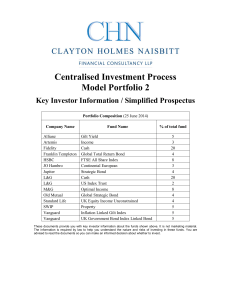

Key Investor Information - Clayton Holmes Naisbitt

... For more information, please consult the Prospectus and latest Reports and Accounts which can be obtained free of charge in English and other main languages from the Fund Manager, the distributors or online at any time. The Net Asset Values per unit are available at the registered office of the Fund ...

... For more information, please consult the Prospectus and latest Reports and Accounts which can be obtained free of charge in English and other main languages from the Fund Manager, the distributors or online at any time. The Net Asset Values per unit are available at the registered office of the Fund ...

Frontier Markets

... larger opportunity set. Furthermore, according to the Efficient Market Hypothesis (Eugene Fama), you cannot beat the market since current prices reflect all available information. The Efficient Market Hypothesis argues that only the “market” portfolio is efficient, and as Frontier Markets represent ...

... larger opportunity set. Furthermore, according to the Efficient Market Hypothesis (Eugene Fama), you cannot beat the market since current prices reflect all available information. The Efficient Market Hypothesis argues that only the “market” portfolio is efficient, and as Frontier Markets represent ...

Toronto District School Board Continuing Education Investment

... Gail Bebee, Canada’s Independent Voice on Personal Finance ...

... Gail Bebee, Canada’s Independent Voice on Personal Finance ...

Country risk, country risk indices, and valuation of FDI: A real options

... used, lower levels of the index would correspond to higher risk of expropriation. Whether the project has been expropriated at a future date may be related to the future levels of the index. This is an example of conditioning the probability of expropriation on the future level of the risk index. It ...

... used, lower levels of the index would correspond to higher risk of expropriation. Whether the project has been expropriated at a future date may be related to the future levels of the index. This is an example of conditioning the probability of expropriation on the future level of the risk index. It ...

2006-11-PE - Public Services International Research Unit

... PE funds are created as partnerships by financial services firms, by inviting investors like pension funds or rich people to commit a certain amount. The funds are then used to invest either in companies which are not quoted on the stock exchange – ‘private’ companies - or in companies which are lis ...

... PE funds are created as partnerships by financial services firms, by inviting investors like pension funds or rich people to commit a certain amount. The funds are then used to invest either in companies which are not quoted on the stock exchange – ‘private’ companies - or in companies which are lis ...

6. Derivatives Market

... The emergence and growth of the market for derivative instruments can be traced back to the willingness of riskaverse economic agents to guard themselves against uncertainties arising out of fluctuations in asset prices. Derivatives are meant to facilitate the hedging of price risks of inventory hol ...

... The emergence and growth of the market for derivative instruments can be traced back to the willingness of riskaverse economic agents to guard themselves against uncertainties arising out of fluctuations in asset prices. Derivatives are meant to facilitate the hedging of price risks of inventory hol ...

Similarities and Differences between US and German Regulation of

... regulation in the ICA is complemented by SEC Releases and the SEC staff responses to written requests of interested parties with respect to the application of the federal securities laws to proposed transactions (the latter are called “no-action” letters). The securities of investment management com ...

... regulation in the ICA is complemented by SEC Releases and the SEC staff responses to written requests of interested parties with respect to the application of the federal securities laws to proposed transactions (the latter are called “no-action” letters). The securities of investment management com ...

Cross-Market Investor Sentiment in Commodity Exchange

... IV. Do commodity ETFs’ tracking errors reflect investor sentiment in the stock market? The literature has well documented that investor sentiment affects the broad market and the cross-section of stock returns. However, whether aggregate investor sentiment in one market affects asset prices in anot ...

... IV. Do commodity ETFs’ tracking errors reflect investor sentiment in the stock market? The literature has well documented that investor sentiment affects the broad market and the cross-section of stock returns. However, whether aggregate investor sentiment in one market affects asset prices in anot ...

