PSF Floating Rate Loan - Pacific Life Annuities

... Fund Distributors, Inc., Neuberger Berman Management LLC, OppenheimerFunds Distributor, Inc., PIMCO Investments LLC, State Street Global Markets, VanEck Securities Corporation, and the products each distributes are not affiliated with Pacific Life or Pacific Select Distributors, LLC. Third-party tra ...

... Fund Distributors, Inc., Neuberger Berman Management LLC, OppenheimerFunds Distributor, Inc., PIMCO Investments LLC, State Street Global Markets, VanEck Securities Corporation, and the products each distributes are not affiliated with Pacific Life or Pacific Select Distributors, LLC. Third-party tra ...

A Guide to Irish Regulated Real Estate Funds

... Authorisation Process The authorisation process for Irish regulated funds has two main elements – the authorisation process for the fund itself and the authorisation process for its promoter and service providers. Fund Authorisation Process For retail funds and for PIFs the fund documentation (pros ...

... Authorisation Process The authorisation process for Irish regulated funds has two main elements – the authorisation process for the fund itself and the authorisation process for its promoter and service providers. Fund Authorisation Process For retail funds and for PIFs the fund documentation (pros ...

BA 275, Fall 1998 Quantitative Business Methods

... total number of advertisements authorized. In addition, television should account for at least 10% of the total number of advertisements authorized. If the promotional budget is limited to $18,200, how many commercial messages should be run on each medium to maximize total audience contact? Formulat ...

... total number of advertisements authorized. In addition, television should account for at least 10% of the total number of advertisements authorized. If the promotional budget is limited to $18,200, how many commercial messages should be run on each medium to maximize total audience contact? Formulat ...

10.xxx Endowment Funds - UNT Health Science Center

... established for one complete quarter. The target distribution of spendable income to each unit of the endowment fund will be between 3 to 6 percent of the average market value of a unit of the endowment fund for the preceding 12 quarters. Unless otherwise determined by the Board of Regents Finance C ...

... established for one complete quarter. The target distribution of spendable income to each unit of the endowment fund will be between 3 to 6 percent of the average market value of a unit of the endowment fund for the preceding 12 quarters. Unless otherwise determined by the Board of Regents Finance C ...

Regime-Based Asset Allocation

... The Federal Reserve Bank of St. Louis is one of the 12 regional reserve banks in the Fed System. ...

... The Federal Reserve Bank of St. Louis is one of the 12 regional reserve banks in the Fed System. ...

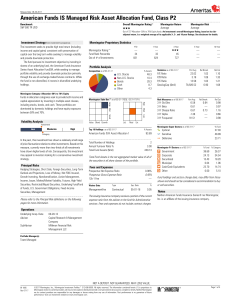

American Funds IS Managed Risk Asset Allocation Fund

... allocation and investment strategies do not perform as expected, which may cause the portfolio to underperform its benchmark, other investments with similar objectives, or the market in general. The investment is subject to the risk of loss of income and capital invested, and the advisor does not gu ...

... allocation and investment strategies do not perform as expected, which may cause the portfolio to underperform its benchmark, other investments with similar objectives, or the market in general. The investment is subject to the risk of loss of income and capital invested, and the advisor does not gu ...

MIS12 Ch14 LT1 Capital Budgeting Methods for

... Heartland Stores is a general merchandise retail chain operating in eight midwestern states. It has five regional distribution centers, 377 stores, and about 14,000 different products stocked in each store. The company is considering investing in new software and hardware modules to upgrade its exis ...

... Heartland Stores is a general merchandise retail chain operating in eight midwestern states. It has five regional distribution centers, 377 stores, and about 14,000 different products stocked in each store. The company is considering investing in new software and hardware modules to upgrade its exis ...

American Funds® IS US Govt/AAA

... Fund Distributors, Inc., Neuberger Berman Management LLC, OppenheimerFunds Distributor, Inc., PIMCO Investments LLC, State Street Global Markets, VanEck Securities Corporation, and the products each distributes are not affiliated with Pacific Life or Pacific Select Distributors, LLC. Third-party tra ...

