Templeton Developing Markets Trust Fact Sheet

... All MSCI data is provided “as is.” The Fund described herein is not sponsored or endorsed by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the Fund described herein. Copying or redistributing the MSCI data is ...

... All MSCI data is provided “as is.” The Fund described herein is not sponsored or endorsed by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the Fund described herein. Copying or redistributing the MSCI data is ...

May 15, 2017 Basel Committee on Banking Supervision Bank for

... The Second Consultation likewise lacks clarity as to the appropriate treatment of regulated stock and bond funds in a framework designed to identify entities whose weakness or failure could prompt a bank sponsor to step in. On the one hand, the Committee correctly recognizes variable NAV funds as “c ...

... The Second Consultation likewise lacks clarity as to the appropriate treatment of regulated stock and bond funds in a framework designed to identify entities whose weakness or failure could prompt a bank sponsor to step in. On the one hand, the Committee correctly recognizes variable NAV funds as “c ...

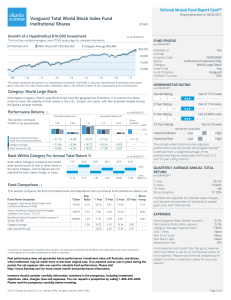

Vanguard Total World Stock Index Fund Institutional Shares

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

MANULIFE CANADIAN MONTHLY INCOME FUND

... Manulife Funds are managed by Manulife Investments, a division of Manulife Asset Management Limited. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund facts as well as the prospectus before investing. The indicate ...

... Manulife Funds are managed by Manulife Investments, a division of Manulife Asset Management Limited. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund facts as well as the prospectus before investing. The indicate ...

Franklin Quotential Growth Portfolio Series A

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and rei ...

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and rei ...

ZI Barings Developed and Emerging Markets High Yield Bond

... Source: FE, figures to 30/06/2017, bid to bid gross in USD. Percentage growth figures are for discrete years, for example Jun 12-Jun 13 equals 30/06/2012 to 30/06/2013. Quartile and rank are based on the FE sector category as highlighted on page 1. Past performance is not a guide to future performan ...

... Source: FE, figures to 30/06/2017, bid to bid gross in USD. Percentage growth figures are for discrete years, for example Jun 12-Jun 13 equals 30/06/2012 to 30/06/2013. Quartile and rank are based on the FE sector category as highlighted on page 1. Past performance is not a guide to future performan ...

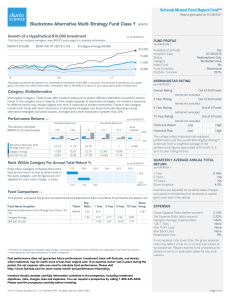

Blackstone Alternative Multi-Strategy Fund Class Y BXMYX

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

CUBIC 2016 Class 6 Personal Finance Day 4

... Peter Lynch, Fidelity Investments “When the dumb investor realizes how dumb he is and buys a low cost index fund, he becomes smarter than the smartest investors.” ...

... Peter Lynch, Fidelity Investments “When the dumb investor realizes how dumb he is and buys a low cost index fund, he becomes smarter than the smartest investors.” ...

Prezentácia

... with a non-stop access to their individual retirement accounts and disclosure requirements, they see the performance of their DSS and/or pension fund may „vote“ and change their pension fund, even leave their DSS and switch to a rival company ...

... with a non-stop access to their individual retirement accounts and disclosure requirements, they see the performance of their DSS and/or pension fund may „vote“ and change their pension fund, even leave their DSS and switch to a rival company ...

Invesco High Yield Municipal Fund fact sheet

... interest rate, credit, leverage, counterparty and management risks. An investment in a derivative could lose more than the cash amount invested. Junk bonds have greater risk of default or price changes due to changes in the issuer’s credit quality. Junk bond values fluctuate more than high quality b ...

... interest rate, credit, leverage, counterparty and management risks. An investment in a derivative could lose more than the cash amount invested. Junk bonds have greater risk of default or price changes due to changes in the issuer’s credit quality. Junk bond values fluctuate more than high quality b ...

Passive Global Equity (inc. UK) Fund

... Source: Financial Express as at 01/04/2017. You shouldn’t use past performance as a suggestion of future performance. It shouldn’t be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise and will be reduced in real term ...

... Source: Financial Express as at 01/04/2017. You shouldn’t use past performance as a suggestion of future performance. It shouldn’t be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise and will be reduced in real term ...

money - West Ada

... At any given time, people demand a certain amount of liquid assets (money) for two different reasons: 1. Transaction Demand for Money- People hold money for everyday transactions. 2. Asset Demand for Money - People hold money since it is less risky than other assets ...

... At any given time, people demand a certain amount of liquid assets (money) for two different reasons: 1. Transaction Demand for Money- People hold money for everyday transactions. 2. Asset Demand for Money - People hold money since it is less risky than other assets ...

SEC Hits Van Wagoner and Fund Director Over Private Placements

... securities," and between June 1998 and June 2000, Colman invested in nine private placements of convertible, preferred securities offered by five private companies. The Funds also invested in the same securities offered by the same companies in the same rounds of private financing. Although Colman ...