The Russell Pure Style Indexes

... due to differences in weighting schemes. The standard style weights are based on capitalization levels, which tend to be top-heavy, resulting in the largest stocks often dominating the returns. The Pure Style weights are based on style scores, and by the index construction, only those stocks with hi ...

... due to differences in weighting schemes. The standard style weights are based on capitalization levels, which tend to be top-heavy, resulting in the largest stocks often dominating the returns. The Pure Style weights are based on style scores, and by the index construction, only those stocks with hi ...

International spill-overs of uncertainty shocks

... consistent with the “flight to safety” type behaviour (McCauley and McGuire (2009)). The uncertainty shock results in a synchronised fall in economic activity, inflation, stock prices and interest rates across major economies. However, we find more diverse responses in international commodity prices an ...

... consistent with the “flight to safety” type behaviour (McCauley and McGuire (2009)). The uncertainty shock results in a synchronised fall in economic activity, inflation, stock prices and interest rates across major economies. However, we find more diverse responses in international commodity prices an ...

The new revenue recognition standard - asset management

... companies, trusts or partnerships (such as hedge funds, private equity funds and open-ended investment companies), which invest in a variety of different products. While the legal forms of the arrangements vary, these vehicles generally provide for investor capital to be pooled and invested to earn ...

... companies, trusts or partnerships (such as hedge funds, private equity funds and open-ended investment companies), which invest in a variety of different products. While the legal forms of the arrangements vary, these vehicles generally provide for investor capital to be pooled and invested to earn ...

Global Markets Minesweeper

... The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but we make no representation or warranty, express or implied, with respect to the fairness, correctness, accuracy or completeness of such information. In addition we have no obligation to u ...

... The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but we make no representation or warranty, express or implied, with respect to the fairness, correctness, accuracy or completeness of such information. In addition we have no obligation to u ...

Market Discipline and Internal Governance in the Mutual Fund Industry

... and the underperformance vanishes after the manager is replaced. All these findings are in accordance with the predictions from our model. Several theoretical models have been advanced to explain subsets of the phenomena mentioned above. Berk and Green (2004) present an interesting discrete-time lea ...

... and the underperformance vanishes after the manager is replaced. All these findings are in accordance with the predictions from our model. Several theoretical models have been advanced to explain subsets of the phenomena mentioned above. Berk and Green (2004) present an interesting discrete-time lea ...

Guide to Private Equity and Venture Capital for

... how to invest in the asset class, plus an overview of the benefits and risks involved and of the different ways of investing in private equity and venture capital, we’ve also gathered the experience of long-standing pension fund investors in private equity and venture capital to show how they manage ...

... how to invest in the asset class, plus an overview of the benefits and risks involved and of the different ways of investing in private equity and venture capital, we’ve also gathered the experience of long-standing pension fund investors in private equity and venture capital to show how they manage ...

Why buyout investments are good for Canada

... A common misconception about Buyout firms is that they burden companies with too much debt. The perception is that this causes companies to be unable to produce sufficient cash flows to pay interest, forces them to undergo cost cutting and leads them to bankruptcy. In reality, all stakeholders are a ...

... A common misconception about Buyout firms is that they burden companies with too much debt. The perception is that this causes companies to be unable to produce sufficient cash flows to pay interest, forces them to undergo cost cutting and leads them to bankruptcy. In reality, all stakeholders are a ...

How to get income from your pension

... ground among private investors because of their low charges. Like investment trusts, they trade just like shares, but premiums and discounts are extremely rare. These funds tend to be “passively” managed, meaning that there is no fund manager making decisions about the assets to buy. Instead, these ...

... ground among private investors because of their low charges. Like investment trusts, they trade just like shares, but premiums and discounts are extremely rare. These funds tend to be “passively” managed, meaning that there is no fund manager making decisions about the assets to buy. Instead, these ...

Returns to Venture Capital - University of Colorado Boulder

... Exhibit 19.1 Summary of Studies of Returns to Venture Capital ...

