The Leverage Rotation Strategy

... which have a higher probability of success. In doing so, one can achieve higher returns with less risk than a comparable buy and hold strategy. This is the primary focus of our paper: systematically determining environments favorable to leverage and developing a strategy to exploit them. The idea th ...

... which have a higher probability of success. In doing so, one can achieve higher returns with less risk than a comparable buy and hold strategy. This is the primary focus of our paper: systematically determining environments favorable to leverage and developing a strategy to exploit them. The idea th ...

KIM - Birla Sun Life Fixed Term Plan

... Having read and understood the contents of the Statement of Additional Information / Scheme Information Document of the Scheme, I/We hereby apply for units of the scheme and agree to abide by the terms, conditions, rules and regulations governing the scheme. I/We hereby declare that the amount inves ...

... Having read and understood the contents of the Statement of Additional Information / Scheme Information Document of the Scheme, I/We hereby apply for units of the scheme and agree to abide by the terms, conditions, rules and regulations governing the scheme. I/We hereby declare that the amount inves ...

Annual Equity-Based Insurance Guarantees Conference

... Dr. K. (Ravi) Ravindran currently spends much of his time lecturing, selectively consulting on VArelated issues and running a private equity fund. In addition to this, he holds a visiting professor appointment in Haskolinn Reykjavik (Iceland) and is the author of the recently published book titled T ...

... Dr. K. (Ravi) Ravindran currently spends much of his time lecturing, selectively consulting on VArelated issues and running a private equity fund. In addition to this, he holds a visiting professor appointment in Haskolinn Reykjavik (Iceland) and is the author of the recently published book titled T ...

Endowment Fund - InFaith Community Foundation

... Do consider near-term projects with big impact and long-term efforts—people need to see the fund working in their lives. Do leave a portion of the fund undesignated for future needs. Do communicate openly and completely with your constituencies about the process and the conclusions. Do celebrate eve ...

... Do consider near-term projects with big impact and long-term efforts—people need to see the fund working in their lives. Do leave a portion of the fund undesignated for future needs. Do communicate openly and completely with your constituencies about the process and the conclusions. Do celebrate eve ...

Derivatives Trading and Its Impact on the Volatility of NSE, India

... some pre-existing risk by taking positions in derivatives markets that offset potential losses in the underlying or spot market. In India, most derivatives users describe themselves as hedgers and Indian laws generally require that derivatives be used for hedging purposes only. Another motive for de ...

... some pre-existing risk by taking positions in derivatives markets that offset potential losses in the underlying or spot market. In India, most derivatives users describe themselves as hedgers and Indian laws generally require that derivatives be used for hedging purposes only. Another motive for de ...

DOWNLOAD

... buying and selling risky assets. Therefore, they represent a downward sloping demand for risky assets. Both assumptions lead to an equilibrium in which noise traders’ random beliefs influence prices. As a result, rational investors—or arbitrageurs, as they are often called—are not as aggressive in f ...

... buying and selling risky assets. Therefore, they represent a downward sloping demand for risky assets. Both assumptions lead to an equilibrium in which noise traders’ random beliefs influence prices. As a result, rational investors—or arbitrageurs, as they are often called—are not as aggressive in f ...

Central and Eastern Europe Economic Scorecard A sustainable

... (People) is well advanced in the CEE North countries and is similar to the levels obtained in Northern and Southern Europe. Unfortunately, the human capital component is underdeveloped in the CEE South subregion, with the index value below the level observed in the compared Emerging Markets. The wea ...

... (People) is well advanced in the CEE North countries and is similar to the levels obtained in Northern and Southern Europe. Unfortunately, the human capital component is underdeveloped in the CEE South subregion, with the index value below the level observed in the compared Emerging Markets. The wea ...

How Much Diversification is Enough

... the benefit of increasing diversification from 30 to 500 stocks by comparing the expected return of a 30-stock portfolio with the expected return of a 500-stock portfolio that was levered so that its expected standard deviation was equal to the expected standard deviation of the 30-stock portfolio. ...

... the benefit of increasing diversification from 30 to 500 stocks by comparing the expected return of a 30-stock portfolio with the expected return of a 500-stock portfolio that was levered so that its expected standard deviation was equal to the expected standard deviation of the 30-stock portfolio. ...

GENCORP INC (Form: SC 13D/A, Received: 10/26/2010 14:01:42)

... For information required by instruction C to Schedule 13D with respect to the executive officers and directors of the foregoing entities and other related persons (collectively, “Covered Persons”), reference is made to Schedule I annexed hereto and incorporated herein by reference. (e) On April 24, ...

