information

... This is a tracker fund following the FTSE All Stocks Gilt index. This is what I was told on the phone, although have been unable to find out what this index is. If you succeed, details of which companies are in the FTSE each month can be found at www.londonstockexchange.com and apparently also in th ...

... This is a tracker fund following the FTSE All Stocks Gilt index. This is what I was told on the phone, although have been unable to find out what this index is. If you succeed, details of which companies are in the FTSE each month can be found at www.londonstockexchange.com and apparently also in th ...

Statutory Accounting Principles Working Group

... direction of management of an underlying company. This guidance clarifies that ETFs and mutual funds are comprised of portfolios of securities, subject to the regulatory requirements of the federal securities laws. Investments in ETFs and mutual funds shall be reported in accordance with the underly ...

... direction of management of an underlying company. This guidance clarifies that ETFs and mutual funds are comprised of portfolios of securities, subject to the regulatory requirements of the federal securities laws. Investments in ETFs and mutual funds shall be reported in accordance with the underly ...

Sample Glossary of Investment-Related Terms for

... Interest Rate Risk: The possibility that a bond’s or bond fund’s market value will decrease due to rising interest rates. When interest rates (and bond yields) go up, bond prices usually go down and vice versa. International Fund: A fund that invests primarily in the securities of companies located, ...

... Interest Rate Risk: The possibility that a bond’s or bond fund’s market value will decrease due to rising interest rates. When interest rates (and bond yields) go up, bond prices usually go down and vice versa. International Fund: A fund that invests primarily in the securities of companies located, ...

An Overview of the Regulatory Framework Applying to Collective

... for a bank to maintain a collective trust, the bank must exercise substantial investment authority over the assets of the trust. A bank that functions in a mere custodial or similar capacity will not satisfy the “maintained” requirement. At the same time, the SEC has long held the position that a ...

... for a bank to maintain a collective trust, the bank must exercise substantial investment authority over the assets of the trust. A bank that functions in a mere custodial or similar capacity will not satisfy the “maintained” requirement. At the same time, the SEC has long held the position that a ...

LUX Global Real Estate FCP-SIF V

... Performance is for the period shown (month end to month end, bid/bid, gross income reinvested, calculated in the currency and currencies indicated). ...

... Performance is for the period shown (month end to month end, bid/bid, gross income reinvested, calculated in the currency and currencies indicated). ...

fund accounting training

... Since endowment principals are generally kept in perpetuity, cash gifts are generally invested in long‐term instruments. When non‐cash instruments such as stocks or bonds are donated to establish an endowment, the asset is valued at market value as of the gift date. Income earned on endowments i ...

... Since endowment principals are generally kept in perpetuity, cash gifts are generally invested in long‐term instruments. When non‐cash instruments such as stocks or bonds are donated to establish an endowment, the asset is valued at market value as of the gift date. Income earned on endowments i ...

Target Outcome Funds

... targeting a specific risk/reward trade‐off achieved through a combination of fixed income securities and options contracts. Each Target Outcome Fund seeks to deliver a return corresponding to a market index or reference asset within specific risk constraints or accompanied by certain return enhancem ...

... targeting a specific risk/reward trade‐off achieved through a combination of fixed income securities and options contracts. Each Target Outcome Fund seeks to deliver a return corresponding to a market index or reference asset within specific risk constraints or accompanied by certain return enhancem ...

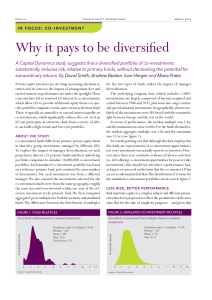

Why it pays to be diversified

... considered, since co-investments attract lower fees. Because only realized investments were used to calculate fund multiples, fee data for the overall fund cannot be overlaid to arrive at net multiples. However, if we suppose an average company holding time of five years and a 2% management fee on in ...

... considered, since co-investments attract lower fees. Because only realized investments were used to calculate fund multiples, fee data for the overall fund cannot be overlaid to arrive at net multiples. However, if we suppose an average company holding time of five years and a 2% management fee on in ...

A legitimate question is raised in several fora– why an

... obtain a PAN and then again produce proof of address, photograph and details of financial status and other demographic particulars in spite of the fact that Mutual Funds accept investments only through cheques / drafts and make payment of redemption through the bank account of the Unitholder. Our on ...

