New Submission Email - Central Bank of Ireland

... Type of Securities: [Debt/Fund/Equity] Document to be used for: Public Offer [Yes/No] Admission to trading on a regulated market [Yes/No] If Yes to admission to trading on a regulated market, name of regulated market: [Name of regulated market] Is this document related to a programme: [Yes/No] If Ye ...

... Type of Securities: [Debt/Fund/Equity] Document to be used for: Public Offer [Yes/No] Admission to trading on a regulated market [Yes/No] If Yes to admission to trading on a regulated market, name of regulated market: [Name of regulated market] Is this document related to a programme: [Yes/No] If Ye ...

Dynamic Factor Timing and the Predictability of Actively Managed

... attempt to capture the historical value premium. The attribution model will attribute any alpha that results from this strategy to the static factor allocation component of the fund’s historical alpha. If this value is non-zero then the fund’s risk profile has consistently differed from that of the ...

... attempt to capture the historical value premium. The attribution model will attribute any alpha that results from this strategy to the static factor allocation component of the fund’s historical alpha. If this value is non-zero then the fund’s risk profile has consistently differed from that of the ...

Access to Information: Vital for Efficient Markets and Economic Reform

... on the daily efforts of millions of entrepreneurs who risk their capital and invest their time and energy to supply the high-quality goods and services demanded by the market. Their success hinges not just on their hard work, but also on the public and private institutional frameworks within which t ...

... on the daily efforts of millions of entrepreneurs who risk their capital and invest their time and energy to supply the high-quality goods and services demanded by the market. Their success hinges not just on their hard work, but also on the public and private institutional frameworks within which t ...

View as DOCX (12/2) 1019 KB

... specified in governing legislation. The required levels of employee contributions are also specified in the Regulations. The Fund, like many other similar public and private sector funded schemes, has a gap between its assets and pension liabilities which this strategy addresses. A number of factors ...

... specified in governing legislation. The required levels of employee contributions are also specified in the Regulations. The Fund, like many other similar public and private sector funded schemes, has a gap between its assets and pension liabilities which this strategy addresses. A number of factors ...

China through the mosaic of its share classes

... China’s global competiveness is not a recent phenomenon. The “Opium Wars” of 1839-1860 left China aspiring to the technological and industrial capabilities of Britain and France. Needing fresh capital in order to fund the desired advancements, the concept of a joint-stock company was introduced. Th ...

... China’s global competiveness is not a recent phenomenon. The “Opium Wars” of 1839-1860 left China aspiring to the technological and industrial capabilities of Britain and France. Needing fresh capital in order to fund the desired advancements, the concept of a joint-stock company was introduced. Th ...

MARKET REVIEW U.S. equity markets closed out 2016 with a post

... U.S. equity markets closed out 2016 with a post-election rally fueled by expectations of expanded pro-growth fiscal policies, lower taxes and regulations, and higher interest rates. Economic indicators released during the quarter continued to show a U.S. economy that was growing modestly, with stead ...

... U.S. equity markets closed out 2016 with a post-election rally fueled by expectations of expanded pro-growth fiscal policies, lower taxes and regulations, and higher interest rates. Economic indicators released during the quarter continued to show a U.S. economy that was growing modestly, with stead ...

IS JAPAN ‘BACK’? 2013 th

... A rise in investment is actually a ‘good thing’ when your starting point is capital consumption (let’s glide over the data quality complications…) Raising dividends would also be a ‘good thing’ for profits because it would increase the income of capitalists Implication is that ‘Abe-nomics’ will real ...

... A rise in investment is actually a ‘good thing’ when your starting point is capital consumption (let’s glide over the data quality complications…) Raising dividends would also be a ‘good thing’ for profits because it would increase the income of capitalists Implication is that ‘Abe-nomics’ will real ...

Predicting turning points of financial markets

... available data related to the economic and financial environment. The analysis results in a set of possible scenarios about the future. These scenarios are ranked from most likely to least likely. An investment strategy is then developed for the most likely scenario, keeping in mind, however, that o ...

... available data related to the economic and financial environment. The analysis results in a set of possible scenarios about the future. These scenarios are ranked from most likely to least likely. An investment strategy is then developed for the most likely scenario, keeping in mind, however, that o ...

