How to Invest in REITs

... REIT Returns are Uncorrelated with Other Assets 60-month rolling periods • vs. Small stocks ...

... REIT Returns are Uncorrelated with Other Assets 60-month rolling periods • vs. Small stocks ...

ACCE 457b PLAN FALL MEETING

... Insurance products and plan administrative services, if applicable, are provided by Principal Life Insurance Company. Principal mutual funds are part of the Principal Funds, Inc. series. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Princor ...

... Insurance products and plan administrative services, if applicable, are provided by Principal Life Insurance Company. Principal mutual funds are part of the Principal Funds, Inc. series. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Princor ...

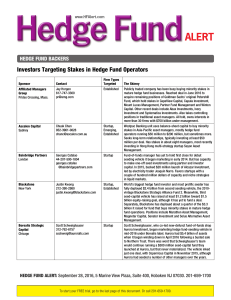

Hedge Fund Backers

... After buying Jefferies in 2013, formed asset-management division that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill A ...

... After buying Jefferies in 2013, formed asset-management division that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill A ...

KKR Investment Funds May Invest in

... KKR Investment Funds May Invest in KKR Private Equity Investors Guernsey, Channel Islands, December 3, 2007 – KKR Private Equity Investors, L.P. (Euronext Amsterdam: KPE) announced today that one or more investment funds that are managed by Kohlberg Kravis Roberts & Co. L.P. may invest from time to ...

... KKR Investment Funds May Invest in KKR Private Equity Investors Guernsey, Channel Islands, December 3, 2007 – KKR Private Equity Investors, L.P. (Euronext Amsterdam: KPE) announced today that one or more investment funds that are managed by Kohlberg Kravis Roberts & Co. L.P. may invest from time to ...

New Investment Portfolios

... Vanguard Explorer 529 Portfolio – Invests exclusively in the Vanguard Explorer Fund which seeks to provide long-term capital appreciation. The fund invests mainly in stocks of small companies. These companies tend to be unseasoned but are considered by the fund’s advisors to have superior growth pot ...

... Vanguard Explorer 529 Portfolio – Invests exclusively in the Vanguard Explorer Fund which seeks to provide long-term capital appreciation. The fund invests mainly in stocks of small companies. These companies tend to be unseasoned but are considered by the fund’s advisors to have superior growth pot ...

US Equities: Light at the End of the Tunnel

... History suggests that the combination of a sustained performance gap and a prolonged shift in investor preferences can lead to over- (or under-) exuberance and relative valuation discrepancies that may provide important signals for a shift in intermediate-term investment performance. The following a ...

... History suggests that the combination of a sustained performance gap and a prolonged shift in investor preferences can lead to over- (or under-) exuberance and relative valuation discrepancies that may provide important signals for a shift in intermediate-term investment performance. The following a ...

The Hidden Cost of Holding a Concentrated Position

... Family wealth created by holding a single stock that appreciates substantially in value over time is fairly common. For example, senior company executives receive stock or stock options as part of their compensation, investors benefit from superior appreciation of one stock relative to the rest of t ...

... Family wealth created by holding a single stock that appreciates substantially in value over time is fairly common. For example, senior company executives receive stock or stock options as part of their compensation, investors benefit from superior appreciation of one stock relative to the rest of t ...

Investment Options and Risk

... choice is yours. You should note that when creating your own portfolio, market movements may take your individual asset class proportions away from the point at which you started. If this happens, your fees and risk level may change and you will need to decide if you want to rebalance them. ...

... choice is yours. You should note that when creating your own portfolio, market movements may take your individual asset class proportions away from the point at which you started. If this happens, your fees and risk level may change and you will need to decide if you want to rebalance them. ...

Shipping Rates

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to inve ...

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to inve ...

march 2017 market commentary economic update

... Despite the consistent tone from Fed leaders, markets were still pricing in a less hawkish Fed, particularly as it relates to a March hike. Fed leaders apparently have something else in mind, though, and Vice Chair Bill Dudley granted an unexpected television interview February 28 that was notably h ...

... Despite the consistent tone from Fed leaders, markets were still pricing in a less hawkish Fed, particularly as it relates to a March hike. Fed leaders apparently have something else in mind, though, and Vice Chair Bill Dudley granted an unexpected television interview February 28 that was notably h ...

A Closer Look at the Virtues of Dividend-Paying

... dividend-paying stocks have compounded money over the past three decades at a rate significantly higher than non-dividend payers. For example, in the small-cap universe, dividend payers have compounded money at over 500 basis points higher than nondividend payers, creating more than four times the a ...

... dividend-paying stocks have compounded money over the past three decades at a rate significantly higher than non-dividend payers. For example, in the small-cap universe, dividend payers have compounded money at over 500 basis points higher than nondividend payers, creating more than four times the a ...

SPIVA® Institutional Scorecard–How Much Do Fees Affect the Active

... meaningfully depending on the type of investor.2 In general, retail investors tend to pay higher advisory and management fees than institutional investors.3 Institutional investors have the option to negotiate fees directly with asset managers based on the size of a mandate and how many strategies m ...

... meaningfully depending on the type of investor.2 In general, retail investors tend to pay higher advisory and management fees than institutional investors.3 Institutional investors have the option to negotiate fees directly with asset managers based on the size of a mandate and how many strategies m ...

David Gray Remarks CBOE Update OIC Conference, Miami, Florida

... study of options-based funds that CBOE released in January. The study analyzed investment companies such as mutual funds, exchange-traded funds and closed-end funds that use exchange-listed options for portfolio management. I’d like to share two of the main highlights from the study: 1) The number o ...