... obtain a PAN and then again produce proof of address, photograph and details of financial status and other demographic particulars in spite of the fact that Mutual Funds accept investments only through cheques / drafts and make payment of redemption through the bank account of the Unitholder. Our on ...

high yield bonds under stress?

... illiquid sections of the credit market, including high yield bonds, bank loans and structured credit to ensure it is in-line with the plan’s stated liquidity needs. 2. Consider the liquidity profile of underlying holdings in mutual funds and other commingled funds and the liquidity offered to inves ...

... illiquid sections of the credit market, including high yield bonds, bank loans and structured credit to ensure it is in-line with the plan’s stated liquidity needs. 2. Consider the liquidity profile of underlying holdings in mutual funds and other commingled funds and the liquidity offered to inves ...

What are General Capital Assets?

... Note: If money received from governmental units, individuals, or organizations is restricted for the purchase or construction of specified capital assets – it is recommended that a Capital Projects Fund be used. ...

... Note: If money received from governmental units, individuals, or organizations is restricted for the purchase or construction of specified capital assets – it is recommended that a Capital Projects Fund be used. ...

Collective investment schemes regulations

... • other material pools, made for special purposes. The first CIF was organized under state law in 1927. In 1936, Congress amended the Internal Revenue Code (IRC) to provide tax-exempt status to certain CIFs maintained by a bank [1]. In 1937, the Federal Reserve promulgated special regulation that a ...

... • other material pools, made for special purposes. The first CIF was organized under state law in 1927. In 1936, Congress amended the Internal Revenue Code (IRC) to provide tax-exempt status to certain CIFs maintained by a bank [1]. In 1937, the Federal Reserve promulgated special regulation that a ...

Is it Overreaction? The Long-Horizon Performance of Value and

... Hedge Funds were riding the bubble Short-sales constraints and “arbitrage” risks are not sufficient to ...

... Hedge Funds were riding the bubble Short-sales constraints and “arbitrage” risks are not sufficient to ...

sample letter

... (a) we have not undertaken and will not undertake to provide impartial investment advice, or to give advice in a fiduciary capacity to the Independent Fiduciary (as defined below) or the Benefit Plan Investor in connection with the purchase, holding or sale of equity interests in the Funds; (b) we h ...

... (a) we have not undertaken and will not undertake to provide impartial investment advice, or to give advice in a fiduciary capacity to the Independent Fiduciary (as defined below) or the Benefit Plan Investor in connection with the purchase, holding or sale of equity interests in the Funds; (b) we h ...

Calvert Green Bond Fund

... recognized statistical rating organization (‘‘NRSRO”), including Moody’s Investors Service or Fitch Ratings, or if unrated, considered to be of comparable credit quality by the Fund’s Adviser. For purposes of rating restrictions, if securities are rated differently by two or more rating agencies, th ...

... recognized statistical rating organization (‘‘NRSRO”), including Moody’s Investors Service or Fitch Ratings, or if unrated, considered to be of comparable credit quality by the Fund’s Adviser. For purposes of rating restrictions, if securities are rated differently by two or more rating agencies, th ...

Core High Yield Fund - John Hancock Investments

... Foreign securities risk. Less information may be publicly available regarding foreign issuers. Foreign securities may be subject to foreign taxes and may be more volatile than U.S. securities. Currency fluctuations and political and economic developments may adversely impact the value of foreign sec ...

... Foreign securities risk. Less information may be publicly available regarding foreign issuers. Foreign securities may be subject to foreign taxes and may be more volatile than U.S. securities. Currency fluctuations and political and economic developments may adversely impact the value of foreign sec ...

From Cattle to Cotton to Corn

... As a “non-diversified” fund, the Fund may hold a smaller number of portfolio securities than many other funds. To the extent the Fund invests in a relatively small number of issuers, a decline in the market value of a particular security held by the Fund may affect its value more than if it invested ...

... As a “non-diversified” fund, the Fund may hold a smaller number of portfolio securities than many other funds. To the extent the Fund invests in a relatively small number of issuers, a decline in the market value of a particular security held by the Fund may affect its value more than if it invested ...

