Changes in Financial Markets and Their Effects on

... notably in the denomination of international contracts related to commodity trading and of financial ...

... notably in the denomination of international contracts related to commodity trading and of financial ...

Slide 1

... departures from predictions of PPP doctrine are much less of a mystery. Reflect the volatile character of 1970’s which witnessed great turbulence in the world economy and large volumes of real shocks: ...

... departures from predictions of PPP doctrine are much less of a mystery. Reflect the volatile character of 1970’s which witnessed great turbulence in the world economy and large volumes of real shocks: ...

Lalin Dias, VP Exchange Systems, MillenniumIT

... routing, market data, clearing, CSD and surveillance products have been implemented at over 30 customer sites in North America, Europe, Asia and Africa. Founded in 1996, MillenniumIT was acquired by London Stock Exchange Group in October 2009 and is now a fully-owned subsidiary and a key technology ...

... routing, market data, clearing, CSD and surveillance products have been implemented at over 30 customer sites in North America, Europe, Asia and Africa. Founded in 1996, MillenniumIT was acquired by London Stock Exchange Group in October 2009 and is now a fully-owned subsidiary and a key technology ...

Reflections on Bretton Woods Edward M. Bemste~n*

... surplus countries acquired foreign currencies rather than gold. Even the concept that exchange rates are a matter of international concern was not new. Marshall noted it in 1887, and the 1936 Tripartite Declaration of the United States, the United Kingdom and France, to which Belgium, the Netherland ...

... surplus countries acquired foreign currencies rather than gold. Even the concept that exchange rates are a matter of international concern was not new. Marshall noted it in 1887, and the 1936 Tripartite Declaration of the United States, the United Kingdom and France, to which Belgium, the Netherland ...

4B - Brenda Spotton Visano

... Hupacasath First Nation led coalition to oppose the Canada’s FIPA with China citing environmental and native rights concerns around land use and energy (coal, tar ...

... Hupacasath First Nation led coalition to oppose the Canada’s FIPA with China citing environmental and native rights concerns around land use and energy (coal, tar ...

Kireyev_Eng - AlexeiKireyev.com

... • resist nominal appreciation: intervene by purchasing foreign exchange to reserves • resist inflation in non-tradables: – sterilize money supply by selling securities – increase reserve requirements, part in foreign exchange – raise policy interest rates ...

... • resist nominal appreciation: intervene by purchasing foreign exchange to reserves • resist inflation in non-tradables: – sterilize money supply by selling securities – increase reserve requirements, part in foreign exchange – raise policy interest rates ...

Results of World War I

... collective security system (League of Nations) undermined at starting point due to isolationism stopping wilsonianism in US Congress Washington Naval Conference (1921-1922) – complementing European peace settlements (UK, USA - 5, Japan - 3, France, Italy - 1.67 ratios for capital ships – recognition ...

... collective security system (League of Nations) undermined at starting point due to isolationism stopping wilsonianism in US Congress Washington Naval Conference (1921-1922) – complementing European peace settlements (UK, USA - 5, Japan - 3, France, Italy - 1.67 ratios for capital ships – recognition ...

EU UK

... Decreases in demand or supply of one product are leveled off by increases in the demand and supply of another product ...

... Decreases in demand or supply of one product are leveled off by increases in the demand and supply of another product ...

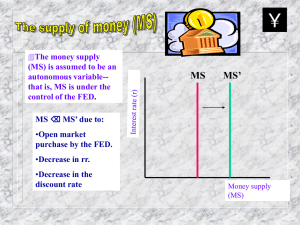

r I

... inversely related to the interest rate, ceteris paribus. •DM /Y > 0 demand for money is positively relation to real income (GDP), ceteris paribus. ...

... inversely related to the interest rate, ceteris paribus. •DM /Y > 0 demand for money is positively relation to real income (GDP), ceteris paribus. ...

Economic and Financial Stability via Exchange Rate Volatility

... • Combination of currency appreciation and low interest rates environment helped to maintain financial stability. • Sustained appreciation worked against the formation of overly optimistic expectations in the corporate sector which tamed the potential for a corporate sector credit boom. • Currency a ...

... • Combination of currency appreciation and low interest rates environment helped to maintain financial stability. • Sustained appreciation worked against the formation of overly optimistic expectations in the corporate sector which tamed the potential for a corporate sector credit boom. • Currency a ...

Post-Hearing Submission of Metals Service Center Institute (“MSCI

... On the specific issue of capital flow, government purchases of foreign assets are a type of capital flow. The IMF definition places a lot of weight on such purchases, but does not absolutely require them. There are scenarios where a government imposes very asymmetric capital restrictions (e.g., diff ...

... On the specific issue of capital flow, government purchases of foreign assets are a type of capital flow. The IMF definition places a lot of weight on such purchases, but does not absolutely require them. There are scenarios where a government imposes very asymmetric capital restrictions (e.g., diff ...

Exchange rates in PWT 8.0

... 1. We use the UN exchange rate series that includes estimated rates, rather than the fully market-‐based series. 2. We include an indicator variable that identifies observations for which an estimated ...

... 1. We use the UN exchange rate series that includes estimated rates, rather than the fully market-‐based series. 2. We include an indicator variable that identifies observations for which an estimated ...

Document

... had increasing difficulties in raising additional capital in support of its reserves on the international markets. • By mid-August, the Russian Central Bank announced it would allow the rouble to fall, postponed short-term domestic debt service and initiated a moratorium on all repayment of foreign ...

... had increasing difficulties in raising additional capital in support of its reserves on the international markets. • By mid-August, the Russian Central Bank announced it would allow the rouble to fall, postponed short-term domestic debt service and initiated a moratorium on all repayment of foreign ...

Monetary Policy Presentation.eve

... Decrease in required reserves • Increases lending by banks • More spending • Increases employment ...

... Decrease in required reserves • Increases lending by banks • More spending • Increases employment ...

International Coordination Jeffrey Frankel 2015 Asia Economic Policy Conference

... whatever model suits its interest in the bargaining process • Ostry & Ghosh (2015). ...

... whatever model suits its interest in the bargaining process • Ostry & Ghosh (2015). ...

Chapter 28 - Exchange Rates and Macroeconomic Policy

... – Single currency means that European firms—when they buy or sell across borders—no longer have to pay commissions on exchange of currency • Or face risk that exchange rates might change before accounts are settled ...

... – Single currency means that European firms—when they buy or sell across borders—no longer have to pay commissions on exchange of currency • Or face risk that exchange rates might change before accounts are settled ...

Lecture 12 - uni

... Before World War I, the world economy operated under the gold standard It means that most world currencies were backed by, and convertible into gold. For currencies whose unit is permanently tied to a certain quantity of gold, the gold standard represents a fixed-exchange rate regime To see how it w ...

... Before World War I, the world economy operated under the gold standard It means that most world currencies were backed by, and convertible into gold. For currencies whose unit is permanently tied to a certain quantity of gold, the gold standard represents a fixed-exchange rate regime To see how it w ...

Chapter No. 6

... Application: Changes in the Equilibrium Exchange Rate • Changes in Interest Rates – When domestic real interest rates raise, the domestic currency appreciates. – When domestic interest rates rise due to an expected increase in inflation, the domestic currency depreciates. ...

... Application: Changes in the Equilibrium Exchange Rate • Changes in Interest Rates – When domestic real interest rates raise, the domestic currency appreciates. – When domestic interest rates rise due to an expected increase in inflation, the domestic currency depreciates. ...