Recessions and balanced portfolio returns

... a recession occur in the near future. Indeed, very deep and long-lasting economic contractions following a run-up in asset prices and leverage—for example, the so-called balance-sheet recessions of the 1930s and 2008–2009—have been associated with lower balanced-portfolio returns, as illustrated in ...

... a recession occur in the near future. Indeed, very deep and long-lasting economic contractions following a run-up in asset prices and leverage—for example, the so-called balance-sheet recessions of the 1930s and 2008–2009—have been associated with lower balanced-portfolio returns, as illustrated in ...

Show Me Financial Freedom Booklet

... Financial Fundamental One: Income must always exceed expenses over time. One of the most famous quotes in financial planning circles is, “it is not what you make but what you keep that counts.” So, what you save depends upon what you earn and how much you spend. Not being able to delay the “urge to ...

... Financial Fundamental One: Income must always exceed expenses over time. One of the most famous quotes in financial planning circles is, “it is not what you make but what you keep that counts.” So, what you save depends upon what you earn and how much you spend. Not being able to delay the “urge to ...

Macro View Canadian Markets U.S. Markets

... in this report may not be available to every interested investor. Accordingly, this report is provided for informational purposes only, and does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such would be prohibited. No part of any r ...

... in this report may not be available to every interested investor. Accordingly, this report is provided for informational purposes only, and does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such would be prohibited. No part of any r ...

Important Information about Hedge Funds

... Not all hedge funds are alike. Hedge funds have different investment objectives and strategies, such as long/short, merger/risk arbitrage, distressed securities, tactical trading, equity-market neutral, convertible and fixed-income arbitrage, capital structure arbitrage, and emerging markets. Some e ...

... Not all hedge funds are alike. Hedge funds have different investment objectives and strategies, such as long/short, merger/risk arbitrage, distressed securities, tactical trading, equity-market neutral, convertible and fixed-income arbitrage, capital structure arbitrage, and emerging markets. Some e ...

Presentation Title Here

... The Funds are subject to the risks of investing in equity securities (including small and mid-sized companies). Growth funds may underperform other funds that use different investing styles. Please refer to the most recent prospectus for a more detailed explanation of the Funds’ principal risks. Lip ...

... The Funds are subject to the risks of investing in equity securities (including small and mid-sized companies). Growth funds may underperform other funds that use different investing styles. Please refer to the most recent prospectus for a more detailed explanation of the Funds’ principal risks. Lip ...

Introduction Hypothesis Central Limit Theorem Objective Madoff

... Our goal is to develop an innovative method for calculating the probability distribution function of a randomly selected portfolio of known size from a large population of potential investments. Given a known universe of potential investments and a known portfolio size and holding period, this metho ...

... Our goal is to develop an innovative method for calculating the probability distribution function of a randomly selected portfolio of known size from a large population of potential investments. Given a known universe of potential investments and a known portfolio size and holding period, this metho ...

Large Cap Growth Factsheet

... In the financial economy there are negative effects from the declining profits in the energy sector to worries that the junk bonds issued by smaller energy companies may end up in default. We are not going to predict where the price of oil will be in the next six months except to say we do not expec ...

... In the financial economy there are negative effects from the declining profits in the energy sector to worries that the junk bonds issued by smaller energy companies may end up in default. We are not going to predict where the price of oil will be in the next six months except to say we do not expec ...

File - The Institute of International Finance

... investor base in the secondary market. Individuals depend on these markets as investors, as pension beneficiaries, and as employees and customers of dynamic companies that raise capital in equity markets to grow. Because of these dependencies, an overly conservative regulatory regime that unnecessar ...

... investor base in the secondary market. Individuals depend on these markets as investors, as pension beneficiaries, and as employees and customers of dynamic companies that raise capital in equity markets to grow. Because of these dependencies, an overly conservative regulatory regime that unnecessar ...

Underlying - UBS

... Regulations 2005 of Singapore. UK – For the purpose of non-discretionary accounts, this Product should not be sold with a consideration of less than EUR 100,000 or equivalent. USA - This Product may not be sold or offered within the United States or to U.S. persons. ...

