Money Morning 24 November 2014

... The information , opinion, views contained in this document are as per prevailing conditions and are of the date of appearing on this material only and are subject to change. No reliance may be placed for any purpose whatsoever on the information contained in this document or on its completeness. Ne ...

... The information , opinion, views contained in this document are as per prevailing conditions and are of the date of appearing on this material only and are subject to change. No reliance may be placed for any purpose whatsoever on the information contained in this document or on its completeness. Ne ...

Scottish Widows Life Funds Investor`s Guide

... For investors who aim to enhance returns by accessing a particular investment style, we offer a broad range of funds from well-established fund managers. These include balanced managed funds, for investors who may prefer a ready-made investment portfolio, and a large number of specialist funds suita ...

... For investors who aim to enhance returns by accessing a particular investment style, we offer a broad range of funds from well-established fund managers. These include balanced managed funds, for investors who may prefer a ready-made investment portfolio, and a large number of specialist funds suita ...

The Case for Strategic Convertible Allocations

... fixed-income-like in others. Because of their structural complexities, convertible securities demand active management within asset allocations. Often, convertible securities are thought of as a single asset class; this ignores the variations within the convertible universe. Our approach is to use d ...

... fixed-income-like in others. Because of their structural complexities, convertible securities demand active management within asset allocations. Often, convertible securities are thought of as a single asset class; this ignores the variations within the convertible universe. Our approach is to use d ...

Item 1 – Cover Page - NorthCoast Asset Management

... As of December 31, 2016 NorthCoast managed approximately $1,600,000,000 on a discretionary and $66,000,000 on a non-discretionary basis for a total of $1.7 billion. NorthCoast specializes in providing clients with portfolio management services to separately managed accounts and a mutual fund through ...

... As of December 31, 2016 NorthCoast managed approximately $1,600,000,000 on a discretionary and $66,000,000 on a non-discretionary basis for a total of $1.7 billion. NorthCoast specializes in providing clients with portfolio management services to separately managed accounts and a mutual fund through ...

Comprehensive Annual Financial Report

... examined annually by an independent certified public accountant and a complete set of financial statements presented in conformity with Generally Accepted Accounting Principles (GAAP) be published within six months of the close of each fiscal year. This report consists of the management’s representa ...

... examined annually by an independent certified public accountant and a complete set of financial statements presented in conformity with Generally Accepted Accounting Principles (GAAP) be published within six months of the close of each fiscal year. This report consists of the management’s representa ...

UCITS Application Form Section 10 Sub

... This application is supported by the information requirements of the Central Bank of Ireland (the ‘Central Bank’) as set out in the Central Bank UCITS Regulations/Guidance. I confirm that the information supplied is complete and accurate, the attached check list has been completed and the applicatio ...

... This application is supported by the information requirements of the Central Bank of Ireland (the ‘Central Bank’) as set out in the Central Bank UCITS Regulations/Guidance. I confirm that the information supplied is complete and accurate, the attached check list has been completed and the applicatio ...

Report submitted by Alternative Investment Policy Advisory

... 7. The first AIPAC report had recommended a number of tax measures, some of which were implemented by the Government of India. After the first AIPAC report was released, the Government entered into a Protocol with the Government of Mauritius to amend the Indo-Mauritius Double Tax Avoidance Tax Agree ...

... 7. The first AIPAC report had recommended a number of tax measures, some of which were implemented by the Government of India. After the first AIPAC report was released, the Government entered into a Protocol with the Government of Mauritius to amend the Indo-Mauritius Double Tax Avoidance Tax Agree ...

The Risk-Free Rate`s Impact on Stock Returns with Representative

... increased possibility for diversification and access to new markets for households, but not without introducing other problems. Rajan (2005) points out that discretionary investment management creates an agency problem since the fund has an incentive to maximize its profits rather than the risk-adju ...

... increased possibility for diversification and access to new markets for households, but not without introducing other problems. Rajan (2005) points out that discretionary investment management creates an agency problem since the fund has an incentive to maximize its profits rather than the risk-adju ...

Not All Benchmarks Are Created Equal

... The concept of a market portfolio plays an important role in many financial models, including the Capital Asset Pricing Model (CAPM). In theory, the market portfolio should be the portfolio of choice for a truly passive investor 1 ...

