Jonathan R. Baum Chairman and Chief Executive Officer

... Clinical Professor of Global Commerce, Strategy and Leadership, he is teaching courses in investments, investment banking, strategy, international relations and leadership. At the 2009 commencement ceremony he received the Lindback Award for distinguished teaching. His thinking has been published by ...

... Clinical Professor of Global Commerce, Strategy and Leadership, he is teaching courses in investments, investment banking, strategy, international relations and leadership. At the 2009 commencement ceremony he received the Lindback Award for distinguished teaching. His thinking has been published by ...

BEPS Action 6 – Discussion Draft on non-CIV examples

... likely not reach. We assume that the intention of this example is not to prevent treaty access solely on the basis that a pooled fund has a greater aggregated percentage holding of a given investment. Therefore, it should be clarified that the test looks to the ability to qualify under a treaty rath ...

... likely not reach. We assume that the intention of this example is not to prevent treaty access solely on the basis that a pooled fund has a greater aggregated percentage holding of a given investment. Therefore, it should be clarified that the test looks to the ability to qualify under a treaty rath ...

Comparative Analysis of Blue Chip Fund

... Net asset value (NAV) Net asset value (NAV) is the value of an entity's assets minus the value of its liabilities, often in relation to open-end or mutual funds, since shares of such funds registered with the U.S. Securities and Exchange Commission are redeemed at their net asset value. This may als ...

... Net asset value (NAV) Net asset value (NAV) is the value of an entity's assets minus the value of its liabilities, often in relation to open-end or mutual funds, since shares of such funds registered with the U.S. Securities and Exchange Commission are redeemed at their net asset value. This may als ...

Key Investor Information db x-trackers Equity Value Factor UCITS ETF

... ending October 2015. It may vary from year to year. It excludes portfolio transaction costs and performance fees, if any. ...

... ending October 2015. It may vary from year to year. It excludes portfolio transaction costs and performance fees, if any. ...

Global Unconstrained Bond a sub-fund of Schroder

... it more sensitive to certain market or interest rate movements and may cause above-average volatility and risk of loss. Liquidity risk: In difficult market conditions, the fund may not be able to sell a security for full value or at all. This could affect performance and could cause the fund to defe ...

... it more sensitive to certain market or interest rate movements and may cause above-average volatility and risk of loss. Liquidity risk: In difficult market conditions, the fund may not be able to sell a security for full value or at all. This could affect performance and could cause the fund to defe ...

Form QIFSF 2013

... I confirm that we, the designated manager of the scheme, have performed sufficient due diligence to be satisfied that the promoter of, and the associated parties to, the scheme continue to be fit and proper and that in this respect consideration has been given to all of the issues set out in the Gui ...

... I confirm that we, the designated manager of the scheme, have performed sufficient due diligence to be satisfied that the promoter of, and the associated parties to, the scheme continue to be fit and proper and that in this respect consideration has been given to all of the issues set out in the Gui ...

Pepperdine University Retirement Plan Committee Meeting 08/31/09

... The Committee reviewed the asset allocation by age group for the Diversified Plan and noted more than 50% of participants age 29 and under have allocated their accounts into the T. Rowe Price target date funds. It was noted the target dates funds are the default option which would likely lead to hig ...

... The Committee reviewed the asset allocation by age group for the Diversified Plan and noted more than 50% of participants age 29 and under have allocated their accounts into the T. Rowe Price target date funds. It was noted the target dates funds are the default option which would likely lead to hig ...

HERMES GLOBAL HIGH YIELD BOND FUND

... use an active approach to seek high risk-adjusted returns from bottom-up analysis of below investment grade corporate and/or government issuers. Fundamental, bottom-up analysis of individual credit will be used to generate returns through anticipated price changes. In addition, the Investment Manage ...

... use an active approach to seek high risk-adjusted returns from bottom-up analysis of below investment grade corporate and/or government issuers. Fundamental, bottom-up analysis of individual credit will be used to generate returns through anticipated price changes. In addition, the Investment Manage ...

Prudential Jennison Mid Cap Growth A LW

... companies. Mid-cap growth portfolios target U.S. firms that are projected to grow faster than other mid-cap stocks, therefore commanding relatively higher prices. The U.S. mid-cap range for market capitalization typically falls between $1 billion and $8 billion and represents 20% of the total capita ...

... companies. Mid-cap growth portfolios target U.S. firms that are projected to grow faster than other mid-cap stocks, therefore commanding relatively higher prices. The U.S. mid-cap range for market capitalization typically falls between $1 billion and $8 billion and represents 20% of the total capita ...

Investment Philosophy - St. Croix Valley Foundation

... Equity. Domestic Equities will represent 35% to 55% of the market value of the total long-term portfolio, with a targeted average of 45%. International Equities will represent 5% to 15% of the market value of the total long-term portfolio, with a targeted average of 10%. Equities authorized for pu ...

... Equity. Domestic Equities will represent 35% to 55% of the market value of the total long-term portfolio, with a targeted average of 45%. International Equities will represent 5% to 15% of the market value of the total long-term portfolio, with a targeted average of 10%. Equities authorized for pu ...

Templeton Foreign Fund Fact Sheet

... All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in developing markets involve heightened risks related to the same factors. Currency ...

... All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in developing markets involve heightened risks related to the same factors. Currency ...

FoHF profile Amundi AI model adapts to trends by focusing on

... Even for those institutional investors that have the scale to do so, considering the percentage of hedge funds in a pension fund portfolio is no more than 15% of the assets, the resources and time it takes to manage the investment is disproportionate and Amundi AI sees the managed account platform a ...