... study of options-based funds that CBOE released in January. The study analyzed investment companies such as mutual funds, exchange-traded funds and closed-end funds that use exchange-listed options for portfolio management. I’d like to share two of the main highlights from the study: 1) The number o ...

Summary of Investment Objectives

... US Large Capitalization Stocks: A portfolio of stocks composed primarily of US-based companies having a market capitalization, on average, exceeding $10.0 billion and whose primary shares trade on a major US exchange. The generally accepted, nationally recognized index for this asset class is the St ...

... US Large Capitalization Stocks: A portfolio of stocks composed primarily of US-based companies having a market capitalization, on average, exceeding $10.0 billion and whose primary shares trade on a major US exchange. The generally accepted, nationally recognized index for this asset class is the St ...

Access the Investor Brochure

... the distributions may have been a return of capital; however, distributions have not included a return of capital as of the date hereof. CION has not established limits on the amount of funds it may use from available sources to make distributions. Through December 31, 2014, a portion of CION’s dist ...

... the distributions may have been a return of capital; however, distributions have not included a return of capital as of the date hereof. CION has not established limits on the amount of funds it may use from available sources to make distributions. Through December 31, 2014, a portion of CION’s dist ...

pdf

... periods of less than five years have little value. They usually reflect only one part of a market cycle and don’t capture what really matters: the actual capital accumulated by clients over the full period of their investment with that fund manager. ...

... periods of less than five years have little value. They usually reflect only one part of a market cycle and don’t capture what really matters: the actual capital accumulated by clients over the full period of their investment with that fund manager. ...

Download attachment

... set up in the trust form, the administration of the fund is the responsibility of a board of trustees that represent the interests of the beneficiaries. The composition and responsibilities of the board vary depending on the country in question. In Italy, the Netherlands, and Japan (the Employees Pe ...

... set up in the trust form, the administration of the fund is the responsibility of a board of trustees that represent the interests of the beneficiaries. The composition and responsibilities of the board vary depending on the country in question. In Italy, the Netherlands, and Japan (the Employees Pe ...

Worth the risk? The appeal and challenges of high

... series, it’s important to note that even during the first and third periods, the total return lagged the average yield, a likely result of the loss rate associated with high-yield bond defaults. If losses were not an issue, it might be reasonable to expect income and total returns to be on par with ...

... series, it’s important to note that even during the first and third periods, the total return lagged the average yield, a likely result of the loss rate associated with high-yield bond defaults. If losses were not an issue, it might be reasonable to expect income and total returns to be on par with ...

prospectus

... may indicate higher transaction costs and may result in higher taxes when shares of the Fund are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. For the most recent fiscal year, the Fund’s portfolio t ...

... may indicate higher transaction costs and may result in higher taxes when shares of the Fund are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. For the most recent fiscal year, the Fund’s portfolio t ...

Investment Process and Philosophy

... Trying to time the market is a strategy doomed for failure. Investment markets often experience periods of volatility and can sometimes look expensive based on historic valuations. We believe that trying to time market entry decisions in the short term is a dangerous strategy as the biggest gains te ...

... Trying to time the market is a strategy doomed for failure. Investment markets often experience periods of volatility and can sometimes look expensive based on historic valuations. We believe that trying to time market entry decisions in the short term is a dangerous strategy as the biggest gains te ...

Alternative Investment Fund Managers Directive (AIFMD) investor

... The portfolio primarily comprises shares traded on the London Stock Exchange including those traded on AIM. The investment managers can also invest in unquoted securities, though these are limited to a maximum of 5% of gross assets at the time of acquisition. The Manager seeks to outperform the benc ...

... The portfolio primarily comprises shares traded on the London Stock Exchange including those traded on AIM. The investment managers can also invest in unquoted securities, though these are limited to a maximum of 5% of gross assets at the time of acquisition. The Manager seeks to outperform the benc ...

Download paper (PDF)

... goes beyond a simple divestment of high carbon footprint or stranded assets stocks. This is just the first step. The second step is to optimize the composition of the low carbon portfolio so as to minimize the tracking error with the reference benchmark index. We show ...

... goes beyond a simple divestment of high carbon footprint or stranded assets stocks. This is just the first step. The second step is to optimize the composition of the low carbon portfolio so as to minimize the tracking error with the reference benchmark index. We show ...

NO BUDGET BOUNCE YET FOR SERVICES

... activity, respondents raised ongoing concerns about weak local economic conditions, business sentiment, and economic outlook. Continuing structural changes in the manufacturing industry, the rapid decline in mining investment, and ongoing weak appetite for investment by businesses and governments ar ...

... activity, respondents raised ongoing concerns about weak local economic conditions, business sentiment, and economic outlook. Continuing structural changes in the manufacturing industry, the rapid decline in mining investment, and ongoing weak appetite for investment by businesses and governments ar ...

Materials

... to increase by $99.0 million, or 9.0%, to $1.2 billion during 2012-2013. The operating margin is expected to be $58.6 million or 4.7%. The budget presentation will include a proposal to increase hospital room rates and ancillary service charges between 7.0 and 9.9% and to enhance personnel compensat ...

... to increase by $99.0 million, or 9.0%, to $1.2 billion during 2012-2013. The operating margin is expected to be $58.6 million or 4.7%. The budget presentation will include a proposal to increase hospital room rates and ancillary service charges between 7.0 and 9.9% and to enhance personnel compensat ...