The MacroReport - Sabrient Systems

... achieved, as may be evidenced by recent currency moves, as well as by the apparent recognition of its leaders for the necessity to shift from an export-orientation model towards a domestic consumption-based model. Still, unwieldy factors such as rising inflation, real estate bubbles, and volatile gl ...

... achieved, as may be evidenced by recent currency moves, as well as by the apparent recognition of its leaders for the necessity to shift from an export-orientation model towards a domestic consumption-based model. Still, unwieldy factors such as rising inflation, real estate bubbles, and volatile gl ...

Does Equity Derivatives Trading Affect the Systematic Risk of the

... has been written on the volatility effects of futures trading. Numerous empirical studies have found that beta estimates can be biased because of nonsynchronous trading and market frictions such as thin trading, trading delays, and price adjustment delays. This can cause the beta estimate to be bias ...

... has been written on the volatility effects of futures trading. Numerous empirical studies have found that beta estimates can be biased because of nonsynchronous trading and market frictions such as thin trading, trading delays, and price adjustment delays. This can cause the beta estimate to be bias ...

The Information Content of the NCREIF Index

... impacted by infrequent appraisals, are often labeled as smoothed, and hence, do not update information as quickly. Recent studies of NCREIF, for example, attempt to refine the measurement of return indexes, and interpret the significance of various measures.2 The relation between the unsecuritized a ...

... impacted by infrequent appraisals, are often labeled as smoothed, and hence, do not update information as quickly. Recent studies of NCREIF, for example, attempt to refine the measurement of return indexes, and interpret the significance of various measures.2 The relation between the unsecuritized a ...

3.4. Officer and Hathaway (1999) Regression Results

... The “US ASX-Weighted Index” is a weighted sum of indices representing diverse sectors of the US economy. The sectors and weights used were chosen so as to mirror as closely as possible the composition of the Australian equity market, as measured by an index created by the Australian Graduate School ...

... The “US ASX-Weighted Index” is a weighted sum of indices representing diverse sectors of the US economy. The sectors and weights used were chosen so as to mirror as closely as possible the composition of the Australian equity market, as measured by an index created by the Australian Graduate School ...

download

... consider bonds issued outside the U.S. "With foreign bonds," says Bohlin, "currency risk dwarfs other factors such as credit or interest-rate risk." The U.S. dollar is generally expected to weaken in 2004, which adds to the appeal of bonds issued in other currencies. "It's true that foreign bonds ar ...

... consider bonds issued outside the U.S. "With foreign bonds," says Bohlin, "currency risk dwarfs other factors such as credit or interest-rate risk." The U.S. dollar is generally expected to weaken in 2004, which adds to the appeal of bonds issued in other currencies. "It's true that foreign bonds ar ...

0000921739-04-000026 - Lasalle Hotel Properties

... Ownership of Five Percent or Less of a Class If this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities, check the following [ ]. Item 6. Ownership of More than Five Pe ...

... Ownership of Five Percent or Less of a Class If this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities, check the following [ ]. Item 6. Ownership of More than Five Pe ...

Understanding private equity and private equity funds

... Source: Thomson Reuters, Morningstar Direct. Private Equity returns are based on the Cambridge Associates U.S. Private Equity Index for all vintage years from 2006-2016. Please see index description at the end of this presentation. U.S. Small-Cap Public Equity, U.S. Large-Cap Public Equity and U.S. ...

... Source: Thomson Reuters, Morningstar Direct. Private Equity returns are based on the Cambridge Associates U.S. Private Equity Index for all vintage years from 2006-2016. Please see index description at the end of this presentation. U.S. Small-Cap Public Equity, U.S. Large-Cap Public Equity and U.S. ...

Mufti Najeeb - Presentation Islamic fund

... Net Liquid Assets vs. Share Price: The net liquid assets per share should be less than the market price of the share. ...

... Net Liquid Assets vs. Share Price: The net liquid assets per share should be less than the market price of the share. ...

Morningstar Strategic Beta Guide

... Others try to address well-known drawbacks of standard benchmarks, such as the the overweighting of debt-laden issuers in market-cap-weighted fixed-income benchmarks. These investable products and their underlying indexes capitalize on many of the same “factors” (size, value, quality, momentum, etc. ...

... Others try to address well-known drawbacks of standard benchmarks, such as the the overweighting of debt-laden issuers in market-cap-weighted fixed-income benchmarks. These investable products and their underlying indexes capitalize on many of the same “factors” (size, value, quality, momentum, etc. ...

chapter 32 institutional investors

... managers has statistically significant positive performance. Furthermore, the risk-adjusted performance of these managers persists, which conflicts with Carhart’s (1997) evidence. Other recent papers that arrive at similar conclusions are Bollen and Busse (2005) and Avramov and Wermers (2006). Howev ...

... managers has statistically significant positive performance. Furthermore, the risk-adjusted performance of these managers persists, which conflicts with Carhart’s (1997) evidence. Other recent papers that arrive at similar conclusions are Bollen and Busse (2005) and Avramov and Wermers (2006). Howev ...

Goodbody Global Leaders Fund

... ‘Mobile Order and Pay’ - ordering from phone, pick-up in store is now available in all US stores. This has led to an increase in average transaction size: an order made on mobile is estimated, on average, to be 15% larger than an in-store order*. ...

... ‘Mobile Order and Pay’ - ordering from phone, pick-up in store is now available in all US stores. This has led to an increase in average transaction size: an order made on mobile is estimated, on average, to be 15% larger than an in-store order*. ...