... Even for those institutional investors that have the scale to do so, considering the percentage of hedge funds in a pension fund portfolio is no more than 15% of the assets, the resources and time it takes to manage the investment is disproportionate and Amundi AI sees the managed account platform a ...

Document

... * Private equities are stocks that are not traded on the public stock exchanges, such as the New York Stock Exchange ** Absolute return investments is another name for hedge funds, which involves a wide variety of investment strategies. ...

... * Private equities are stocks that are not traded on the public stock exchanges, such as the New York Stock Exchange ** Absolute return investments is another name for hedge funds, which involves a wide variety of investment strategies. ...

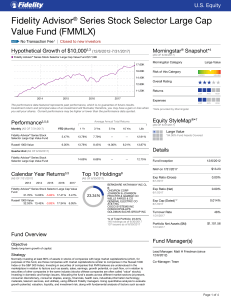

Fidelity Advisor® Series Stock Selector Large Cap Value Fund

... and American Depositary Receipts), are based on historical data, and are not predictive of the fund's future investments. Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed. 8. Any holdings, asset allocation, diversification breakdowns or other compo ...

... and American Depositary Receipts), are based on historical data, and are not predictive of the fund's future investments. Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed. 8. Any holdings, asset allocation, diversification breakdowns or other compo ...

Contact Name - Boston Partners

... Boston Partners Global Investors, Inc. is the investment adviser to the Boston Partners Investment Funds. Foreside Funds Distributors LLC is the Distributor of the Funds and is not an adviser affiliate. Securities offered through Boston Partners Securities, LLC, member FINRA, SIPC, an affiliate of B ...

... Boston Partners Global Investors, Inc. is the investment adviser to the Boston Partners Investment Funds. Foreside Funds Distributors LLC is the Distributor of the Funds and is not an adviser affiliate. Securities offered through Boston Partners Securities, LLC, member FINRA, SIPC, an affiliate of B ...

Nationwide® Investor Destinations Conservative Fund

... investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. It rolls up into other Barclays flagship indices, such as the multi-currency Global Aggreg ...

... investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. It rolls up into other Barclays flagship indices, such as the multi-currency Global Aggreg ...

Chapter 1, Answer to Questions

... buying a portion of a portfolio of securities owned by the fund. Thus, you will have a claim on a fraction of an entire portfolio of securities. (c) An investment in debt represents funds loaned in exchange for the receipt of interest income and repayment of the loan at a given future date. The bond ...

... buying a portion of a portfolio of securities owned by the fund. Thus, you will have a claim on a fraction of an entire portfolio of securities. (c) An investment in debt represents funds loaned in exchange for the receipt of interest income and repayment of the loan at a given future date. The bond ...

Pensions Investment Sub 080512 Appendix A to Previous Part 1

... considered given exposure within the above mandates. Adding complexity to the investment strategy as noted above leads us to believe that, whilst the introduction of property to the investment strategy is not unreasonable, there are other demands on the governance budget that should take precedence ...

... considered given exposure within the above mandates. Adding complexity to the investment strategy as noted above leads us to believe that, whilst the introduction of property to the investment strategy is not unreasonable, there are other demands on the governance budget that should take precedence ...

Identify the right investments

... An investor in a unit trust ‘buys’ a number of units, while an investor in an investment trust or OEIC ‘buys’ shares. Unit trusts are open-ended, which means that units can be issued as demand requires. The price of these units is dependent on the value of the underlying assets, and they can be sold ...

... An investor in a unit trust ‘buys’ a number of units, while an investor in an investment trust or OEIC ‘buys’ shares. Unit trusts are open-ended, which means that units can be issued as demand requires. The price of these units is dependent on the value of the underlying assets, and they can be sold ...

Consider the risks - Guinness Asset Management

... Investors should not consider investing money in an offering which can hold shares in unlisted companies if their investment may be required during the life of the offering, which is normally at least three years. Investors should not consider subscribing unless they can afford a total loss of their ...

... Investors should not consider investing money in an offering which can hold shares in unlisted companies if their investment may be required during the life of the offering, which is normally at least three years. Investors should not consider subscribing unless they can afford a total loss of their ...

T t l d p t t - The University of Chicago Booth School of Business

... the risk of their portfolios, and how these incentives vary both over time as returns are realized and cross-sectionally with fund attributes. Incentives are affected both by the sensitivity of investment flow to fund performance and by the shape of the flow-performance relationship. Hence, we begin ...

... the risk of their portfolios, and how these incentives vary both over time as returns are realized and cross-sectionally with fund attributes. Incentives are affected both by the sensitivity of investment flow to fund performance and by the shape of the flow-performance relationship. Hence, we begin ...

Sizing up active small-cap - Charles Schwab Investment Management

... Small Cap funds are subject to greater volatility than those in other asset classes. Charles Schwab Investment Management, Inc. (CSIM), the investment advisor for Schwab’s proprietary funds, and Charles Schwab & Co., Inc. (Schwab), the distributor for Schwab Funds, are separate but affiliated compan ...

... Small Cap funds are subject to greater volatility than those in other asset classes. Charles Schwab Investment Management, Inc. (CSIM), the investment advisor for Schwab’s proprietary funds, and Charles Schwab & Co., Inc. (Schwab), the distributor for Schwab Funds, are separate but affiliated compan ...

press release

... This release does not contain or constitute an offer to sell or a solicitation of an offer to purchase securities in the United States or any other jurisdiction. The securities of TFG have not been and will not be registered under the U.S. Securities Act of 1933 (the "Securities Act"), as amended, a ...

... This release does not contain or constitute an offer to sell or a solicitation of an offer to purchase securities in the United States or any other jurisdiction. The securities of TFG have not been and will not be registered under the U.S. Securities Act of 1933 (the "Securities Act"), as amended, a ...