the law of turkmenistan on investment activities in

... • funds, special bank deposits, shares, stocks and other securities; • movable property and real estate (buildings, constructions, equipment and other material values); • rights of land and other natural resources use, and other property rights; • property rights related to copyright, know-h ...

... • funds, special bank deposits, shares, stocks and other securities; • movable property and real estate (buildings, constructions, equipment and other material values); • rights of land and other natural resources use, and other property rights; • property rights related to copyright, know-h ...

Procedures For Investment From Overseas MCB PSM

... State Bank of Pakistan (SBP) has allowed investments in MCB Pakistan Stock Market Fund (MCB PSM Fund) from Overseas or Non-Resident Pakistanis and Individuals on repatriation basis. Units of MCB PSM Fund will be issued against Pak Rupee equivalent amount as shown in the “Proceeds Realisation Certifi ...

... State Bank of Pakistan (SBP) has allowed investments in MCB Pakistan Stock Market Fund (MCB PSM Fund) from Overseas or Non-Resident Pakistanis and Individuals on repatriation basis. Units of MCB PSM Fund will be issued against Pak Rupee equivalent amount as shown in the “Proceeds Realisation Certifi ...

Type Title Here (20-pt Arial bold)

... This document shall be exclusively made available to, and directed at, investors domiciled in Switzerland as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended. Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct A ...

... This document shall be exclusively made available to, and directed at, investors domiciled in Switzerland as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended. Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct A ...

Quarterly Investment Chartbook

... Sense Where Appropriate If a significant duration mismatch exists between investments and liabilities, LDI may make the most sense. LDI is one of the very few scenarios where we see the need to purchase long-duration bonds based on the ...

... Sense Where Appropriate If a significant duration mismatch exists between investments and liabilities, LDI may make the most sense. LDI is one of the very few scenarios where we see the need to purchase long-duration bonds based on the ...

investment funds to isa application form

... We can’t always guarantee the exact amount that your deal will realise. In these cases, we’ll sell the amount stated above, plus an additional 3% in units. This is to make sure we get the amount you require for your ISA, but this may lead to an excess balance. For more information about excess balan ...

... We can’t always guarantee the exact amount that your deal will realise. In these cases, we’ll sell the amount stated above, plus an additional 3% in units. This is to make sure we get the amount you require for your ISA, but this may lead to an excess balance. For more information about excess balan ...

Using Morningstar to Select Funds (TT07)

... bring up a special screen. Where it says “Screen For:” click on [Funds]. This limits our criteria to Mutual Funds. Start by adding the criteria that you think important. Following are four examples and some suggestions that may be helpful. Remember that your criteria may be different than those chos ...

... bring up a special screen. Where it says “Screen For:” click on [Funds]. This limits our criteria to Mutual Funds. Start by adding the criteria that you think important. Following are four examples and some suggestions that may be helpful. Remember that your criteria may be different than those chos ...

Lesson 16 - Mr. Wilson

... Investment banks can come in many different styles and sizes, and this aspect of the industry seems to be constantly changing. For example, up until 2008 you would commonly hear the term bulge bracket in reference to investment banks. This type of investment bank included some of the largest and mos ...

... Investment banks can come in many different styles and sizes, and this aspect of the industry seems to be constantly changing. For example, up until 2008 you would commonly hear the term bulge bracket in reference to investment banks. This type of investment bank included some of the largest and mos ...

simibtopic4 - Homework Market

... (cf. Lindblom, 1959; and Johnson, 1988). • Investment decisions and actual investment commitments are made incrementally as uncertainty is successively reduced. • The more the firm knows about a foreign market, the lower the perceived market risk will be and, consequently, the higher the actual inve ...

... (cf. Lindblom, 1959; and Johnson, 1988). • Investment decisions and actual investment commitments are made incrementally as uncertainty is successively reduced. • The more the firm knows about a foreign market, the lower the perceived market risk will be and, consequently, the higher the actual inve ...

