Help satisfy participant investment needs

... This material is not a recommendation to buy, sell, hold or rollover any asset, adopt an investment strategy, retain a specific investment manager or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of ...

... This material is not a recommendation to buy, sell, hold or rollover any asset, adopt an investment strategy, retain a specific investment manager or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of ...

TIPS ETF Driven Higher By Inflation Worries

... The Federal Reserve is pumping more money into the financial system with rate cuts and by taking agencybacked securities. As long as the system is in gridlock, TIPS will likely stay high. "The Fed has to do a lot of easing to catch up to the market, and these products are going to benefit," Spa ...

... The Federal Reserve is pumping more money into the financial system with rate cuts and by taking agencybacked securities. As long as the system is in gridlock, TIPS will likely stay high. "The Fed has to do a lot of easing to catch up to the market, and these products are going to benefit," Spa ...

First Trust Large Cap Core AlphaDEX® Fund

... ¹On April 8, 2016, the fund’s underlying index changed from the Defined Large Cap Core Index to the NASDAQ AlphaDEX® Large Cap Core Index. Therefore, the fund’s performance and historical returns shown for the periods prior to this date are not necessarily indicative of the performance that the fund, ...

... ¹On April 8, 2016, the fund’s underlying index changed from the Defined Large Cap Core Index to the NASDAQ AlphaDEX® Large Cap Core Index. Therefore, the fund’s performance and historical returns shown for the periods prior to this date are not necessarily indicative of the performance that the fund, ...

Fact Sheet: The New Morningstar Style Box™ Methodology

... The Morningstar Style BoxTM was introduced in 1992 and quickly gained favor within the investment community. For the first time, individual and professional investors had a way to quickly understand the investment positioning of a mutual fund. By providing an easy-to-understand visual representation ...

... The Morningstar Style BoxTM was introduced in 1992 and quickly gained favor within the investment community. For the first time, individual and professional investors had a way to quickly understand the investment positioning of a mutual fund. By providing an easy-to-understand visual representation ...

Action plan - Northumberland County Council

... follow up work to implement the new LGPS Local Pensions Board; any items referred back to the Pension Fund Panel by the Pension Board; (NEW) consider shared service arrangements with Durham County Council. ...

... follow up work to implement the new LGPS Local Pensions Board; any items referred back to the Pension Fund Panel by the Pension Board; (NEW) consider shared service arrangements with Durham County Council. ...

EMBARGOED UNTIL 9AM GMT 19.3.2015 European investors

... Achieving the Investment Plan for Europe’s €315bn ambition: 12 fixes, says European institutional investors have in recent years fallen short of their aim to allocate 8% of total assets to infrastructure and that their investment in infrastructure projects can be increased – if the conditions are ri ...

... Achieving the Investment Plan for Europe’s €315bn ambition: 12 fixes, says European institutional investors have in recent years fallen short of their aim to allocate 8% of total assets to infrastructure and that their investment in infrastructure projects can be increased – if the conditions are ri ...

Kurzinformation Simplified Prospectus iShares eb

... The unit value can fluctuate. Investors may not recover the full value of their investment. If the index falls in value, causing the value of the Investment Fund to fall, the Company’s fund management will not attempt to limit losses through hedging transactions or sales of equities (i.e. the fund i ...

... The unit value can fluctuate. Investors may not recover the full value of their investment. If the index falls in value, causing the value of the Investment Fund to fall, the Company’s fund management will not attempt to limit losses through hedging transactions or sales of equities (i.e. the fund i ...

5 key facts to consider- Ideall Absolute Return Strategies Fund (7652)

... The Ideal Global Absolute Return Strategies Fund invests in Canadian dollar hedged Class Z shares of the Standard Life Investments Global SICAV Global Absolute Return Strategies Fund (the “underlying fund”). In this document, “GARS Fund” refers to the underlying fund and “GARS” refers to the Global ...

... The Ideal Global Absolute Return Strategies Fund invests in Canadian dollar hedged Class Z shares of the Standard Life Investments Global SICAV Global Absolute Return Strategies Fund (the “underlying fund”). In this document, “GARS Fund” refers to the underlying fund and “GARS” refers to the Global ...

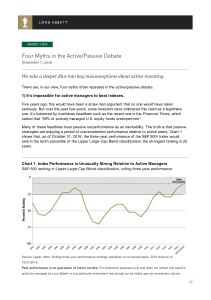

Four Myths in the Active/Passive Debate

... expansion. Growth stocks may also perf orm well during an expansion, but they may also be out of f avor during market downturns, when investors pay more attention to price ratios. While growth stocks are subject to the daily ups and downs of the stock market, their long-term potential as well as t ...

... expansion. Growth stocks may also perf orm well during an expansion, but they may also be out of f avor during market downturns, when investors pay more attention to price ratios. While growth stocks are subject to the daily ups and downs of the stock market, their long-term potential as well as t ...

Wells Capital Management ERISA Investment Management Training

... requirements for qualification under Section 401 of the Internal Revenue Code of 1986 as amended, (the “Code”); or Any governmental plan described in Section 3(a)(2)(C) of the Securities Act of 1933 as amended, (the “1933 Act”); or Any collective trust fund maintained by a bank consisting solely of ...

... requirements for qualification under Section 401 of the Internal Revenue Code of 1986 as amended, (the “Code”); or Any governmental plan described in Section 3(a)(2)(C) of the Securities Act of 1933 as amended, (the “1933 Act”); or Any collective trust fund maintained by a bank consisting solely of ...

TCW High Dividend Equities Fund Summary Prospectus

... of the value of its net assets, plus any borrowings for investment purposes, in equity securities listed on U.S. financial markets. If the Fund changes this investment policy, it will notify shareholders in writing at least 60 days in advance of the change. In seeking to achieve the Fund’s investmen ...