... Fund Distributors, Inc., Neuberger Berman Management LLC, OppenheimerFunds Distributor, Inc., PIMCO Investments LLC, State Street Global Markets, VanEck Securities Corporation, and the products each distributes are not affiliated with Pacific Life or Pacific Select Distributors, LLC. Third-party tra ...

Fact Sheet: The Morningstar Style Box™

... robust approach to style analysis is a powerful lens for understanding stocks, funds, and portfolios. ...

... robust approach to style analysis is a powerful lens for understanding stocks, funds, and portfolios. ...

No Slide Title

... Through the use of a financial metric (free cash flow) rather than an accounting metric (earnings) it is easier to discern those firms most likely to utilize their free cash flow intelligently for shareholder value creation. If the return on incremental capital to be deployed in the business is eq ...

... Through the use of a financial metric (free cash flow) rather than an accounting metric (earnings) it is easier to discern those firms most likely to utilize their free cash flow intelligently for shareholder value creation. If the return on incremental capital to be deployed in the business is eq ...

Factsheet - Venture Capital Trusts

... Venture Capital Trusts (VCTs) are investment companies which typically invest in unquoted shares including new shares of privately owned companies, and new shares of companies that are traded on the Alternative Investment Market (AIM) and PLUS Market. VCTs were launched in 1995 as vehicles to encour ...

... Venture Capital Trusts (VCTs) are investment companies which typically invest in unquoted shares including new shares of privately owned companies, and new shares of companies that are traded on the Alternative Investment Market (AIM) and PLUS Market. VCTs were launched in 1995 as vehicles to encour ...

Add Title here - Textile Development Unit in Tanzania

... • Ever since the mid 1990s Tanzania has followed a path of liberalisation and privatisation. It has welcomed foreign investment and managed to attracted more FDI than Kenya or Rwanda, particularly in areas such as agriculture, tourism, mining and FMCG • The government is continuing to pursue Public ...

... • Ever since the mid 1990s Tanzania has followed a path of liberalisation and privatisation. It has welcomed foreign investment and managed to attracted more FDI than Kenya or Rwanda, particularly in areas such as agriculture, tourism, mining and FMCG • The government is continuing to pursue Public ...

Week12.1 Asset Allocation - B-K

... – Do you know more than the pros? – Placing a bet – Think of the person on the other side of a trade as an evil genius. They’re probably not evil, but they are very smart. ...

... – Do you know more than the pros? – Placing a bet – Think of the person on the other side of a trade as an evil genius. They’re probably not evil, but they are very smart. ...

The International Diversification Fallacy of Exchange

... through an index fund will provide a hedge against many potential pitfalls. In addition to the potential for impressive returns, indexing allows for low trading costs due to its passive management style. Indexing also assists in international stock selection that can prove challenging to some fund m ...

... through an index fund will provide a hedge against many potential pitfalls. In addition to the potential for impressive returns, indexing allows for low trading costs due to its passive management style. Indexing also assists in international stock selection that can prove challenging to some fund m ...

the relevance of real estate market trends for investment property

... The analysis considers first of all the asset allocation of the real estate funds and compare the weight assigned to each type of asset (office, retail, industrial, residential and other) with the real estate trend. The analysis is released using a standard pairwise correlation measure and a F test ...

... The analysis considers first of all the asset allocation of the real estate funds and compare the weight assigned to each type of asset (office, retail, industrial, residential and other) with the real estate trend. The analysis is released using a standard pairwise correlation measure and a F test ...

SRT510 Business Case Studies

... an investment is higher risk, a “risk premium” is often added to the discount rate to compensate for the risk (e.g. that the investment will not meet projected cash flows). This means that the discount rate for a higher risk investment will typically be higher. ...

... an investment is higher risk, a “risk premium” is often added to the discount rate to compensate for the risk (e.g. that the investment will not meet projected cash flows). This means that the discount rate for a higher risk investment will typically be higher. ...

officers - Maine Estate Planning Council

... grew 14% per annum compared to just 2% per annum for traditional investments, from 2005 to 2011. By the end of 2015, alternative investments are expected to account for a quarter of all revenue earned by financial service firms from high-net worth clients. Bartley Parker of MainePERS will define alt ...

