Real estate has a place in a well-diversified investment

... with equities. By most accounts, the majority of pension funds have 40‒60% allocated to stocks, the riskiest asset class. Any time a pension fund with high equity risk introduces a less volatile asset class that has low correlations to equities, it will improve diversification. Real estate historica ...

... with equities. By most accounts, the majority of pension funds have 40‒60% allocated to stocks, the riskiest asset class. Any time a pension fund with high equity risk introduces a less volatile asset class that has low correlations to equities, it will improve diversification. Real estate historica ...

Endowment Investment Policy

... of return on total Endowment Fund assets, with a concern for stability and preservation of principal. 3. When selecting securities, the investment manager(s) or investment advisor(s) without discretion (brokers) are expected to prudently diversify the investments of the Endowment fund consistent wit ...

... of return on total Endowment Fund assets, with a concern for stability and preservation of principal. 3. When selecting securities, the investment manager(s) or investment advisor(s) without discretion (brokers) are expected to prudently diversify the investments of the Endowment fund consistent wit ...

Providers - Multnomah County

... Products in which participants may invest their money. To make changes to where your money is invested log on to your Voya account or call their Customer Service Center. There are no fees for changing your investment elections, but there is a limit on how often you can do this. Voya has adopted an e ...

... Products in which participants may invest their money. To make changes to where your money is invested log on to your Voya account or call their Customer Service Center. There are no fees for changing your investment elections, but there is a limit on how often you can do this. Voya has adopted an e ...

columbia high quality high yield fixed income

... Important disclosures for performance and asset information on page 1: There is no guarantee the objective will be achieved or that any return expectations will be met. Past performance does not guarantee future results. Periods over one year are annualized. Portfolios are valued and composite retur ...

... Important disclosures for performance and asset information on page 1: There is no guarantee the objective will be achieved or that any return expectations will be met. Past performance does not guarantee future results. Periods over one year are annualized. Portfolios are valued and composite retur ...

Results of DNB investment surveys into alternative investments by

... part of the investment process. By assessing investment proposals in advance, pension funds can avoid making investments which are not in keeping with their policy. At the same time, predetermined procedures guarantee that the selection is made in a uniform, structured and transparent manner. This e ...

... part of the investment process. By assessing investment proposals in advance, pension funds can avoid making investments which are not in keeping with their policy. At the same time, predetermined procedures guarantee that the selection is made in a uniform, structured and transparent manner. This e ...

Fact Sheet: The New Morningstar Style Box™ Methodology

... construction based on what funds actually held, rather than assumptions based on a fund’s name or how it was described by its marketers. In time, the Style BoxTM became the basis for Morningstar’s style-based fund categories, a move later followed by other fund trackers. Building Better Portfolios M ...

... construction based on what funds actually held, rather than assumptions based on a fund’s name or how it was described by its marketers. In time, the Style BoxTM became the basis for Morningstar’s style-based fund categories, a move later followed by other fund trackers. Building Better Portfolios M ...

Chapter 7 12

... year and the $50,000 cash must be entirely invested in one of the stocks shown in Table 7.8. What is the safest attainable portfolio under these restrictions? Safest” means lowest risk; in a portfolio context, this means lowest variance of return. Half of the portfolio is invested in Alcan stock, an ...

... year and the $50,000 cash must be entirely invested in one of the stocks shown in Table 7.8. What is the safest attainable portfolio under these restrictions? Safest” means lowest risk; in a portfolio context, this means lowest variance of return. Half of the portfolio is invested in Alcan stock, an ...

2012-13 Babson Entrepreneurs and Executives-in

... Daymond’s creative vision and foresight enabled him to build one of the most iconic fashion brands in recent years. FUBU, standing for “For Us By Us,” represented a lifestyle that was neglected by other clothing companies. Realizing this marketplace void, John created the untapped urban apparel spac ...

... Daymond’s creative vision and foresight enabled him to build one of the most iconic fashion brands in recent years. FUBU, standing for “For Us By Us,” represented a lifestyle that was neglected by other clothing companies. Realizing this marketplace void, John created the untapped urban apparel spac ...

