Socially Responsible Investments - Centre for Financial Research

... preferences are less likely to use socially responsible investments as a signaling tool to improve their reputation. More broadly, our paper shows that individuals who behave prosocially in one domain (the trust game) also behave more prosocially in another domain (socially responsible investments). ...

... preferences are less likely to use socially responsible investments as a signaling tool to improve their reputation. More broadly, our paper shows that individuals who behave prosocially in one domain (the trust game) also behave more prosocially in another domain (socially responsible investments). ...

Stock Prices in the Presence of Liquidity Crises

... A central problem in the credit market is that lenders are reluctant to make loans because they cannot easily determine whether a prospective borrower has resources to repay the loan. If the loan is made, the lender is concerned whether the borrower will engage in risky behavior that could lower th ...

... A central problem in the credit market is that lenders are reluctant to make loans because they cannot easily determine whether a prospective borrower has resources to repay the loan. If the loan is made, the lender is concerned whether the borrower will engage in risky behavior that could lower th ...

Do Precious Metals Shine in the Portfolio of a Nordic

... The reason why we are interested in the low correlations that precious metals have with the equity market is the Modern portfolio theory by Harry Markowitz (1952). The theory states that investors can reduce the risk in their investment portfolios by choosing assets that are not perfectly correlated ...

... The reason why we are interested in the low correlations that precious metals have with the equity market is the Modern portfolio theory by Harry Markowitz (1952). The theory states that investors can reduce the risk in their investment portfolios by choosing assets that are not perfectly correlated ...

TRMCX TRMIX TAMVX RRMVX Mid-Cap Value Fund Investor Class

... Portfolio Turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the fund’s shares are held in a taxable account. Thes ...

... Portfolio Turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the fund’s shares are held in a taxable account. Thes ...

NBER WORKING PAPER SERIES TRANSPARENCY AND INTERNATIONAL INVESTOR BEHAVIOR R. Gaston Gelos

... countries (where herding is defined as funds taking investment decisions which they would not take if they did not observe other funds taking them). As a result, investors may rush in and out of countries even in the absence of substantial news about fundamentals. In theory, however, it is controver ...

... countries (where herding is defined as funds taking investment decisions which they would not take if they did not observe other funds taking them). As a result, investors may rush in and out of countries even in the absence of substantial news about fundamentals. In theory, however, it is controver ...

Endowment? - Office of the Vice President for Finance and Treasurer

... income of your endowment. Funds which are fully reinvested will have the reinvestment flag turned to “Y” (yes; reinvest). Funds which are fully reinvested will still have gross and net AIF income available for spending indicated in the upper right-hand corner of the 114 reports, however all yield wi ...

... income of your endowment. Funds which are fully reinvested will have the reinvestment flag turned to “Y” (yes; reinvest). Funds which are fully reinvested will still have gross and net AIF income available for spending indicated in the upper right-hand corner of the 114 reports, however all yield wi ...

PDP-Working Paper

... institutional investors determine their investment policies on the basis of sound financial risk and return-related considerations, taking into account key lessons from crises and uncertainties in the financial markets. In this way, long-term investors can avoid, for example, a “herd” sale of assets ...

... institutional investors determine their investment policies on the basis of sound financial risk and return-related considerations, taking into account key lessons from crises and uncertainties in the financial markets. In this way, long-term investors can avoid, for example, a “herd” sale of assets ...

(Ab)Use of Omega?

... the purpose of the analysis which might be, for instance, one of the following: an investment decision, the evaluation of managers’ abilities, the identification of management strategies and of their impact, either in terms of deviations from the benchmark or in terms of risk/return. Despite some l ...

... the purpose of the analysis which might be, for instance, one of the following: an investment decision, the evaluation of managers’ abilities, the identification of management strategies and of their impact, either in terms of deviations from the benchmark or in terms of risk/return. Despite some l ...

Dynamic Allocation Strategies using Minimum Volatility

... Barra US Equity Model (USE4) to manage risk and rebalance monthly.The factor structure of the Barra US Equity Model is designed for the US market and contains several advanced methodologies such as Optimization Bias Adjustment as well as an enhanced specific risk model to generate the lowest risk por ...