... grew 14% per annum compared to just 2% per annum for traditional investments, from 2005 to 2011. By the end of 2015, alternative investments are expected to account for a quarter of all revenue earned by financial service firms from high-net worth clients. Bartley Parker of MainePERS will define alt ...

lifeplan icfs financial advice satisfaction index

... 1. Wealthier investors are most concerned about advice on retirement plans and how to manage financial risk. The wealthiest investors are most concerned about financial risk management, for both genders. Different wealth groups put equal importance on wealth transfer services. 2. All investors wer ...

... 1. Wealthier investors are most concerned about advice on retirement plans and how to manage financial risk. The wealthiest investors are most concerned about financial risk management, for both genders. Different wealth groups put equal importance on wealth transfer services. 2. All investors wer ...

Wisconsin`s Uniform Prudent Management of Institutional Act

... investor in a like position would exercise under similar circumstances. May incur only costs that are appropriate and reasonable in relation to the assets, the purposes of the institution, and the skills available to the institution. Shall make a reasonable effort to verify facts relevant to the man ...

... investor in a like position would exercise under similar circumstances. May incur only costs that are appropriate and reasonable in relation to the assets, the purposes of the institution, and the skills available to the institution. Shall make a reasonable effort to verify facts relevant to the man ...

ENDOWMENT TRUSTEES

... reported positive results. Additionally, comparisons to their respective benchmarks were also positive with a few exceptions. The results in the 1st quarter were probably the strongest quarterly market results since 1998. Many market pundits felt that this was the result of too much investor exubera ...

... reported positive results. Additionally, comparisons to their respective benchmarks were also positive with a few exceptions. The results in the 1st quarter were probably the strongest quarterly market results since 1998. Many market pundits felt that this was the result of too much investor exubera ...

automatic enrollment under irs revenue ruling 98-30

... including December 23, 2007 was a stable value fund as defined under the Qualified Default Investment Alternative regulations.] Any contributions credited to your participant account prior to and including December 23, 2007, for which you made no investment selection, are invested in the [insert the ...

... including December 23, 2007 was a stable value fund as defined under the Qualified Default Investment Alternative regulations.] Any contributions credited to your participant account prior to and including December 23, 2007, for which you made no investment selection, are invested in the [insert the ...

the Research Summary

... public sector pension plans will remain solvent has declined, raising concerns about their sustainability. The average funding ratio, commonly used to evaluate the fiscal solvency of public sector pensions, has declined nationwide from about 84 percent in 2008 to 72 percent in 2012. Ohio in particul ...

... public sector pension plans will remain solvent has declined, raising concerns about their sustainability. The average funding ratio, commonly used to evaluate the fiscal solvency of public sector pensions, has declined nationwide from about 84 percent in 2008 to 72 percent in 2012. Ohio in particul ...

OPERS What Plan to Choose

... *Refunded time must be purchased in the plan from which the the member refunded. **Can purchase contributing months. See Member Handbook for details. ...

... *Refunded time must be purchased in the plan from which the the member refunded. **Can purchase contributing months. See Member Handbook for details. ...

Changes to Hong Kong`s Professional Investor

... would be loosened if the financial institution through their internal check finds out that the investors fall into the definition of Professional Investor. With this hidden loophole, a floodgate of complaints may arise which would have negative impact on market as a whole. Furthermore, even though t ...

... would be loosened if the financial institution through their internal check finds out that the investors fall into the definition of Professional Investor. With this hidden loophole, a floodgate of complaints may arise which would have negative impact on market as a whole. Furthermore, even though t ...

Mutual fund

... Funds (ETFs): Some Basics Financial services organization that receives money from shareholders and invests it on their behalf Investors become part owners in a securities portfolio More people invest in mutual funds than any other financial product ...

... Funds (ETFs): Some Basics Financial services organization that receives money from shareholders and invests it on their behalf Investors become part owners in a securities portfolio More people invest in mutual funds than any other financial product ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.