... of the value of its net assets, plus any borrowings for investment purposes, in equity securities listed on U.S. financial markets. If the Fund changes this investment policy, it will notify shareholders in writing at least 60 days in advance of the change. In seeking to achieve the Fund’s investmen ...

Mutual Funds Investment

... concerned. For any individual who intends to allocate his assets into proper forms of investment and want to diversify his Investment Portfolio as well as the risks, Mutual Funds can be proved as the biggest opportunity. Investors gets a lot of advantages with the Mutual Fund Investment. Firstly, th ...

... concerned. For any individual who intends to allocate his assets into proper forms of investment and want to diversify his Investment Portfolio as well as the risks, Mutual Funds can be proved as the biggest opportunity. Investors gets a lot of advantages with the Mutual Fund Investment. Firstly, th ...

Financial Report 2005

... Any gain or loss arising from a change in fair value is included in the statement of income in the period in which it arises. 2. Definition of Ratios NAV = Net Asset Value = The equity value of one unit of the Investment Fund. Calculated by subtracting the liabilities per unit from the assets per un ...

... Any gain or loss arising from a change in fair value is included in the statement of income in the period in which it arises. 2. Definition of Ratios NAV = Net Asset Value = The equity value of one unit of the Investment Fund. Calculated by subtracting the liabilities per unit from the assets per un ...

In the Matters of DELAWARE MANAGEMENT COMPANY, INC

... stock of Libby, McNeill & Libby (“Libby”) at $13.50 per share on March 5, 1965, through a brokerdealer firm, although Delaware had theretofore been offered $14 per share by another brokerdealer firm and could have obtained that price for such shares on the same day. The executing broker was selected ...

... stock of Libby, McNeill & Libby (“Libby”) at $13.50 per share on March 5, 1965, through a brokerdealer firm, although Delaware had theretofore been offered $14 per share by another brokerdealer firm and could have obtained that price for such shares on the same day. The executing broker was selected ...

Performance of Australian superannuation funds

... Fund mission and objectives Trustee practice/ethics code (self-regulation) Selection policies of trustees, directors, members Policies for selection/monitoring: outsourcing, external service providers, related party transactions Risk (return, volatility, liquidity and fraud) Cost control ...

... Fund mission and objectives Trustee practice/ethics code (self-regulation) Selection policies of trustees, directors, members Policies for selection/monitoring: outsourcing, external service providers, related party transactions Risk (return, volatility, liquidity and fraud) Cost control ...

Close Tactical Select Passive Growth X Acc

... Source: FE You should not use past performance as a suggestion of future performance. It should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise. You may not get back the amount you invested. Tax concessions ...

... Source: FE You should not use past performance as a suggestion of future performance. It should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise. You may not get back the amount you invested. Tax concessions ...

award from institutional investor magazine

... ceremony, to be held this year at the Mandarin Oriental in NYC.” Awards referenced do not reflect the experiences of any Neuberger Berman client and readers should not view such information as representative of any particular client’s experience or assume that they will have a similar investment exp ...

... ceremony, to be held this year at the Mandarin Oriental in NYC.” Awards referenced do not reflect the experiences of any Neuberger Berman client and readers should not view such information as representative of any particular client’s experience or assume that they will have a similar investment exp ...

Birla Sun Life Focused Equity Fund - Series 4.cdr

... document, in part or in whole, or in any other manner whatsoever without prior and explicit approval of BSLAMC. ...

... document, in part or in whole, or in any other manner whatsoever without prior and explicit approval of BSLAMC. ...

ICICI Prudential AMC launches ICICI Prudential Dividend Yield

... information that is publicly available, including information developed in-house. Some of the material used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gat ...

... information that is publicly available, including information developed in-house. Some of the material used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gat ...

What Are 401(k) Plans?

... permitted to become a participant if you have reached age 21 and have completed 1 year of service. Even if you work part-time or seasonally, you cannot be excluded from the plan on the grounds of age or service if you meet this service standard. You must be permitted to begin to participate in the p ...

... permitted to become a participant if you have reached age 21 and have completed 1 year of service. Even if you work part-time or seasonally, you cannot be excluded from the plan on the grounds of age or service if you meet this service standard. You must be permitted to begin to participate in the p ...

Fidelity Convertible Securities Investment Trust

... Fidelity’s mutual funds are sold by registered Investment Professionals. Each Fund has a simplified prospectus, which contains important information on the Fund, including its investment objective, purchase options, and applicable charges. Please obtain a copy of the prospectus, read it carefully, a ...

... Fidelity’s mutual funds are sold by registered Investment Professionals. Each Fund has a simplified prospectus, which contains important information on the Fund, including its investment objective, purchase options, and applicable charges. Please obtain a copy of the prospectus, read it carefully, a ...

- CAIA Association

... You Could be Wrong Even When You are Right! Suppose you discover an asset that has been losing money since inception (e.g., a mutual fund run by an incompetent manager). Further, you have every reason to believe that the asset will continue to lose money going forward. You wonder how good it would b ...

... You Could be Wrong Even When You are Right! Suppose you discover an asset that has been losing money since inception (e.g., a mutual fund run by an incompetent manager). Further, you have every reason to believe that the asset will continue to lose money going forward. You wonder how good it would b ...

Full Article - Nash Family Wealth

... credit cycle. When the spread between corporate-bond and government-bond yields is small, as was the case in 2007, management tends to focus on high-quality, safer corporate bonds or even government securities. When spreads widen, such as in 2008 and early 2009, management will become aggressive and ...

... credit cycle. When the spread between corporate-bond and government-bond yields is small, as was the case in 2007, management tends to focus on high-quality, safer corporate bonds or even government securities. When spreads widen, such as in 2008 and early 2009, management will become aggressive and ...