to 30 April 2016 - Allianz Global Investors

... because of the appreciation of the JPY (Japanese Yen). Market Background: The Japanese equity market declined in local currency terms on the back of concerns on China’s economy and US monetary policy. The BOJ (Bank of Japan) introduced negative interest rate policy in January 2016 which surprised th ...

... because of the appreciation of the JPY (Japanese Yen). Market Background: The Japanese equity market declined in local currency terms on the back of concerns on China’s economy and US monetary policy. The BOJ (Bank of Japan) introduced negative interest rate policy in January 2016 which surprised th ...

Employing Finders and Solicitors

... effects securities transactions through U.S. jurisdictional means to register with the SEC as a brokerdealer, unless, in the case of an individual, such person is an associated person of a registered brokerdealer. In very limited circumstances, finders who are not registered broker-dealers may be us ...

... effects securities transactions through U.S. jurisdictional means to register with the SEC as a brokerdealer, unless, in the case of an individual, such person is an associated person of a registered brokerdealer. In very limited circumstances, finders who are not registered broker-dealers may be us ...

chile - FIAP

... solving the problem of pensions, this reform has positive economic effects. • The macroeconomic, labour market and capital market reforms contribute to increasing the positive effects of the pension reform on the economy. • Although the capitalization system has suffered considerable political threa ...

... solving the problem of pensions, this reform has positive economic effects. • The macroeconomic, labour market and capital market reforms contribute to increasing the positive effects of the pension reform on the economy. • Although the capitalization system has suffered considerable political threa ...

Overseas Fund - First Eagle Investment Management

... The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate s ...

... The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate s ...

THE CENTRAL BANK OF THE RUSSIAN FEDERATION DEPUTY

... Depositaries of Joint-stock Investment Funds, Unit Investment Funds and Non-Government Pension Funds, approved by FCSM Resolution No. 04-3/ps of 10 February 2004, “On the Regulation of the Specialized Depositaries of Joint-stock Investment Funds, Unit Investment Funds, and Non-Government Pension Fun ...

... Depositaries of Joint-stock Investment Funds, Unit Investment Funds and Non-Government Pension Funds, approved by FCSM Resolution No. 04-3/ps of 10 February 2004, “On the Regulation of the Specialized Depositaries of Joint-stock Investment Funds, Unit Investment Funds, and Non-Government Pension Fun ...

Co-operators Ethical Select Growth Portfolio - The Co

... withdraw 10% of the value of the units of your segregated funds at December 31 without paying a deferred sales charge. If you have a registered retirement income plan or systematic withdrawal plan you can withdraw 20% of the value of the units of your segregated funds at December 31. You can switch ...

... withdraw 10% of the value of the units of your segregated funds at December 31 without paying a deferred sales charge. If you have a registered retirement income plan or systematic withdrawal plan you can withdraw 20% of the value of the units of your segregated funds at December 31. You can switch ...

The case for low-cost index-fund investing for Asian investors

... This document is being made available in Hong Kong by Vanguard Investments Hong Kong Limited (CE No. : AYT820) (“Vanguard Hong Kong”). Vanguard Hong Kong is licensed with the Securities and Futures Commission to carry on Type 1 – Dealing in Securities and Type 4 – Advising on Securities and Type 9 – ...

... This document is being made available in Hong Kong by Vanguard Investments Hong Kong Limited (CE No. : AYT820) (“Vanguard Hong Kong”). Vanguard Hong Kong is licensed with the Securities and Futures Commission to carry on Type 1 – Dealing in Securities and Type 4 – Advising on Securities and Type 9 – ...

J.P. Morgan to Pay $267 Million for Disclosure Failures

... advice they are receiving,” said Andrew J. Ceresney, Director of the SEC Enforcement Division. “These J.P. Morgan subsidiaries failed to disclose that they preferred to invest client money in firm-managed mutual funds and hedge funds, and clients were denied all the facts to determine why investment ...

... advice they are receiving,” said Andrew J. Ceresney, Director of the SEC Enforcement Division. “These J.P. Morgan subsidiaries failed to disclose that they preferred to invest client money in firm-managed mutual funds and hedge funds, and clients were denied all the facts to determine why investment ...

