Annual Report 2011-2012 - Financial Intelligence Centre

... terror financing The Financial Action Task Force (FATF) is the global standard-setter in combating money laundering and the financing of terrorism and the proliferation of weapons of mass destruction. It has 36 members – including South Africa, which is the only African representative – and its Reco ...

... terror financing The Financial Action Task Force (FATF) is the global standard-setter in combating money laundering and the financing of terrorism and the proliferation of weapons of mass destruction. It has 36 members – including South Africa, which is the only African representative – and its Reco ...

THE VALUE RELEVANCE OF MANAGERS` AND

... The PCAOB currently proposes that auditors communicate second-order information from auditors about material measurement uncertainty as critical auditing matters (hereafter, CAudMs) in audit reports (PCAOB 2016). When material measurement uncertainty exists, auditors can only obtain assurance over a ...

... The PCAOB currently proposes that auditors communicate second-order information from auditors about material measurement uncertainty as critical auditing matters (hereafter, CAudMs) in audit reports (PCAOB 2016). When material measurement uncertainty exists, auditors can only obtain assurance over a ...

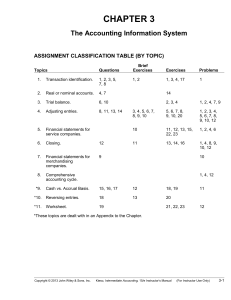

chap.3 - HCC Learning Web

... 18. The income statement classifies amounts into such categories as gross profit, income from operations, income before taxes, and net income. The statement of retained earnings shows the changes in retained earnings during the period. A classified balance sheet classifies assets and liabilities int ...

... 18. The income statement classifies amounts into such categories as gross profit, income from operations, income before taxes, and net income. The statement of retained earnings shows the changes in retained earnings during the period. A classified balance sheet classifies assets and liabilities int ...

English - EDUCatt

... speakers of English to use English successfully in the auditing profession. The 10 units provide vocabulary, reading, writing, speaking exercises and pronunciation and include a considerable amount of authentic texts provided by ENI. This means that the book should prepare would-be auditors for the ...

... speakers of English to use English successfully in the auditing profession. The 10 units provide vocabulary, reading, writing, speaking exercises and pronunciation and include a considerable amount of authentic texts provided by ENI. This means that the book should prepare would-be auditors for the ...

Chapter_2_Solutions

... 2-10 Companies can generate additional revenues by (1) deepening relationships with existing customers by selling additional products or services, or (2) by introducing new products, selling products or services to new customers, or by expanding into new markets. 2-11 Productivity improvements can b ...

... 2-10 Companies can generate additional revenues by (1) deepening relationships with existing customers by selling additional products or services, or (2) by introducing new products, selling products or services to new customers, or by expanding into new markets. 2-11 Productivity improvements can b ...

public finance management act no. 1 of 1999

... 3. Institutions to which this Act applies.— (1) This Act, to the extent indicated in the Act, applies to— (a) departments; (b) public entities listed in Schedule 2 or 3; (c) constitutional institutions; and (d) Parliament and the provincial legislatures, subject to subsection (2). (2) To the extent ...

... 3. Institutions to which this Act applies.— (1) This Act, to the extent indicated in the Act, applies to— (a) departments; (b) public entities listed in Schedule 2 or 3; (c) constitutional institutions; and (d) Parliament and the provincial legislatures, subject to subsection (2). (2) To the extent ...

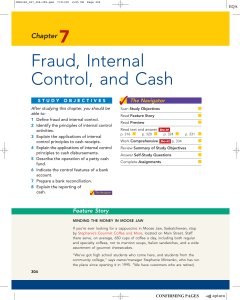

Fraud, Internal Control, and Cash 7

... clear that the organization values integrity and that unethical activity will not be tolerated. This component is often referred to as the “tone at the top.” Risk assessment. Companies must identify and analyze the various factors that create risk for the business and must determine how to manage th ...

... clear that the organization values integrity and that unethical activity will not be tolerated. This component is often referred to as the “tone at the top.” Risk assessment. Companies must identify and analyze the various factors that create risk for the business and must determine how to manage th ...