Coronation Granite Fixed Income Fund Fact Sheet

... made it clear that the MPC is still in a rate normalisation cycle, and more tightening can be expected. Nonetheless, the MPC revised both its inflation and growth forecasts. A nearterm deterioration in inflation came as a result of a higher food inflation forecast. The SARB now sees inflation averag ...

... made it clear that the MPC is still in a rate normalisation cycle, and more tightening can be expected. Nonetheless, the MPC revised both its inflation and growth forecasts. A nearterm deterioration in inflation came as a result of a higher food inflation forecast. The SARB now sees inflation averag ...

MWRA Side Letter

... General Laws Chapter 32, §§ 23(2)(g)(ii) and (iii), no funds of the MWRA Employees’ Retirement System can be invested in any bank or financial institution which directly or through any subsidiary has outstanding loans to any individual corporation engaged in the manufacture, distribution or sale of ...

... General Laws Chapter 32, §§ 23(2)(g)(ii) and (iii), no funds of the MWRA Employees’ Retirement System can be invested in any bank or financial institution which directly or through any subsidiary has outstanding loans to any individual corporation engaged in the manufacture, distribution or sale of ...

IEF 213 - Portfolio Management

... equity management and style analysis. The author uses a new global factor–return equity database, defined in 1990 and allowed to evolve over time, that was designed to avoid incurring some of the common critiques of market anomaly studies. The framework and data the author presents are intended to e ...

... equity management and style analysis. The author uses a new global factor–return equity database, defined in 1990 and allowed to evolve over time, that was designed to avoid incurring some of the common critiques of market anomaly studies. The framework and data the author presents are intended to e ...

Privatization: Pros and Cons

... – You will be smart enough to always have high rates of return – You will be smart enough to outsmart the market ...

... – You will be smart enough to always have high rates of return – You will be smart enough to outsmart the market ...

Finance , Saving, And Investment,

... Boeing has issued 900 million shares of its stock. If you owned 900 Boeing shares, you would own 1 millionth of Boeing and be entitled to receive 1 millionth of its profit. ...

... Boeing has issued 900 million shares of its stock. If you owned 900 Boeing shares, you would own 1 millionth of Boeing and be entitled to receive 1 millionth of its profit. ...

The Facts about Fossil Fuel Divestment

... trendsetters and leaders. They are also responsible for the future livelihood of many in the US—which makes it doublyimportant that they remove their investments from overvalued fossil fuels, often referred to as “the carbon bubble.” The more pension funds who address this risk, the more steps we ...

... trendsetters and leaders. They are also responsible for the future livelihood of many in the US—which makes it doublyimportant that they remove their investments from overvalued fossil fuels, often referred to as “the carbon bubble.” The more pension funds who address this risk, the more steps we ...

Joining the family business: An emerging opportunity for investors

... family- and founder-owned businesses around the world survive to the third generation as familyowned businesses,6 and it’s an open question whether those in emerging markets will fare any better. History suggests they won’t. While statistics are scarce, a comparison of the top 20 familyowned busines ...

... family- and founder-owned businesses around the world survive to the third generation as familyowned businesses,6 and it’s an open question whether those in emerging markets will fare any better. History suggests they won’t. While statistics are scarce, a comparison of the top 20 familyowned busines ...

Cole E. Backstrom, CFP - Novation Credit Union

... Securities and advisory services offered through Cetera Advisor Networks LLC, Member FINRA/SIPC. Cetera Advisor Networks and Novation Credit Union are not affiliated companies. ...

... Securities and advisory services offered through Cetera Advisor Networks LLC, Member FINRA/SIPC. Cetera Advisor Networks and Novation Credit Union are not affiliated companies. ...

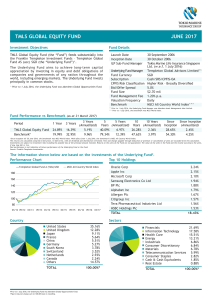

tmls global equity fund june 2017

... • Global equities advanced in the first quarter of 2017 as investors weighed a broadening global economic recovery and continued corporate earnings strength against the perception of elevated political risk in major western economies. Market trends shifted as the reflationary “Trump Trade” gave way ...