Free Sample - Exam Test Bank Store

... c. A short position is closed when the short seller purchases the security and returns it to the lender. d. If the price does decline, the short seller profits because the shares are purchased for a lower price than they were sold. The investor makes a profit by buying low and selling high, but wit ...

... c. A short position is closed when the short seller purchases the security and returns it to the lender. d. If the price does decline, the short seller profits because the shares are purchased for a lower price than they were sold. The investor makes a profit by buying low and selling high, but wit ...

9 BMO Guardian Global High Yield Bond Fund Advisor Series

... Canadian investors missing out Global markets – multitude and range of issues across many countries: ...

... Canadian investors missing out Global markets – multitude and range of issues across many countries: ...

the collective - BNY Mellon Investment Management

... negotiate investment management fees and, in most cases, plan asset (or TDF asset size) minimums. As CITs do not have 12(b)-1 fees, DC plans looking to reduce or eliminate revenue-sharing and shift to a per-person administrative fee model are gravitating to this investment vehicle option. Both facto ...

... negotiate investment management fees and, in most cases, plan asset (or TDF asset size) minimums. As CITs do not have 12(b)-1 fees, DC plans looking to reduce or eliminate revenue-sharing and shift to a per-person administrative fee model are gravitating to this investment vehicle option. Both facto ...

Investing in Common Stocks

... companies still in their developing stages, with hopes of superior earnings growth over time. Some of these companies will make it, but others will fall by the wayside. ■ Value stocks are generally less risky than growth stocks since their higher dividend yields and lower P/Es offer some protection ...

... companies still in their developing stages, with hopes of superior earnings growth over time. Some of these companies will make it, but others will fall by the wayside. ■ Value stocks are generally less risky than growth stocks since their higher dividend yields and lower P/Es offer some protection ...

1606_CF Canlife Global High Yield Bond

... Fixed interest securities are affected by trends in interest rates and inflation. If interest rates go up the value of capital may fall and vice versa. Inflation will also decrease the real value of capital. The value of a fixed interest security is also affected by its credit rating. Liquidity Risk: T ...

... Fixed interest securities are affected by trends in interest rates and inflation. If interest rates go up the value of capital may fall and vice versa. Inflation will also decrease the real value of capital. The value of a fixed interest security is also affected by its credit rating. Liquidity Risk: T ...

Endowment Investment Policy

... composed of equity, fixed income, cash equivalent securities, and other investments as determined by the Board of Regents. As such, the portfolio is intended to be more aggressive than short to intermediate fixed income oriented portfolios and less aggressive than equity only oriented portfolios. In ...

... composed of equity, fixed income, cash equivalent securities, and other investments as determined by the Board of Regents. As such, the portfolio is intended to be more aggressive than short to intermediate fixed income oriented portfolios and less aggressive than equity only oriented portfolios. In ...

Greenfield Seitz Capital Management, LLC

... Firm Information: Greenfield Seitz Capital Management LLC ("GSCM") is a registered investment advisor based in Dallas, Texas. GSCM is a 4-person entity controlled by Stuart Greenfield and Yancey Seitz. GSCM specializes in managing separate investment accounts for high net-worth individuals, with a f ...

... Firm Information: Greenfield Seitz Capital Management LLC ("GSCM") is a registered investment advisor based in Dallas, Texas. GSCM is a 4-person entity controlled by Stuart Greenfield and Yancey Seitz. GSCM specializes in managing separate investment accounts for high net-worth individuals, with a f ...

Introducing RBC Dominion Securities

... Benefit from a professionally managed, highly disciplined process that employs purely rational criteria for all investment decisions made on your behalf. ...

... Benefit from a professionally managed, highly disciplined process that employs purely rational criteria for all investment decisions made on your behalf. ...

Dr. Daniele Franco

... no taxation on benefits attributable to returns from capital; benefits attributable to capital component are subject to separate taxation (rate depends on years of work) ...

... no taxation on benefits attributable to returns from capital; benefits attributable to capital component are subject to separate taxation (rate depends on years of work) ...