... Barra US Equity Model (USE4) to manage risk and rebalance monthly.The factor structure of the Barra US Equity Model is designed for the US market and contains several advanced methodologies such as Optimization Bias Adjustment as well as an enhanced specific risk model to generate the lowest risk por ...

Is the Risk-Return Tradeoff Hypothesis valid: Should an

... Furthermore Fama assumed that all information was free: no transaction costs or taxes existed. Fama based the idea about EMH on the random walk theory. He also stated that there are three different forms of efficiency when discussing available information, according to the EMH: i) weak-form efficien ...

... Furthermore Fama assumed that all information was free: no transaction costs or taxes existed. Fama based the idea about EMH on the random walk theory. He also stated that there are three different forms of efficiency when discussing available information, according to the EMH: i) weak-form efficien ...

Portfolio rebalancing is the process of bringing the different asset

... Portfolios are adjusted if and when a particular asset class deviates from its target allocation by more than a certain amount—say plus or minus five percentage points. So if, for example, the target for large-cap stocks was 60%, but a market rise caused that share to climb above 65%, stocks would ...

... Portfolios are adjusted if and when a particular asset class deviates from its target allocation by more than a certain amount—say plus or minus five percentage points. So if, for example, the target for large-cap stocks was 60%, but a market rise caused that share to climb above 65%, stocks would ...

offering memorandum - Unit Trust Corporation

... used without compliance with any registration or other legal requirements. Accordingly, this Offering Memorandum does not constitute an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not lawful or in which the person making such offer or solicitation is no ...

... used without compliance with any registration or other legal requirements. Accordingly, this Offering Memorandum does not constitute an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not lawful or in which the person making such offer or solicitation is no ...

The properties of hedge fund investors* actual returns

... investors (Stulz 2007). The magnitude of this alpha varies across studies but typical estimates are on the magnitude of 3 to 5 percent, e.g., Ibbotson and Chen (2006), Kosowski, Naik and Teo (2007) and Brown, Goetzmann and Ibbotson (1999). Such large-scale evidence of outperformance is rare in the i ...

... investors (Stulz 2007). The magnitude of this alpha varies across studies but typical estimates are on the magnitude of 3 to 5 percent, e.g., Ibbotson and Chen (2006), Kosowski, Naik and Teo (2007) and Brown, Goetzmann and Ibbotson (1999). Such large-scale evidence of outperformance is rare in the i ...

Europe`s ETF Primary Market

... The ETF Arbitrage Mechanism “Only authorised participants (specialists, market makers, institutions) transact directly with the ETF. Participants and the ETF engage in ‘in-kind’ transactions, trading baskets of securities for very large blocks of shares called ‘creation units’. These transactions, ...

... The ETF Arbitrage Mechanism “Only authorised participants (specialists, market makers, institutions) transact directly with the ETF. Participants and the ETF engage in ‘in-kind’ transactions, trading baskets of securities for very large blocks of shares called ‘creation units’. These transactions, ...

Templeton Global Balanced Fund Annual Report

... Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to frank ...

... Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to frank ...

CLUSTERING STOCK MARKET COMPANIES VIA K

... all attributes (criteria) used in clustering are profitability ratios and these ratios analyze the level of success of company to make profit and provide it through income, sales and investment. So, the higher amounts of these ratios express proper performance of the company. Therefore, Based on out ...

... all attributes (criteria) used in clustering are profitability ratios and these ratios analyze the level of success of company to make profit and provide it through income, sales and investment. So, the higher amounts of these ratios express proper performance of the company. Therefore, Based on out ...

risk appetite renaissance - RBC Global Asset Management

... 2000 and 2007, risk appetite is not obviously overblown this time. ...

... 2000 and 2007, risk appetite is not obviously overblown this time. ...

Statement of Advice sample wording

... aligned with those of its clients. Investment objective The fund aims to deliver long-term capital growth and to outperform the MSCI All Country World Index (ex Australia) Net Dividends Reinvested (A$) over rolling five-year periods before fees and taxes. Description The fund aims to provide long te ...

