Emerging Markets: Crossing the Rubicon.

... status. An example of this approach is that South Korea was placed on FTSE’s watch list for three years before its elevation to Developed market status. South Korea was added to FTSE’s Developed market indexes in September 2009. Equipped with these indexes, investors can begin to make informed tacti ...

... status. An example of this approach is that South Korea was placed on FTSE’s watch list for three years before its elevation to Developed market status. South Korea was added to FTSE’s Developed market indexes in September 2009. Equipped with these indexes, investors can begin to make informed tacti ...

Report 52 - Fixed Maturity EUR Industrial Bond Funds

... Until December 31st, 2011 returns of all institutional mandates were presented net of fees, namely actual custody fees, management commissions and transaction costs. There are no performance based fees. For the mutual funds, and institutional mandates from January 1st, 2012, the returns are prese ...

... Until December 31st, 2011 returns of all institutional mandates were presented net of fees, namely actual custody fees, management commissions and transaction costs. There are no performance based fees. For the mutual funds, and institutional mandates from January 1st, 2012, the returns are prese ...

The Efficient Market Theory and Evidence

... Turning to the non-retail sector, there is some evidence of positive post-fee risk-adjusted returns in hedge funds where highly paid managers actively trade marketable securities. One caveat is that the quality and duration of these data, as well as the changing institutional marketplace for hedge f ...

... Turning to the non-retail sector, there is some evidence of positive post-fee risk-adjusted returns in hedge funds where highly paid managers actively trade marketable securities. One caveat is that the quality and duration of these data, as well as the changing institutional marketplace for hedge f ...

Wave 7 - BetterInvesting

... research studies to better understand the attitudes and behaviors of American investors. This study represents the seventh wave of research conducted for BetterInvesting. The previous waves were conducted in September 2003, January 2004, May 2004, November 2004, February 2005, and June 2005. By regu ...

... research studies to better understand the attitudes and behaviors of American investors. This study represents the seventh wave of research conducted for BetterInvesting. The previous waves were conducted in September 2003, January 2004, May 2004, November 2004, February 2005, and June 2005. By regu ...

Lecture 5

... ETFs are cost efficient. You can buy exposure with one transaction that otherwise would require establishing an entire portfolio wit many individual transaction fees ...

... ETFs are cost efficient. You can buy exposure with one transaction that otherwise would require establishing an entire portfolio wit many individual transaction fees ...

The Cost of Immediacy for Corporate Bonds

... and Gurel (1986); Chen, Noronha, and Singal (2004) and others), the Nikkei 225 (Greenwood, 2005) and the FTSE 100 (Mase, 2007). ...

... and Gurel (1986); Chen, Noronha, and Singal (2004) and others), the Nikkei 225 (Greenwood, 2005) and the FTSE 100 (Mase, 2007). ...

403(b) – Vendor Charge Comparison Annuities

... District administrative requirements allow companies which meet certain standards and maintain a minimum number of employee accounts to provide 403(b) TSA accounts to employees. The companies listed are currently authorized under administrative guidelines to establish 403(b) and 403(b)(7) accounts f ...

... District administrative requirements allow companies which meet certain standards and maintain a minimum number of employee accounts to provide 403(b) TSA accounts to employees. The companies listed are currently authorized under administrative guidelines to establish 403(b) and 403(b)(7) accounts f ...

Reducing bonds? Proceed with caution

... unreasonable, given that the best predictor of bonds’ future returns— that is, their current yield to maturity—projects returns of 1%–2% over the next ten years (according to Davis, Aliaga-Díaz, and Patterson, 2013). With return expectations low and interest rates close to 0%, investors are justifia ...

... unreasonable, given that the best predictor of bonds’ future returns— that is, their current yield to maturity—projects returns of 1%–2% over the next ten years (according to Davis, Aliaga-Díaz, and Patterson, 2013). With return expectations low and interest rates close to 0%, investors are justifia ...

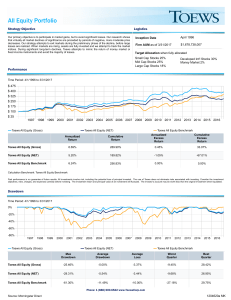

All Equity Portfolio

... Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal invested. The use of Toews does not eliminate risks associated with investing. Consider the investment objectives, risks, charges, and expenses carefully before investing. The ...

... Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal invested. The use of Toews does not eliminate risks associated with investing. Consider the investment objectives, risks, charges, and expenses carefully before investing. The ...

Capital Formation Agenda - Small Business Investor Alliance

... Business Investment Companies (SBIC). SBICs are U.S. Small Business Administration (SBA)-regulated investment vehicles that can borrow up to two times the private capital they raise to invest in small businesses. See page 23 for more background on the SBIC Program. A growing number of SBIA members a ...

... Business Investment Companies (SBIC). SBICs are U.S. Small Business Administration (SBA)-regulated investment vehicles that can borrow up to two times the private capital they raise to invest in small businesses. See page 23 for more background on the SBIC Program. A growing number of SBIA members a ...

Most Traded Stocks on the Tel Aviv Stock Exchange in 2014

... - After three years as the runner-up for the ICL stock, Teva reclaimed its topmost position on the most traded stocks list, with an average daily volume of NIS 84.4 million, an increase of 28% compared with the volume in 2013, concurrently with a sharp rise of 64% in stock price. - The ICL stock, wh ...

... - After three years as the runner-up for the ICL stock, Teva reclaimed its topmost position on the most traded stocks list, with an average daily volume of NIS 84.4 million, an increase of 28% compared with the volume in 2013, concurrently with a sharp rise of 64% in stock price. - The ICL stock, wh ...

Chap014

... Presents aggregate view of the financial position of the NPO as a whole, rather than a disaggregated view focused on funds Can also be called a balance sheet Net assets (the difference between assets and liabilities) must be classified into three classes: ...

... Presents aggregate view of the financial position of the NPO as a whole, rather than a disaggregated view focused on funds Can also be called a balance sheet Net assets (the difference between assets and liabilities) must be classified into three classes: ...

Impact of Macroeconomic Factors on Share Price Index

... Impact of Macroeconomic Factors on Share Price Index in Vietnam’s Stock Market Research of Friedman and Schwartz (1963) shows the initial explanation about the relation between money supply and income of stock. Since then, increase of money supply will raise the liquidity and credit for investors o ...

... Impact of Macroeconomic Factors on Share Price Index in Vietnam’s Stock Market Research of Friedman and Schwartz (1963) shows the initial explanation about the relation between money supply and income of stock. Since then, increase of money supply will raise the liquidity and credit for investors o ...

Venture Capital Fund

... in the United States of America. The form and content of each reporting entity’s financial statements are the responsibility of the entity’s management. The materials are being provided with the understanding that the information contained therein should not be construed as legal, accounting, tax or ...

... in the United States of America. The form and content of each reporting entity’s financial statements are the responsibility of the entity’s management. The materials are being provided with the understanding that the information contained therein should not be construed as legal, accounting, tax or ...

Realpool Investment Fund - British Columbia Investment

... bcIMC maintains systems of internal control and supporting processes to provide reasonable assurance that assets are safeguarded; that transactions are appropriately authorized and recorded; and that there are no material misstatements in the financial statements. bcIMC’s internal control framework ...

... bcIMC maintains systems of internal control and supporting processes to provide reasonable assurance that assets are safeguarded; that transactions are appropriately authorized and recorded; and that there are no material misstatements in the financial statements. bcIMC’s internal control framework ...

Socio-Economic development is a process through which quality of

... have many different causes and manifestations. Although the government of India has been laying much stress on wiping out regional disparities through their different programmes and policies but the achievement is not up to the expectations. It is seen that disparities exists at macro, meso, and mic ...

... have many different causes and manifestations. Although the government of India has been laying much stress on wiping out regional disparities through their different programmes and policies but the achievement is not up to the expectations. It is seen that disparities exists at macro, meso, and mic ...

instructions for preparing and publishing the annual

... Eliminate other financing sources, uses and expenditures associated with debt service. From an accrual perspective, debt issuance has no impact on net assets, but rather affects only accounts reported on the statement of position (debt payable, premiums, discounts, issuance costs, difference between ...