... For information required by instruction C to Schedule 13D with respect to the executive officers and directors of the foregoing entities and other related persons (collectively, “Covered Persons”), reference is made to Schedule I annexed hereto and incorporated herein by reference. (e) On April 24, ...

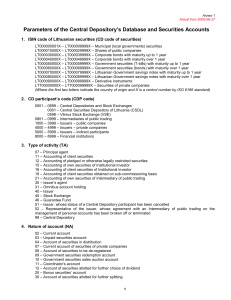

1. ISIN code of Lithuanian securities (CD code of securities)

... 10 – Government securities sales auction account 11 – Coordinator’s account 12 – Account of securities allotted for further choice of dividend 20 – Bonus securities’ account 30 – Account of securities allotted for further splitting ...

... 10 – Government securities sales auction account 11 – Coordinator’s account 12 – Account of securities allotted for further choice of dividend 20 – Bonus securities’ account 30 – Account of securities allotted for further splitting ...

Document

... 9. Equity securities have a ____ expected return than most long-term debt securities, and they exhibit a ____ degree of risk. a. higher; higher b. lower; lower c. lower; higher d. higher; lower ANS: A ...

... 9. Equity securities have a ____ expected return than most long-term debt securities, and they exhibit a ____ degree of risk. a. higher; higher b. lower; lower c. lower; higher d. higher; lower ANS: A ...

The thirty-minute guide to Private Equity

... invested, in the traditional way, in shares traded on stock markets: they are used to buy up whole companies, and then take them ‘private’. This means that companies no longer have their shares traded publicly. Instead, they are completely under the control of the investment fund. ...

... invested, in the traditional way, in shares traded on stock markets: they are used to buy up whole companies, and then take them ‘private’. This means that companies no longer have their shares traded publicly. Instead, they are completely under the control of the investment fund. ...

Regulatory Guide RG 240 Hedge funds: Improving disclosure

... investment decisions, service providers, fund strategies and fund assets. Where a hedge fund has invested in one or more significant underlying funds (being an underlying fund that accounts for 35% or more of the fund of hedge fund’s assets), the benchmarks and disclosure principles in this guide sh ...

... investment decisions, service providers, fund strategies and fund assets. Where a hedge fund has invested in one or more significant underlying funds (being an underlying fund that accounts for 35% or more of the fund of hedge fund’s assets), the benchmarks and disclosure principles in this guide sh ...

system of indicators for barbados

... national levels. These particularly affect the more socially and economically fragile population and generate a highly damaging impact on the country’s development. 3. The Prevalent Vulnerability Index, PVI, is made up of a series of indicators that characterize prevailing vulnerability conditions ...

... national levels. These particularly affect the more socially and economically fragile population and generate a highly damaging impact on the country’s development. 3. The Prevalent Vulnerability Index, PVI, is made up of a series of indicators that characterize prevailing vulnerability conditions ...

NBER WORKING PAPER SERIES SOCIAL SECURITY AND TRUST FUND MANAGEMENT Takashi Oshio

... trust fund will start to be run down. If the fund is exhausted, benefits would have to be cut and/or taxes raised, or the government would have to completely change the social security programs. Aaron and Reischeuer (1998) insist on shifting the existing trust fund from (non-marketable) government b ...

... trust fund will start to be run down. If the fund is exhausted, benefits would have to be cut and/or taxes raised, or the government would have to completely change the social security programs. Aaron and Reischeuer (1998) insist on shifting the existing trust fund from (non-marketable) government b ...

Risk Arbitrage and the Prediction of Successful

... obtain higher returns, risk arbitrageurs need to take positions where the probability of a successful tender offer is low. Samuelson and Rosenthal [1986] as well as Brown and Raymond [1986] use price movements in the target firm as an indicator of the tender offer success. The sample which Samuelson ...

... obtain higher returns, risk arbitrageurs need to take positions where the probability of a successful tender offer is low. Samuelson and Rosenthal [1986] as well as Brown and Raymond [1986] use price movements in the target firm as an indicator of the tender offer success. The sample which Samuelson ...

four reasons to consider an allocation to international small cap

... this offers some potential to exploit inefficiencies. The total assets under management (AUM) in the eVestment Alliance database for international small cap is approximately $98 billion (as of 12/31/2015), representing just 5% of the $1.9 trillion international small cap universe. Compare that to th ...

