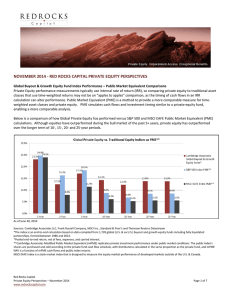

NOVEMBER 2014 - RED ROCKS CAPITAL PRIVATE EQUITY PERSPECTIVES

... KKR & Co, which earlier this year invested in Ethiopian flower company Afriflora, is one of a number of global investment managers capitalizing on growth prospects in Africa. Investment by international shops more than doubled in the first half of the year to $1.5 billion compared with $621 million ...

... KKR & Co, which earlier this year invested in Ethiopian flower company Afriflora, is one of a number of global investment managers capitalizing on growth prospects in Africa. Investment by international shops more than doubled in the first half of the year to $1.5 billion compared with $621 million ...

Key Investor Information

... appear low relative to their long-term profit potential, and which are typically paying an attractive and growing dividend. The fund may also invest in other financial instruments and hold cash on deposit. Derivatives may be used to reduce risk or manage the fund more effectively. ...

... appear low relative to their long-term profit potential, and which are typically paying an attractive and growing dividend. The fund may also invest in other financial instruments and hold cash on deposit. Derivatives may be used to reduce risk or manage the fund more effectively. ...

Saving, Investment & the Financial System

... © 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. ...

... © 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. ...

Templeton Foreign Fund Fact Sheet

... Investors should carefully consider a fund’s investment goals, risks, charges and expenses before investing. To obtain a summary prospectus and/or prospectus, which contains this and other information, talk to your financial advisor, call us at (800) DIAL BEN/342-5236 or visit franklintempleton.com. ...

... Investors should carefully consider a fund’s investment goals, risks, charges and expenses before investing. To obtain a summary prospectus and/or prospectus, which contains this and other information, talk to your financial advisor, call us at (800) DIAL BEN/342-5236 or visit franklintempleton.com. ...

fin 394 14-venture captl fellows prog -nolen

... provided with an opportunity to apply these concepts in actual investment decisions and management of businesses. The course provides the student with an opportunity to integrate and apply the concepts from the major functional areas in business. Because the content varies each semester (later stage ...

... provided with an opportunity to apply these concepts in actual investment decisions and management of businesses. The course provides the student with an opportunity to integrate and apply the concepts from the major functional areas in business. Because the content varies each semester (later stage ...

Resolution Amending Authorized Representatives

... WHereas, it is in the best interest of the participant to invest local funds in investments that provide for the preservation and safety of principal, liquidity, and yield consistent with the public funds investment act; and WHereas, the texas Local government investment pool (“texpool/ texpool prim ...

... WHereas, it is in the best interest of the participant to invest local funds in investments that provide for the preservation and safety of principal, liquidity, and yield consistent with the public funds investment act; and WHereas, the texas Local government investment pool (“texpool/ texpool prim ...

the new face of commodity market the new face of commodity market

... NSEL. This is required for holding E-Series units in demat form. Thereafter, he can buy and sell E-Series products, either by placing orders through the member on phone, else by trading on line by getting a trading terminal through the member. In case of buy transaction, the investor is required to ...

... NSEL. This is required for holding E-Series units in demat form. Thereafter, he can buy and sell E-Series products, either by placing orders through the member on phone, else by trading on line by getting a trading terminal through the member. In case of buy transaction, the investor is required to ...

Infrastructure - African Private Equity and Venture Capital Association

... The African Private Equity and Venture Capital Association is the pan-African industry body which promotes and enables private investment in Africa. AVCA plays an important role as a champion and effective change agent for the industry, educating, equipping and connecting members and stakeholders wi ...

... The African Private Equity and Venture Capital Association is the pan-African industry body which promotes and enables private investment in Africa. AVCA plays an important role as a champion and effective change agent for the industry, educating, equipping and connecting members and stakeholders wi ...