TRANSLATED VERSION As of May 30, 2014 Readers should be

... the Notification of the Securities and Exchange Commission concerning Determination regarding Definition of Institutional Investor and High Net Worth Investor. “high net worth investor” means a high net worth investor under the Notification of the Securities and Exchange Commission concerning Determ ...

... the Notification of the Securities and Exchange Commission concerning Determination regarding Definition of Institutional Investor and High Net Worth Investor. “high net worth investor” means a high net worth investor under the Notification of the Securities and Exchange Commission concerning Determ ...

from the full article

... balanced funds annual returns have varied between minus 12% and plus 18% over the last nearly seven years with an average after tax annual return of between five and six percent. This is a similar average return for the average KiwiSaver growth funds, only here the range of results (minus 18% to plu ...

... balanced funds annual returns have varied between minus 12% and plus 18% over the last nearly seven years with an average after tax annual return of between five and six percent. This is a similar average return for the average KiwiSaver growth funds, only here the range of results (minus 18% to plu ...

How to Pick Managed Investments

... • The aggregate return of all investors in the market will be the market return, (obviously), because all the investors own all the stocks. The market return is the weighted average of passive returns plus active returns. • If the index funds have the same pre-fee return as the market (which is what ...

... • The aggregate return of all investors in the market will be the market return, (obviously), because all the investors own all the stocks. The market return is the weighted average of passive returns plus active returns. • If the index funds have the same pre-fee return as the market (which is what ...

The Quantitative, Data-Based, Risk

... magazine writer named Alfred Winslow Jones, who hung out his shingle in 1949 with $100,000 in capital and a new idea about making money in the market. He wanted to invest aggressively while still trying to protect investors' capital. These would seem to be contradictory goals, but here's how he went ...

... magazine writer named Alfred Winslow Jones, who hung out his shingle in 1949 with $100,000 in capital and a new idea about making money in the market. He wanted to invest aggressively while still trying to protect investors' capital. These would seem to be contradictory goals, but here's how he went ...

Power of Dividends - Investing in global dividend

... defensively positioned and well-diversified portfolio. Stocks that pay dividends provide a return regardless of stock market conditions and price fluctuations. This is one reason why investors have shown relatively stronger demand for dividendpaying stocks during market downturns. The strong balance ...

... defensively positioned and well-diversified portfolio. Stocks that pay dividends provide a return regardless of stock market conditions and price fluctuations. This is one reason why investors have shown relatively stronger demand for dividendpaying stocks during market downturns. The strong balance ...

INVESTMENT POLICY STATEMENT APPROVED JANUARY 30

... The Committee’s intent is to select and retain the best managers or funds for each asset class and to maintain long term mutually beneficial relationships with these managers or funds. It is believed that over time, managers who understand the Foundation's long-term goals will be better able to cont ...

... The Committee’s intent is to select and retain the best managers or funds for each asset class and to maintain long term mutually beneficial relationships with these managers or funds. It is believed that over time, managers who understand the Foundation's long-term goals will be better able to cont ...

Strategic Asset Management (SAM)

... Beginning 12/31/82 and ending 12/31/02, “Rhoda” invests $10,000 on January 1 of each year for twenty years into the worst-performing market segment of the previous year. The money is left in the specific sector for the ...

... Beginning 12/31/82 and ending 12/31/02, “Rhoda” invests $10,000 on January 1 of each year for twenty years into the worst-performing market segment of the previous year. The money is left in the specific sector for the ...

Treasury International Capital System (“TIC”) Form S: Purchases

... Reporters are required to report the gross amount of funds (or assets) transferred to execute a transaction. Purchase amounts should reflect the cost of the securities acquired, including brokerage charges, taxes, and any other expenses incurred by the purchaser. Sales amounts should reflect the pro ...

... Reporters are required to report the gross amount of funds (or assets) transferred to execute a transaction. Purchase amounts should reflect the cost of the securities acquired, including brokerage charges, taxes, and any other expenses incurred by the purchaser. Sales amounts should reflect the pro ...

Business Ethics

... Health Administration. Quality-of-Life Issues. Balancing work and family through flexible work schedules, subsidized child care, and regulation such as the Family and Medical Leave Act of 1993. Ensuring Equal Opportunity on the Job. Providing equal opportunities to all employees without discriminati ...