... this offers some potential to exploit inefficiencies. The total assets under management (AUM) in the eVestment Alliance database for international small cap is approximately $98 billion (as of 12/31/2015), representing just 5% of the $1.9 trillion international small cap universe. Compare that to th ...

DHFL Pramerica Dual Advantage Fund Series 1 to 3

... available subject to the guidelines issued by SEBI from time to time and in line with the investment objective of the Scheme. These may be taken to hedge the portfolio, rebalance the same or to undertake any other strategy as permitted under SEBI (Mutual Funds) Regulations from time to time. In term ...

... available subject to the guidelines issued by SEBI from time to time and in line with the investment objective of the Scheme. These may be taken to hedge the portfolio, rebalance the same or to undertake any other strategy as permitted under SEBI (Mutual Funds) Regulations from time to time. In term ...

A model of financialization of commodities

... mark index for performance evaluation or because their mandate includes hedging against commodity price inflation. We capture such benchmarking through the institutional objective function. Consistent with the extant literature on benchmarking (originating from Brennan (1993)), we postulate that the ...

... mark index for performance evaluation or because their mandate includes hedging against commodity price inflation. We capture such benchmarking through the institutional objective function. Consistent with the extant literature on benchmarking (originating from Brennan (1993)), we postulate that the ...

Predicting Mutual Fund Performance: The Win

... Are there truly-talented mutual fund managers who consistently generate additional riskadjusted returns? If yes, how can we identify those managers? Avramov and Wermers (2006) find that among the three investment strategies they form, predictability in manager skills is the dominant source of mutua ...

... Are there truly-talented mutual fund managers who consistently generate additional riskadjusted returns? If yes, how can we identify those managers? Avramov and Wermers (2006) find that among the three investment strategies they form, predictability in manager skills is the dominant source of mutua ...

Securities Processing: The Effects of a T+3 System on Security Prices

... require a risk premium. For example, in the 2008 financial crisis, when financial institutions were closed or sold over the weekend, sellers may have built a greater rate of compensation than the risk-free rate into the price of equity securities. This risk premium may indicate investors‟ lack of co ...

... require a risk premium. For example, in the 2008 financial crisis, when financial institutions were closed or sold over the weekend, sellers may have built a greater rate of compensation than the risk-free rate into the price of equity securities. This risk premium may indicate investors‟ lack of co ...

Indicators for Bubble Formation in Housing Markets

... 2. The concept of a bubble A bubble can be defined as a short term price increase due to psychological effects. For example, when real estate prices have been increasing for some time there may be a perception in the population that this increase will continue forever and that the investment is ris ...

... 2. The concept of a bubble A bubble can be defined as a short term price increase due to psychological effects. For example, when real estate prices have been increasing for some time there may be a perception in the population that this increase will continue forever and that the investment is ris ...

Annual Report - John Hancock Investments

... government debt instruments; Morningstar Financial—tracks funds that invest primarily in equity securities of financial services companies; Morningstar Health—tracks funds that invest primarily in equity securities of health care companies; Morningstar Specialty Technology—tracks funds that invest p ...

... government debt instruments; Morningstar Financial—tracks funds that invest primarily in equity securities of financial services companies; Morningstar Health—tracks funds that invest primarily in equity securities of health care companies; Morningstar Specialty Technology—tracks funds that invest p ...

Effect of Investor Sentiment on Market Response to Stock Splits

... believed to convey favorable private information for future firm’s value. As such, this paper can mainly focus on whether the positive market response is mainly due to the true signal of the future value or the sentiment combined with investor’s other behavioral bias. Second, earlier studies about s ...

... believed to convey favorable private information for future firm’s value. As such, this paper can mainly focus on whether the positive market response is mainly due to the true signal of the future value or the sentiment combined with investor’s other behavioral bias. Second, earlier studies about s ...

MACD BASED DOLLAR COST AVERAGING STRATEGY

... In Thailand, long-term equity funds (LTF) are equity funds mainly focused on common stocks. The LTF was established by governmental support with the objective of increasing the proportion of institutional investors to make long-term investments in the Stock Exchange of Thailand (SET). Increasing ins ...

... In Thailand, long-term equity funds (LTF) are equity funds mainly focused on common stocks. The LTF was established by governmental support with the objective of increasing the proportion of institutional investors to make long-term investments in the Stock Exchange of Thailand (SET). Increasing ins ...