... The concept of a market portfolio plays an important role in many financial models, including the Capital Asset Pricing Model (CAPM). In theory, the market portfolio should be the portfolio of choice for a truly passive investor 1 ...

tactical timing of low volatility equity strategies

... delivered higher returns with lower risk than the capitalization-weighted market. Moreover, the behavioral and market-structural forces that have been suggested as possible explanations are inherently hard to change, which means the anomaly might not readily disappear2. However, we often hear two ta ...

... delivered higher returns with lower risk than the capitalization-weighted market. Moreover, the behavioral and market-structural forces that have been suggested as possible explanations are inherently hard to change, which means the anomaly might not readily disappear2. However, we often hear two ta ...

Why do foreign firms have less idiosyncratic risk than U.S.... Söhnke M. Bartram, Gregory Brown, and René M. Stulz*

... This paper is connected closely to three strands of recent research. The first literature our work relates to is the research that, following Morck, Yeung, and Yu (2000), investigates the determinants of the market model R2 across countries. In the R2 literature, the average R2 in a country is negat ...

... This paper is connected closely to three strands of recent research. The first literature our work relates to is the research that, following Morck, Yeung, and Yu (2000), investigates the determinants of the market model R2 across countries. In the R2 literature, the average R2 in a country is negat ...

2 amended and restated private placement

... Rubicon Mortgage Fund, LLC (the “Fund”) is a California limited liability company. The Manager of the Fund is Rubicon Realty Advisors, Inc. (the “Manager”) (formerly known as Rubicon Management LLC), a California corporation. In 2013 the managing entity, Rubicon Management LLC, was converted via Cal ...

... Rubicon Mortgage Fund, LLC (the “Fund”) is a California limited liability company. The Manager of the Fund is Rubicon Realty Advisors, Inc. (the “Manager”) (formerly known as Rubicon Management LLC), a California corporation. In 2013 the managing entity, Rubicon Management LLC, was converted via Cal ...

Strategy Spotlight: Considerations in volatility

... exposure, and some can be considered pure exposures to volatility. Covered call and put-write strategies are examples of those with embedded directional exposure. Whether an investor is considering options, swaps or futures, common to the use of any of these instruments is the need to specify tradin ...

... exposure, and some can be considered pure exposures to volatility. Covered call and put-write strategies are examples of those with embedded directional exposure. Whether an investor is considering options, swaps or futures, common to the use of any of these instruments is the need to specify tradin ...

The Evolution of Quantitative Investment Strategies

... the data supported the theory. Of these, the works by Black, Jensen, and Scholes (1972) and Fama and MacBeth (1973) are widely cited. These papers were partially, but not fully, supportive of the theory. While they confirmed that a security’s expected return was positively related to its beta, the e ...

... the data supported the theory. Of these, the works by Black, Jensen, and Scholes (1972) and Fama and MacBeth (1973) are widely cited. These papers were partially, but not fully, supportive of the theory. While they confirmed that a security’s expected return was positively related to its beta, the e ...

SRC review guide for general-purpose governments

... the checklist address purely factual matters or formatting issues that can be resolved easily and objectively during the staff review. Members of GFOA’s Special Review Committee (SRC) are welcome, of course, to use that same comprehensive checklist to perform their own reviews for the Certificate Pr ...

... the checklist address purely factual matters or formatting issues that can be resolved easily and objectively during the staff review. Members of GFOA’s Special Review Committee (SRC) are welcome, of course, to use that same comprehensive checklist to perform their own reviews for the Certificate Pr ...

small, smid, or mid?

... illustrative is the effective increase in the upper end of the Russell indexes in just over six months since the 2013 reconstitution. The largest market caps in the Russell Midcap, 2500, and 2000 Indexes, as of December 31, 2013, have swelled to $29.1 billion, $10.8 billion, and $5.3 billion, respec ...

... illustrative is the effective increase in the upper end of the Russell indexes in just over six months since the 2013 reconstitution. The largest market caps in the Russell Midcap, 2500, and 2000 Indexes, as of December 31, 2013, have swelled to $29.1 billion, $10.8 billion, and $5.3 billion, respec ...

Prospectus - Pacific Asset Management

... relevant Fund in seeking to achieve its investment objective. The Net Asset Value and the performance of the Shares of the different Funds and classes thereof are expected to differ. It should be remembered that the price of Shares and the income (if any) from them may fall as well as rise and there ...