Basics with Equity Market Neutral

... the same time, hold favorite stocks and bet against least favorite stocks. To maintain market neutrality, the funds are typically managed to be zero beta with the market exposure of the long positions offset by the exposure of the short positions. Dollar neutrality is also maintained by matching the ...

... the same time, hold favorite stocks and bet against least favorite stocks. To maintain market neutrality, the funds are typically managed to be zero beta with the market exposure of the long positions offset by the exposure of the short positions. Dollar neutrality is also maintained by matching the ...

Slide 1

... Borrowing cost, repo market are good indicators for liquidity, it could be used to get a long or a short position on liquidity on FI market. ...

... Borrowing cost, repo market are good indicators for liquidity, it could be used to get a long or a short position on liquidity on FI market. ...

Digging Deeper into Stock Diversification

... diversification that you can apply to potentially improve success. The overall objective for the portfolio is determined by your long-term financial goals and tolerance for risk. From there, the first important layer of diversification guides how much to invest across each asset class within equity ...

... diversification that you can apply to potentially improve success. The overall objective for the portfolio is determined by your long-term financial goals and tolerance for risk. From there, the first important layer of diversification guides how much to invest across each asset class within equity ...

es220050945197.ps, page 1-3 @ Normalize_2 ( cs220050945197 )

... This Notice amends Part 2 of Schedule 5 to the Securities and Futures Ordinance (Cap. 571) as follows— (a) the definitions of “advising on futures contracts” and “advising on securities” are amended so that the giving of advice by a person, who is licensed or registered for Type 9 regulated activity ...

... This Notice amends Part 2 of Schedule 5 to the Securities and Futures Ordinance (Cap. 571) as follows— (a) the definitions of “advising on futures contracts” and “advising on securities” are amended so that the giving of advice by a person, who is licensed or registered for Type 9 regulated activity ...

Fact Sheet: The Morningstar Equity Style Box™

... different levels of risk and can lead to differences in returns. Therefore, it is crucial that investors understand style and have a tool to measure their style exposure. Morningstar’s equity style methodology uses a “building block,” holdings-based approach that is consistent with Morningstar’s fun ...

... different levels of risk and can lead to differences in returns. Therefore, it is crucial that investors understand style and have a tool to measure their style exposure. Morningstar’s equity style methodology uses a “building block,” holdings-based approach that is consistent with Morningstar’s fun ...

GIA(net) Portfolio Summary

... Your adviser has assessed your risk profile level as 8. As such, you may be thought of as an ‘adventurous’ investor. As an adventurous investor you are prepared to take on additional investment risk in order to generate higher returns. You understand that this is fundamental to achieving superior lo ...

... Your adviser has assessed your risk profile level as 8. As such, you may be thought of as an ‘adventurous’ investor. As an adventurous investor you are prepared to take on additional investment risk in order to generate higher returns. You understand that this is fundamental to achieving superior lo ...

MFG Investment Policy - Mersberger Financial Group, Inc.

... tolerance. Each model is intended to potentially keep volatility/risk within predefined metrics over a 5 to 10 year time horizon. Volatility/risk parameters are based on historical data of each model over trailing 5 and 10 year time periods. Each model will include equity, fixed income, and non-corr ...

... tolerance. Each model is intended to potentially keep volatility/risk within predefined metrics over a 5 to 10 year time horizon. Volatility/risk parameters are based on historical data of each model over trailing 5 and 10 year time periods. Each model will include equity, fixed income, and non-corr ...

Ch 6

... over 50%. The value of the mutual funds held by households dropped by almost $2T. Investors’ participation in the stock market is affected by their expected returns. Research: investors experiencing bear markets (20% ↓) often reluctant to invest later. So, the financial crisis of 2007–2009 may have ...

... over 50%. The value of the mutual funds held by households dropped by almost $2T. Investors’ participation in the stock market is affected by their expected returns. Research: investors experiencing bear markets (20% ↓) often reluctant to invest later. So, the financial crisis of 2007–2009 may have ...

- CitiBank.cz

... legislation, known as MiFID (European Parliament and Council 2004/39/EC of 21 April 2004 on markets in financial instruments), which was transposed into Czech law by the Capital Market Act Nr. 256/2004 Coll., as amended, and further regulations governing the rules for investment services. This legis ...