... securities," and between June 1998 and June 2000, Colman invested in nine private placements of convertible, preferred securities offered by five private companies. The Funds also invested in the same securities offered by the same companies in the same rounds of private financing. Although Colman ...

Title – Times New Roman 28pt, Line spacing 28pt Title 2 – Times

... the foregoing’s affiliates (collectively the “Deloitte Network”) are, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should i ...

... the foregoing’s affiliates (collectively the “Deloitte Network”) are, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should i ...

Chapter 6 - Fund Accounting

... another fund. A LUA reports most of their financial transactions in this fund. LUAs should report only one general fund. ...

... another fund. A LUA reports most of their financial transactions in this fund. LUAs should report only one general fund. ...

presentation

... bank’s cash vault is total bank reserves. • The Fed mandates member commercial banks to hold a certain fraction of their checkable deposits in reserve form. This fraction is called the required reserve ratio. • The difference between a bank’s total reserves and its required reserves is its excess re ...

... bank’s cash vault is total bank reserves. • The Fed mandates member commercial banks to hold a certain fraction of their checkable deposits in reserve form. This fraction is called the required reserve ratio. • The difference between a bank’s total reserves and its required reserves is its excess re ...

Multiplier Effect The Public Pensions:

... The investments went toward renovation, new construction, or financing of more than 30,000 units of affordable housing and many small retail spaces. They “created thousands of construction jobs and financed child-care facilities and senior citizen centers. The five-year overall return on the pension ...

... The investments went toward renovation, new construction, or financing of more than 30,000 units of affordable housing and many small retail spaces. They “created thousands of construction jobs and financed child-care facilities and senior citizen centers. The five-year overall return on the pension ...

Vanguard Developed All-Cap ex North America Equity Index Pooled

... Email (Canada): [email protected] Tel (Canada): 888-293-6729 This document is for informational purposes only regarding the Vanguard Index Pooled Funds. It is not a recommendation or solicitation to buy, hold or sell any security, including any securities of the funds. The information is not ...

... Email (Canada): [email protected] Tel (Canada): 888-293-6729 This document is for informational purposes only regarding the Vanguard Index Pooled Funds. It is not a recommendation or solicitation to buy, hold or sell any security, including any securities of the funds. The information is not ...

Absa Multi Managed Bond Fund - Absa | Wealth And Investment

... Fees: Class A Annual management fee does not include the financial Adviser’s ongoing advisory fee. Costs: Total Expense Ratio (“TER”) is expressed as an annualised percentage of the value of the class of the portfolio that was incurred as expenses relating to the administration of the portfolio. A h ...

... Fees: Class A Annual management fee does not include the financial Adviser’s ongoing advisory fee. Costs: Total Expense Ratio (“TER”) is expressed as an annualised percentage of the value of the class of the portfolio that was incurred as expenses relating to the administration of the portfolio. A h ...

Invesco Great Wall Core Competence Mixed Securities Fund

... ChiNext and the main board market, emerging nature of ChiNext companies, higher fluctuation on stock prices, delisting risk and valuation risk) and (d) Mainland debt securities risks (including volatility and liquidity risks, counterparty risk, interest rate risk, downgrading risk, credit rating age ...

... ChiNext and the main board market, emerging nature of ChiNext companies, higher fluctuation on stock prices, delisting risk and valuation risk) and (d) Mainland debt securities risks (including volatility and liquidity risks, counterparty risk, interest rate risk, downgrading risk, credit rating age ...

Monitoring trade data reduces the cost of asset

... January 24th will be the start date for the new tightened soft-dollar regulation to take effect. New regulations are focused around tightening the “Safe Harbor” rules that have allowed money managers to pay research services through client commissions. Services which will continue to be eligible for ...

... January 24th will be the start date for the new tightened soft-dollar regulation to take effect. New regulations are focused around tightening the “Safe Harbor” rules that have allowed money managers to pay research services through client commissions. Services which will continue to be eligible for ...

Asia Investment Grade Bond Fund

... company with variable capital and segregated liability between its sub-funds, established as an undertaking for Collective Investment in Transferable Securities under the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011. This document was prep ...

... company with variable capital and segregated liability between its sub-funds, established as an undertaking for Collective Investment in Transferable Securities under the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011. This document was prep ...

Europe ex UK Smaller Companies Fund

... The fund aims to provide long term capital growth by investing predominantly in the shares of smaller companies listed on European stock markets, excluding the UK. The fund is actively managed by our investment team, who will select stocks to try to take advantage of opportunities they have identifi ...

... The fund aims to provide long term capital growth by investing predominantly in the shares of smaller companies listed on European stock markets, excluding the UK. The fund is actively managed by our investment team, who will select stocks to try to take advantage of opportunities they have identifi ...

Karoll Capital Management is a licensed asset manager established

... The region of Central and Eastern Europe continued to post strong performance as a whole in February with the pace of advance of MSCI EFM Europe + CIS ex RU accelerating as the benchmark climbed 5.83% for the month. Thus its return YTD amounts to 8.52%, significantly above the results of the benchma ...

... The region of Central and Eastern Europe continued to post strong performance as a whole in February with the pace of advance of MSCI EFM Europe + CIS ex RU accelerating as the benchmark climbed 5.83% for the month. Thus its return YTD amounts to 8.52%, significantly above the results of the benchma ...