... • Global equities advanced in the first quarter of 2017 as investors weighed a broadening global economic recovery and continued corporate earnings strength against the perception of elevated political risk in major western economies. Market trends shifted as the reflationary “Trump Trade” gave way ...

CI LifeCycle Portfolios

... and recommendations are critical underpinnings of the program. SSgA, a global leader in institutional asset management, has more than US$2.3 trillion* in assets under management, including US$30 billion in target date solutions in North America as of December 31, 2014. CI Investment Consulting’s phi ...

... and recommendations are critical underpinnings of the program. SSgA, a global leader in institutional asset management, has more than US$2.3 trillion* in assets under management, including US$30 billion in target date solutions in North America as of December 31, 2014. CI Investment Consulting’s phi ...

Key Investor Information

... appear low relative to their long-term profit potential, and which are typically paying an attractive and growing dividend. The fund may also invest in other financial instruments and hold cash on deposit. Derivatives may be used to reduce risk or manage the fund more effectively. ...

... appear low relative to their long-term profit potential, and which are typically paying an attractive and growing dividend. The fund may also invest in other financial instruments and hold cash on deposit. Derivatives may be used to reduce risk or manage the fund more effectively. ...

Credit Union-Owned Life Insurance

... benefits. CUOLI can also provide the credit union with the ability to offset expenses from existing benefit programs. Many credit unions utilize CUOLI as an investment strategy to fund, or cost-offset, benefit programs designed to reward and retain key employees. However, CUOLI is very flexible and ...

... benefits. CUOLI can also provide the credit union with the ability to offset expenses from existing benefit programs. Many credit unions utilize CUOLI as an investment strategy to fund, or cost-offset, benefit programs designed to reward and retain key employees. However, CUOLI is very flexible and ...

Far Horizon Investments - Penn State Smeal College of Business

... A large expected return, by itself, does not necessarily a good investment make. For instance, stocks, on average, have a higher expected return than bonds. Does that mean everybody should buy stocks and no one should hold bonds? The difference is that bonds are less risky than stocks. All other thi ...

... A large expected return, by itself, does not necessarily a good investment make. For instance, stocks, on average, have a higher expected return than bonds. Does that mean everybody should buy stocks and no one should hold bonds? The difference is that bonds are less risky than stocks. All other thi ...

TCW High Dividend Equities Fund Summary Prospectus

... the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The cost of investing in the Fund reflects the net expenses of the Fund that result from the contractual expense limitation in the first year only ...

... the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The cost of investing in the Fund reflects the net expenses of the Fund that result from the contractual expense limitation in the first year only ...

GENERAL Retirement Plan Enrollment Form *088004*

... Fees reduce your retirement benefit. Over 30 years, an annual fee of 0.50% on a fund ($5 per $1,000 account balance) will reduce your final account balance by approximately 15%. For more information about each FRS Investment Plan fund, please review the fund profiles and the Investment Fund Summary ...

... Fees reduce your retirement benefit. Over 30 years, an annual fee of 0.50% on a fund ($5 per $1,000 account balance) will reduce your final account balance by approximately 15%. For more information about each FRS Investment Plan fund, please review the fund profiles and the Investment Fund Summary ...

Discussion of the Index Rule Change for MVIS Global

... prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing. This content is published in the United States for residents of specified countries. Investors are subjec ...

... prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing. This content is published in the United States for residents of specified countries. Investors are subjec ...

Gary A. Weuve, CLU, ChFC, RFC®, CRPC®, CFP

... Gary A. Weuve leads The Center for Advisor Excellence™ that supports, advises, and guides financial advisors to help them continue to grow their business. He is a Practice Management Consultant for the MEMBERS Insurance and Investments and Retirement Plan Services product groups for CUNA Mutual Grou ...

... Gary A. Weuve leads The Center for Advisor Excellence™ that supports, advises, and guides financial advisors to help them continue to grow their business. He is a Practice Management Consultant for the MEMBERS Insurance and Investments and Retirement Plan Services product groups for CUNA Mutual Grou ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.