Shareholder Assessment of Bond Fund Risk Ratings

... who owned equity and bond funds as well as those owning money market funds. Most of the respondents were seasoned fund investors who had long-term financial goals and long-term investment strategies. The survey questionnaire was designed, inter alia, to determine: how risk enters into investment dec ...

... who owned equity and bond funds as well as those owning money market funds. Most of the respondents were seasoned fund investors who had long-term financial goals and long-term investment strategies. The survey questionnaire was designed, inter alia, to determine: how risk enters into investment dec ...

2015 Preqin Sovereign Wealth Fund Review: Exclusive Extract

... Where other institutional investors hold more stringent liquidity requirements in comparison with the multi-generational mission of sovereign wealth funds, potential investments in highly illiquid asset classes and strategies are more feasible, the longer the investment horizon. Sovereign wealth fun ...

... Where other institutional investors hold more stringent liquidity requirements in comparison with the multi-generational mission of sovereign wealth funds, potential investments in highly illiquid asset classes and strategies are more feasible, the longer the investment horizon. Sovereign wealth fun ...

Liquidity and the Law of One Price: The Case of the Futures/Cash

... NYSE composite index. The riskless rate r is the continuously compounded yield on a Treasury Bill maturing as close to the futures expiration date as possible, and, if necessary, the yield is extrapolated from the last day of the bill’s life to the end of the contract. The dividend yield δ is the (c ...

... NYSE composite index. The riskless rate r is the continuously compounded yield on a Treasury Bill maturing as close to the futures expiration date as possible, and, if necessary, the yield is extrapolated from the last day of the bill’s life to the end of the contract. The dividend yield δ is the (c ...

General Money Market Funds

... The Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example a ...

... The Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example a ...

2nd Con Doc on NBNI G

... framework for identifying G-SIFIs that would apply across NBNI financial entities (as set out in this Section), as well as a “backstop” guiding methodology for assessing the global systemic importance of NBNI financial entities that are not covered by one of the sectorspecific methodologies for (i) ...

... framework for identifying G-SIFIs that would apply across NBNI financial entities (as set out in this Section), as well as a “backstop” guiding methodology for assessing the global systemic importance of NBNI financial entities that are not covered by one of the sectorspecific methodologies for (i) ...

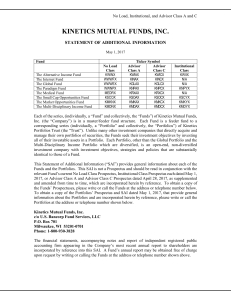

Statement of Additional Information

... Each share of common stock of a Fund is entitled to one vote in electing Directors and other matters that may be submitted to shareholders for a vote. All shares of all Classes of each Fund generally have equal voting rights. However, matters affecting only one particular Fund or Class of shares can ...

... Each share of common stock of a Fund is entitled to one vote in electing Directors and other matters that may be submitted to shareholders for a vote. All shares of all Classes of each Fund generally have equal voting rights. However, matters affecting only one particular Fund or Class of shares can ...

IPE EDHEC-Risk Research Insights Spring 2014

... We then discuss smart factor indices. We construct smart factor indices by using diversified multi-strategy weighting on characteristics-based half universes – small size, high momentum, low volatility, and value. In this way, investors can i) manage systematic risks through explicit stock selection ...

... We then discuss smart factor indices. We construct smart factor indices by using diversified multi-strategy weighting on characteristics-based half universes – small size, high momentum, low volatility, and value. In this way, investors can i) manage systematic risks through explicit stock selection ...

Equity Diversification:

... Reduce volatility by diversifying wisely. Reduce risk by choosing wisely. I'd like to point out that this discussion has been a simplification — though not a fairy tale. The intelligent investor will consider many other factors that influence portfolio volatility and risk. For example, in our comple ...

... Reduce volatility by diversifying wisely. Reduce risk by choosing wisely. I'd like to point out that this discussion has been a simplification — though not a fairy tale. The intelligent investor will consider many other factors that influence portfolio volatility and risk. For example, in our comple ...