... aligned with those of its clients. Investment objective The fund aims to deliver long-term capital growth and to outperform the MSCI All Country World Index (ex Australia) Net Dividends Reinvested (A$) over rolling five-year periods before fees and taxes. Description The fund aims to provide long te ...

Stochastic pension funding when the benefit and the risky asset

... high capitalization. However, in most developed countries the pension system is been subject to controversy and concern because the age pyramid is changing due to the reduction of the birth rate and a longer life expectancy, which, in our context, means that a smaller workforce should fund a large n ...

... high capitalization. However, in most developed countries the pension system is been subject to controversy and concern because the age pyramid is changing due to the reduction of the birth rate and a longer life expectancy, which, in our context, means that a smaller workforce should fund a large n ...

CLAREMONT McKENNA COLLEGE STOCK MARKET SENTIMENT

... Investor sentiment in the context of this study will be defined as the investment preferences that prevail throughout the market. Investors can become overly-enthusiastic or pessimistic about a particular investment vehicle beyond what market fundamentals should dictate, which can eventually affect ...

... Investor sentiment in the context of this study will be defined as the investment preferences that prevail throughout the market. Investors can become overly-enthusiastic or pessimistic about a particular investment vehicle beyond what market fundamentals should dictate, which can eventually affect ...

clear invest

... risk rating between 1 (Safety First) and 7 (Very Adventurous). Each of our Multi Asset Portfolio Funds is designed for a specific risk rating, as the graphic shows above, the target market for Multi Asset Portfolio 3 is someone with risk rating 3 (Conservative). Our investment managers will manage t ...

... risk rating between 1 (Safety First) and 7 (Very Adventurous). Each of our Multi Asset Portfolio Funds is designed for a specific risk rating, as the graphic shows above, the target market for Multi Asset Portfolio 3 is someone with risk rating 3 (Conservative). Our investment managers will manage t ...

hedge fund headlines mislead

... type of market, as they can provide an alternative to traditional fixed income that can offer some of the same advantages — stability, capital preservation, capital appreciation — often with even less risk. For investors seeking liquidity, however, hedge funds may not be a suitable replacement for f ...

... type of market, as they can provide an alternative to traditional fixed income that can offer some of the same advantages — stability, capital preservation, capital appreciation — often with even less risk. For investors seeking liquidity, however, hedge funds may not be a suitable replacement for f ...

Global Market Outlook 2016: Trends in real estate private equity

... estate fund market and an increasingly discerning investor base. Yet it is also a reflection of a rising market: pricing in secondary stakes has risen over the last few years — in 2010, discounts to net asset value were around 19%, but in today’s market, the average has fallen to single digits. As t ...

... estate fund market and an increasingly discerning investor base. Yet it is also a reflection of a rising market: pricing in secondary stakes has risen over the last few years — in 2010, discounts to net asset value were around 19%, but in today’s market, the average has fallen to single digits. As t ...

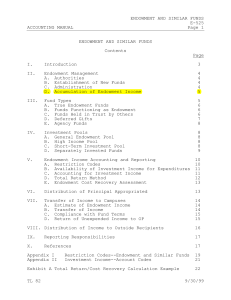

Endowment and Similar Funds

... designated revenue accounts (J-239590-3XXXX). Participation is based on a daily weighted average for the month--which is ascertained from the STIP history file. The total STIP income available for the month is distributed in proportion to the weighted average. Endowment income balances, however, par ...

... designated revenue accounts (J-239590-3XXXX). Participation is based on a daily weighted average for the month--which is ascertained from the STIP history file. The total STIP income available for the month is distributed in proportion to the weighted average. Endowment income balances, however, par ...

Diversification Bias

... • One study examined employee behavior in the retirement saving plans of 170 companies • It found that the more stock mutual funds a plan offered, the greater was the percentage of employees’ money that was invested in stocks ...

... • One study examined employee behavior in the retirement saving plans of 170 companies • It found that the more stock mutual funds a plan offered, the greater was the percentage of employees’ money that was invested in stocks ...