Outpatient Pharmacy Billing Review

... completeness and accuracy of medical records is not in place. Billing for pharmaceuticals that are not supported by patient treatment documentation may be construed as false claim and could result in denied charges and/or penalties and fines. Additionally, the lack of documentation or discrepancies ...

... completeness and accuracy of medical records is not in place. Billing for pharmaceuticals that are not supported by patient treatment documentation may be construed as false claim and could result in denied charges and/or penalties and fines. Additionally, the lack of documentation or discrepancies ...

MANDATORY EMPHASIS PARAGRAPHS, CLARIFYING

... the audit report. However, it is unclear how jurors’ enhanced understanding of the audit will impact the auditors’ litigation risk. Jurors’ Assessments of Auditor Negligence We rely on the Culpable Control Model (CCM) of blame attribution (Alicke 2000) to predict and test how the proposed changes in ...

... the audit report. However, it is unclear how jurors’ enhanced understanding of the audit will impact the auditors’ litigation risk. Jurors’ Assessments of Auditor Negligence We rely on the Culpable Control Model (CCM) of blame attribution (Alicke 2000) to predict and test how the proposed changes in ...

General Financial Management

... information about our financial management policies and procedures. Our Ministry, wanting to model and reflect the teachings of Christ at all times, is committed to the highest standards of ethical, moral, and legal conduct. The Board has approved this Handbook to establish policies and procedures i ...

... information about our financial management policies and procedures. Our Ministry, wanting to model and reflect the teachings of Christ at all times, is committed to the highest standards of ethical, moral, and legal conduct. The Board has approved this Handbook to establish policies and procedures i ...

PowerPoints Chapter 06

... • Proponents argue that without agreement on these issues accounting standards will be developed in an ad hoc manner ...

... • Proponents argue that without agreement on these issues accounting standards will be developed in an ad hoc manner ...

APPTICATION OF THE AUDIT PROCESS TO OTHER CYCTES

... or classifications for each transaction, such as repair and maintenance, inventory, or utilities. It also identifies whether the acquisition was for cash or accounts payable. The journal or listing can coyer any time period, typically a month. The journal or listing includes totals of every account ...

... or classifications for each transaction, such as repair and maintenance, inventory, or utilities. It also identifies whether the acquisition was for cash or accounts payable. The journal or listing can coyer any time period, typically a month. The journal or listing includes totals of every account ...

SIGNATURE THEATRE COMPANY, INC. FINANCIAL

... We have audited the accompanying statement of financial position of Signature Theatre Company, Inc. (a not-for-profit corporation) as of June 30, 2011, and the related statements of activities and cash flows for the year then ended. These financial statements are the responsibility of the Organizati ...

... We have audited the accompanying statement of financial position of Signature Theatre Company, Inc. (a not-for-profit corporation) as of June 30, 2011, and the related statements of activities and cash flows for the year then ended. These financial statements are the responsibility of the Organizati ...

Does Fair Value Reporting Affect Risk Management?

... problematic. Finally, our survey approach also allows us to assess changes in the risk management policies of private companies whose financial statements are not available in many countries. Many interesting results emerge from our analyses. First, 42% of the companies which actively engage in some ...

... problematic. Finally, our survey approach also allows us to assess changes in the risk management policies of private companies whose financial statements are not available in many countries. Many interesting results emerge from our analyses. First, 42% of the companies which actively engage in some ...

IFRS 7 Financial Instruments: Disclosures

... (c) the amount of change that is attributable to changes in the credit risk of the financial asset determined either: (i) as the amount of change in its fair value that is not attributable to changes in market conditions that give rise to market risk; or ...

... (c) the amount of change that is attributable to changes in the credit risk of the financial asset determined either: (i) as the amount of change in its fair value that is not attributable to changes in market conditions that give rise to market risk; or ...

ORRS 2011 (Text)

... number of Sector Databases have been, or are in the process of being established by ORX. These Sector Databases may have particular emphasis on geography or business activity, for example Canada and Investment Banking. The standards for these Sector Databases may deviate in some way from the standar ...

... number of Sector Databases have been, or are in the process of being established by ORX. These Sector Databases may have particular emphasis on geography or business activity, for example Canada and Investment Banking. The standards for these Sector Databases may deviate in some way from the standar ...

annual report 2016

... sheep measles at farm level. In addition, the support of processors in increasing the quality of data provided either specifically for the programme, or as a by-product of process improvement, has seen an increase in data capture in recent years. This in turn, has resulted in improved feedback to su ...

... sheep measles at farm level. In addition, the support of processors in increasing the quality of data provided either specifically for the programme, or as a by-product of process improvement, has seen an increase in data capture in recent years. This in turn, has resulted in improved feedback to su ...

Guide to New Canadian Independence Standard

... As noted in the Introduction, threats to independence must be considered before and during an assurance engagement. There are five categories of threat to independence. A Self-Interest Threat occurs when a firm or a person on the engagement team could benefit from a financial interest in, or another ...

... As noted in the Introduction, threats to independence must be considered before and during an assurance engagement. There are five categories of threat to independence. A Self-Interest Threat occurs when a firm or a person on the engagement team could benefit from a financial interest in, or another ...

ch02_sm_rankin

... Students may identify a range of problems or difficulties including: If there are no ‘standards;’ concerning such items and their disclosure this could lead to inconsistencies even as to what information should be provided about, as well as level of detail of information. This of course would red ...

... Students may identify a range of problems or difficulties including: If there are no ‘standards;’ concerning such items and their disclosure this could lead to inconsistencies even as to what information should be provided about, as well as level of detail of information. This of course would red ...