Close Strategic Alpha Prospectus - Close Brothers Asset Management

... Prospectus and accepts responsibility accordingly. It has taken all reasonable care to ensure that, to the best of its knowledge and belief, the information in this document does not contain any untrue or misleading statement or omit any matters required by the COLL Sourcebook to be included in it. ...

... Prospectus and accepts responsibility accordingly. It has taken all reasonable care to ensure that, to the best of its knowledge and belief, the information in this document does not contain any untrue or misleading statement or omit any matters required by the COLL Sourcebook to be included in it. ...

#32842_30_Mutual Fund Regulation_P1 1..72

... Prior to the adoption of Rule 2a-7, the SEC had expressed the view that the portfolio valuation provisions of the ICA required a money market fund to (i) determine the fair value of short-term debt securities for which market quotations were not readily available by reference generally to current ma ...

... Prior to the adoption of Rule 2a-7, the SEC had expressed the view that the portfolio valuation provisions of the ICA required a money market fund to (i) determine the fair value of short-term debt securities for which market quotations were not readily available by reference generally to current ma ...

I 1) Which of the following is NOT an example of a

... a) Selling any security of equal quantity. b) Selling the same scrip and same quantity. c) Selling any index scrip of equal quantity d) Selling any A-group scrip for equal quantity. 56) The selection criteria for a scrip to form part of the BSE Sensitive index is a) The scripts must have been traded ...

... a) Selling any security of equal quantity. b) Selling the same scrip and same quantity. c) Selling any index scrip of equal quantity d) Selling any A-group scrip for equal quantity. 56) The selection criteria for a scrip to form part of the BSE Sensitive index is a) The scripts must have been traded ...

Sustainable Landscapes: Investor Mapping in Asia

... and/or the preservation or enhancement of critical habitat'. The study captures investments across three conservation areas: sustainable food and fiber production, habitat conservation, and water quality and quantity conservation. Source: “Investing in Conservation: A landscape assessment of an em ...

... and/or the preservation or enhancement of critical habitat'. The study captures investments across three conservation areas: sustainable food and fiber production, habitat conservation, and water quality and quantity conservation. Source: “Investing in Conservation: A landscape assessment of an em ...

Working Paper 29: Overcoming barriers to institutional investment in

... characteristics as rental growth can increase capital values. These characteristics, together with the low correlation with other assets, make commercial property attractive to institutional investors. However, only a small proportion of residential investments offer these characteristics, with the ...

... characteristics as rental growth can increase capital values. These characteristics, together with the low correlation with other assets, make commercial property attractive to institutional investors. However, only a small proportion of residential investments offer these characteristics, with the ...

Retirement Date Fund

... What Is a Retirement Date Fund? Retirement Date Funds (also known as target date funds) make investing for your retirement simple. All you have to do is choose the fund that most closely matches the year you expect to retire from the Florida Retirement System (FRS) Investment Plan. Diversification, ...

... What Is a Retirement Date Fund? Retirement Date Funds (also known as target date funds) make investing for your retirement simple. All you have to do is choose the fund that most closely matches the year you expect to retire from the Florida Retirement System (FRS) Investment Plan. Diversification, ...

Oral Disclosure - CIBC Structured Notes

... rate of 0.25% per annum. For funds deposited on or prior to the Thursday of a given week, the investment period will commence and interest will accrue from and including the first Banking Day of such week up to but excluding the Issue Date. For funds deposited after the Thursday of a given week, the ...

... rate of 0.25% per annum. For funds deposited on or prior to the Thursday of a given week, the investment period will commence and interest will accrue from and including the first Banking Day of such week up to but excluding the Issue Date. For funds deposited after the Thursday of a given week, the ...

Smart Beta - A referential guide for institutional investors

... he says. “For example, selecting or weighting component securities by book yield, dividend yield or earnings yield may all, to varying degrees, provide access to the ‘value premium’ that has been identified in the academic research over time. The latter is a ‘return premium,’ the former are simply f ...