... Regulations 2005 of Singapore. UK – For the purpose of non-discretionary accounts, this Product should not be sold with a consideration of less than EUR 100,000 or equivalent. USA - This Product may not be sold or offered within the United States or to U.S. persons. ...

Upcoming Deadline for Form SHC - Holdings of Foreign Securities

... Short-Term Debt Securities: Short-term debt securities include bills, commercial paper and other money market instruments of a foreign issuer with an original maturity of one year or less that give the holder unconditional right to financial assets. ...

... Short-Term Debt Securities: Short-term debt securities include bills, commercial paper and other money market instruments of a foreign issuer with an original maturity of one year or less that give the holder unconditional right to financial assets. ...

IRS Releases 871(m) Final Regulations – New Tests for Dividend

... corporation had no earnings and profits from which to make a dividend. A payment made pursuant to a due bill arising from the actions of a securities exchange that apply to all transactions in the stock with respect to the dividend. For this purpose, stock will be considered to trade with a due bill ...

... corporation had no earnings and profits from which to make a dividend. A payment made pursuant to a due bill arising from the actions of a securities exchange that apply to all transactions in the stock with respect to the dividend. For this purpose, stock will be considered to trade with a due bill ...

AAPT taps a different funds pool for its domestic market return

... manager suggested in 2013 that in order to ascertain whether the capacity existed for AAPT to return investors would need to assess how the debut deal performed. The issue’s performance does not appear to support an asset manager-targeted follow-up deal. Paton points out that AAPT’s owner, Adani, al ...

... manager suggested in 2013 that in order to ascertain whether the capacity existed for AAPT to return investors would need to assess how the debut deal performed. The issue’s performance does not appear to support an asset manager-targeted follow-up deal. Paton points out that AAPT’s owner, Adani, al ...

Finding Value in US High Yield Fixed Income

... Information and opinions presented have been obtained or derived from sources believed by Lazard to be reliable. Lazard makes no representation as to their accuracy or completeness. All opinions expressed herein are as of the published date and are subject to change. An investment in bonds carries r ...

... Information and opinions presented have been obtained or derived from sources believed by Lazard to be reliable. Lazard makes no representation as to their accuracy or completeness. All opinions expressed herein are as of the published date and are subject to change. An investment in bonds carries r ...

Key Fundraising Issues: Placement Agents

... BD requirement is for persons who are officials of the “issuer” and who do not receive special compensation tied to their sales or marketing activities. See 34 Act Rule 3a4-1. The “issuer” of a fund would include its general partner(s) or a managing member (if the fund is an LLC, rather than an LP). ...

... BD requirement is for persons who are officials of the “issuer” and who do not receive special compensation tied to their sales or marketing activities. See 34 Act Rule 3a4-1. The “issuer” of a fund would include its general partner(s) or a managing member (if the fund is an LLC, rather than an LP). ...

A Guide to Irish Regulated Real Estate Funds

... An individual investing into a QIF must have a minimum net worth of at least Euro 1.25 million (excluding principal private residence/contents) and all other investors must own or invest on a discretionary basis at least Euro 25 million or be owned by individuals who themselves qualify as qualifying ...

... An individual investing into a QIF must have a minimum net worth of at least Euro 1.25 million (excluding principal private residence/contents) and all other investors must own or invest on a discretionary basis at least Euro 25 million or be owned by individuals who themselves qualify as qualifying ...

Derivatives on RDX USD Index

... and any related sub-indexes are service marks of Dow Jones & Company, Inc. and UBS AG. All derivatives based on these indexes ar e not sponsored, endorsed, sold or promoted by Dow Jones & Company, Inc. or UBS AG, and neither party makes any representation regarding the advisability of trading or of ...

... and any related sub-indexes are service marks of Dow Jones & Company, Inc. and UBS AG. All derivatives based on these indexes ar e not sponsored, endorsed, sold or promoted by Dow Jones & Company, Inc. or UBS AG, and neither party makes any representation regarding the advisability of trading or of ...

