Choosing Not to Choose - The Australia Institute

... the present system—the ability to take a super fund from one job to the next. ...

... the present system—the ability to take a super fund from one job to the next. ...

A Primer on Non-Traded REITs and other Alternative Real Estate

... of the issuer and information on the issuer’s management. Traded REITs trade on an exchange and can be bought or sold through a brokerage firm. Non-traded REITs are registered with the SEC but their shares are not listed on an exchange; their shares are illiquid and difficult to value. Investors can ...

... of the issuer and information on the issuer’s management. Traded REITs trade on an exchange and can be bought or sold through a brokerage firm. Non-traded REITs are registered with the SEC but their shares are not listed on an exchange; their shares are illiquid and difficult to value. Investors can ...

European Fixed Interest - Invesco Global Product Range

... Source: Invesco Perpetual, Bloomberg, 31 March 2017, unless otherwise noted. $ = USD. Indices are BoAML. Return data in local currency. *Price return. **Bloomberg field: YAS_MOD_DUR. This is not financial advice and not a recommendation to buy / hold / sell these securities. There is no guarantee th ...

... Source: Invesco Perpetual, Bloomberg, 31 March 2017, unless otherwise noted. $ = USD. Indices are BoAML. Return data in local currency. *Price return. **Bloomberg field: YAS_MOD_DUR. This is not financial advice and not a recommendation to buy / hold / sell these securities. There is no guarantee th ...

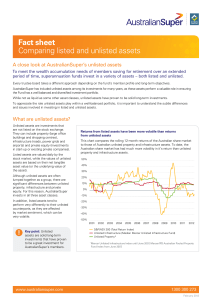

Fact sheet Comparing listed and unlisted assets

... experience and expertise in their particular market segment. One advantage of investing with specialist managers is scale. Some billion dollar infrastructure assets are too large for even the biggest Australian super funds to own directly. Owning one large retail property asset can be more than some ...

... experience and expertise in their particular market segment. One advantage of investing with specialist managers is scale. Some billion dollar infrastructure assets are too large for even the biggest Australian super funds to own directly. Owning one large retail property asset can be more than some ...

Measuring Swedish Investor Sentiment Stock Market Response to

... denominated noise traders, were subject to sentiment – a belief about future cash flows and risks of securities not supported by economic fundamentals of the underlying asset(s) – while other investors were rational arbitrageurs, free of sentiment. The irrational beliefs were caused by noise, interp ...

... denominated noise traders, were subject to sentiment – a belief about future cash flows and risks of securities not supported by economic fundamentals of the underlying asset(s) – while other investors were rational arbitrageurs, free of sentiment. The irrational beliefs were caused by noise, interp ...

Chapter One * Introduction - Mutual Fund Directors Forum

... This has no connection with securities lending as, by its nature, it is a sale by someone who does not have, and has no intention of obtaining, the security they are selling. This practice has now been banned by a number of regulators worldwide and has also been condemned by the international securi ...

... This has no connection with securities lending as, by its nature, it is a sale by someone who does not have, and has no intention of obtaining, the security they are selling. This practice has now been banned by a number of regulators worldwide and has also been condemned by the international securi ...

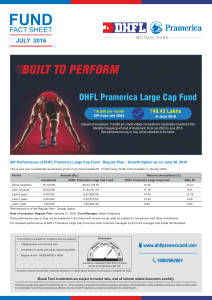

DHFL Pramerica Large Cap Fund

... higher than in May (5.76%). Most of the upward pressure came again from food inflation. Food inflation continued its upward journey printing at 7.4% as against 7.2% and 6.3% in the preceding two months, respectively. Core inflation offered some solace recording almost a 20 bps decline to 4.5% as com ...

... higher than in May (5.76%). Most of the upward pressure came again from food inflation. Food inflation continued its upward journey printing at 7.4% as against 7.2% and 6.3% in the preceding two months, respectively. Core inflation offered some solace recording almost a 20 bps decline to 4.5% as com ...

Commonality In The Determinants Of Expected Stock Returns

... cross-section. In light of this possibility, our predictions of expected stock returns will be based on five classes of factors: risk, liquidity, price-level, growth potential, and price-history. Given the price reactions to unexpected changes in market risk reported in longitudinal studies (French ...