AMENDMENT NO. 1 DATED JULY 21, 2016 TO

... Napier Advisors, LLC to NEI Investments and AllianceBernstein Canada, Inc. will be appointed as subadvisor; (b) The portfolio manager of the NEI Ethical Global Dividend Fund will change from Beutel, Goodman & Company Ltd. to NEI Investments and Amundi Canada Inc. and Amundi Asset Management will be ...

... Napier Advisors, LLC to NEI Investments and AllianceBernstein Canada, Inc. will be appointed as subadvisor; (b) The portfolio manager of the NEI Ethical Global Dividend Fund will change from Beutel, Goodman & Company Ltd. to NEI Investments and Amundi Canada Inc. and Amundi Asset Management will be ...

About Our Private Investment Benchmarks

... year in which the first capital is invested. Vintage year statistics are critical to assessing an individual fund’s performance because they provide a similar universe for comparison. 8. The Cambridge Associates commentaries talk a lot about comparative size vintages. Why is this important? Because ...

... year in which the first capital is invested. Vintage year statistics are critical to assessing an individual fund’s performance because they provide a similar universe for comparison. 8. The Cambridge Associates commentaries talk a lot about comparative size vintages. Why is this important? Because ...

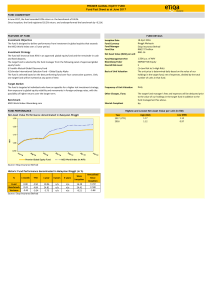

Etiqa Insurance Berhad Overall Risk Level Basis of Unit Valuation

... 1 Market Risk - The risk of losses in the value of an investment fund, due to factors that affect the overall performance of financial markets. These factors could be the current situation or future outlook, and could be both local and foreign. These factors could include the economy, politics, gove ...

... 1 Market Risk - The risk of losses in the value of an investment fund, due to factors that affect the overall performance of financial markets. These factors could be the current situation or future outlook, and could be both local and foreign. These factors could include the economy, politics, gove ...

2017-01-0130-SBIMF_Blue Chip Leaflet Dec A5

... business models, high visibility and reach and good recognition. In essence, they can help you steadily achieve your long-term investing goals. SBI Blue Chip Fund invests predominantly in such blue chip companies and hence, is a must-have scheme for every portfolio. The focus of the fund is on gener ...

... business models, high visibility and reach and good recognition. In essence, they can help you steadily achieve your long-term investing goals. SBI Blue Chip Fund invests predominantly in such blue chip companies and hence, is a must-have scheme for every portfolio. The focus of the fund is on gener ...

Tariff of Charges Part 2: Investment Product Charges

... the amount reaches a minimum of £2.50) into the largest fund of the product that the rebated fund is held in. Rebates to Unit Trust/OEIC fund charges are taxable as income and any amount used to buy units will be net of basic rate tax at 20%. This means that if you’re a higher rate or additional rat ...

... the amount reaches a minimum of £2.50) into the largest fund of the product that the rebated fund is held in. Rebates to Unit Trust/OEIC fund charges are taxable as income and any amount used to buy units will be net of basic rate tax at 20%. This means that if you’re a higher rate or additional rat ...

FCA Consultation CP16/30: Transaction cost disclosure in

... being traded are often small and so are met out of funds’ cash-flows (investor inflows and outflows as well as rental income) rather than buying or selling assets. As a result, while transaction costs in equity and bond funds can be linked to specific sales and purchases of portfolio holdings, there ...

... being traded are often small and so are met out of funds’ cash-flows (investor inflows and outflows as well as rental income) rather than buying or selling assets. As a result, while transaction costs in equity and bond funds can be linked to specific sales and purchases of portfolio holdings, there ...

Bendigo Socially Responsible Growth Fund

... The Bendigo Socially Responsible Growth Fund (Fund) and Bendigo SmartStart Super ABN 57 526 653 420 are issued by Sandhurst Trustees Limited ABN 16 004 030 737 AFSL 237906 (Sandhurst) a subsidiary of Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL 237879 (the Bank). Both of these companies ...

... The Bendigo Socially Responsible Growth Fund (Fund) and Bendigo SmartStart Super ABN 57 526 653 420 are issued by Sandhurst Trustees Limited ABN 16 004 030 737 AFSL 237906 (Sandhurst) a subsidiary of Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL 237879 (the Bank). Both of these companies ...