... Health Administration. Quality-of-Life Issues. Balancing work and family through flexible work schedules, subsidized child care, and regulation such as the Family and Medical Leave Act of 1993. Ensuring Equal Opportunity on the Job. Providing equal opportunities to all employees without discriminati ...

Challenges of Financing Infrastructure

... Risk Profiles: A move away from describing risk according to asset class will enable new innovations that will enable infrastructure investments to be structured for different investment profiles. The actual range of investments by a super fund depends on a number of factors. Some superannuation fun ...

... Risk Profiles: A move away from describing risk according to asset class will enable new innovations that will enable infrastructure investments to be structured for different investment profiles. The actual range of investments by a super fund depends on a number of factors. Some superannuation fun ...

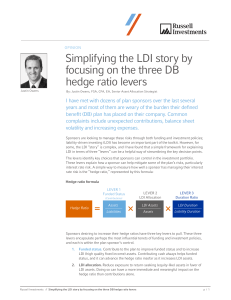

Simplifying the LDI story by focusing on the three DB hedge ratio

... investment, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. Please remember that all investments carry some level of risk, including the potential ...

... investment, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. Please remember that all investments carry some level of risk, including the potential ...

Investor Guide - Private Wealth Pools

... Mackenzie Investments is one of Canada’s leading independent asset managers, distributing investment services to individual Canadians through their advisors, and to institutions globally. In business since 1967, Mackenzie is known for innovative investment solutions, proven investment management exp ...

... Mackenzie Investments is one of Canada’s leading independent asset managers, distributing investment services to individual Canadians through their advisors, and to institutions globally. In business since 1967, Mackenzie is known for innovative investment solutions, proven investment management exp ...

Robustness Test Results

... 1. CrossoverProb = 1.5. Having observed the run of this program there was no specific error in the run of the program. This is because “jgprog” does not have a validation check on the control parameters inputted into the program. However, absolutely no crossover was performed. The same chromosomes o ...

... 1. CrossoverProb = 1.5. Having observed the run of this program there was no specific error in the run of the program. This is because “jgprog” does not have a validation check on the control parameters inputted into the program. However, absolutely no crossover was performed. The same chromosomes o ...

High Quality High Yield Select UMA Seix Advisors

... holdings, performance and other data will vary depending on the size of an account, cash flows within an account, and restrictions on an account. Holdings are subject to change daily. The information in this profile is not a recommendation to buy, hold or sell securities. ...

... holdings, performance and other data will vary depending on the size of an account, cash flows within an account, and restrictions on an account. Holdings are subject to change daily. The information in this profile is not a recommendation to buy, hold or sell securities. ...

Weekly Economic Update - flight wealth management

... a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment. The Dow Jones Industrial Average is a priceweighted index of 30 actively trade ...

... a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment. The Dow Jones Industrial Average is a priceweighted index of 30 actively trade ...

Risk: How Much Is Too Much?

... But just because you’re willing to take on a lot of risk doesn’t mean that you should. And that’s particularly true when you’re investing for your future. Consider some of the ways that your relationship with risk influences investment choices. Personality and risk. Conservative investors who aren’t ...

... But just because you’re willing to take on a lot of risk doesn’t mean that you should. And that’s particularly true when you’re investing for your future. Consider some of the ways that your relationship with risk influences investment choices. Personality and risk. Conservative investors who aren’t ...

1 - Inseta

... CRITICAL CROSS FIELD and DEVELOPMENTAL OUTCOMES: This Unit Standard supports in particular, the following Critical Cross-field Outcomes at NQF Level 5: 1. The learner is able to identify and solve problems in which responses show that responsible decisions using critical thinking have been made in s ...

... CRITICAL CROSS FIELD and DEVELOPMENTAL OUTCOMES: This Unit Standard supports in particular, the following Critical Cross-field Outcomes at NQF Level 5: 1. The learner is able to identify and solve problems in which responses show that responsible decisions using critical thinking have been made in s ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.