaches. Diversification. Index funds and ETFs typically are more diversified than actively managed funds, a by-product of the way indices are constructed. Except for index funds that track narrow market segments, most index fund ...

... appealing to investors who may have tired of the vagaries of active approaches. Diversification. Index funds and ETFs typically are more diversified than actively managed funds, a by-product of the way indices are constructed. Except for index funds that track narrow market segments, most index fund ...

INTRODUCTION TO BANKING SOLUTI ONS MAY 2012.do c

... b. Divisibility – money ought to be used for any size of transaction. When animals and other forms of commodities were used, divisibility was a great challenge c. Homogeneity – one piece of money must be exactly the same in quality and value. It was not possible to maintain same quality of money wit ...

... b. Divisibility – money ought to be used for any size of transaction. When animals and other forms of commodities were used, divisibility was a great challenge c. Homogeneity – one piece of money must be exactly the same in quality and value. It was not possible to maintain same quality of money wit ...

tax loss selling strategies for closed-end fund investors

... BlackRock does not provide tax advice, and investors should consult their professional advisors before making any tax or investment decision. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quot ...

... BlackRock does not provide tax advice, and investors should consult their professional advisors before making any tax or investment decision. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quot ...

EF projekt2_Layout 1 - Enterprise Funds Association

... of mortgage loans. Every dollar invested by the Funds in the region has attracted an extra 2 dollars from other investors. Indeed the assets of Funds operating in CE Europe had by 2009 seen a doubling of their initial capital. In all, the Funds increased their initial capital by 44%. (see attached t ...

... of mortgage loans. Every dollar invested by the Funds in the region has attracted an extra 2 dollars from other investors. Indeed the assets of Funds operating in CE Europe had by 2009 seen a doubling of their initial capital. In all, the Funds increased their initial capital by 44%. (see attached t ...

Fixed maturity, attractive dividends: ESPA

... Document and details of any other collection offices are published on the website of the respective issuer namely www.sparinvest.com. This document serves to provide additional information to our investors and reflects the knowledge of its authors at the time of going to press. Our analyses and conc ...

... Document and details of any other collection offices are published on the website of the respective issuer namely www.sparinvest.com. This document serves to provide additional information to our investors and reflects the knowledge of its authors at the time of going to press. Our analyses and conc ...

MANULIFE HIGH YIELD BOND FUND

... Manulife Funds are managed by Manulife Investments, a division of Manulife Asset Management Limited. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund facts as well as the prospectus before investing. The indicate ...

... Manulife Funds are managed by Manulife Investments, a division of Manulife Asset Management Limited. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund facts as well as the prospectus before investing. The indicate ...

North Carolina Fixed Income Fund

... Prudential Core Plus Bond Fund seeks an excess return over the Bloomberg Barclays U.S. Aggregate Bond Index. The strategy aims to generate excess return from top-down sector allocation and bottom-up subsector/security selection. Duration and yield curve are tactically managed. The strategy actively ...

... Prudential Core Plus Bond Fund seeks an excess return over the Bloomberg Barclays U.S. Aggregate Bond Index. The strategy aims to generate excess return from top-down sector allocation and bottom-up subsector/security selection. Duration and yield curve are tactically managed. The strategy actively ...

Canadian Responsible Investment Mutual Funds Risk / Return

... 2014, RI assets stood at more than $1 trillion, a remarkable 68% increase in two years. The RIA report also showed that growth in Responsible Investment mutual fund assets outpaced non-RI mutual funds — 52% vs. ...

... 2014, RI assets stood at more than $1 trillion, a remarkable 68% increase in two years. The RIA report also showed that growth in Responsible Investment mutual fund assets outpaced non-RI mutual funds — 52% vs. ...

CIT Investment Discl..

... invests in equities, the principal risk is stock market risk, that is, the risk that the price of the stocks in which the Fund invests may fluctuate or fall in response to economic events or trends. The prices of bonds in which a Fund may invest may fall because of a rise in interest rates. Investme ...

... invests in equities, the principal risk is stock market risk, that is, the risk that the price of the stocks in which the Fund invests may fluctuate or fall in response to economic events or trends. The prices of bonds in which a Fund may invest may fall because of a rise in interest rates. Investme ...

BAE Systems Pension Scheme Additional Voluntary Contributions

... *The Standard Life Money Market The Standard Life Money Market Fund (formerly called the Standard Life Sterling Fund) and With Profits Funds are not available to new contributors. They remain available only to members who were paying regular contributions prior to 1 February 2011. ...

... *The Standard Life Money Market The Standard Life Money Market Fund (formerly called the Standard Life Sterling Fund) and With Profits Funds are not available to new contributors. They remain available only to members who were paying regular contributions prior to 1 February 2011. ...