... Eliminate other financing sources, uses and expenditures associated with debt service. From an accrual perspective, debt issuance has no impact on net assets, but rather affects only accounts reported on the statement of position (debt payable, premiums, discounts, issuance costs, difference between ...

A note on portfolio selection, diversification and

... formed by randomly selecting funds from the sample. Given that our sample includes nonsurviving funds, if a fund that is part of a simulated FoF portfolio terminates, it is replaced with another fund in the subsequent period (consistent with Amin and Kat (2002)). The replacement fund is randomly sel ...

... formed by randomly selecting funds from the sample. Given that our sample includes nonsurviving funds, if a fund that is part of a simulated FoF portfolio terminates, it is replaced with another fund in the subsequent period (consistent with Amin and Kat (2002)). The replacement fund is randomly sel ...

The Case for shorT-MaTuriTy, higher QualiTy, high yield

... given the turmoil in the financial markets in 2008. We believe these companies are in a good position to pay off their outstanding short-term debt as it comes due. Market Risk: Periods of extreme market stress can lead to disruptive price volatility, even in short-maturity bonds. In late 2008, sys ...

... given the turmoil in the financial markets in 2008. We believe these companies are in a good position to pay off their outstanding short-term debt as it comes due. Market Risk: Periods of extreme market stress can lead to disruptive price volatility, even in short-maturity bonds. In late 2008, sys ...

absolute return strategy sicav

... Last year was dominated by various crises in the Eurozone. In early May, the euro countries attempted to ward off the crisis by creating the European Financial Stability Facility, or EFSF, a EUR750 billion fund for hard-up euro countries only able to finance their national debt at extremely high int ...

... Last year was dominated by various crises in the Eurozone. In early May, the euro countries attempted to ward off the crisis by creating the European Financial Stability Facility, or EFSF, a EUR750 billion fund for hard-up euro countries only able to finance their national debt at extremely high int ...

2014 Triennial Surveillance Review : External Study -- Risks

... that those were not sources of macroeconomic vulnerability. Formal and informal analysis are complements, warranting mutual respect and deserving to be joined up. Not all remedies will be macro-prudential, but many will be. Although tragically late, policymakers have recovered the old knowledge that ...

... that those were not sources of macroeconomic vulnerability. Formal and informal analysis are complements, warranting mutual respect and deserving to be joined up. Not all remedies will be macro-prudential, but many will be. Although tragically late, policymakers have recovered the old knowledge that ...

Realpool Investment Fund

... bcIMC maintains systems of internal control and supporting processes to provide reasonable assurance that assets are safeguarded; that transactions are appropriately authorized and recorded; and that there are no material misstatements in the financial statements. bcIMC’s internal control framework ...

... bcIMC maintains systems of internal control and supporting processes to provide reasonable assurance that assets are safeguarded; that transactions are appropriately authorized and recorded; and that there are no material misstatements in the financial statements. bcIMC’s internal control framework ...

Informed Trading, Liquidity Provision, and Stock Selection by Mutual

... based on the …ndings reported in the literature.6 Third, as expected, we …nd that the informed trading component is more important than the liquidity provision component in explaining crosssectional variation in the CS measures; and informed trading becomes relatively more important for growth-orien ...

... based on the …ndings reported in the literature.6 Third, as expected, we …nd that the informed trading component is more important than the liquidity provision component in explaining crosssectional variation in the CS measures; and informed trading becomes relatively more important for growth-orien ...

Policy Prescription to the Regional Disparities in the Supply

... Each of the supported funds in the scheme received a reimbursable, interest-free advance of up to 50% of the annual operating costs of the fund over a three to five year period. This loan is due for repayment after ten years when it was deemed that sufficient investment realisations would have been ...

... Each of the supported funds in the scheme received a reimbursable, interest-free advance of up to 50% of the annual operating costs of the fund over a three to five year period. This loan is due for repayment after ten years when it was deemed that sufficient investment realisations would have been ...

UK Equities for income and total return

... Stock weightings typically between 1% and 10% of NAV. Sector positions are an outcome of stock selection. Normally expect a max of 25% in any one sector Typical active money of between 60 – 70% ...

... Stock weightings typically between 1% and 10% of NAV. Sector positions are an outcome of stock selection. Normally expect a max of 25% in any one sector Typical active money of between 60 – 70% ...