Forthcoming, Journal of Empirical Finance Measuring The Market

... contrast, two funds with the same "style" having the same information and employing similar trading strategy are likely to have the same trades. However, herding necessarily implies a lead-lag relationship between the trades of leaders and followers, whereas funds with the same style can have ...

... contrast, two funds with the same "style" having the same information and employing similar trading strategy are likely to have the same trades. However, herding necessarily implies a lead-lag relationship between the trades of leaders and followers, whereas funds with the same style can have ...

From Start-up to Scale-up - Centre for Economic Policy Research

... have also become more prominent. At the scale-up stages we again find (later-stage) venture capitalists and corporate investors, but also growth equity funds, private equity funds, hedge funds, cross-over funds , family offices, sovereign wealth funds, and institutional investors investing directly. ...

... have also become more prominent. At the scale-up stages we again find (later-stage) venture capitalists and corporate investors, but also growth equity funds, private equity funds, hedge funds, cross-over funds , family offices, sovereign wealth funds, and institutional investors investing directly. ...

Co-investments in funds of funds and separate accounts

... During fundraising, GPs are routinely asked by interested LPs to address the likelihood of co-investment in their next fund. While some GPs look at co-investment as a requirement to entice certain LPs into a fund commitment, the practice has evolved into an important part of the business model for m ...

... During fundraising, GPs are routinely asked by interested LPs to address the likelihood of co-investment in their next fund. While some GPs look at co-investment as a requirement to entice certain LPs into a fund commitment, the practice has evolved into an important part of the business model for m ...

Annual Report - Putnam Investments

... Investors around the world have witnessed generally positive performance from financial markets in 2016. Most stock and bond indexes have added gains, benefiting from a slowly recovering global economy and contending with only intermittent bouts of volatility. Even advancing markets, however, can po ...

... Investors around the world have witnessed generally positive performance from financial markets in 2016. Most stock and bond indexes have added gains, benefiting from a slowly recovering global economy and contending with only intermittent bouts of volatility. Even advancing markets, however, can po ...

Agarwal Daniel Naik

... individual hedge funds. Therefore, we also examine how money-flows and performance relate to managerial incentives. We have six main findings. First, we find money-flows chase returns and the performance-flow relation is convex. This finding is consistent with that of Chevalier and Ellison (1997), ...

... individual hedge funds. Therefore, we also examine how money-flows and performance relate to managerial incentives. We have six main findings. First, we find money-flows chase returns and the performance-flow relation is convex. This finding is consistent with that of Chevalier and Ellison (1997), ...

Report and Audited Financial Statements Schroder UK Real Estate Fund Feeder Trust

... The principle accounting policies, expenses, the net income of the Trust which have been applied consistently is available to be distributed to throughout the year are set out below. unitholders. All income is distributed, (b) Basis of valuation of investments at unit class level, to the unitholders ...

... The principle accounting policies, expenses, the net income of the Trust which have been applied consistently is available to be distributed to throughout the year are set out below. unitholders. All income is distributed, (b) Basis of valuation of investments at unit class level, to the unitholders ...

Hedge Fund Innovation - American Economic Association

... The large and increasing size of the hedge fund industry suggests that hedge funds are offering value to investors that is not available elsewhere. As of April 2012, the hedge fund industry has grown in size to approximately USD 2 trillion of assets under management (Hedge Fund Research, 2012). The ...

... The large and increasing size of the hedge fund industry suggests that hedge funds are offering value to investors that is not available elsewhere. As of April 2012, the hedge fund industry has grown in size to approximately USD 2 trillion of assets under management (Hedge Fund Research, 2012). The ...

Liquidity transformation in asset management

... impact, bank loans cannot be traded before maturity without creating substantial price impact. For asset managers, however, there is no comparable measure. Their assets are typically tradeable securities, though with varying levels of liquidity. Furthermore, some price impact can be passed on to inv ...

... impact, bank loans cannot be traded before maturity without creating substantial price impact. For asset managers, however, there is no comparable measure. Their assets are typically tradeable securities, though with varying levels of liquidity. Furthermore, some price impact can be passed on to inv ...

SIFM A Proposed C onform ance R ule C om m

... The purpose of Section 13(c) is to ensure that banking entities move steadily toward conforming their activities and investments in funds, while minimizing any disruption to the market, such as harm to the relevant banking entity, the funds it sponsors or invests in, the investors in such funds, the ...