... relevant Fund in seeking to achieve its investment objective. The Net Asset Value and the performance of the Shares of the different Funds and classes thereof are expected to differ. It should be remembered that the price of Shares and the income (if any) from them may fall as well as rise and there ...

Trading Is Hazardous to Your Wealth: The Common Stock

... 11 percent as active. Sampled households were required to have an open account with the discount brokerage firm during 1991. Roughly half of the accounts in our analysis were opened prior to 1987 and half were opened between 1987 and 1991. In this research, we focus on the common stock investments o ...

... 11 percent as active. Sampled households were required to have an open account with the discount brokerage firm during 1991. Roughly half of the accounts in our analysis were opened prior to 1987 and half were opened between 1987 and 1991. In this research, we focus on the common stock investments o ...

Personal Retirement Savings Accounts

... This is a very low risk fund. While there will be a very low level of volatility in fund returns, there is also only a very low potential for gains. It is suitable for investors who are very close to retirement or have a very low appetite for risk. ...

... This is a very low risk fund. While there will be a very low level of volatility in fund returns, there is also only a very low potential for gains. It is suitable for investors who are very close to retirement or have a very low appetite for risk. ...

UBS Global Real Estate Bubble Index

... have also decoupled from local incomes in London, Paris, Singapore, New York and Tokyo, where price-to-income (PI) multiples exceed 10. Unaffordable housing is often a sign of strong investment demand from abroad and tight rental market regulations. If investment demand weakens, the risk of a price ...

... have also decoupled from local incomes in London, Paris, Singapore, New York and Tokyo, where price-to-income (PI) multiples exceed 10. Unaffordable housing is often a sign of strong investment demand from abroad and tight rental market regulations. If investment demand weakens, the risk of a price ...

Lyxor Index Fund December 2014

... Person and may require the mandatory repurchase of Shares beneficially owned by US Persons. The Company retains the right to offer only one Class of Shares for subscription in any particular jurisdiction in order to conform to local law, custom, business practice or the Company’s commercial objectiv ...

... Person and may require the mandatory repurchase of Shares beneficially owned by US Persons. The Company retains the right to offer only one Class of Shares for subscription in any particular jurisdiction in order to conform to local law, custom, business practice or the Company’s commercial objectiv ...

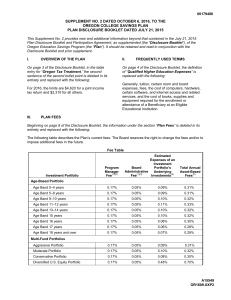

Disclosure Booklet - Oregon College Savings Plan

... Investment Cost Example. The example in the following table is intended to help you compare the cost of investing in the different Investment Portfolios over various periods of time. This example assumes that: ...

... Investment Cost Example. The example in the following table is intended to help you compare the cost of investing in the different Investment Portfolios over various periods of time. This example assumes that: ...

Disappointment Aversion in Asset Allocation

... absolute risk aversion holds and thus risk aversion decreases with wealth, wealthier investors may feel more disappointment for losses. We also find that disappointment aversion increases as expected excess return increases. The results are consistent with the experimental findings of Abdellaoui an ...

... absolute risk aversion holds and thus risk aversion decreases with wealth, wealthier investors may feel more disappointment for losses. We also find that disappointment aversion increases as expected excess return increases. The results are consistent with the experimental findings of Abdellaoui an ...

A CLEAR AND SIMPLE

... attitude. The Governed Range does this for you. Each option has been designed for a particular risk attitude, which means we take care of the asset allocation for you. However, if you’re in either the ‘Very Cautious’ or ‘Very Adventurous’ category you should seek more specialist advice from your adv ...

... attitude. The Governed Range does this for you. Each option has been designed for a particular risk attitude, which means we take care of the asset allocation for you. However, if you’re in either the ‘Very Cautious’ or ‘Very Adventurous’ category you should seek more specialist advice from your adv ...

basics of equity derivatives

... markets. Margining, monitoring and surveillance of the activities of various participants become extremely difficult in these kind of mixed markets. History of derivatives markets Early forward contracts in the US addressed merchants' concerns about ensuring that there were buyers and sellers for c ...

... markets. Margining, monitoring and surveillance of the activities of various participants become extremely difficult in these kind of mixed markets. History of derivatives markets Early forward contracts in the US addressed merchants' concerns about ensuring that there were buyers and sellers for c ...