J.P. Morgan to Pay $267 Million for Disclosure Failures

... LLC (JPMS) and nationally chartered bank JPMorgan Chase Bank N.A. (JPMCB) preferred to invest clients in the firm’s own proprietary investment products without properly disclosing this preference. This preference impacted two fundamental aspects of money management – asset allocation and the selecti ...

... LLC (JPMS) and nationally chartered bank JPMorgan Chase Bank N.A. (JPMCB) preferred to invest clients in the firm’s own proprietary investment products without properly disclosing this preference. This preference impacted two fundamental aspects of money management – asset allocation and the selecti ...

ASB Investment Funds World Fixed Interest Fund Update

... much the value of the fund’s assets goes up and down. A higher risk generally means higher potential returns over time, but more ups and downs along the way. To help you clarify your own attitude to risk, you can seek financial advice or work out your risk profile at http://www.sorted.org.nz/tools/i ...

... much the value of the fund’s assets goes up and down. A higher risk generally means higher potential returns over time, but more ups and downs along the way. To help you clarify your own attitude to risk, you can seek financial advice or work out your risk profile at http://www.sorted.org.nz/tools/i ...

Basics with Equity Market Neutral

... BACK TO BASICS WITH EQUTIY MARKET NEUTRAL Cont. strategies. Evaluating the Hedge Fund Research index returns for 28 different strategies from January 2005 to April 2009 showed that equity market neutral had the second lowest correlation with any of the other strategies, behind only Short Bias funds ...

... BACK TO BASICS WITH EQUTIY MARKET NEUTRAL Cont. strategies. Evaluating the Hedge Fund Research index returns for 28 different strategies from January 2005 to April 2009 showed that equity market neutral had the second lowest correlation with any of the other strategies, behind only Short Bias funds ...

II. How to Read a Mutual Fund Prospectus

... A fund's investment objective will usually seek capital gains (gains from the sale of securities), income (interest and dividends earned on the securities) or a combination of both. Money Market: A money market fund seeks safety of principal by investing in high quality, short-term securities. This ...

... A fund's investment objective will usually seek capital gains (gains from the sale of securities), income (interest and dividends earned on the securities) or a combination of both. Money Market: A money market fund seeks safety of principal by investing in high quality, short-term securities. This ...

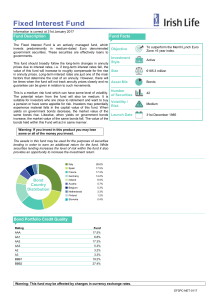

Fixed Interest Fund - Irish Life Corporate Business

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

Monthly Investment Commentary

... which, tracks hedge-fund-like mutual funds that deliver more than one strategy in a single fund. The category includes a number of multimanager funds as well as some single-manager funds that cover multiple strategies. As of the end of September 2011, there were about 76 funds in the category. Howev ...

... which, tracks hedge-fund-like mutual funds that deliver more than one strategy in a single fund. The category includes a number of multimanager funds as well as some single-manager funds that cover multiple strategies. As of the end of September 2011, there were about 76 funds in the category. Howev ...

guest slides - WordPress.com

... Growing, large, definable market Awareness of the competitive landscape Rapid growth and ability to scale Clear strategy to execute the route to market Capitalisation plan (how much money required?) ...

... Growing, large, definable market Awareness of the competitive landscape Rapid growth and ability to scale Clear strategy to execute the route to market Capitalisation plan (how much money required?) ...

5vcforum - Attica Ventures

... In March 2004 the ZAITECH fund, a venture capital fund, was set up under the management of Attica Ventures. Its shareholders/investors are Bank of Attica and the New Economy Development Fund (TANEO). To date it has not been possible for TSMEDE to carry out its investment decision due to the reasons ...

... In March 2004 the ZAITECH fund, a venture capital fund, was set up under the management of Attica Ventures. Its shareholders/investors are Bank of Attica and the New Economy Development Fund (TANEO). To date it has not been possible for TSMEDE to carry out its investment decision due to the reasons ...

Five-Year Ranking: Pimco Leads 10

... message that bond powerhouse Pimco has long preached. The firm credits its macrodriven approach with helping it find opportunities throughout a tumultuous year—and powering its move to the second-place slot from 62nd place in 2015. “Looking back at 2016, the strategies that did the best were ones th ...

... message that bond powerhouse Pimco has long preached. The firm credits its macrodriven approach with helping it find opportunities throughout a tumultuous year—and powering its move to the second-place slot from 62nd place in 2015. “Looking back at 2016, the strategies that did the best were ones th ...

Al Beit Al Mali Fund Al-Beit Al Mali Fund

... Looking at individual stocks, we find those with index weight decreases lost the most, while those with increases had near flat performance. ...

... Looking at individual stocks, we find those with index weight decreases lost the most, while those with increases had near flat performance. ...