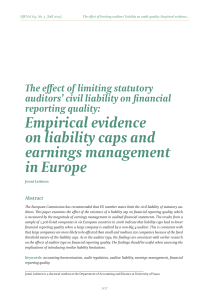

Empirical evidence on liability caps and earnings management in

... higher liability risk. This applies to expected damage payments as well as potential loss of reputation6. The fixed monetary caps affect the liability risks associated with each audit client only when the potential damage payments following from an audit failure are larger than the monetary cap. The ...

... higher liability risk. This applies to expected damage payments as well as potential loss of reputation6. The fixed monetary caps affect the liability risks associated with each audit client only when the potential damage payments following from an audit failure are larger than the monetary cap. The ...

FREE Sample Here - Find the cheapest test bank for your

... b. The Treadway Commission has released reports detailing internal control systems. c. Management’s Report on Internal Control over Financial Reporting and the independent public accounting firm report to the shareholders and board of directors often refer to criteria established on internal control ...

... b. The Treadway Commission has released reports detailing internal control systems. c. Management’s Report on Internal Control over Financial Reporting and the independent public accounting firm report to the shareholders and board of directors often refer to criteria established on internal control ...

FASB: Status of Statement 5

... Disclosure of the nature of an accrual 5 made pursuant to the provisions of paragraph 8, and in some circumstances the amount accrued, may be necessary for the financial statements not to be misleading. 10. If no accrual is made for a loss contingency because one or both of the conditions in paragra ...

... Disclosure of the nature of an accrual 5 made pursuant to the provisions of paragraph 8, and in some circumstances the amount accrued, may be necessary for the financial statements not to be misleading. 10. If no accrual is made for a loss contingency because one or both of the conditions in paragra ...

FASB: Status of Statement 5

... Disclosure of the nature of an accrual 5 made pursuant to the provisions of paragraph 8, and in some circumstances the amount accrued, may be necessary for the financial statements not to be misleading. 10. If no accrual is made for a loss contingency because one or both of the conditions in paragra ...

... Disclosure of the nature of an accrual 5 made pursuant to the provisions of paragraph 8, and in some circumstances the amount accrued, may be necessary for the financial statements not to be misleading. 10. If no accrual is made for a loss contingency because one or both of the conditions in paragra ...

Detecting asset misappropriation: a framework for

... The current study is more concerned about internal or occupational fraud, and more specifically asset misappropriation for several reasons. First, occupational fraud is the most common and costly type of fraud and occurs more frequently than external fraud (ACFE, 2010, 2012; PWC, 2010; Hassink, et a ...

... The current study is more concerned about internal or occupational fraud, and more specifically asset misappropriation for several reasons. First, occupational fraud is the most common and costly type of fraud and occurs more frequently than external fraud (ACFE, 2010, 2012; PWC, 2010; Hassink, et a ...

accounting revision notes and assessment tasks

... 1. True profits cannot be known – since detailed information about the expenses etc. is not available and true profits cannot known. 2. Financial position of the business cannot be ascertained – under this system statement of affairs is prepared in an unsatisfactory manner thus exact position of tot ...

... 1. True profits cannot be known – since detailed information about the expenses etc. is not available and true profits cannot known. 2. Financial position of the business cannot be ascertained – under this system statement of affairs is prepared in an unsatisfactory manner thus exact position of tot ...

Staff Guidance for Auditors of SEC-Registered Brokers and

... "Commission") adopted amendments to Rule 17a-5 under the Securities Exchange Act of 1934 ("Exchange Act") ("SEC Rule 17a-5"), 1 that, among other things, require audits of brokers 2 and dealers 3 to be performed in accordance with the standards of the Public Company Accounting Oversight Board ("PCAO ...

... "Commission") adopted amendments to Rule 17a-5 under the Securities Exchange Act of 1934 ("Exchange Act") ("SEC Rule 17a-5"), 1 that, among other things, require audits of brokers 2 and dealers 3 to be performed in accordance with the standards of the Public Company Accounting Oversight Board ("PCAO ...