Western Kentucky University Accountants’ Report and Financial Statements

... based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America and the standards for financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Those standards require tha ...

... based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America and the standards for financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Those standards require tha ...

(revised) compilation engagements

... a reported item in the financial information, and the amount, classification, presentation, or disclosure that is required for the item to be in accordance with the applicable financial reporting framework. Misstatements can arise from error or fraud. Where the financial information is prepared in a ...

... a reported item in the financial information, and the amount, classification, presentation, or disclosure that is required for the item to be in accordance with the applicable financial reporting framework. Misstatements can arise from error or fraud. Where the financial information is prepared in a ...

word

... The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by us or on our behalf. Certain statements contained in this annual report, including those within the forward-looking perspective section within this Management’s Discussion and Analysis, ...

... The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by us or on our behalf. Certain statements contained in this annual report, including those within the forward-looking perspective section within this Management’s Discussion and Analysis, ...

Lesson Preparation Project

... desires of management rather than the underlying financial performance of the company." Companies use various devices to influence earnings outcomes, including "big bath" charges, "cookie jar" reserves, and the abuse of materiality and revenue recognition principles. These practices tend to erode th ...

... desires of management rather than the underlying financial performance of the company." Companies use various devices to influence earnings outcomes, including "big bath" charges, "cookie jar" reserves, and the abuse of materiality and revenue recognition principles. These practices tend to erode th ...

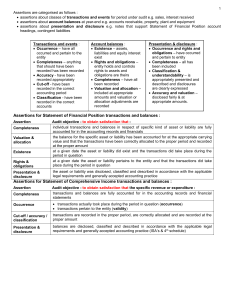

Aue2602 Summary

... payment from debtor actually occurred and pertains to entity (occurrence) receipts are recorded at correct amount (accuracy) and are allocated to the proper accounting period (cut-off) all receipts have been recorded (completeness) in the proper accounts (classification) Debtors and bank / cas ...

... payment from debtor actually occurred and pertains to entity (occurrence) receipts are recorded at correct amount (accuracy) and are allocated to the proper accounting period (cut-off) all receipts have been recorded (completeness) in the proper accounts (classification) Debtors and bank / cas ...

In Re: Gravity Co., Ltd. Securities Litigation 05-CV

... send Ragnarok Online royalty payments to the accounts . In total, Defendant J . Kim embezzled at least $6 million from the Company through this scheme (the "Embezzlement Scheme") . 26. At the time of the Embezzlement Scheme, Defendant J . Kim did not serve in a managerial role at Gravity and only m ...

... send Ragnarok Online royalty payments to the accounts . In total, Defendant J . Kim embezzled at least $6 million from the Company through this scheme (the "Embezzlement Scheme") . 26. At the time of the Embezzlement Scheme, Defendant J . Kim did not serve in a managerial role at Gravity and only m ...

Advanced Oxygen Technologies 10K, June 30, 2012 - aoxy

... 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically and posted on its c ...

... 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically and posted on its c ...

Public Financial Management - National Open University of Nigeria

... hand and an outflow of payments on the other. The subject matter of public financial management could be summed to be the acquisition and disposal of resources by the government and it agencies through proper management and control through budgeting usually prepared annually or through developmental ...

... hand and an outflow of payments on the other. The subject matter of public financial management could be summed to be the acquisition and disposal of resources by the government and it agencies through proper management and control through budgeting usually prepared annually or through developmental ...

Financial Statements of a Company

... position of any business concern. They provide information about the results of the business concern during a specified period of time in terms of assets and liabilities, which provide the basis for taking decisions. Thus, the primary objective of financial statements is to assist the users in their ...

... position of any business concern. They provide information about the results of the business concern during a specified period of time in terms of assets and liabilities, which provide the basis for taking decisions. Thus, the primary objective of financial statements is to assist the users in their ...

Annual Audit - Atlantic City Municipal Utilities Authority

... certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the basic financial statements or to the basic financial statements themselves, and other additional procedures in accordance with auditing stan ...

... certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the basic financial statements or to the basic financial statements themselves, and other additional procedures in accordance with auditing stan ...

old dominion freight line, inc.

... The condensed financial statements should be read in conjunction with the financial statements and related footnotes, which appear in our Annual Report on Form 10-K for the year ended December 31, 2008. For comparability, certain reclassifications were made to conform prior-period financial statemen ...

... The condensed financial statements should be read in conjunction with the financial statements and related footnotes, which appear in our Annual Report on Form 10-K for the year ended December 31, 2008. For comparability, certain reclassifications were made to conform prior-period financial statemen ...

Guide to Certifications

... Half survey of chief financial officers (CFOs), a large majority said earning a certification is valuable for an accounting or finance professional’s career advancement. In addition, according to the Salary Guide from Robert Half, those who have earned professional credentials may receive starting s ...

... Half survey of chief financial officers (CFOs), a large majority said earning a certification is valuable for an accounting or finance professional’s career advancement. In addition, according to the Salary Guide from Robert Half, those who have earned professional credentials may receive starting s ...

Financial Statements for Manufacturing Businesses

... Financial Statements for Manufacturing Businesses Importance of Financial Statements Accounting plays a critical role in decision-making. Accounting provides the financial framework for analyzing the results of an executed set of decisions and makes possible the continuous success of a business or i ...

... Financial Statements for Manufacturing Businesses Importance of Financial Statements Accounting plays a critical role in decision-making. Accounting provides the financial framework for analyzing the results of an executed set of decisions and makes possible the continuous success of a business or i ...