... The purpose of Section 13(c) is to ensure that banking entities move steadily toward conforming their activities and investments in funds, while minimizing any disruption to the market, such as harm to the relevant banking entity, the funds it sponsors or invests in, the investors in such funds, the ...

Equity Trading by Institutional Investors: To Cross or Not

... Several trading cost components are low for traders in crossing networks compared with trading on regular exchanges. First, crossing commissions are substantially lower than commissions charged by brokers on exchanges. Second, there are no spread costs because the participants in the network are pro ...

... Several trading cost components are low for traders in crossing networks compared with trading on regular exchanges. First, crossing commissions are substantially lower than commissions charged by brokers on exchanges. Second, there are no spread costs because the participants in the network are pro ...

What Does a Mutual Fund`s Average Credit Quality

... economically meaningful and comparable to individual bonds and across homogenous bond portfolios, the Average Credit Quality statistic as currently calculated is not. For the Average Credit Quality statistic to be a useful measure of the credit risk in bond mutual funds’ portfolios, it must reflect ...

... economically meaningful and comparable to individual bonds and across homogenous bond portfolios, the Average Credit Quality statistic as currently calculated is not. For the Average Credit Quality statistic to be a useful measure of the credit risk in bond mutual funds’ portfolios, it must reflect ...

Asset Allocation by Institutional Investors after the Recent Financial

... remained relatively stable from 2005 to 2006, shifts began to emerge by 2007. Not all regions started with the same baseline for asset allocation in 2007. For instance, investors in Europe have traditionally had much lower allocations to equities than those in the United States. Similarly, not all s ...

... remained relatively stable from 2005 to 2006, shifts began to emerge by 2007. Not all regions started with the same baseline for asset allocation in 2007. For instance, investors in Europe have traditionally had much lower allocations to equities than those in the United States. Similarly, not all s ...

role of capital market

... continues to be a cause of concern. It has been ascertained that the total number of retail investors is much less than 1% of the total Indian population. While on one hand, the number of retail investors is low, on the other hand substantial amount of household savings are available which can be ch ...

... continues to be a cause of concern. It has been ascertained that the total number of retail investors is much less than 1% of the total Indian population. While on one hand, the number of retail investors is low, on the other hand substantial amount of household savings are available which can be ch ...

A Model-Based Approach to Constructing Corporate Bond Portfolios

... Both our Investment Grade and High Yield Model Portfolios also perform better than the popular Exchange Traded Funds (ETFs) on corporate credits. We also achieve the performance using smaller portfolios relative to ML indices, and we demonstrate a more realistic operational approach for most portfol ...

... Both our Investment Grade and High Yield Model Portfolios also perform better than the popular Exchange Traded Funds (ETFs) on corporate credits. We also achieve the performance using smaller portfolios relative to ML indices, and we demonstrate a more realistic operational approach for most portfol ...

The Closed-End Fund Market, 2014

... the fund. Rather, shares are bought and sold by investors in the open market. Because a closed-end fund does not need to maintain cash reserves or sell securities to meet redemptions, the fund has the flexibility to invest in lessliquid portfolio securities. For example, a closed-end fund may invest ...

... the fund. Rather, shares are bought and sold by investors in the open market. Because a closed-end fund does not need to maintain cash reserves or sell securities to meet redemptions, the fund has the flexibility to invest in lessliquid portfolio securities. For example, a closed-end fund may invest ...

cm advisors small cap value fund cm advisors fixed income fund

... other factors, small cap companies may be more susceptible to market downturns, and their stock prices may be more volatile and less liquid than those of larger companies. In addition, the market for small cap securities may be more limited than the market for larger companies. • Interest Rate Risk ...

... other factors, small cap companies may be more susceptible to market downturns, and their stock prices may be more volatile and less liquid than those of larger companies. In addition, the market for small cap securities may be more limited than the market for larger companies. • Interest Rate Risk ...

How does investor sentiment affect stock market crises

... followed by low cumulative long-run returns. Baker and Wurgler (2006) construct an index of investor sentiment as the first principal component of six indirect investor measures suggested in the literature. They find that the sentiment effects are stronger among stocks whose valuations are highly su ...