Vilar Gave Select Access to IPOs

... At a time when IPOs often soared in their first day of trading, Mr. [Alberto Vilar]'s firm, Amerindo Investment Advisors Inc., channeled most of the IPO shares it received to a small group of wealthy clients investing through an offshore account, the filings say. But until 2002, his mutual fund gear ...

... At a time when IPOs often soared in their first day of trading, Mr. [Alberto Vilar]'s firm, Amerindo Investment Advisors Inc., channeled most of the IPO shares it received to a small group of wealthy clients investing through an offshore account, the filings say. But until 2002, his mutual fund gear ...

“Lost” Decade 2000 – 2009

... that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. • The Russell 1000 index measures the performance of the 1,000 largest companies of the Russell 3000 index. • The Russell 2000 index ...

... that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. • The Russell 1000 index measures the performance of the 1,000 largest companies of the Russell 3000 index. • The Russell 2000 index ...

Hang Seng Investment`s First Northbound Fund Makes Mainland

... Hang Seng Bank, said: “We are delighted to start the public offering of Hang Seng Investment’s first northbound fund on the Mainland, providing a new investment option for Mainland investors. The public offering of the Fund demonstrates how our good cross-border connectivity enables us to capitalise ...

... Hang Seng Bank, said: “We are delighted to start the public offering of Hang Seng Investment’s first northbound fund on the Mainland, providing a new investment option for Mainland investors. The public offering of the Fund demonstrates how our good cross-border connectivity enables us to capitalise ...

MFIN5600 Practice questions Chapter 1 1. Characterize each of the

... “The LSC Pension Plan’s return objective should focus on real total returns that will fund its longterm obligations on an inflation-adjusted basis. The “time-to-maturity” of the corporate workforce is a key element for any defined pension plan; given our young workforce, LSC’s Plan has a long invest ...

... “The LSC Pension Plan’s return objective should focus on real total returns that will fund its longterm obligations on an inflation-adjusted basis. The “time-to-maturity” of the corporate workforce is a key element for any defined pension plan; given our young workforce, LSC’s Plan has a long invest ...

Key Investor Information

... The fund invests in 'value' stocks – those whose share prices appear low relative to their long-term profit potential, and which are typically paying an attractive and growing dividend. The fund may also invest in other financial instruments and hold cash on deposit. Derivatives may be used to reduc ...

... The fund invests in 'value' stocks – those whose share prices appear low relative to their long-term profit potential, and which are typically paying an attractive and growing dividend. The fund may also invest in other financial instruments and hold cash on deposit. Derivatives may be used to reduc ...

Media Release

... half of this year compared to the same period last year. Compared to the second half of last year an equally impressive increase of 31% was recorded. The same trend is true for new single premium RA fund policies, where a 21% increase brought total sales to R3.1-billion, compared to the second half ...

... half of this year compared to the same period last year. Compared to the second half of last year an equally impressive increase of 31% was recorded. The same trend is true for new single premium RA fund policies, where a 21% increase brought total sales to R3.1-billion, compared to the second half ...

Investment Methodology and the Batting Average

... Detailed Analysis Report located on the top left-hand side of the page (see example on Page 7). Brief descriptions of the batting average evaluation measures are also provided. ...

... Detailed Analysis Report located on the top left-hand side of the page (see example on Page 7). Brief descriptions of the batting average evaluation measures are also provided. ...

Invesco Great Wall Core Competence Mixed Securities Fund

... ChiNext and the main board market, emerging nature of ChiNext companies, higher fluctuation on stock prices, delisting risk and valuation risk) and (d) Mainland debt securities risks (including volatility and liquidity risks, counterparty risk, interest rate risk, downgrading risk, credit rating age ...

... ChiNext and the main board market, emerging nature of ChiNext companies, higher fluctuation on stock prices, delisting risk and valuation risk) and (d) Mainland debt securities risks (including volatility and liquidity risks, counterparty risk, interest rate risk, downgrading risk, credit rating age ...

RBC Multi-Strategy Alpha Fund

... Investments in alternative funds are speculative and involve significant risk of loss of all or a substantial amount of your investment. Alternative funds (i) may engage in leverage and other speculative investment practices that may increase the risk of investment loss; (ii) can be highly illiquid; ...