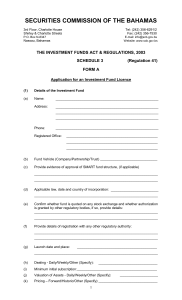

The Investment Funds Act, 2003 - Securities Commission of the

... E-mail: [email protected] Website: www.scb.gov.bs ...

... E-mail: [email protected] Website: www.scb.gov.bs ...

ExxonMobil scheme cites Dutch rigidity for plan to decamp to

... represent a substantially higher issuer risk, that is credit quality dropping below investment grade, the amount allocated to high-yield bonds is rather small. This is the case for most Belgian pension funds, given their small size.” The Mercer figures support these observations. Government bonds sl ...

... represent a substantially higher issuer risk, that is credit quality dropping below investment grade, the amount allocated to high-yield bonds is rather small. This is the case for most Belgian pension funds, given their small size.” The Mercer figures support these observations. Government bonds sl ...

International Developed Markets Fund

... The firm’s strategy tends to favor mid/smaller capitalization companies, which will often do well in periods of economic expansion. However, Barrow Hanley also targets an above average dividend yield when purchasing companies and so can outperform in periods where investors seek yield. Periods when ...

... The firm’s strategy tends to favor mid/smaller capitalization companies, which will often do well in periods of economic expansion. However, Barrow Hanley also targets an above average dividend yield when purchasing companies and so can outperform in periods where investors seek yield. Periods when ...

Efficient Price Discovery in Stock Index Cash and Futures Markets

... CHAN and KAROLYI [1991]).While these analyses provide some evidence about ...

... CHAN and KAROLYI [1991]).While these analyses provide some evidence about ...

Active Management Performance Cycles

... Fee assumptions are based on eVestment Alliance peer group median given the mandate size of $500 million for US large cap, core fixed income, and non-US large cap, and $200 million for US small cap and emerging markets. For clients with smaller mandates, the excess return would be reduced as a resul ...

... Fee assumptions are based on eVestment Alliance peer group median given the mandate size of $500 million for US large cap, core fixed income, and non-US large cap, and $200 million for US small cap and emerging markets. For clients with smaller mandates, the excess return would be reduced as a resul ...

leaseurope index results: q2 2011 - NVL

... The Leaseurope Index is a unique survey that tracks key performance indicators of a sample of 23 European lessors on a quarterly basis. This Q2 2016 is the twenty-second edition of the survey. The weighted average ratios for Q2 2016 have deteriorated across the board compared to Q2 2015, following m ...

... The Leaseurope Index is a unique survey that tracks key performance indicators of a sample of 23 European lessors on a quarterly basis. This Q2 2016 is the twenty-second edition of the survey. The weighted average ratios for Q2 2016 have deteriorated across the board compared to Q2 2015, following m ...

a scandal or a scapegoat? - University of Nottingham

... This point highlights an important moral issue that stresses the significance of this subject. While a bubble in equities or bonds may lead to someone losing a large sum of money, the vast majority of participants in these markets have the money to lose. This is completely different w ...

... This point highlights an important moral issue that stresses the significance of this subject. While a bubble in equities or bonds may lead to someone losing a large sum of money, the vast majority of participants in these markets have the money to lose. This is completely different w ...

Foord Conservative Fund (Class B2)

... affected by changes in the market or economic conditions and legal, regulatory and tax requirements. Foord Unit Trusts does not provide any guarantee either with respect to the capital or the performance return of the investment. Unit trusts are traded at ruling prices and can engage in borrowing. F ...

... affected by changes in the market or economic conditions and legal, regulatory and tax requirements. Foord Unit Trusts does not provide any guarantee either with respect to the capital or the performance return of the investment. Unit trusts are traded at ruling prices and can engage in borrowing. F ...

Correlation Analysis Between Commodity Market And Stock Market

... the strategic and tactical asset allocation process. Commonly accepted benefits include the equitylike return of commodity indexes, the role of commodity futures as risk diversifiers, and their high potential for alpha generation through longshort dynamic trading. This article examines conditional c ...

... the strategic and tactical asset allocation process. Commonly accepted benefits include the equitylike return of commodity indexes, the role of commodity futures as risk diversifiers, and their high potential for alpha generation through longshort dynamic trading. This article examines conditional c ...

Sample Endowment Fund policy

... inquire as to any current holdings affected by this restriction and determine an appropriate strategy for divesting the affected holdings within a reasonable time frame. Portfolio Diversification: The investment objectives should be achieved through a diversified portfolio, which may include but it ...

... inquire as to any current holdings affected by this restriction and determine an appropriate strategy for divesting the affected holdings within a reasonable time frame. Portfolio Diversification: The investment objectives should be achieved through a diversified portfolio, which may include but it ...

Investor Relations Communications Plan

... In Nasdaq Online, there are 13 possible styles, defined below, by which institutional investors are classified by the source of the data, the Carson Group. The Carson Group employs quantitative techniques based on key financial fundamentals of an investor's portfolio: primarily, the portions of the ...

... In Nasdaq Online, there are 13 possible styles, defined below, by which institutional investors are classified by the source of the data, the Carson Group. The Carson Group employs quantitative techniques based on key financial fundamentals of an investor's portfolio: primarily, the portions of the ...

A Comparative Study of Venture Capital Performance in the US and

... investment horizon, and higher information asymmetry than the public equity investments. Venture capital funds specialize in long-term private equity investments in startup and super-growth companies that offer high potential returns and substantial risk. Since venture capital investments are made i ...

... investment horizon, and higher information asymmetry than the public equity investments. Venture capital funds specialize in long-term private equity investments in startup and super-growth companies that offer high potential returns and substantial risk. Since venture capital investments are made i ...