... cross-section. In light of this possibility, our predictions of expected stock returns will be based on five classes of factors: risk, liquidity, price-level, growth potential, and price-history. Given the price reactions to unexpected changes in market risk reported in longitudinal studies (French ...

TNI BLUE CHIP UAE FUND - The National Investor

... SUBSCRIPTION AND SALE: The Units have not been, and will not be registered under the Securities Act of 1933, as amended, and have not been registered or qualified under any state securities law of the U.S. and may not be offered or sold within the US except pursuant to an exemption from, or in a tra ...

... SUBSCRIPTION AND SALE: The Units have not been, and will not be registered under the Securities Act of 1933, as amended, and have not been registered or qualified under any state securities law of the U.S. and may not be offered or sold within the US except pursuant to an exemption from, or in a tra ...

Herding Behavior - Evidence from Portuguese Mutual Funds

... For the last two decades, the importance of mutual funds all over the world has increased enormously. In 1950, institutional investors in the US held 6% of the stock market. Today that share represents over 50% of the stock market capitalization (around US dollars 30 trillion) and mutual funds are t ...

... For the last two decades, the importance of mutual funds all over the world has increased enormously. In 1950, institutional investors in the US held 6% of the stock market. Today that share represents over 50% of the stock market capitalization (around US dollars 30 trillion) and mutual funds are t ...

Shifting the Lens – A De-Risking Toolkit for Impact Investment

... of combining financial and social returns. Yet, despite some progress, a sense of inadequacy persists, with some saying that there is too much capital chasing too few investable projects and others concerned that there is too much demand and not enough supply of capital. This supply versus demand is ...

... of combining financial and social returns. Yet, despite some progress, a sense of inadequacy persists, with some saying that there is too much capital chasing too few investable projects and others concerned that there is too much demand and not enough supply of capital. This supply versus demand is ...

LINCOLN NATIONAL CORP

... and consider all information contained in this prospectus in making your investment decision. You should also read and consider the additional information under the caption "Where You Can Find More Information." You should rely only on information in this prospectus, the Plan Document or information ...

... and consider all information contained in this prospectus in making your investment decision. You should also read and consider the additional information under the caption "Where You Can Find More Information." You should rely only on information in this prospectus, the Plan Document or information ...

New risks. New insights.

... How these tilts relate to the portfolio’s established benchmark is critical to portfolio construction. It is dangerous to create such deviations in any portfolio and not understand the implications of their potential outcomes — both good and bad. As examples, consider that the effect of interest rat ...

... How these tilts relate to the portfolio’s established benchmark is critical to portfolio construction. It is dangerous to create such deviations in any portfolio and not understand the implications of their potential outcomes — both good and bad. As examples, consider that the effect of interest rat ...

The Effectiveness of Sell Discipline Strategies in Institutional Portfolios

... discipline, with target price being used with the fifth most frequency compared to the third most frequency for the entire sample. Lastly, top-down funds were more likely to use down from cost rather than opportunity cost, which is the reverse of the sample’s frequency. These results can be summariz ...

... discipline, with target price being used with the fifth most frequency compared to the third most frequency for the entire sample. Lastly, top-down funds were more likely to use down from cost rather than opportunity cost, which is the reverse of the sample’s frequency. These results can be summariz ...

CPDO – Managed Trades

... Analytic services and products provided by Standard & Poor’s are the result of separate activities designed to preserve the independence and objectivity of each analytic process. Standard & Poor’s has established policies and procedures to maintain the confidentiality of non-public information recei ...

... Analytic services and products provided by Standard & Poor’s are the result of separate activities designed to preserve the independence and objectivity of each analytic process. Standard & Poor’s has established policies and procedures to maintain the confidentiality of non-public information recei ...

Investor Sentiment and Beta Pricing

... firm size. A portfolio approach also confirms our main result that beta is strongly and positively priced in pessimistic periods.2 The prevalence of other anomalies shows that beta is not the sole determinant of expected returns, unlike what the classical version of the CAPM would predict.3 However ...