CHAPTER 1 – Principles of Accounting

... with special regulations, restrictions, or limitations. (GASB Cod. Sec. 1100.102. See also Sec. 1300, “Fund Accounting.”) Because all governmental units receive financial resources that may be used only in accordance with restrictions established by law or by agreements with donors or grantors, thei ...

... with special regulations, restrictions, or limitations. (GASB Cod. Sec. 1100.102. See also Sec. 1300, “Fund Accounting.”) Because all governmental units receive financial resources that may be used only in accordance with restrictions established by law or by agreements with donors or grantors, thei ...

Substantive Tests of Transactions and Balances

... transaction documents, it is important to be specific about the purpose of particular procedures. Dual-purpose tests should be narrowly defined to include only those tests that are specifically planned to provide direct evidence of both controls and substantive matters. In a broad sense, all audit t ...

... transaction documents, it is important to be specific about the purpose of particular procedures. Dual-purpose tests should be narrowly defined to include only those tests that are specifically planned to provide direct evidence of both controls and substantive matters. In a broad sense, all audit t ...

Notification 297/2015 dated 28th December, 2015 - Regarding the Internal Audit Manual (672 KB)

... designed to add value and improve an organization’s operations. It helps the organization to accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. With commitment to integrity and acco ...

... designed to add value and improve an organization’s operations. It helps the organization to accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. With commitment to integrity and acco ...

accounting - WordPress.com

... A major accounting method that recognizes revenues and expenses at the time physical cash is actually received or paid out. This contrasts to the other major accounting method, accrual accounting, which requires income to be recognized in a company's books at the time the revenue is earned (but not ...

... A major accounting method that recognizes revenues and expenses at the time physical cash is actually received or paid out. This contrasts to the other major accounting method, accrual accounting, which requires income to be recognized in a company's books at the time the revenue is earned (but not ...

What is Accounting? - masif-emba-fais-s12

... WorldCom, HealthSouth, AIG, and others. Congress passed Sarbanes-Oxley Act of 2002. Effective financial reporting depends on sound ethical behavior. Chapter ...

... WorldCom, HealthSouth, AIG, and others. Congress passed Sarbanes-Oxley Act of 2002. Effective financial reporting depends on sound ethical behavior. Chapter ...

1. Which of the following statements best describes the IFRS

... costs. D. it makes it harder to measure transactions. ...

... costs. D. it makes it harder to measure transactions. ...

department of management and entrepreneurship subject information (overview of syllabus)

... and implementation, international strategies, business ethics and social responsibility, and contemporary management issues relevant to strategic management (Total tuition time: not available) ADVANCED STRATEGIC MANAGEMENT IV (AST400T) 1 X 4-HOUR PAPER (OPEN BOOK) (Subject custodian: Department of ...

... and implementation, international strategies, business ethics and social responsibility, and contemporary management issues relevant to strategic management (Total tuition time: not available) ADVANCED STRATEGIC MANAGEMENT IV (AST400T) 1 X 4-HOUR PAPER (OPEN BOOK) (Subject custodian: Department of ...

Yes, there is a big Difference between Audit on Profit Organizations

... specialize in security audits, information systems audits, and environmental audits. In financial accounting, an audit is an independent assessment of the fairness by which a company's financial statements are presented by its management. It is performed by competent, independent and objective perso ...

... specialize in security audits, information systems audits, and environmental audits. In financial accounting, an audit is an independent assessment of the fairness by which a company's financial statements are presented by its management. It is performed by competent, independent and objective perso ...

Word - corporate

... The Company’s activities are subject to significant risks and uncertainties including failing to successfully develop products and services based on its technology and to achieve the market acceptance necessary to generate sufficient revenues to support its operations and to achieve and sustain prof ...

... The Company’s activities are subject to significant risks and uncertainties including failing to successfully develop products and services based on its technology and to achieve the market acceptance necessary to generate sufficient revenues to support its operations and to achieve and sustain prof ...

Demand Management User Manual

... In terms of this policy strategy, Accounting Officers are required to establish and implement a Supply Chain Management function that promotes sound financial management and uniformity in all spheres of Government. ...

... In terms of this policy strategy, Accounting Officers are required to establish and implement a Supply Chain Management function that promotes sound financial management and uniformity in all spheres of Government. ...