... followed by low cumulative long-run returns. Baker and Wurgler (2006) construct an index of investor sentiment as the first principal component of six indirect investor measures suggested in the literature. They find that the sentiment effects are stronger among stocks whose valuations are highly su ...

MCCM 3Q2016_Market Outlook.pub

... voyage be successful. There was huge risk in taking wooden ships across the ocean and when capital is put at risk, ...

... voyage be successful. There was huge risk in taking wooden ships across the ocean and when capital is put at risk, ...

issue price: 101%

... used by, any other person. By accepting delivery of this Prospectus each prospective investor agrees to treat the contents hereof as confidential. No person has been authorised to give any information or to make any representations other than those contained in this Prospectus and, if given or made, ...

... used by, any other person. By accepting delivery of this Prospectus each prospective investor agrees to treat the contents hereof as confidential. No person has been authorised to give any information or to make any representations other than those contained in this Prospectus and, if given or made, ...

MLC Investment Trust Product Guide

... Diversify to reduce volatility and other risks Diversification—investing in a range of investments—is a sound way to reduce short-term volatility and help smooth a portfolio’s returns. That’s because different types of investments perform well in different times and circumstances. When some are prov ...

... Diversify to reduce volatility and other risks Diversification—investing in a range of investments—is a sound way to reduce short-term volatility and help smooth a portfolio’s returns. That’s because different types of investments perform well in different times and circumstances. When some are prov ...

cordros money market fund - Cordros Asset Management

... Statement Of Financial Position For The Years Ending December 31, 2016, 2017 & 2018 .................................. 25 Statement of Cash Flow as at 31 December 2016, 2017 AND 2018 ...................................................................... 26 Notes To The Profit Forecast .............. ...

... Statement Of Financial Position For The Years Ending December 31, 2016, 2017 & 2018 .................................. 25 Statement of Cash Flow as at 31 December 2016, 2017 AND 2018 ...................................................................... 26 Notes To The Profit Forecast .............. ...

Tributary Capital Management, LLC

... portion of their securities transactions to a specific broker-dealer, we will treat the client direction as a decision by the client to retain, to the extent of the direction, the discretion we would otherwise have in selecting brokers-dealers to effect transactions and in negotiating commissions. A ...

... portion of their securities transactions to a specific broker-dealer, we will treat the client direction as a decision by the client to retain, to the extent of the direction, the discretion we would otherwise have in selecting brokers-dealers to effect transactions and in negotiating commissions. A ...

Introducing the J.P. Morgan Emerging Markets Bond Index Global

... of US$500 million and at least 2½ years to maturity (at the time each is added to the index). However, the EMBI Global does not require that its “candidate instruments” satisfy the EMBI+’s series of additional liquidity tests (a minimum bid/ask price spread and a specific number of interdealer broke ...

... of US$500 million and at least 2½ years to maturity (at the time each is added to the index). However, the EMBI Global does not require that its “candidate instruments” satisfy the EMBI+’s series of additional liquidity tests (a minimum bid/ask price spread and a specific number of interdealer broke ...

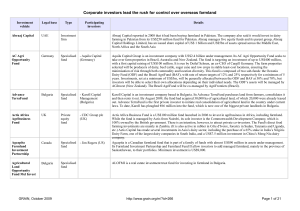

The new farm owners table

... The Altima One World Agricultural Fund is a US$625 million fund created by Altima Partners, a US$3 billion hedge fund, to invest in agricultural land and farming operations in emerging market countries. Altima invests in agribusinesses in Latin America and the Russia/Ukraine/Kazakhstan (RUK) region. ...

... The Altima One World Agricultural Fund is a US$625 million fund created by Altima Partners, a US$3 billion hedge fund, to invest in agricultural land and farming operations in emerging market countries. Altima invests in agribusinesses in Latin America and the Russia/Ukraine/Kazakhstan (RUK) region. ...

liberty high yield fund

... value, repayment of capital, payment of income or performance of the Fund. Information in this PDS is subject to change. If the change is not materially adverse, the information will be updated on our website at www.liberty.com.au. A paper copy of any updated information will also be available free ...

... value, repayment of capital, payment of income or performance of the Fund. Information in this PDS is subject to change. If the change is not materially adverse, the information will be updated on our website at www.liberty.com.au. A paper copy of any updated information will also be available free ...