... he says. “For example, selecting or weighting component securities by book yield, dividend yield or earnings yield may all, to varying degrees, provide access to the ‘value premium’ that has been identified in the academic research over time. The latter is a ‘return premium,’ the former are simply f ...

2003 Report as a word document

... of the amortisation of deficit, which will be spread over 9.5 years being the average remaining service lives of the active members. A prepayment of £425,000 (in 2002 £638,000) has been included on the Balance Sheet. The latest formal actuarial assessment of the scheme was as at 31 December 2002. Th ...

... of the amortisation of deficit, which will be spread over 9.5 years being the average remaining service lives of the active members. A prepayment of £425,000 (in 2002 £638,000) has been included on the Balance Sheet. The latest formal actuarial assessment of the scheme was as at 31 December 2002. Th ...

Has Economic Policy Uncertainty Hampered the Recovery? BFI Working Paper Series No. 2012-003

... To measure disagreement about future inflation, we compute the interquartile range – the spread between the 75th and 25th percentiles – of the four-quarter-ahead forecasts for the quarterly inflation rate. For government purchases, we follow the survey and treat federal government purchases separate ...

... To measure disagreement about future inflation, we compute the interquartile range – the spread between the 75th and 25th percentiles – of the four-quarter-ahead forecasts for the quarterly inflation rate. For government purchases, we follow the survey and treat federal government purchases separate ...

Dublin City School District Comprehensive Annual Financial Report June 30, 2004

... restaurants) ranking among the highest in local employment. Dublin markets itself to the service industry and as a home for the corporate headquarters of businesses. Additionally, the city is the home to numerous R & D companies and high-tech manufacturing businesses. The continued economic growth a ...

... restaurants) ranking among the highest in local employment. Dublin markets itself to the service industry and as a home for the corporate headquarters of businesses. Additionally, the city is the home to numerous R & D companies and high-tech manufacturing businesses. The continued economic growth a ...

Vanguard Presentation

... companies • Approximately $950 billion in U.S. mutual funds (as of December 31, 2005) ...

... companies • Approximately $950 billion in U.S. mutual funds (as of December 31, 2005) ...

George J. Stigler Center for the Study of the Economy and the State

... To measure disagreement about future inflation, we compute the interquartile range – the spread between the 75th and 25th percentiles – of the four-quarter-ahead forecasts for the quarterly inflation rate. For government purchases, we follow the survey and treat federal government purchases separate ...

... To measure disagreement about future inflation, we compute the interquartile range – the spread between the 75th and 25th percentiles – of the four-quarter-ahead forecasts for the quarterly inflation rate. For government purchases, we follow the survey and treat federal government purchases separate ...

Morning Briefing Global Economic Trading Calendar

... European bourses are initially seen little changed Friday, with the FTSE seen unchanged and the CAC and DAX both higher by 0.1%. US STOCKS CLOSE: Stocks eked out modest gains mostly Thursday, ...

... European bourses are initially seen little changed Friday, with the FTSE seen unchanged and the CAC and DAX both higher by 0.1%. US STOCKS CLOSE: Stocks eked out modest gains mostly Thursday, ...

Brochure - The Brookdale Group

... properties) located within the Mid-Atlantic, Southeast and Southwest regions of the United States. ...

... properties) located within the Mid-Atlantic, Southeast and Southwest regions of the United States. ...

The Importance of Asset Management

... found consistent with an increase in the weight of equities. Modern financial portfolio theory also created the intellectual conditions for an increased share of equity in portfolios by demonstrating that the total returns approach was the most efficient one; a plan sponsor could now also rely on t ...

... found consistent with an increase in the weight of equities. Modern financial portfolio theory also created the intellectual conditions for an increased share of equity in portfolios by demonstrating that the total returns approach was the most efficient one; a plan sponsor could now also rely on t ...