... firm size. A portfolio approach also confirms our main result that beta is strongly and positively priced in pessimistic periods.2 The prevalence of other anomalies shows that beta is not the sole determinant of expected returns, unlike what the classical version of the CAPM would predict.3 However ...

English - Vanguard Global sites

... Shares in any Fund described in this Prospectus as well as in the Key Investor Information Documents are offered only on the basis of the information contained therein and (if applicable) any addendum hereto and the latest audited annual financial report and any subsequent semi-annual financial repo ...

... Shares in any Fund described in this Prospectus as well as in the Key Investor Information Documents are offered only on the basis of the information contained therein and (if applicable) any addendum hereto and the latest audited annual financial report and any subsequent semi-annual financial repo ...

Fidelity Retirement Master Trust

... return through investing in two Constituent Funds of the Master Trust, namely the CAF and the A65F, according to the pre-set allocation percentages at different ages. The CAF will indirectly invest around 60% in higher risk assets (higher risk assets generally mean equities or similar investments) a ...

... return through investing in two Constituent Funds of the Master Trust, namely the CAF and the A65F, according to the pre-set allocation percentages at different ages. The CAF will indirectly invest around 60% in higher risk assets (higher risk assets generally mean equities or similar investments) a ...

Comovement and Predictability Relationships Between

... linked to some stocks than others. They involve cash flows, risk-based required returns, and flights to quality or investor sentiment. These have all been suggested and studied before but not in the cross-sectional context, which provides some additional power to assess their relevance. We believe t ...

... linked to some stocks than others. They involve cash flows, risk-based required returns, and flights to quality or investor sentiment. These have all been suggested and studied before but not in the cross-sectional context, which provides some additional power to assess their relevance. We believe t ...

collective investment schemes in emerging markets

... pool resources of many small savers, generating a large pool of resources which they then invest in a variety of assets like shares, bonds, futures and property with the sole purpose of generating high returns. Consequently, CIS have been instrumental in raising the financial sophistication of the p ...

... pool resources of many small savers, generating a large pool of resources which they then invest in a variety of assets like shares, bonds, futures and property with the sole purpose of generating high returns. Consequently, CIS have been instrumental in raising the financial sophistication of the p ...

The Unintended Consequences of Banning Derivatives in Asset Management Alessandro Beber, Cass Business School Christophe Pérignon, HEC Paris

... industry? In this study, we present a what‐if analysis of the potential consequences for asset managers and their customers of the enforcement of such a ban. Specifically, we describe how an economy without derivatives would look like, with a special emphasis on the asset management industry as i ...

... industry? In this study, we present a what‐if analysis of the potential consequences for asset managers and their customers of the enforcement of such a ban. Specifically, we describe how an economy without derivatives would look like, with a special emphasis on the asset management industry as i ...

Franklin California Tax-Free Income Fund SAI

... General obligation bonds. Issuers of general obligation bonds include states, counties, cities, towns and regional districts. The proceeds of these obligations are used to fund a wide range of public projects, including construction or improvement of schools, highways and roads. The basic security ...

... General obligation bonds. Issuers of general obligation bonds include states, counties, cities, towns and regional districts. The proceeds of these obligations are used to fund a wide range of public projects, including construction or improvement of schools, highways and roads. The basic security ...

CAM Government Securities Investment Fund ANNUAL REPORT

... investment funds that we plan to launch in the future, we believe Capital Asset Management cjsc can offer local and foreign investors a strong alternative to bank deposits and other traditional investment instruments. Investment funds are available to institutional as well as retail clients and may ...

... investment funds that we plan to launch in the future, we believe Capital Asset Management cjsc can offer local and foreign investors a strong alternative to bank deposits and other traditional investment instruments. Investment funds are available to institutional as well as retail clients and may ...

Pushing further in search of return: The new private equity model

... are therefore only going to sell to buyers they can trust. It’s therefore important to approach targets with a strong story for future investment and growth, as well as strong financial offers. Funds may also need to look at a broader range of opportunities, be this countries or industries that have ...

... are therefore only going to sell to buyers they can trust. It’s therefore important to approach targets with a strong story for future investment and growth, as well as strong financial offers. Funds may also need to look at a broader range of opportunities, be this countries or industries that have ...