... Exhibit 19.1 Summary of Studies of Returns to Venture Capital ...

Product Disclosure Statement

... Earnings ex pectations: Reactions to changing earnings forecasts are monitored to discern shifts in investor behaviour. We have found that investors generally underreact to changing earnings forecasts. This tendency allows us to predict the relative performance of stocks. ...

... Earnings ex pectations: Reactions to changing earnings forecasts are monitored to discern shifts in investor behaviour. We have found that investors generally underreact to changing earnings forecasts. This tendency allows us to predict the relative performance of stocks. ...

What is owners equity in accounting? Peter Baskerville The

... The business will then use both the Equity funds (Owners equity) and the Debt Funds (Liabilities) to purchase assets. Assets are those items of financial value that the Source URL: http://knol.google.com/k/what-is-owners-equity-in-accounting# ...

... The business will then use both the Equity funds (Owners equity) and the Debt Funds (Liabilities) to purchase assets. Assets are those items of financial value that the Source URL: http://knol.google.com/k/what-is-owners-equity-in-accounting# ...

CRA Investment Fund Audited Financial Statements

... December 31, 2014 and 2013 2. Summary of si gnificant accounting pol icies and nature of operations (continued) Concentration of credit risk The Companies maintain cash in bank deposit accounts that, at times, may exceed federally insured limits. The Companies have not experienced any losses in such ...

... December 31, 2014 and 2013 2. Summary of si gnificant accounting pol icies and nature of operations (continued) Concentration of credit risk The Companies maintain cash in bank deposit accounts that, at times, may exceed federally insured limits. The Companies have not experienced any losses in such ...

International Pricing Strategy: Why Prices Rise and How Prices

... prices in the internal market stay sufficiently high. This idea sustains the simplest and wellknown model for international pricing. The “Law of One Price” states that identical goods which can be moved around easily are sold anywhere for the same price in a given currency provided there are no barr ...

... prices in the internal market stay sufficiently high. This idea sustains the simplest and wellknown model for international pricing. The “Law of One Price” states that identical goods which can be moved around easily are sold anywhere for the same price in a given currency provided there are no barr ...

2013 Audit - Hartsel Fire Protection District

... During 2013, the District’s long-term liabilities were reduced by $116,736. This was the result of reducing the principal on the District’s two capital leases, one of which was paid off during 2013, leaving one capital lease with an outstanding balance at December 31, 2013. See notes to financial st ...

... During 2013, the District’s long-term liabilities were reduced by $116,736. This was the result of reducing the principal on the District’s two capital leases, one of which was paid off during 2013, leaving one capital lease with an outstanding balance at December 31, 2013. See notes to financial st ...

pension funds as new financial intermediaries

... Accordingly, we seek to elucidate the role of pension funds mainly in the context of the Merton and Bodie (1995) “functions of the financial system” framework, which is introduced in Section III. The functional approach, which encompasses the traditional approach to intermediation, provides a natura ...

... Accordingly, we seek to elucidate the role of pension funds mainly in the context of the Merton and Bodie (1995) “functions of the financial system” framework, which is introduced in Section III. The functional approach, which encompasses the traditional approach to intermediation, provides a natura ...

perspectives on dynamic asset allocation

... approach by also taking convexity into account. One way of doing this is by applying cash-flow matching techniques. The PSP building block relates to the diversification concept of the framework, which is theoretically constructed as a portfolio with the highest possible Sharpe ratio for the next sh ...

... approach by also taking convexity into account. One way of doing this is by applying cash-flow matching techniques. The PSP building block relates to the diversification concept of the framework, which is theoretically constructed as a portfolio with the highest possible Sharpe ratio for the next sh ...

Focus your aim - JP Morgan Asset Management

... portfolios are likely to interact with real-world participant usage shows improved risk/ reward characteristics and potentially stronger investment performance through a wide range of possible market environments. ...

... portfolios are likely to interact with real-world participant usage shows improved risk/ reward characteristics and potentially stronger investment performance through a wide range of possible market environments. ...