US Trust Collateral L4 Template

... Hedge funds affiliated with Bank of America Corporation may not be available as collateral. Credit facilities may be provided by Bank of America, N.A., Member FDIC, or other subsidiaries of Bank of America Corporation, each an Equal Opportunity Lender. All credit and collateral are subject to credit ...

... Hedge funds affiliated with Bank of America Corporation may not be available as collateral. Credit facilities may be provided by Bank of America, N.A., Member FDIC, or other subsidiaries of Bank of America Corporation, each an Equal Opportunity Lender. All credit and collateral are subject to credit ...

Presentation

... not by institutional-oriented funds. These findings are all consistent with the presence of payoff complementarities among corporate bond-fund investors driven by the illiquidity of their assets. ...

... not by institutional-oriented funds. These findings are all consistent with the presence of payoff complementarities among corporate bond-fund investors driven by the illiquidity of their assets. ...

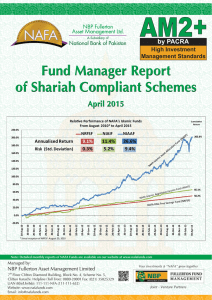

Islamic FMR- April 2015_(Complete)

... growth and strong margins. Power stocks remained attractive play for the yield hungry investors in the backdrop of the collapsing yields on the alternative fixed income avenues. Though sector performance remained slightly below the market, amid a decent recovery in the global oil prices and attracti ...

... growth and strong margins. Power stocks remained attractive play for the yield hungry investors in the backdrop of the collapsing yields on the alternative fixed income avenues. Though sector performance remained slightly below the market, amid a decent recovery in the global oil prices and attracti ...

investing for charitable good

... Similarities: • Asset allocation— The asset allocation decision (how much of the portfolio should go into stocks, bonds, cash, real estate, commodities, socially responsible investments, etc.) remains the primary driver of expected risk and return and should always come first. • Diversification— W ...

... Similarities: • Asset allocation— The asset allocation decision (how much of the portfolio should go into stocks, bonds, cash, real estate, commodities, socially responsible investments, etc.) remains the primary driver of expected risk and return and should always come first. • Diversification— W ...

Trending stocks are responsible for virtually all of the market`s gains

... Simulation of conventional academic theory and actual historical record both show that a minority of especially strong stocks account for the vast majority of the overall market’s gains. Every member of this minority shared one common characteristic. Each showed the propensity to appreciate to new a ...

... Simulation of conventional academic theory and actual historical record both show that a minority of especially strong stocks account for the vast majority of the overall market’s gains. Every member of this minority shared one common characteristic. Each showed the propensity to appreciate to new a ...

ECFS845

... o Firstly, they generally would not buy stocks if there is a news announcement coming in the near future. o Secondly, DFA would look to avoid stocks that were likely to negatively surprise in the near future by doing a thorough investigation of a stock – examination of a company’s reports. o Finally ...

... o Firstly, they generally would not buy stocks if there is a news announcement coming in the near future. o Secondly, DFA would look to avoid stocks that were likely to negatively surprise in the near future by doing a thorough investigation of a stock – examination of a company’s reports. o Finally ...

Opportunistic Portfolios

... less liquid than the securities of larger companies. Smaller companies typically have a higher risk of failure and are not as well established as larger blue-chip companies. Historically, smaller company stocks have experienced a greater degree of market volatility than the overall market average. F ...

... less liquid than the securities of larger companies. Smaller companies typically have a higher risk of failure and are not as well established as larger blue-chip companies. Historically, smaller company stocks have experienced a greater degree of market volatility than the overall market average. F ...

Long-Term Capital Market Assumptions

... significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because ...

... significant limitations. “Expected” return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted. Because ...

Cash Reserve Policy

... The Executive Director and staff will identify the need for access to reserve funds and confirm that the use is consistent with the purpose of the reserves as described in this Policy. This step requires analysis of the reason for the shortfall, the availability of any other sources of funds before ...

... The Executive Director and staff will identify the need for access to reserve funds and confirm that the use is consistent with the purpose of the reserves as described in this Policy. This step requires analysis of the reason for the shortfall, the availability of any other sources of funds before ...