Corporate Governance and Earnings Management

... Ribbon Commission (1999) called for auditors to discuss with the audit committee the quality and not just the acceptability of the financial reporting alternatives. Corporate governance has received increasing emphasis both in practice and in academic research (e.g., Blue Ribbon Committee Report 199 ...

... Ribbon Commission (1999) called for auditors to discuss with the audit committee the quality and not just the acceptability of the financial reporting alternatives. Corporate governance has received increasing emphasis both in practice and in academic research (e.g., Blue Ribbon Committee Report 199 ...

Key Accounting Issues for Nonprofits

... unconditional promises to give, are recognized as revenues in the period received at their fair values. Contributions made, including unconditional promises to give, are recognized as expenses in the period made at their fair values. Conditional promises to give, whether received or made, are recogn ...

... unconditional promises to give, are recognized as revenues in the period received at their fair values. Contributions made, including unconditional promises to give, are recognized as expenses in the period made at their fair values. Conditional promises to give, whether received or made, are recogn ...

4.2.2 Standard Costing - College of Education and External Studies

... standards are standards which can be attained under the most favorable conditions with no allowance for normal losses, waste and machine breakdown also as a potential standard. Attainable standards are based on efficient operation conditions an attainable standards is one which can be attained if a ...

... standards are standards which can be attained under the most favorable conditions with no allowance for normal losses, waste and machine breakdown also as a potential standard. Attainable standards are based on efficient operation conditions an attainable standards is one which can be attained if a ...

Words - corporate

... This Form 10-Q and certain information incorporated herein by reference contain forward-looking statements and information within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchang ...

... This Form 10-Q and certain information incorporated herein by reference contain forward-looking statements and information within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchang ...

Accounting and Neoliberalism: A Critical - Research Online

... 2005; van Treeck 2009), not only contribute suspicious value to real income flows and physical investment at the macroeconomic level, but also largely compel managers to satisfy the interests of shareholders. This is in other words, the owners of capital. As a result, the huge liquidity that was pro ...

... 2005; van Treeck 2009), not only contribute suspicious value to real income flows and physical investment at the macroeconomic level, but also largely compel managers to satisfy the interests of shareholders. This is in other words, the owners of capital. As a result, the huge liquidity that was pro ...

FREE Sample Here

... 33. An auditor discovers a likely fraud during an audit but concludes that the effect of the fraud is not sufficiently material to affect the audit opinion. The auditor should A. Disclose the fraud to the appropriate level of the client's management B. Disclose the fraud to appropriate authorities e ...

... 33. An auditor discovers a likely fraud during an audit but concludes that the effect of the fraud is not sufficiently material to affect the audit opinion. The auditor should A. Disclose the fraud to the appropriate level of the client's management B. Disclose the fraud to appropriate authorities e ...

The purposes of accounting

... Comprehensive reporting of financial activity Managers properly control the activities of the state/organisation they are responsible for There is accurate preparation of budgets using definitions that are understood and accurate. Successful management depends upon good quality and timely financ ...

... Comprehensive reporting of financial activity Managers properly control the activities of the state/organisation they are responsible for There is accurate preparation of budgets using definitions that are understood and accurate. Successful management depends upon good quality and timely financ ...

Chapter 7

... States Copyright Act without the express written consent of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. T ...

... States Copyright Act without the express written consent of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. T ...

1. The primary function of financial accounting is

... . purchase method of accounting for the combination. B The negative effects on subsequent earnings of amortizing goodwill if firms were required to use the . pooling method of accounting for the combination. C The unrealistic balance sheet assets that would be created if firms were required to use t ...

... . purchase method of accounting for the combination. B The negative effects on subsequent earnings of amortizing goodwill if firms were required to use the . pooling method of accounting for the combination. C The unrealistic balance sheet assets that would be created if firms were required to use t ...

Fiscal Policies and Procedures Guide

... statements. The Board of Trustees, acting as public agents authorized by the Commonwealth, are responsible for management of the School or Schools, which includes developing and adopting sound fiscal policies and procedures. In an effort to support these requirements, the Massachusetts Department of ...

... statements. The Board of Trustees, acting as public agents authorized by the Commonwealth, are responsible for management of the School or Schools, which includes developing and adopting sound fiscal policies and procedures. In an effort to support these requirements, the Massachusetts Department of ...

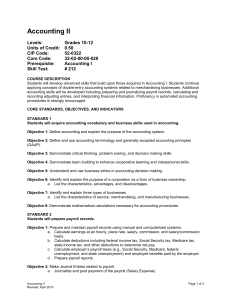

Accounting II - davis.k12.ut.us

... Objective 6: Identify and explain the purpose of a corporation as a form of business ownership. a. List the characteristics, advantages, and disadvantages. Objective 7: Identify and explain three types of businesses. a. List the characteristics of service, merchandising, and manufacturing businesses ...

... Objective 6: Identify and explain the purpose of a corporation as a form of business ownership. a. List the characteristics, advantages, and disadvantages. Objective 7: Identify and explain three types of businesses. a. List the characteristics of service, merchandising, and manufacturing businesses ...

FREE Sample Here

... that it addressed only accounting’s transaction function. Rather, he saw accounting as encompassing other important functions, such as managerial control and the protection of the interests of equity holders. He also viewed accounting as having both an internal control function and an external funct ...

... that it addressed only accounting’s transaction function. Rather, he saw accounting as encompassing other important functions, such as managerial control and the protection of the interests of equity holders. He also viewed accounting as having both an internal control function and an external funct ...

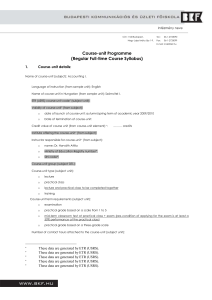

Document

... (sample unit): The objective of the course is to equip students with the standard tools in probability calculus necessary for carrying out various economic, statistical and business calculations of probabilistic nature. ...