... legislation, known as MiFID (European Parliament and Council 2004/39/EC of 21 April 2004 on markets in financial instruments), which was transposed into Czech law by the Capital Market Act Nr. 256/2004 Coll., as amended, and further regulations governing the rules for investment services. This legis ...

Advanced Accounting by Hoyle et al, 6th Edition

... Unrealized holding gains and losses are reported in shareholders’ equity as other comprehensive income (ie, not included in net income). ...

... Unrealized holding gains and losses are reported in shareholders’ equity as other comprehensive income (ie, not included in net income). ...

managed volatility strategies defending returns in

... A managed volatility strategy seeks to invest in the stock market by minimising steep price declines whilst participating on the upside. This would potentially translate into equity returns similar if not better than the market, with potentially attractive yields and lower volatility than traditiona ...

... A managed volatility strategy seeks to invest in the stock market by minimising steep price declines whilst participating on the upside. This would potentially translate into equity returns similar if not better than the market, with potentially attractive yields and lower volatility than traditiona ...

CF Heartwood Growth Multi Asset Fund

... Charges for this Fund The charges you pay are used to pay the costs of running the fund. These charges reduce the potential growth of your investment. The ongoing charges figure is based on expenses as at 31st July 2016. This figure may vary from year to year. The ongoing charges are taken from the ...

... Charges for this Fund The charges you pay are used to pay the costs of running the fund. These charges reduce the potential growth of your investment. The ongoing charges figure is based on expenses as at 31st July 2016. This figure may vary from year to year. The ongoing charges are taken from the ...

From Cattle to Cotton to Corn

... It’s All About Diversification Many portfolios typically comprise of just two asset classes, stocks and bonds. However, investors tend to further diversify their portfolios, allocating a portion of their holdings to non-traditional securities such as commodities. These securities are not correlated ...

... It’s All About Diversification Many portfolios typically comprise of just two asset classes, stocks and bonds. However, investors tend to further diversify their portfolios, allocating a portion of their holdings to non-traditional securities such as commodities. These securities are not correlated ...

Roll out the red carpet and they will come: Investment promotion and

... encompassing popular FDI destinations, countries close to existing operations and emerging FDI destinations is created. The third group represents an opportunity for an IPA that, by advertising in the business press and participating in industry fairs, can draw attention to its country. In the secon ...

... encompassing popular FDI destinations, countries close to existing operations and emerging FDI destinations is created. The third group represents an opportunity for an IPA that, by advertising in the business press and participating in industry fairs, can draw attention to its country. In the secon ...

this PDF file

... to the other statements like Income statement and Balance Sheet. Financial statements are largely used by the institutional investors such as insurance companies, mutual fund companies and many more and then by the financial analysts. The uses of company's financial report by the ...

... to the other statements like Income statement and Balance Sheet. Financial statements are largely used by the institutional investors such as insurance companies, mutual fund companies and many more and then by the financial analysts. The uses of company's financial report by the ...

Document

... 6. Which sources of investment information are the most helpful to investors? 7. What can investors learn from stock, bond, and mutual fund quotations? 8. What are the current trends in the securities markets? ...

... 6. Which sources of investment information are the most helpful to investors? 7. What can investors learn from stock, bond, and mutual fund quotations? 8. What are the current trends in the securities markets? ...

FIRST ASSET CANADIAN DIVIDEND LOW VOLATILITY INDEX ETF

... First Asset, a CI Financial Company, is a Canadian investment firm delivering a comprehensive suite of smart ETF solutions. Rooted in strong fundamentals, First Asset`s smart solutions strive to deliver better risk-adjusted returns than the broad market while helping investors achieve their personal ...

... First Asset, a CI Financial Company, is a Canadian investment firm delivering a comprehensive suite of smart ETF solutions. Rooted in strong fundamentals, First Asset`s smart solutions strive to deliver better risk-adjusted returns than the broad market while helping investors achieve their personal ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.