How to Read Your Form 1099-B

... calculating and reporting gains and losses realized on the sale of noncovered securities. Note that boxes 1b, 3, and 5 may be blank for a noncovered security sale. Box 8: Contains a description of the security and the price per share at sale. Boxes 13, 14, and 15: State-related information reportabl ...

... calculating and reporting gains and losses realized on the sale of noncovered securities. Note that boxes 1b, 3, and 5 may be blank for a noncovered security sale. Box 8: Contains a description of the security and the price per share at sale. Boxes 13, 14, and 15: State-related information reportabl ...

Trustee Corporations Association of Australia

... As evidenced by the HIH episode, this “expectation gap” results in pressure on the Government to use taxpayer funds to provide compensation for losses suffered by investors in regulated institutions. This highlights the importance of the supervisory framework incorporating appropriate measures aimed ...

... As evidenced by the HIH episode, this “expectation gap” results in pressure on the Government to use taxpayer funds to provide compensation for losses suffered by investors in regulated institutions. This highlights the importance of the supervisory framework incorporating appropriate measures aimed ...

HSBC Russia Manufacturing PMI

... contribution to Russian Industrial Production. Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month. For each of the indicators the ‘Report’ shows the percentage reporting each response, the net difference between the numb ...

... contribution to Russian Industrial Production. Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month. For each of the indicators the ‘Report’ shows the percentage reporting each response, the net difference between the numb ...

The past five years have seen market behaviour dominated by

... Investors cited a number of concerns about market capitalisation weighted indices including their bias towards large caps, certain sectors and regions as some of the practical issues with traditional indices. In addition, there are a number of conceptual and empirical limitations often highlighted b ...

... Investors cited a number of concerns about market capitalisation weighted indices including their bias towards large caps, certain sectors and regions as some of the practical issues with traditional indices. In addition, there are a number of conceptual and empirical limitations often highlighted b ...

LONGzTERM INVESTORS?

... How different asset classes relate to inflation It matters greatly whether inflation is accelerating or falling: • Equities: Company revenues are closely linked with inflation. Revenue = Price x Quantity. As long as firms can keep input costs under control and defend their margins – which the good ...

... How different asset classes relate to inflation It matters greatly whether inflation is accelerating or falling: • Equities: Company revenues are closely linked with inflation. Revenue = Price x Quantity. As long as firms can keep input costs under control and defend their margins – which the good ...

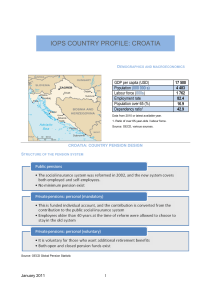

IOPS COUNTRY PROFILE: CROATIA

... HRK 1,250 and allows a deduction of up to HRK 1,050 per month from personal taxable income. This means that there is a double benefit – state subsidy and tax deduction – for these contributions. Contributions The insurance operates according to the same principles as the mandatory savings accounts w ...

... HRK 1,250 and allows a deduction of up to HRK 1,050 per month from personal taxable income. This means that there is a double benefit – state subsidy and tax deduction – for these contributions. Contributions The insurance operates according to the same principles as the mandatory savings accounts w ...

Emerging Market Corporate Debt: An Attractive Investment Opportunity

... The comments provided herein are a general market overview and do not constitute investment advice, are not predictive of any future market performance, are not provided as a sales or advertising communication, and do not represent an offer to sell or a solicitation of an offer to buy any security. ...

... The comments provided herein are a general market overview and do not constitute investment advice, are not predictive of any future market performance, are not provided as a sales or advertising communication, and do not represent an offer to sell or a solicitation of an offer to buy any security. ...

Reducing the Fear of Inflation with TIPS

... a lot of investors are beginning to look toward hedging against the potential of rising inflation “just in case1.” But what asset classes should investors embrace to provide inflation insurance? Gold? Commodities? Real assets? They all have their cheerleaders but for many investors, there continues ...

... a lot of investors are beginning to look toward hedging against the potential of rising inflation “just in case1.” But what asset classes should investors embrace to provide inflation insurance? Gold? Commodities? Real assets? They all have their cheerleaders but for many investors, there continues ...