... Investments in alternative funds are speculative and involve significant risk of loss of all or a substantial amount of your investment. Alternative funds (i) may engage in leverage and other speculative investment practices that may increase the risk of investment loss; (ii) can be highly illiquid; ...

foundation market-based investment funds

... The asset targets for this fund are 85% invested in investment grade intermediate term debt obligations, 10% in high yield bonds and 5% in cash. There may be some fluctuation in principal values as assets may be sold before they mature to provide liquidity, and the asset values will fluctuate on a d ...

... The asset targets for this fund are 85% invested in investment grade intermediate term debt obligations, 10% in high yield bonds and 5% in cash. There may be some fluctuation in principal values as assets may be sold before they mature to provide liquidity, and the asset values will fluctuate on a d ...

Aberdeen Global - Eastern European Equity Fund

... The value of shares and the income from them can go down as well as up and you may get back less than the amount invested. l Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of your in ...

... The value of shares and the income from them can go down as well as up and you may get back less than the amount invested. l Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of your in ...

BAE Systems Pension Scheme Additional Voluntary Contributions

... Lifetime Allowance If your total lifetime pension benefits are above the Lifetime Allowance, any excess benefits above the Lifetime Allowance will be subject to 55% tax when they are paid. See the Scheme booklet for more information. Any transfer of existing funds to your new fund choices will take ...

... Lifetime Allowance If your total lifetime pension benefits are above the Lifetime Allowance, any excess benefits above the Lifetime Allowance will be subject to 55% tax when they are paid. See the Scheme booklet for more information. Any transfer of existing funds to your new fund choices will take ...

press release

... About the Institutional Investors Group on Climate Change (IIGCC) The Institutional Investors Group on Climate Change (IIGCC) is a forum for collaboration on climate change for European investors. It provides investors with a collaborative platform to encourage public policies, investment practices, ...

... About the Institutional Investors Group on Climate Change (IIGCC) The Institutional Investors Group on Climate Change (IIGCC) is a forum for collaboration on climate change for European investors. It provides investors with a collaborative platform to encourage public policies, investment practices, ...

guest slides - WordPress.com

... Harvard building this social network called The Facebook. It had already gotten some traction, so when I looked into it, I thought “this thing is amazing.” I sent a note to all of my colleagues with information about the business... But there wasn’t a lot of ...

... Harvard building this social network called The Facebook. It had already gotten some traction, so when I looked into it, I thought “this thing is amazing.” I sent a note to all of my colleagues with information about the business... But there wasn’t a lot of ...

Sequence contains no elements

... analysis and portfolio management. The fee is deducted from the fund and is levied as a percentage of the value of the fund’s assets. Ongoing Charge Figure (OCF) represents the ongoing costs to the fund, which includes the AMC and charges for other services such as keeping a register of investors, c ...

... analysis and portfolio management. The fee is deducted from the fund and is levied as a percentage of the value of the fund’s assets. Ongoing Charge Figure (OCF) represents the ongoing costs to the fund, which includes the AMC and charges for other services such as keeping a register of investors, c ...

April 2015 Factsheet - Electric and General Investment Fund

... Electric & General Investment Fund: As at 30.04.15 International / Equity Growth Investment Manager’s Commentary (1st April 2015 to 30th April 2015) Equities made further progress in a month which saw a number of record highs pared back by mixed economic data. Performance in the US in particular was ...

... Electric & General Investment Fund: As at 30.04.15 International / Equity Growth Investment Manager’s Commentary (1st April 2015 to 30th April 2015) Equities made further progress in a month which saw a number of record highs pared back by mixed economic data. Performance in the US in particular was ...

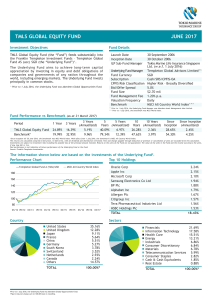

tmls global equity fund june 2017

... corporate earnings strength against the perception of elevated political risk in major western economies. Market trends shifted as the reflationary “Trump Trade” gave way to a more cautious view. • The portfolio underperformed its benchmark during the quarter. Market trends shifted as the pro-cycli ...

... corporate earnings strength against the perception of elevated political risk in major western economies. Market trends shifted as the reflationary “Trump Trade” gave way to a more cautious view. • The portfolio underperformed its benchmark during the quarter. Market trends shifted as the pro-cycli ...