... (sample unit): The objective of the course is to equip students with the standard tools in probability calculus necessary for carrying out various economic, statistical and business calculations of probabilistic nature. ...

An examination of the fraudulent factors associated with

... Difficulty in determining the organization or individuals that have controlling interest in the entity Overly complex organizational structure involving unusual legal entities or managerial lines of authority ...

... Difficulty in determining the organization or individuals that have controlling interest in the entity Overly complex organizational structure involving unusual legal entities or managerial lines of authority ...

Accounting Theory Defined

... does not issue detailed application guidelines. Addresses business ventures – not public sector, government or not-for-profit activities. ...

... does not issue detailed application guidelines. Addresses business ventures – not public sector, government or not-for-profit activities. ...

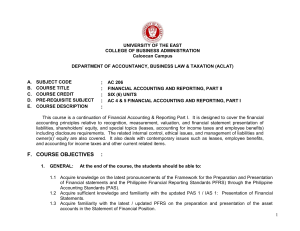

UNIVERSITY OF THE EAST – CALOOCAN CAMPUS

... This course is a continuation of Financial Accounting & Reporting Part I. It is designed to cover the financial accounting principles relative to recognition, measurement, valuation, and financial statement presentation of liabilities, shareholders’ equity, and special topics (leases, accounting for ...

... This course is a continuation of Financial Accounting & Reporting Part I. It is designed to cover the financial accounting principles relative to recognition, measurement, valuation, and financial statement presentation of liabilities, shareholders’ equity, and special topics (leases, accounting for ...

Revenue Collection Training

... Model • Internal Control Assessment – Revenue Collection http://www.montana.edu/audit/guidance.html ...

... Model • Internal Control Assessment – Revenue Collection http://www.montana.edu/audit/guidance.html ...

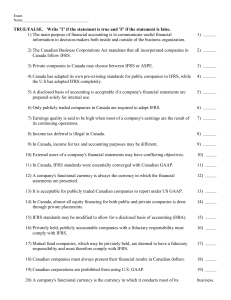

Exam Name___________________________________ TRUE

... A) communication of financial information to interested persons, communication of financial information about economic entities, and identification, measurement, and communication of financial information. B) communication of financial information to interested persons. C) identification, measuremen ...

... A) communication of financial information to interested persons, communication of financial information about economic entities, and identification, measurement, and communication of financial information. B) communication of financial information to interested persons. C) identification, measuremen ...

The Auditor`s Responsibility to Detect Fraud

... ACFE estimate that this 5 percent figure would translate to approximately $2.9 trillion as applied to the estimated 2009 gross world product (Crawford and Weirich, 2011). For instance, almost daily one can read about organisations that have been exploited in both the private and public sectors resu ...

... ACFE estimate that this 5 percent figure would translate to approximately $2.9 trillion as applied to the estimated 2009 gross world product (Crawford and Weirich, 2011). For instance, almost daily one can read about organisations that have been exploited in both the private and public sectors resu ...

Honors Accounting - Rutherford Public Schools

... systems, internal controls, journals, receivables and payables, accruals and deferrals, inventory, fixed assets and depreciation, and financial statement preparation and analysis. Computerized accounting systems will be implemented for an up-to-date accounting experience. The core material for this ...

... systems, internal controls, journals, receivables and payables, accruals and deferrals, inventory, fixed assets and depreciation, and financial statement preparation and analysis. Computerized accounting systems will be implemented for an up-to-date accounting experience. The core material for this ...

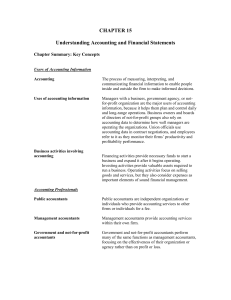

CHAPTER 15 Understanding Accounting and Financial

... business and expand it after it begins operating. Investing activities provide valuable assets required to run a business. Operating activities focus on selling goods and services, but they also consider expenses as important elements of sound financial management. ...

... business and expand it after it begins operating. Investing activities provide valuable assets required to run a business. Operating activities focus on selling goods and services, but they also consider expenses as important elements of sound financial management. ...

November 12, 2014 International Ethics Standards Board for

... time-off period may have a positive impact on audit effectiveness due to auditor learning and knowledge, there is the potential negative impact because of the risk of familiarity threat (such as complacency and reduced professional skepticism) that increases with length of time as KAP. The IESBA con ...

... time-off period may have a positive impact on audit effectiveness due to auditor learning and knowledge, there is the potential negative impact because of the risk of familiarity threat (such as complacency and reduced professional skepticism) that increases with length of time as KAP. The IESBA con ...

Auditor Liability and Professional Skepticism: A Look at Lehman

... underlies failures to detect financial reporting frauds perpetrated by companies ranging from large publicly-held entities to small and privately owned enterprises. The key to effective auditing: maintaining professional skepticism The role assigned to auditors in our society is as examiners of the ...

... underlies failures to detect financial reporting frauds perpetrated by companies ranging from large publicly-held entities to small and privately owned enterprises. The key to effective auditing: maintaining professional skepticism The role assigned to auditors in our society is as examiners of the ...

User guide to Standing Direction 1

... Section 3 – Financial management structure, systems, policies and procedures The Directions for financial management structure, systems, policies and procedures set standards for all public sector agencies to achieve sound systems of internal control to support financial management. Section 4 – Fina ...

... Section 3 – Financial management structure, systems, policies and procedures The Directions for financial management structure, systems, policies and procedures set standards for all public sector agencies to achieve sound systems of internal control to support financial management. Section 4 – Fina ...